- English

- عربي

Undeniably, it’s been quite the rocky week for markets, with risk appetite having taken a beating amid a tech-led slide on Wall St. Amid the hysteria and hyperbole, though, some context is important.

Sell-Off Seems More Like A Blip

The S&P, for instance, continues to trade within touching distance of its all-time high, with the current drawdown being a mere 3%. Moreover, the benchmark is just about flat on a YTD basis, once again evidencing how the recent move is far from disastrous.

Though the drawdown in the Nasdaq 100 is larger, to the tune of around 6%, this is still far from a catastrophe in the grand scheme of things, particularly when the decline is largely representative of participants rotating into cyclically-oriented areas of the market, as opposed to selling-down equities entirely.

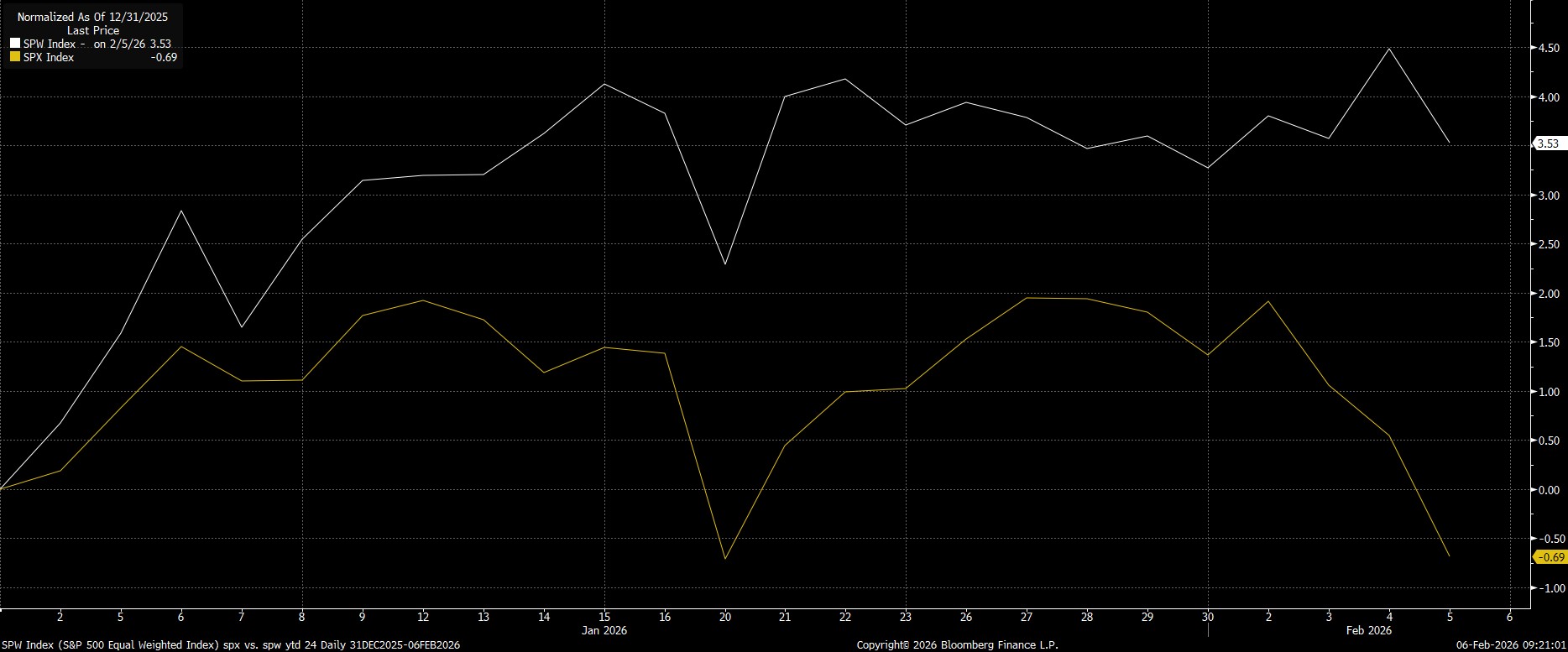

This, in turn, helps to explain not only the relative outperformance of the Russell, but also why the equal-weighted S&P sits with a rather handsome 3.5% YTD gain.

Stocks Have Been Treading Water For A While

Zooming out further, it’s noteworthy that the market hasn’t really gone anywhere for the last four months, with spoos having sat in a tight 6,600 – 7,000 range since the middle of October. At the time of writing, we trade right in the middle of said range, at 6,800, again, hardly catastrophic in the grand scheme of things.

Of course, this is not to say that headwinds shan’t persist. The NQ has now closed below its 100-day moving average for the first time since November, which could open the door to a test of recent lows around 24,000. Spoos are also perilously close to breaking the 100-day MA, beneath which the aforementioned range lows could well be probed.

Fundamental Bull Case Is Still Robust

That said, from a fundamental perspective, while oodles of column inches are taken up with inane commentary as to how many billions worth of market cap have been wiped off software stocks – perhaps the most ridiculous way of measuring anything in the equity space – the backdrop remains a very robust one.

The underlying economy is still clearly resilient. This week has brought along a solid set of both manufacturing and services PMIs from the ISM stateside, as well as decent-enough PMI figures on this side of the pond too. Though the ADP employment report was a little sub-par, this doesn’t tell us much we didn’t know already; namely, that the US labour market continues to operate in ‘no hire, no fire’ mode, against which the Fed have already taken out 75bp of insurance cuts, and may well take out more.

Earnings growth is still strong. Megacap earnings from the likes of Alphabet and Amazon this week delivered on expectations, even if huge capex guides gave investors a bit of a fright. For the market at large, blended earnings growth for Q4 is running at around 11%, which would mark the fifth straight quarter of double-digit earnings growth on Wall St.

The fiscal backdrop continues to ease. As the year progresses, the global economy will begin to feel the positive fiscal impulse not only from the ‘One Big Beautiful Bill Act’ in the US, but from various other fiscal loosening initiatives, including Germany’s huge push towards increased defence and infrastructure spending, as well as likely additional policy support in China, all providing helpful tailwinds.

The monetary backdrop continues to loosen. The Fed remain on course to deliver at least two, if not more, further rate cuts this year, while balance sheet expansion by virtue of ongoing reserve management purchases provides a further backstop. Here in Europe, the BoE have embarked on a renewed dovish pivot, while the ECB shan’t be tightening policy any time soon. Yes, the RBA have already done so, but the global impact of moves there is insignificant.

Conclusion

Putting all that together, we can reasonably say that nothing has changed in the last two or three weeks that builds a structural bear case for global equities. In fact, quite the opposite, with this remaining a very favourable environment indeed for risk taking.

Consequently, I reiterate my view that the path of least resistance continues to lead higher over the medium-term, and that further gains, on Wall St and elsewhere, are still on the cards. Dips, hence, should be viewed as buying opportunities, with the embattled tech sector ‘catching-up’ to the rest of the market considerably more likely than the broader market also falling out of bed, to my mind.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.