- English

- عربي

Global Markets Weekly Outlook: Tariff Fallout, Crude Oil and Nvidia Earnings

Markets in Focus:

Bullish Momentum & Trend:

KOSPI, TSEC, EU STOXX 50, FRA40, FTSE100, AUDNZD, XAUEUR, XAUGBP, XAUCHF, CRUDE.

Bearish Momentum & Trend:

GBPMXN, EURMXN, GBPAUD, CHFNOK, CIBR ETF (First Trust cyber security ETF)

Tariff Policy Shift: Markets Brace for Section 122 Rate Increase

Markets are assessing reports that President Trump may lift the global tariff rate imposed under Section 122 authority from 10% to 15%. While investors may attempt to digest and move beyond the announcement efficiently, the broader implications remain complex.

The tariff refund process now heads to the Lower House for clarification. With hundreds of claims already filed, resolution may stretch beyond the U.S. midterm elections, if claims are indeed honoured at all. This creates prolonged uncertainty for trade-exposed sectors and multinational corporates.

Trump’s approval rating has slipped to 42%, sitting only marginally above public support for tariffs themselves. Replacing IEEPA tariffs with alternative trade remedies could reinforce the improved deficit-to-GDP dynamic, particularly if the Treasury retains the $170 billion collected in reciprocal tariffs since implementation.

However, maintaining strong tariff convictions carries political risk. Backtracking could damage credibility and weaken the broader “America First” narrative.

The reaction on Friday saw the S&P500 close just off the 5-day high. We’ll see if there is any spillover into Asia, and with Trump adjusting the tariffs rate 5ppt higher.

U.S.–Iran Tensions Drive Crude Oil Higher

Geopolitical risk remains elevated. Increased U.S. military presence in the region has pushed crude oil prices toward $72 per barrel, reflecting a rising probability of military confrontation and potential supply disruption.

Markets are unsure whether the escalation is a negotiating tactic designed to pressure Iran into a deal, or whether a tactical military surprise, similar to the June 2025 strike on Iran or previous action in Venezuela, could unfold. A prolonged conflict could drive oil significantly higher. However, such an outcome appears unlikely in an election year, given the negative economic consequences of sustained energy price spikes and extended military engagement on presidential approval ratings.

Crude oil volatility remains an elevated prospect, so position sizing will of utmost importance when entering a trade.

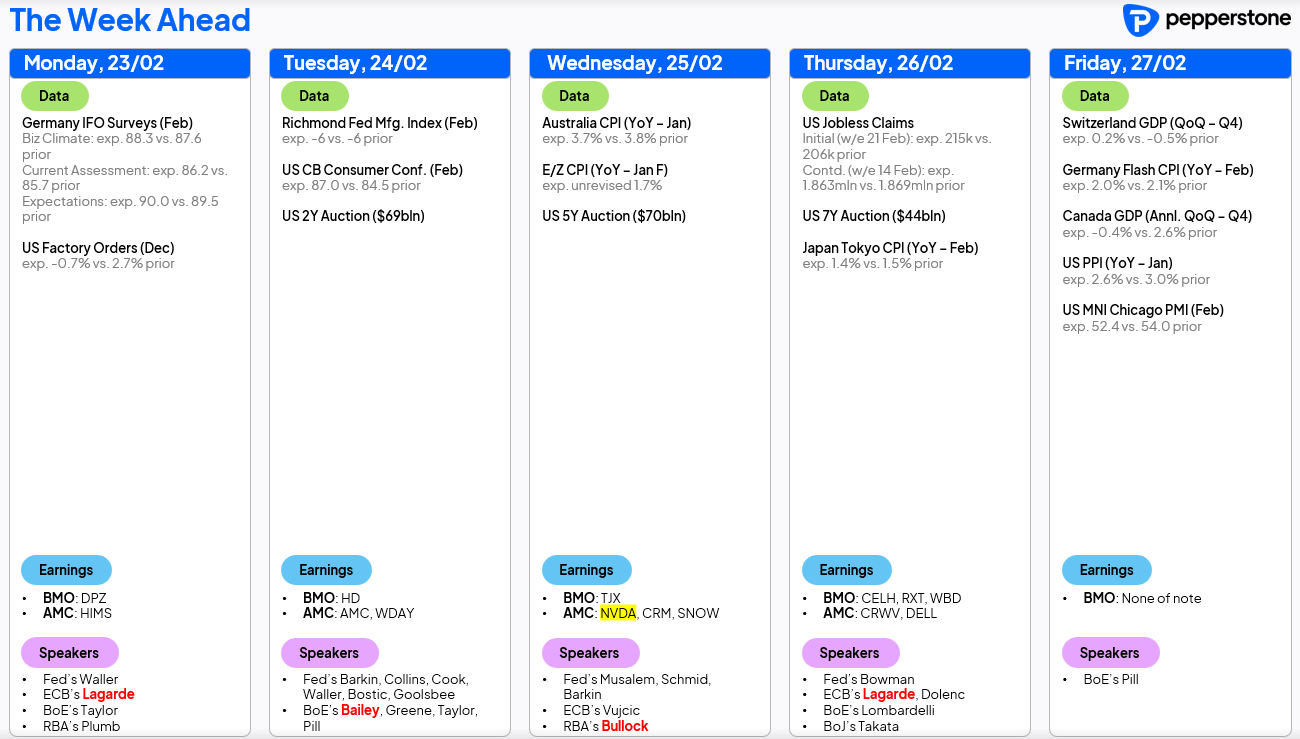

U.S. Economic Data and Federal Reserve Speakers

The U.S. economic calendar is relatively light, but still market-relevant. The focus includes:

• Consumer confidence

• Producer Price Index (PPI)

• Regional manufacturing and services surveys

• Weekly jobless claims

A number of Federal Reserve officials are scheduled to speak. While no immediate rate cut pivot is expected, markets will scrutinise whether policymakers shift their emphasis from labour market concerns toward persistent inflation risks.

The US dollar remains central to cross-asset positioning this week, particularly as traders assess Fed rhetoric and inflation trends.

President Trump’s State of the Union address (Tuesday, 9pm local time) may provide additional clarity on economic and trade policy direction.

Australia: CPI, Capex and RBA Governor Bullock

In Australia, attention turns to:

• January CPI data

• Private capital expenditure (capex) figures

These releases will feed into Q4 GDP, due on 4 March. RBA Governor Michele Bullock speaks shortly after CPI publication, meaning her interpretation of inflation trends could materially impact the Australian dollar and domestic rate expectations.

For AUD traders, this represents the key regional macro catalyst for the week. Short GBPAUD has been the play and the down trend builds.

UK Politics and Bank of England Expectations

The UK data calendar is relatively quiet ahead of the March Bank of England decision, where markets are firmly pricing in a rate cut.

Political developments, however, could generate volatility in GBP. Pressure is building on Prime Minister Rishi Sunak, and by-elections in Gorton and Denton have added uncertainty following Andrew Gwynne’s resignation.

While Labour won the seat in 2024, the key question now is whether the Greens or Reform UK take the spoils. Broader implications include potential shifts in political influence heading into May’s local elections, where 5,000 council seats are contested, where this could set the tone and put renewed pressure on PM Starmer.

Although Reform UK is not expected to win the next general election outright, their influence as a minority or coalition partner could affect fiscal policy and the Bank of England’s operational independence, developments that may weigh on the GBP.

Nvidia Earnings: The Week’s Major Corporate Catalyst

The marquee earnings event is Nvidia, reporting Wednesday 20 minutes after the close. Markets are pricing a ±4.4% move on results, notably one of the lowest implied earnings days moves seen in several quarters, suggesting subdued volatility expectations relative to history.

Consensus expectations:

• January quarter reported revenue: $65.7 billion

• April quarter revenue guidance: $72.4 billion To satisfy buy-side expectations, revenue likely needs to print closer to $73.5–74 billion to please investors.

Gross margins are expected to remain near 75%, despite concerns surrounding DRAM pricing and competitive pressures. Given Nvidia’s pricing power and sustained AI demand, margin resilience remains plausible.

Technically, an upside break above $194 would signal bullish momentum and could support broader equity market strength.

The upcoming GTC Conference on 16 March is widely viewed as a potential catalyst, with investors expecting to hear more on the Reuben rollout and the pipeline of innovation.

China Reopens: Liquidity and Precious Metals Impact

China returns from holidays on Tuesday, increasing liquidity during the Asian trading session. This typically influences price action in gold and silver, with renewed participation from Chinese investors often contributing to early-week volatility in precious metals.

Market Summary:

Key Themes to Watch This week’s dominant themes include:

• U.S. tariff policy and fiscal implications • Escalating U.S.–Iran tensions and crude oil volatility

• Federal Reserve communication and inflation dynamics

• Australia CPI and RBA commentary • Nvidia earnings and AI-driven equity leadership

• Political developments in the UK Cross-asset volatility may rise as macro and geopolitical narratives intersect.

Traders should remain disciplined in position sizing, particularly across energy, FX, and high-beta technology equities.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.