Analysis

As we look forward, here are the key volatility drivers for the week ahead:

- Geopolitical headlines – remains really the absolute dominant focal point for markets - will we see anything in the news flow that changes the insatiable demand for Commodities, Commodity currencies (AUD, NZD) and the short Europe trade (more on that below)?

- EU leaders meeting in Versailles (10-11 March) – headlines on further trade and financial sanctions will be a risk for traders.

- US Feb CPI (11 March 00:00 AEDT) – consensus excepts 6.4% core CPI and 7.9% on headline – a big inflation number will cement a 25bp rate hike from the Fed (on 17 March) and could get the USD fired up, potentially raising anxiety levels further

- ECB meeting (Wed 23:45 AEDT) – With rising inflation, amid an evolving major growth shock and risks to the banking sector, the ECB will need to balance this one carefully.

- China NPC (through the week) – we’ve already seen headlines on economic targets for 2022, so this may not cause too many gyrations as the week progresses, but one to be aware of.

- China Feb credit data (no set time this week) – important as China’s credit impulse tends to lead many risk assets. Consider the January numbers were huge, so some cooling may play out in the February numbers.

- China CPI/PPI (Wed 12:30 AEDT) – markets expect PPI to pull back to 8.6% (from 9.1%) – could be seen as a leading indicator for developed markets.

- RBA gov Lowe speaks (Wednesday at 09:15 and Friday at 09:15), Deputy gov Debelle speaks Wed 19:00 AEDT) – with the market feeling the RBA start to hike in August, will we learn anything from the heavyweights of Aussie monetary policy?

- Apple - for the stock traders, Apple will hold its first product and hardware launch event of 2022 on Tuesday – Apple is coining the event “Peak Performance”, suggesting it's all about delivering faster products than a new blockbuster.

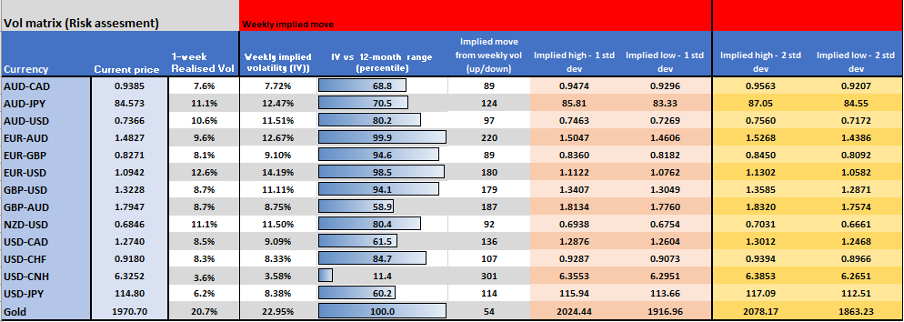

Weekly volatility matrix – Using options data to see how the market is seeing future movement.

Thoughts of the day

We look for forward in trading, but we acknowledge the journey from A to B and the probability distribution of that journey continuing. The moves in markets last week were simply incredible and obviously caused by a world trying to understand the future and finding the ability to price risk and certainty is truly challenging.The question for today is what's the circuit breaker to change some of the trends detailed below and at the very least cause some consolidation? Of course, nothing is 100% linear so there'll be counter-rallies, but will these be simply driven by positioning – as we’re seeing now in a number of markets, positioning is extremely skewed and any positive news in geopolitical tensions could cause big short-term gyrations. This is life in a high volatility regime and we have to take on more risk and subsequently take down our position size in order to stay in the game.In many cases identifying these moves and entering was straight-forward – long palladium and short EURAUD were ideas being pushed for a couple of weeks – the hard part, obviously if swing or position-trading, is holding and extracting as much as you can – these are multi-year affairs and for the hedge funds, these are the ones you simply have to hold to generate real alpha. This is where a rules-based approach can be truly advantageous.

Market moves that have to be on the radar

Wheat +40% over the past 5 days – this is a huge macro story as there is increasing talk about a food crisis in the making with Russia and Ukraine producing over a third of the world’s wheat exports and a desperate need for farmers to crank up planting – these things take time – currently trading like a meme stock in 2020.Palladium rallied +27% last week and closed > $3000 – one we talked up on The Trade-Off two weeks ago as Russia export 46% of the worlds’ palladium. Eyeing a break of the May 2021 highs.XAUUSD - A big week for Gold (XAUUSD) putting on 4.3% and now eyeing a test of $2k. The break of the double bottom neckline at $1917 sets the yellow metal on for a target of $2140. XAUEUR was the star though gaining +7.6% on the week, with XAGEUR (silver in EUR terms) +9.2%. Gold 1-week calls trade at a 3.3 vols premium to puts which is the highest since March 2020 – there’s a lot of love for Gold. Crude rallied +23% on the week, with our Brent price closing above $120 and SpotCrude also eyeing $120. While there are many ways to look at how overbought or one-sided the moves have been, one I traditionally look at is crude -/+ % the 50-day MA – we see Crude now trades at a 31% premium to its 50-day MA, which is 3 standard deviations to its average since 2000. These are extraordinary times though and perhaps these metrics have limited sway when the market is still unsure about the future of Russian supply – still too many unknowns to be anywhere near a lasting decline. Sugar +8.6% last week - hugging the upper Bolly Band and above the 5-day EMA – happy to hold longs until this dynamic changes. EU Nat gas +120% last week to close above E200 – not a market offered, but one that's incredibly volatile and has one of the biggest implications for European households as we head into the winter period – if this keeps heading higher it will get more and more attention. EU equity markets were savaged on Friday, with the EU Stoxx -5% on the day on volumes 80% above the 30-day average. EU Stoxx 50 lost 10.4% last week alone and is easily underperforming other developed market equities.Our GER40 has nearly lost 20% since the highs on 6 January and the market finds sellers into any rallies. EU banks are being called into question and are at the heart of the concern with traders looking at funding and interbank borrowing metrics and a ballooning cost to insure against debt default (Credit Default Swaps).Copper gained +9.6% in 5 days and eyeing a break of $5 – lovely shape I think this test the round number.EURAUD fell 5.1% last week – a huge move and is the quintessential expression of all that is playing out in markets – short Europe (as it is easily most exposed to the fallout of sanctions and Russian debt repayment consensus) and long Commodities. The hard part is when to fold – the EURAUD RSI is 12.9, and we see a 2.4% discount in price to the 5-day EMA (a 3.5 standard deviation event) – as oversold technically as you’ll likely see – but these are exceptional times. EURNZD -4.9% on the week – obviously the same theme as EURAUD, so if expressing be cognisant of the correlation so as not to double up on the exposure. EURCHF fell 3.9% last week and is now eyeing parity – the SNB are going to be watching this closely, but what can they do?EURJPY – we see EURJPY 1-week put volatility trading a 4.4 premium to calls – a huge reading and most since 2020 & 2016. I am surprised the JPY isn’t far stronger in this market. EURUSD fell 3% on the week and has firmly broken the double top neckline of 1.1121 and targets 1.0750 – can’t find a friend and could be headed to target if we get an 8% headline US CPI.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.