- English

- عربي

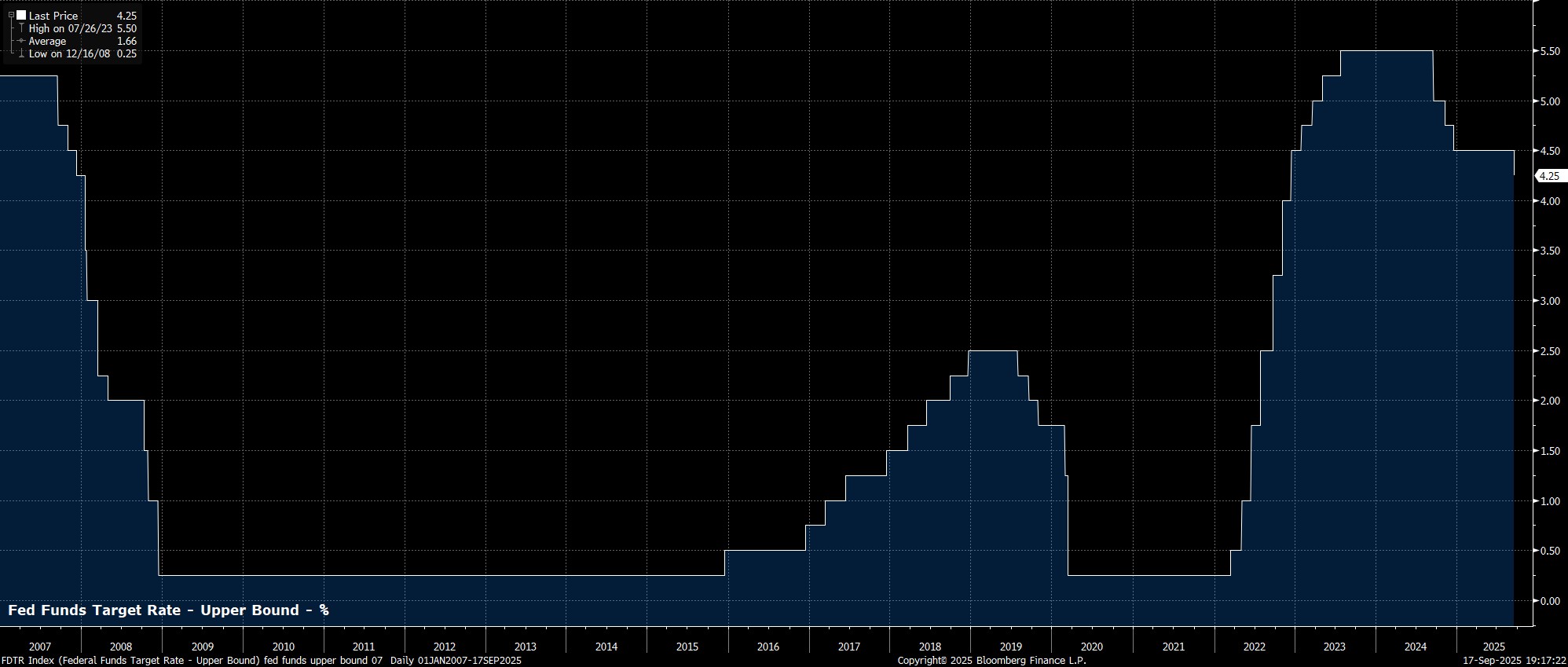

The FOMC delivered a 25bp cut at the conclusion of the September meeting, lowering the target range for the fed funds rate to 4.00% - 4.25%, in line with both consensus expectations, and the outcome that money markets had fully discounted.

Such a rate reduction marks the first cut since last December, as the Committee’s reaction function shifts to place increasing weight on the stalling labour market, amid signs that the pass-through of tariff-related price pressures is proving slower, and potentially weaker, than had been expected.

The decision to deliver a 25bp cut, however, was not a unanimous one, with the Committee divided as to the appropriate magnitude of cut to deliver. Unsurprisingly, new Governor – and Trump puppet – Steve Miran, dissented in favour of a larger 50bp move, though notably neither of the previous dissenters, Waller or Bowman, deviated from the majority this time out.

Accompanying the decision to reduce the fed funds rate for the first time in nine months, was the Committee’s updated policy statement.

Here, the Committee, 'marked to market' their views on the economy, noting that job gains have 'slowed', unemployment has 'edged up', but that inflation still remains 'somewhat elevated'. Meanwhile, forward guidance was altered to remove reference to the ‘extent and timing’ of future rate adjustments, strongly suggesting that a relatively rapid removal of monetary policy restriction is now on the cards.

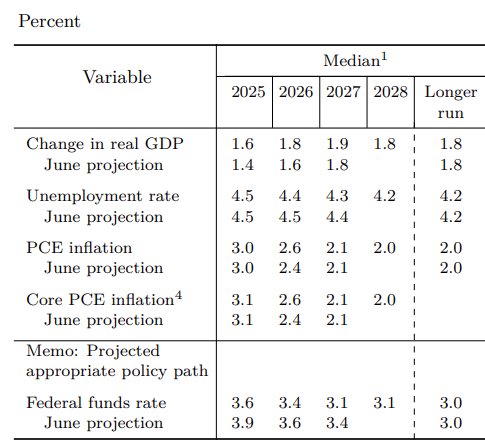

Meanwhile, the September meeting also brought with it an update to the FOMC’s quarterly Summary of Economic Projections (SEP). While economic uncertainty has diminished markedly over the summer, it remains at a relatively high level, hence the projections likely have a much shorter ‘shelf life’ than usual.

In any case, compared to the prior forecast round in June, the updated SEP marginally upgraded their expectations for economic growth over the short-term, while also pencilling in a higher inflation profile as well, even if the 2% target is still set to be achieved by the end of the forecast horizon in 2028.

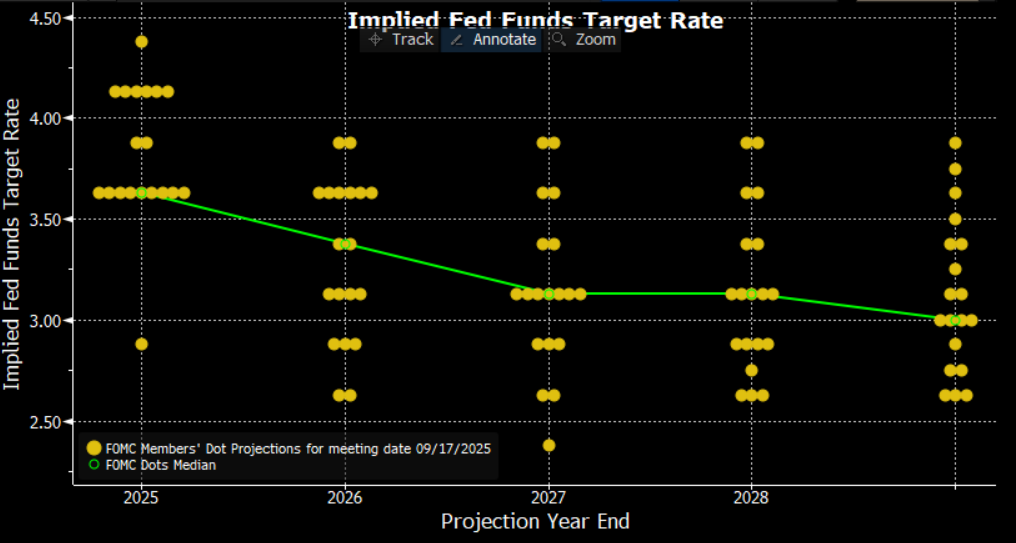

Taking into account those updated projections, the Committee’s refreshed ‘dot plot’ pointed to a further 2x 25bp cuts being delivered this year, with another 25bp of easing being delivered next year, followed by a solitary 25bp cut in 2027, all considerably more dovish than expected, and suggesting a front-loading of cuts akin to what the OIS curve had recently been discounting.

Taking stock of all this, at the post-meeting press conference, Chair Powell noted that downside risks to the labour market have ‘risen’, while longer-run inflation expectations remain ‘well-anchored’. On policy, Powell remarked that this shifting balance of risks suggests that the FOMC should be moving policy back to a more neutral setting, though nevertheless framed today’s move as a ‘risk management cut’.

Overall, the September FOMC meeting will, doubtless, go down as a significant one, with the Committee choosing to lean heavily towards the employment side of the dual mandate, despite lingering upside inflation risks, and resume the journey back to a more neutral setting of the fed funds rate.

The journey back to neutral now seems set to be a relatively rapid one, with my base case shifting to the FOMC now cutting at both of the remaining meetings this year, and likely at the first couple of 2026 meetings as well.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.