- English

- عربي

WHERE WE STAND – For a moment, Friday looked set to descend into shambles, as another round of technical gremlins at the BLS threatened the timely release of the August US labour market report.

Mercifully, all was released in good order as usual, though I’d imagine a few would rather the report wasn’t released at all, given the rather glum tone of the whole thing.

Headline payrolls rose just 22k last month, well below the 75k consensus, while net revisions not only dragged the 3-month average of job gains to 29k, about half the breakeven pace, but also saw June’s jobs figure revised to show the first fall in payrolled employment since the back end of 2020. On a sectoral level, healthcare again propped things up almost entirely, with employment elsewhere flat/negative on the month. While earnings pressures remain contained, rising 0.3% MoM/3.7% YoY, the household survey was also rather downbeat, as both unemployment and underemployment rose to cycle highs at 4.3% and 8.1% respectively. Labour force participation did rise, to 62.3%, but that’s hardly worth celebrating given the rest of the data.

In short, we’ve gone from a jobs market that was last year going gangbusters, to one that is now undeniably stalling.

Market participants reacted to the data in the dovish manner that one would expect, as front-end Treasuries rallied hard, the dollar rolled over against all peers, and gold rallied to fresh record highs. Initially, equities also advanced, benefitting from that rally at the front-end, though gains fizzled out as trade progressed in a realisation that, perhaps, bad news actually is bad news.

The jobs report, to be clear, shan’t change the calculus for the September FOMC meeting, where a 25bp cut remains the base case, though it could result in a handful more policymakers dissenting in favour of a larger 50bp move. The data does, however, raise the potential for consecutive, as opposed to gradual, cuts from the Fed through year-end, though I stick with my base case of 25bp moves in September and December for now, given where the balance of risks to inflation lies.

I’m not entirely convinced that the jobs report changes much for markets just yet either, frankly, though of course we must now be attentive to whether a cracking labour market results in stalling consumer spending, which would of course pose a headwind to equities at large. For the time being, though, oodles of AI CapEx from the hyperscalers, plus solid earnings growth, calmer tones prevailing on trade, and a more accommodative policy stance, should all keep the path of least resistance leading higher.

Elsewhere, that ‘path of least resistance’ continues to lead higher for gold, not only as physical demand for bullion remains underpinned as reserve allocators continue to diversify, but with haven demand also now entering the fray if/when jitters over the state of the US economy intensify. Momentum also still favours the bulls, as one record high tends to beget another.

A broadly softer USD, spurred on by a dovish Fed, and Trump’s continued undermining of monetary policy independence, will also help gold to gain ground, likewise G10 FX. For this reason, I still retain a preference to play my bearish UK view in the crosses, as fiscal worries look set to persist up until, and almost certainly beyond, the Budget on 26 Nov, with Friday’s Cabinet shuffle akin to the deckchairs on the Titanic being rearranged. Political risk has also re-emerged in Japan, over the weekend, after PM Ishiba’s resignation, posing downside risks to the JPY and JGBs as an LDP leadership campaign ensues, the possibility of a general election looms, and the fiscal stance looks set to become considerably looser.

Speaking of fiscal fragility, my bias also remains towards steeper curves across DM Govvies. For Treasuries, in particular, there is also a risk that the August jobs report will spook the Fed into panic stations, but could actually prove to be the trough in the labour market, as the dregs of tariff-related uncertainty made themselves felt in the economy.

The Fed easing into an economic re-acceleration, amid a plethora of upside inflation risks, with the deficit ballooning, and financial conditions already loose, is an underpriced risk. Nothing feels recessionary here, with the labour market not grappling with structural issues, but instead adjusting to a one-time shock – namely, the ‘Liberation Day’ nonsense in early-April. Let’s see how things shake out, but I’d not be surprised if we’re at, or close to, the bottom in terms of labour market softness.

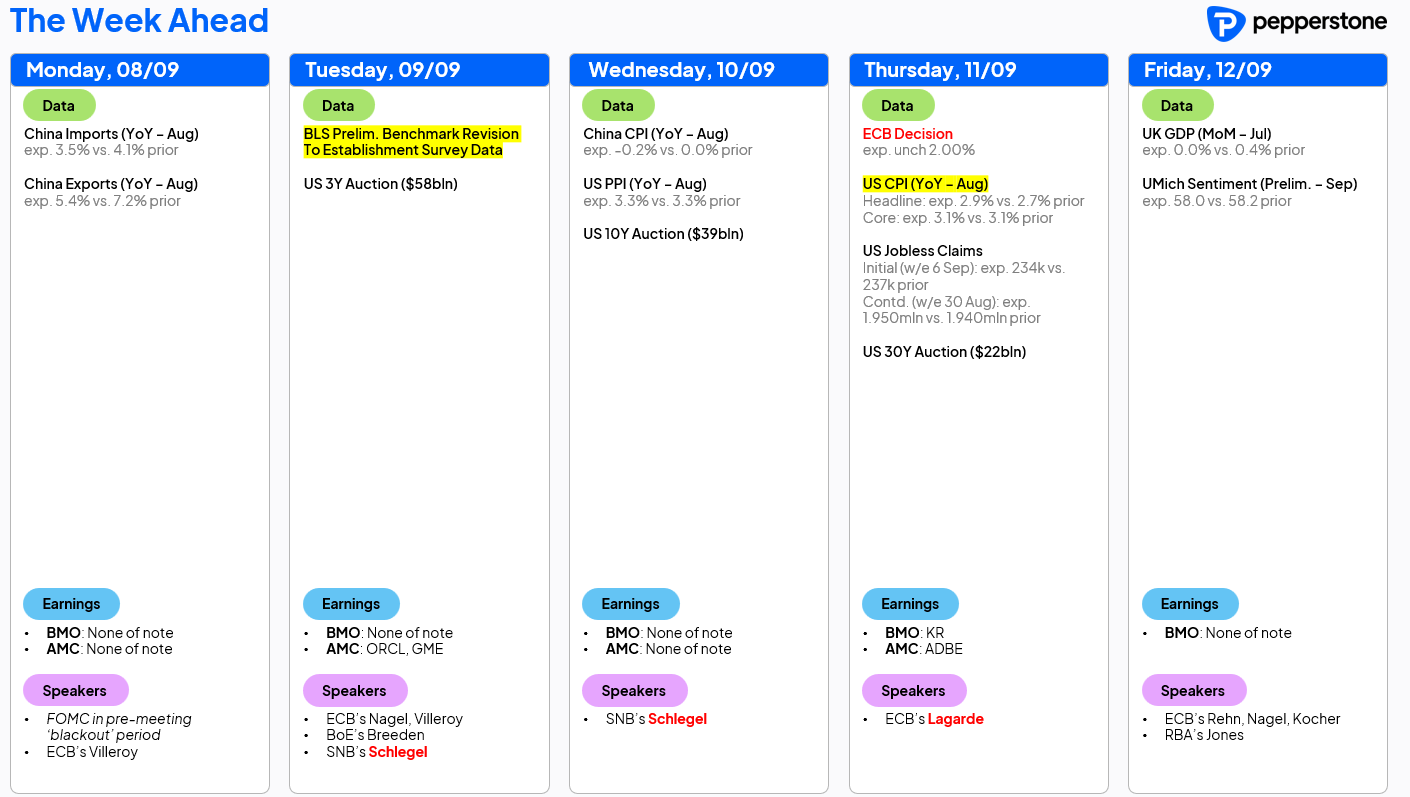

LOOK AHEAD – A somewhat lighter economic docket this week, as participants continue to digest Friday’s disappointing jobs data, and the FOMC being their pre-meeting ‘blackout’ period.

While today’s docket brings little of interest, the state of the US labour market will be back in focus tomorrow, as the BLS release preliminary benchmark revisions to establishment survey data, for the 12 months to the end of Q1 25. Given the recent trend, it’s almost certain that the benchmark revisions will be revised a fair chunk lower, potentially to the tune of as much as 800k.

Besides that, we also have the latest US CPI figures this week, which are set to have shown a further pass-through of tariff-related costs in August, with headline CPI seen rising 2.9% YoY, and core inflation having held steady at 3.1% YoY. While the FOMC do appear prepared to look-through the ‘one-time shift in price level’ caused by tariffs, inflation data of this ilk will nonetheless prevent anything larger than a 25bp cut being delivered later in the month.

Elsewhere, the ECB will stand pat on policy on Thursday, with Lagarde & Co set to maintain the deposit rate at 2.00%, and the easing cycle now being at an end. The ECB’s latest round of projections, meanwhile, will likely again point to a modest undershoot of the 2% inflation aim next year, before a return to target in 2027, while growth expectations are likely to be broadly unchanged.

Speaking of growth, the latest UK GDP stats are out on Friday. While the monthly GDP report is incredibly noisy, the economy is set to have stagnated in July, further adding to Chancellor Reeves’s woes ahead of the late-November Budget.

Other than that, a week of relatively chunky Treasury supply awaits, with 3-, 10- and 30-year auctions all on deck, while notable corporate earnings come from the likes of Oracle (ORCL) and Adobe (ADBE). Of course, trade, and geopolitical, headlines will also continue to be closely watched throughout the week.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.