- English

- عربي

September 2025 BoE Review: A Pragmatic QT Tweak With Further Cuts On The Cards

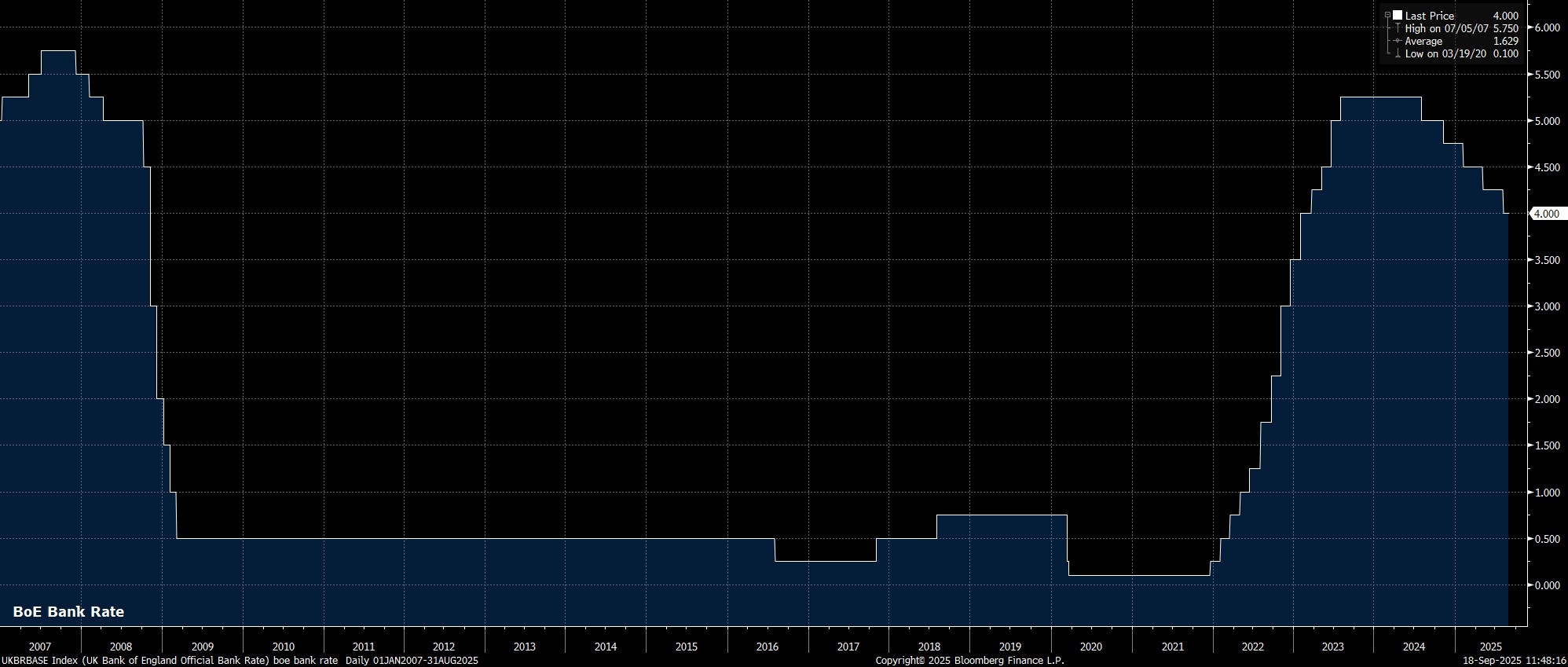

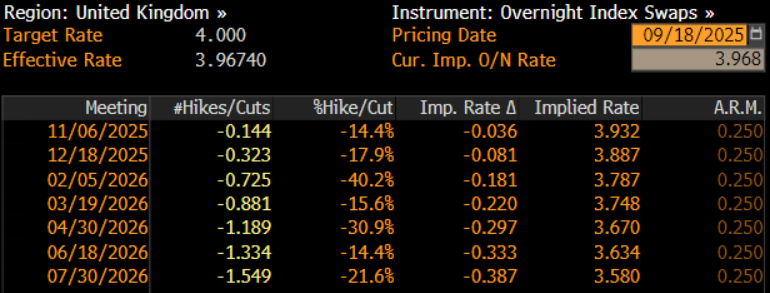

As expected, and had been fully discounted by the GBP OIS curve, the Bank of England’s Monetary Policy Committee stood pat at the conclusion of the September meeting, holding Bank Rate steady at 4.00%, having delivered this cycle’s fifth rate reduction last time out, in August.

Once again, however, policymakers were divided on the appropriate course for monetary policy, something that has become a bit of a hallmark for the MPC over the last couple of years. This time out, the decision to leave Bank Rate unchanged came via a 7-2 vote, with external members Dhingra and Taylor dissenting in favour of a 25bp cut. This dissent, frankly, isn’t especially surprising, and is very much in keeping with their longstanding dovish stances.

Thankfully, the accompanying policy statement was a considerably more straightforward affair, broadly being a repeat of that issued after the August confab. Hence, policymakers reiterated that a ‘gradual and careful’ approach to further rate reductions remains appropriate, while also repeating that policy will remain ‘data-dependent’, and not on any ‘pre-set’ path. All of this was not only in line with expectations, but also confirms that the MPC retain a fairly obvious easing bias for the time being.

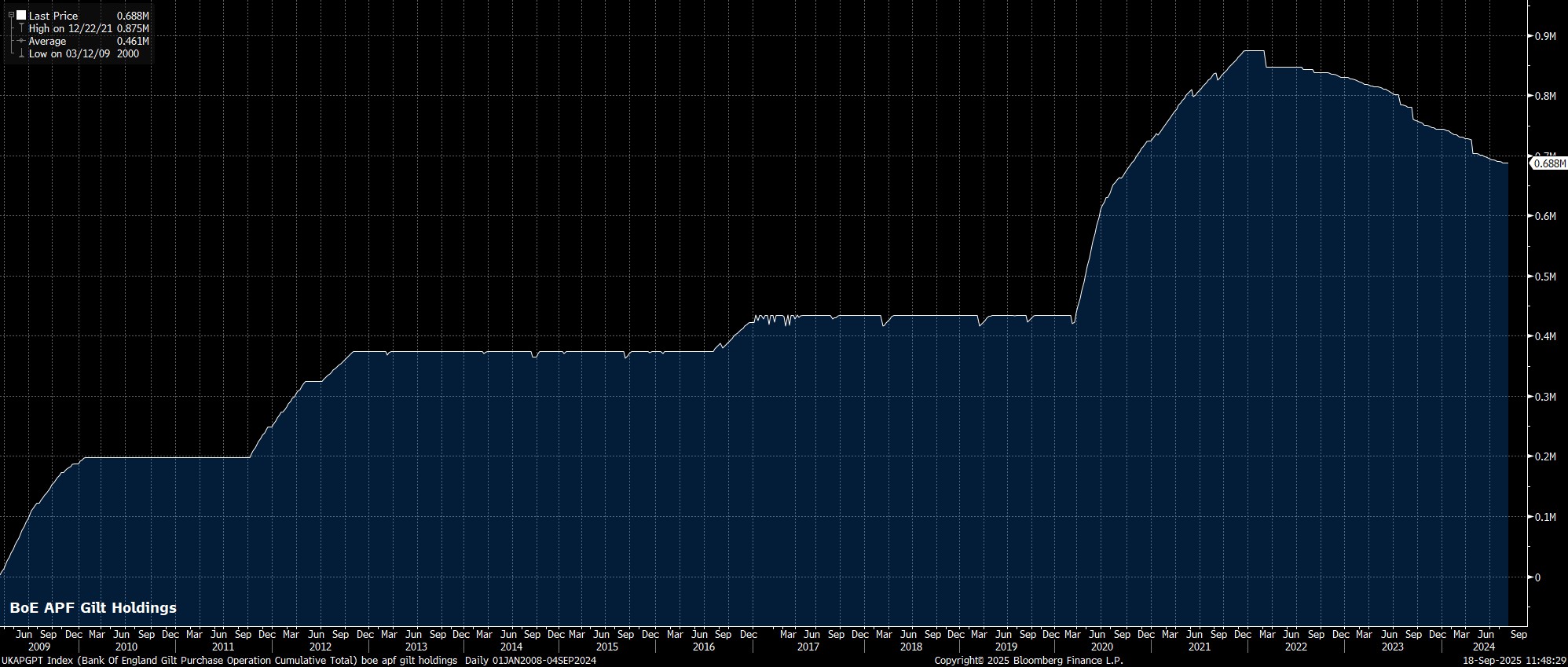

Bank Rate, however, was never going to be the ‘main event’ at the September meeting, with focus instead falling on the MPC’s plans in terms of the balance sheet over the next 12 months.

On this front, the MPC confirmed that the overall QT envelope will amount to £70bln over the next year, comprising the roll-off of approx. £49bln in maturing securities, plus £21 in active sales, with these sales tilted heavily towards the front-end of the curve, with long-dated Gilts to account for just 20% of offerings. This is a pragmatic decision from policymakers, which should help alleviate some modest pressure at the long-end of the curve.

Taking a step back, besides the aforementioned balance sheet developments, the September MPC meeting changes little in the grand scheme of things in terms of the policy outlook.

By maintaining the ‘gradual and careful’ guidance, one can reasonably assume that the MPC’s base case is to continue with the present path of one 25bp cut per quarter, though the bar to said cuts is clearly a relatively high one, after 4 members dissented against the August reduction.

The September inflation data, due 22nd October, remains the key date for the diary, and potentially the sole determinant of whether another cut will come before year-end. If, next month, headline CPI prints at, or below, the Bank’s expected 4% peak, then a 25bp cut at the November MPC is likely – as, for now, remains my base case. That said, a rise in headline CPI north of that 4% mark, especially if accompanied by a renewed intensification in underlying price pressures, would likely kill the possibility of any further Bank Rate cuts this year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.