- English

- عربي

Bank of Japan Decision

The BoJ perhaps disappointed some expectations on Tuesday, though the announced policy tweaks were undoubtedly more significant than initially met the eye. In short, yield curve control (YCC) as we knew it is no more, with the ‘hard’ 1% cap on 10-year JGB yields having been removed, and instead bond purchases to be conducted ‘nimbly’ and ‘flexibly’, with the 1% mark being used as a reference for when said purchases are to be carried out, this reference being 50bp higher than that used prior to Tuesday’s decision.

Importantly, with a formal cap on yields having been abolished, markets are likely to begin to test the BoJ’s mettle, sparking a JGB sell-off to determine where exactly the upper yield limit lies for the BoJ. However, it’s also important to recognise that this week’s shift from the BoJ is another that is designed to enhance the sustainability of policy easing (i.e. allow easing for longer), rather than tightening being driven a need to deliver a more restrictive stance as a result of persistently high inflation, in line with that of other G10 central banks. Consequently, while undoubtedly another gentle step towards exiting decades of ultra-loose policy, the journey to the BoJ’s first rate hike remains a long one.

Nevertheless, even a modest sell-off in JGBs would substantially narrow the US-Japan yield spread, which has widened substantially this year, particularly as the long-end of the Treasury curve sold off. This, coupled with potential increased domestic demand sparking some capital repatriation, could be a more medium-term catalyst for USD/JPY downside.

_j_2023-11-02_13-58-57.jpg)

Quarterly Refunding

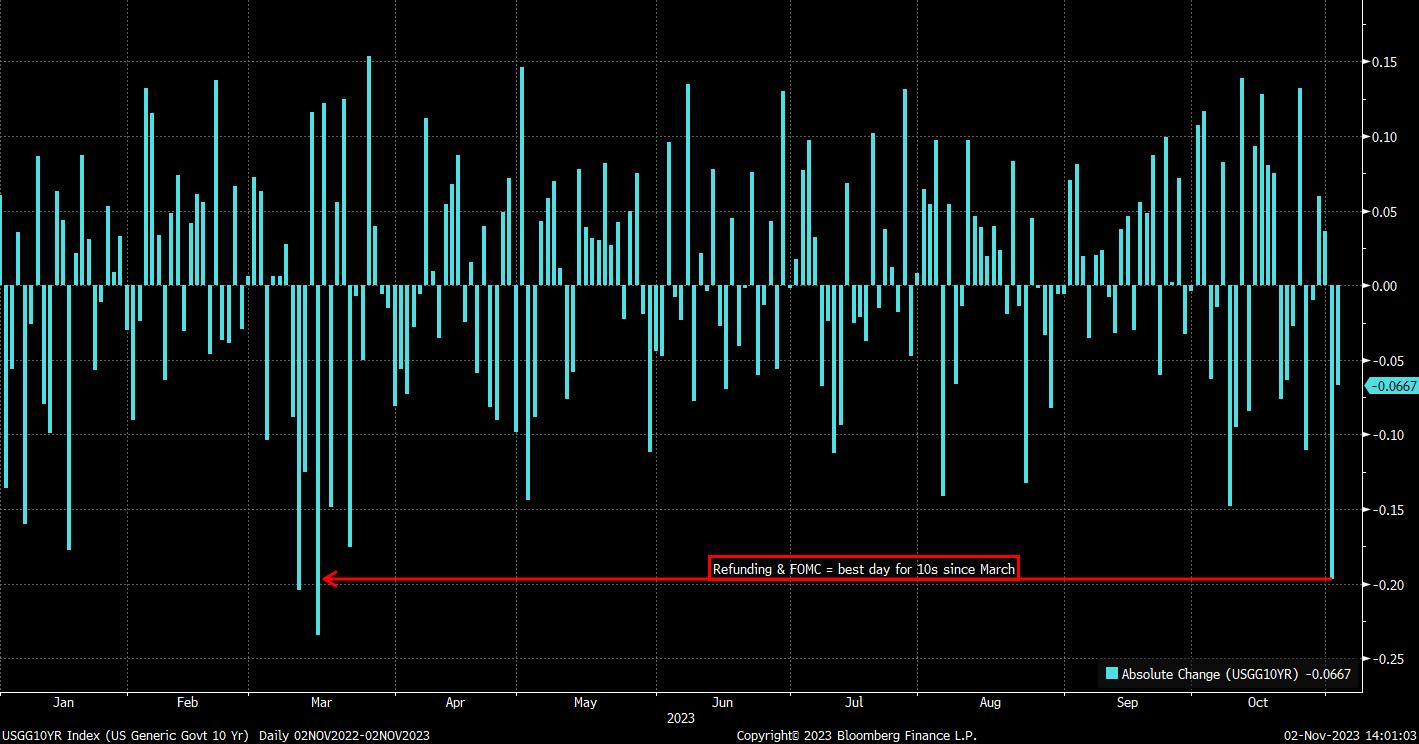

The US Treasury’s quarterly refunding announcement typically flies a little under the radar, though the recent supply-driven sell-off in long-duration Treasuries brought greater attention on the detail of how Yellen & Co. plan to fund government spending over coming quarters.

As it happened, the refunding announcement actually provided beleaguered bond bulls with a modicum of relief, as the Treasury boosted coupon sizes by $9bln to $112bln, below the $114bln estimate, while also noting that just one further quarter of coupon auction boosts is likely. Furthermore, issuance was weighted a little more to the front end of the curve, with 2- and 5-year issuance to rise by $3bln per month, compared to just $2bln in 10s, and $1bln in 30s.

As noted, with issuance below market expectations, the announcement provided relief to bond bulls, with many stepping in to buy the long end of the curve, either to cover short positions that are now comfortably in profit, or with market participants seeing value in securing yields around the 5% mark.

Demand at the long-end has seen the curve flatten a touch, with the 2s10s falling 8bp to -25bp this week, reversing just a modicum of the 100bp of bear steepening seen since mid-summer. Nevertheless, while lower issuance has provided some relief, it still seems too early to claim that a decisive cycle high in yields has been made, even if risks in the fixed income space are now evenly balanced than before.

FOMC Decision

To nobody’s surprise, the FOMC unanimously voted to maintain the target range for the fed funds rate at 5.25% - 5.50% on Wednesday, a decision that money markets had fully priced prior to the announcement. The policy statement also offered little by way of fresh guidance, being largely a ‘copy and paste’ of that unveiled six weeks ago, as the Committee maintained a data-dependent tightening bias, leaving the possibility of a further hike before year-end on the table.

Such a hike had been signalled in the ‘dot plot’ accompanying the September decision, though the doves will likely take some solace in Chair Powell’s remarks that the dots are “not a promise or plan” of future policy decisions, while also noting that the efficacy of said dot plot decays over time. Though the dots may have been downplayed, Powell was not prepared to call an end to the hiking cycle just yet, remarking that the FOMC is not yet confident policy is “sufficiently” restrictive, while stressing that there remains “a long way to go” to return inflation to the 2% objective.

Markets, however, are no longer buying what the Fed is selling in terms of its hawkish rhetoric, pricing just 5bp of further tightening this cycle – i.e., a four-in-five chance that the FOMC are done and dusted. Furthermore, the ‘longer’ part of the Committee’s ‘higher for longer’ guidance is not priced, with OIS seeing the Fed delivering the first 25bp cut next June, with a total of 56bp of easing priced by next September.

Increased faith in the idea of the Fed being ‘done’ sparked some modest USD weakness in reaction to the FOMC, along with further demand for Treasuries, especially at the front end, while also helping the S&P 500 to trade back above its 200-day moving average for the first time in over a week. To bet against the USD solely on the idea that the FOMC won’t tighten further, however, seems folly, particularly given lingering haven demand amid ongoing elevated geopolitical risk, as well as the continued outperformance of the US economy relative to its G10 peers, epitomised by the almost 5% annual growth rate recorded in Q3.

_D_2023-11-02_14-02-16.jpg)

Bank of England Decision

The ‘Old Lady’ held Bank Rate steady at a post-crisis high 5.25% this week, as had been widely expected, extending a policy pause into a second meeting running, in what was again a split decision, with three external MPC members voting in favour of a 25bp hike. The MPC’s policy guidance also brought little by way of fresh information, once more repeating that further tightening could be required if signs of more persistent inflationary pressures emerge, in addition to reiterating the ‘higher for longer’ policy stance, with policy said to need to be restrictive for “an extended period of time”.

None of this was particularly new, nor was it vastly different from present market pricing, though OIS discounting 33bp of cuts by next September does seem a little overdone, with Governor Bailey noting that it is “much too early” to be thinking about rate cuts. With inflation still over 3x the MPC’s objective, and the MPC’s own forecasts not seeing a return to said objective until the latter half of 2025, it remains incoming inflation data, particularly on services prices, that is the key determinant of how long Bank Rate will remain at the current restrictive level.

Despite that, while the BoE may maintain a higher rate for longer than most G10 peers, all is not necessarily rosy for the GBP, especially as the economy shows early signs of losing momentum, the BoE themselves forecasting next-to-no growth in 2024, and the pace of re-mortgaging onto substantially higher fixed rates set to continue. Risks, therefore, continue to point to further downside for the GBP, particularly if equities were to see another bout of substantial downside.

_2023-11-02_14-02-57.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.