- English

- عربي

Trading In The Week Ahead: Silver Volatility, US Nonfarm Payrolls & Global Market Risks

Extreme Volatility and Position Sizing Remain the Core Risk

Last week will not be forgotten for some time. Those with exposure to ultra-crowded markets will be acutely aware that trading any financial instrument with a 10-day realised volatility of 186%, as seen in silver, demands both an open mind as to where the collective may push price and a disciplined approach to position sizing. Correctly sizing exposure relative to such extreme levels of volatility is absolutely essential. As the new trading week begins and markets attempt to re-establish fair value and some form of balance, the eruptions seen in several more dysfunctional markets may yet prove to be aftershocks. Carrying risk when one cannot immediately react remains the primary consideration.

Market Flows, Liquidity and Event Risk Drive Price Action

Markets ultimately respond to flows, while liquidity conditions go a long way in explaining the magnitude of price movements. For risk managers, the event risks ahead must also be carefully assessed. Traders are right to ask whether an upcoming event is likely to generate an outsized move or a volatility shock that could materially impact existing exposures. Given the range of possible outcomes, it is also worth questioning whether there is any clear directional skew that provides a genuine trading edge.

US Nonfarm Payrolls the Marquee Scheduled Event Risk This Week

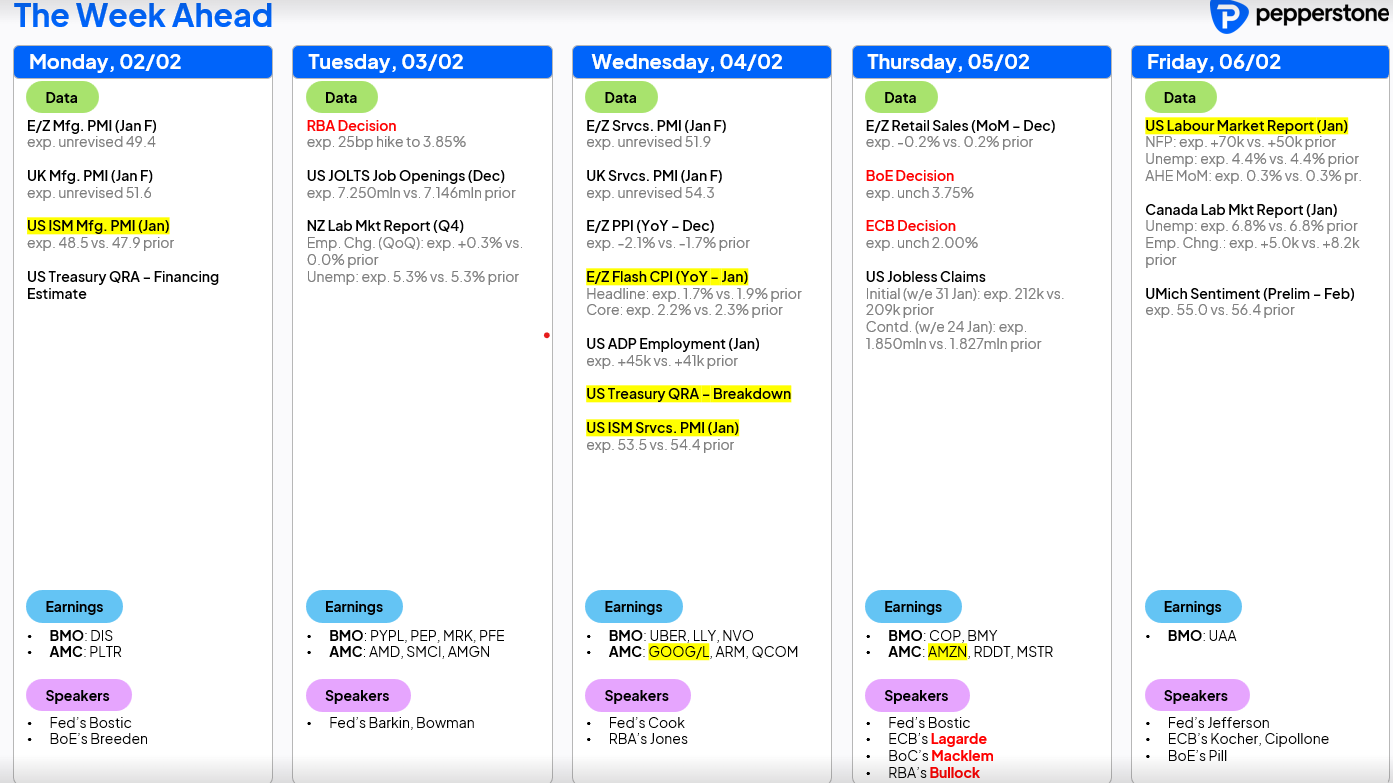

With that framework in mind, it is fitting that the economic calendar is particularly full in the week ahead. The Friday release of US nonfarm payrolls stands out as the marquee risk event. Markets are currently modelling a central estimate of 68,000 net new jobs created in January, with the unemployment rate expected to hold at 4.4%. If realised, this outcome would likely be viewed as supportive for risk assets such as equities, offering enough job creation to limit renewed concerns about the US labour market, but not so strong as to materially reduce expectations for Fed rate cuts in June or July, or the pricing of two 25 basis point cuts by December.

JOLTS and ISM Surveys Still Capable of Moving Risk

Elsewhere in the US, and while likely secondary to nonfarm payrolls, JOLTS job openings and the ISM manufacturing and services surveys still have the capacity to move markets if outcomes prove to be meaningful outliers relative to expectations. RBA Meeting Poses Near Term Risk for AUD Traders Outside the US, the RBA meeting on Tuesday presents a near-term risk for AUD exposures. Interest rate swaps price around 15 basis points of tightening for this meeting, implying a 71% probability of a 25 basis point hike. That said, even if the RBA does raise rates, any AUD reaction may fade quickly unless the accompanying statement is interpreted as sufficiently hawkish to lift expectations for further tightening at future meetings.

ECB and BoE Meetings Likely to Generate Only Short Lived Volatility

The ECB and BoE meetings are not expected to result in changes to policy rates. While there may be some review of ECB guidance and the potential for brief volatility in EUR and GBP pairs, any market reaction should be contained and short-lived.

US Earnings Season Accelerates with Major Tech in Focus

US equity indices will also command attention, with just under 30% of S&P 500 market capitalisation reporting earnings and guidance this week. Alphabet and Amazon are the major heavyweight releases, while trader favourites such as Palantir, AMD, Qualcomm, Iren, Reddit and Barrick are also on the radar.

European Earnings and Index Consolidation Continue

It is a similarly busy earnings week in Europe, with around 30% of Euro Stoxx market capitalisation due to report. European equity indices are consolidating after a modest pullback from recent all-time highs. Conviction around a clear directional move in the DAX or Euro Stoxx 50 remains low, and the indices likely require further work to attract meaningful flows in either direction.

Silver Volatility Highlights Structural Stress in Precious Metals Markets

Attention also naturally remains on silver, gold and the US dollar. Silver, and XAGUSD in particular, has become a case study in trading within a dysfunctional market, with products that typically move in close alignment becoming fractured and misaligned. XAG is trading with a 10-day realised volatility of 186%, equating to daily realised moves of nearly 12%, which is extraordinary. The CME’s shift to percentage-based margining and successive increases in margin requirements have clearly contributed, alongside elevated positioning.

China Liquidity and SHFE Selling Triggered the Latest Silver Liquidation

China remains central to the silver narrative and appears to have provided the trigger for Friday’s generational moves. Many traders outside China are now familiar with the UBS SDIC silver futures fund (161226), which had become the primary vehicle for Chinese retail investors to gain exposure to silver. When the Shenzhen Stock Exchange halted trading in the fund on Friday, investors were effectively locked in and forced to seek alternative ways to reduce exposure. That exit occurred through SHFE silver futures, with the resulting selling pressure rippling into COMEX futures and triggering a significant liquidation of positions.

Is Silver Near a Bottom or Are Further Aftershocks Ahead

Whether silver has reached a durable bottom is difficult to say. Another round of selling cannot be ruled out as Shanghai futures markets reopen, particularly given the residual stress across leveraged positions and market structure.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.