- English

- عربي

The Dollar Turns a Corner, How It Recovered From a Difficult Year

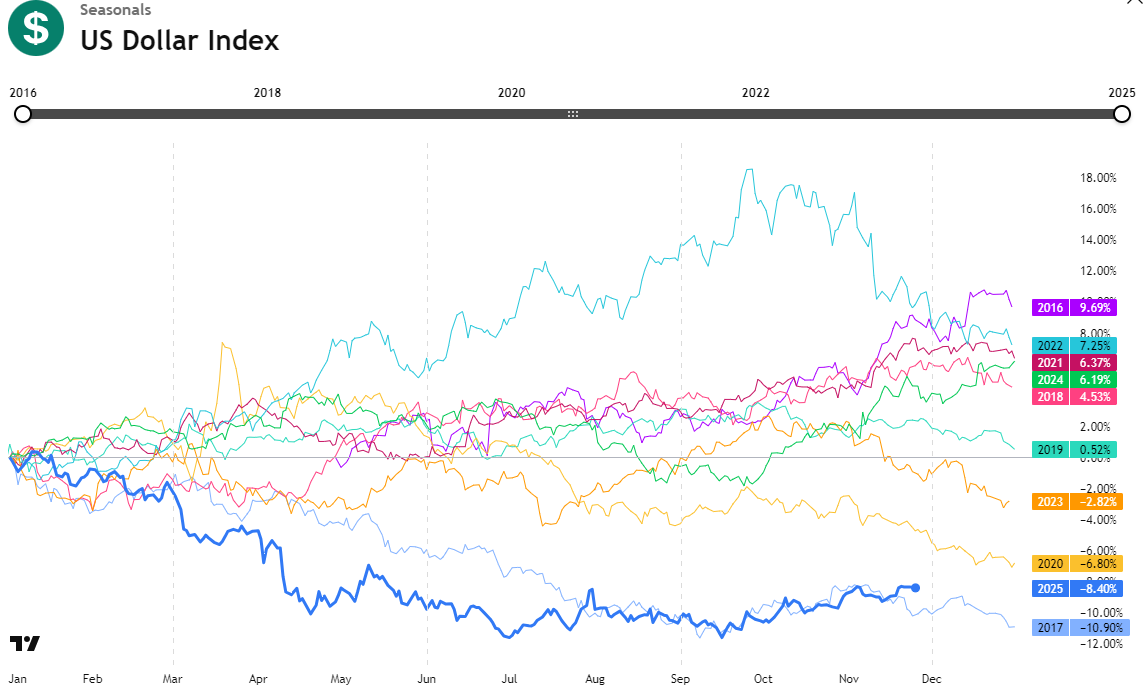

The US dollar has navigated a complicated year, marked by periods of weakness through the first half. The index came under steady pressure from tariff uncertainty, softening macro data and a market convinced that aggressive monetary easing was on the horizon. Dollar exceptional strength faded clearly from January through the end of Q2, before it slipped into a mildly downward leaning consolidation over the summer. The overall pattern created the impression that the greenback was gradually losing its relative advantage after an extended tightening cycle.

But the tone began to shift toward the end of August. The rebound was not explosive, yet the improvement became more orderly and consistent throughout Q4 thus far. The index staged a clean recovery from sub-98 levels to trade comfortably back above the 100 handle this month. This transition reflects a meaningful change in how markets are responding to the monetary policy path, especially as expectations for near term easing have become far less certain than they appeared in Q3.

A Divided Fed Is Supporting Dollar Upside - For Now

The current environment is defined by unusually wide divergence inside the FOMC, with potentially the largest split in decades to come in December. The absence of decisive macro data has deprived policymakers of the usual anchors that guide their policy bias. This vacuum makes markets sensitive to shift in tone, as even subtle changes from Fed members in communication can alter rate cut expectations.

With the labour market weakening in recent months and consumer confidence slipping a bit, mapping the true easing path has become more complicated. In such an environment, investors naturally gravitate toward currencies that offer a higher degree of relative stability. The dollar is benefiting from this backdrop of uncertainty, each time the easing trajectory becomes less certain, the greenback finds additional support.

Could the December Meeting Set the Stage for a 2026 Upswing?

The importance of the December FOMC meeting goes beyond the size of a potential rate cut. It matters how the framework is set for 2026 and the tone policymakers adopt on the future path of easing. The dollar appears to favour a slower and more cautious pace of the easing path.

The dollar’s return above 100 reflects a broader reassessment of US yield dynamics, a recalibration of risk balance and relative softness across other major currencies. If this uncertainty persists, the dollar may continue to get relative strength into year end and the early part of next year. For investors, this creates an environment where a firm dollar coexists with a slow moving easing cycle, a mix that can shape cross asset positioning and open tactical positioning across FX pairs.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.