- English

- عربي

WHERE WE STAND – Ugh, here we go again then.

Surely this week can’t be quite as crazy as last. Surely?!

No, I’m not going to take my chances on that one either, given how choppy things have been of late.

Anyway, Friday. Another day, another tariff. At least that was the main macro theme, with China upping their levy on US goods imports to 125%, in retaliation to the retaliatory tariffs that were retaliation for retaliatory tariffs imposed earlier last week. Anyone else struggling to keep up?

At this point, though, the actual tariff % doesn’t really matter at all. With tariffs this high, we effectively have a trade embargo between the world’s two largest economies. Only those products that are in ridiculously high demand and can’t be sourced anywhere else, or have humongous margins, will continue to be imported into the US. The weekend did bring some excitement that smartphones, and other tech, will be excluded from the US ‘reciprocal’ tariffs, but this is likely down to them instead being levied with a semiconductor-specific tariff, due to be announced as soon as Monday.

Now, then, it’s a question of ‘who blinks first’? Neither side are likely to want to concede ground to the other, with neither Trump or Xi wanting to be seen to lose face. At least the Chinese side acknowledge that further retaliation would be pointless, given the current level of tariffs, though we still seem some way off the Trump-Xi phone call that might break the present impasse. In the meantime, all this is almost certain to harm the US economy more than that of China.

Certainly, consumer sentiment has continued to plunge, even among GOP voters, with the outlook now having an ugly stench of ‘stagflation’ about it. Friday’s UMich sentiment data saw the headline metric tumble to 50.8, from 57.0, while year-ahead inflation expectations surged to 6.7%, the highest level since the early 80s. While the survey is a bit ropey, with a limited sample size, what worries me is how ugly this figure will look in a month or two, after a few weeks of blanket 10% tariffs on all imports ex-China (& a few others). Worse is likely to come, and with a growing risk of inflation expectations becoming de-anchored, the chances of near-term Fed easing seem slim.

What worries me even more than that, though, is the continued dislocations that we see in the Treasury complex. Once more, we saw benchmarks sell-off across the curve as the week drew to a close, with this move now feeling a lot less like a liquidation to fund margin calls, and a lot more like a loss of confidence in the US economy, and its institutional credibility. Think Liz Truss, October 2022, on steroids.

Strengthening this argument is the broad USD declines that we saw as the week drew to a close, with the DXY dipping below the 100 handle, taking the EUR to 3-year highs north of 1.14, cable briefly back into the 1.31s, and USD/JPY back down to the 142 handle for the first time since last September.

No matter the nation involved - when yields and the currency move in opposite directions it is never a good sign. Never!! Capital is rushing out of the US at a rate of knots.

On a serious note, though, we are - and I can’t quite believe I’m saying this - at risk of moving away from a decades-long period of dollar & US hegemony. Right now, there is no alternative to the buck as a reserve currency, to be clear. However, the incoherence with which economic policy is being made, coupled with the credibility erosion caused by President Trump’s constant U-turns and ‘governing by tweet’ modus operandi, is clearly creating more than a few jitters. Fundamentally, even though the ridiculous ‘reciprocal’ tariffs have been paused (for now), the prospect of those levies being imposed again will continue to linger.

All this has eroded a huge amount of trust in the United States. Hence, those who have re-allocated their reserve holdings and sold down US assets of late, will not be coming back as buyers any time soon. De-dollarisation is now a real, and frankly scary, prospect.

Amid that, worrying about where the last few % in the S&P were feels a bit insignificant. Anyway, Friday saw the benchmark index trade in choppy fashion, though ultimately ended the day about 2% higher, wrapping up its best weekly advance since late-2023. I retain my preference for rally selling, for the time being at least, especially given the elevated degree of uncertainty which persists, and which seems unlikely to dissipate any time soon. Furthermore, even with the current tariff levels, both earnings and economic growth expectations feel too ambitious, given where Wall Street currently trades.

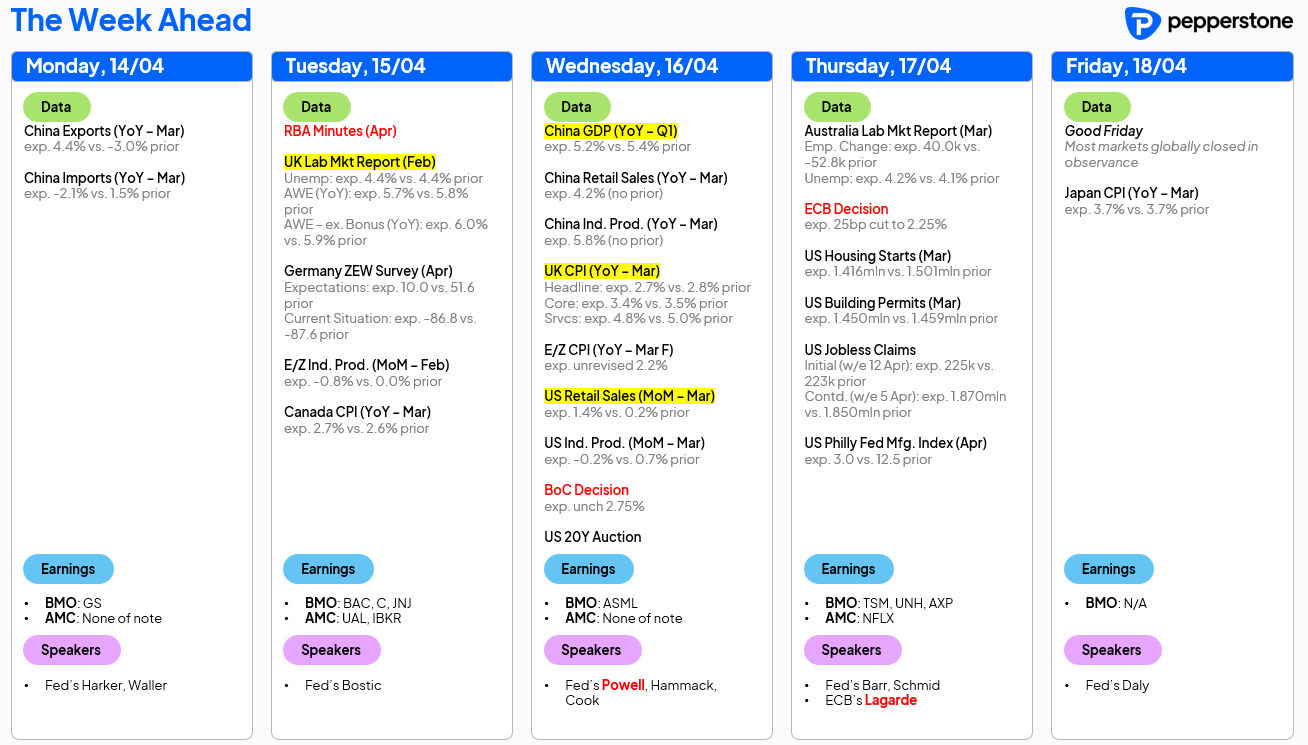

LOOK AHEAD – Headline-watching will, of course, remain the main priority during the holiday-shortened week ahead, though a busy calendar nonetheless presents itself.

On the policy front, the ECB are set to deliver their seventh cut of the cycle on Thursday, as Lagarde & Co continue with their attempts to cushion the eurozone economy from further downside growth risks as a result of Trump’s tariff impositions. The Bank of Canada, on the other hand, will probably stand pat at 2.75%, not only needing to grapple with trade concerns, but also being forced to decide policy in the middle of an election campaign.

Turning to economic data, Wednesday’s US retail sales report is the highlight, as concerns over a US economic slowdown, and likely recession, continue to mount. Key here will be whether the recent plunge in consumer sentiment has translated into a subsequent drop in spending, which will only add further fuel onto the fire of those aforementioned economic concerns.

Elsewhere, it’s a busy week here in the UK with the latest jobs and inflation figures due, though with the ONS seemingly unable to provide accurate data on anything right now, a pinch of salt may be required in interpreting each print. That said, there shouldn’t be anything to deter the BoE from another 25bp cut in early-May. Speaking of dodgy stats, a data deluge is due from China, including Q1 GDP figures, which as usual are likely to be suspiciously close to the state-mandated growth target.

Besides that, plenty of central bank speakers are due, including Fed Chair Powell on Wednesday night, though any deviation from the recent script seems unlikely. Q1 earnings season also steps up a gear, with banks wrapping up their reports in the early part of the week, before focus turns to semi names, and Netflix, as the week goes on.

The full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.