- English

- عربي

September 2024 US CPI: Hotter Data Shan’t Deter FOMC From November Cut

Headline CPI rose by a hotter than expected 2.4% YoY in September, though this still represents slowest annual inflation rate since February 2021. Concurrently, core CPI rose by 3.3% YoY, also above consensus expectations for a 3.2% increase.

Meanwhile, on an MoM basis, which remains less prone to distorting base effects than the YoY metrics mentioned above, figures were also hotter than expected across the board. Headline prices rose by 0.2% MoM, unchanged from the pace seen in August, while core prices also remained unchanged, at 0.3% MoM.

Annualising these metrics can help to provide a clearer picture of underlying inflationary trends, and produces the below figures:

- 3-month annualised CPI: 2.1% (prior 1.1%)

- 6-month annualised CPI: 1.6 % (prior 2.0%)

- 3-month annualised core CPI: 3.1 % (prior 2.1%)

- 6-month annualised core CPI: 2.6% (prior 2.7%)

Clearly, data of this ilk will do nothing to dispel the confidence that FOMC policymakers have obtained in inflation continuing to make sustainable progress back towards the 2% target over the medium-term, therefore not deterring the Committee from continuing with the policy normalisation process.

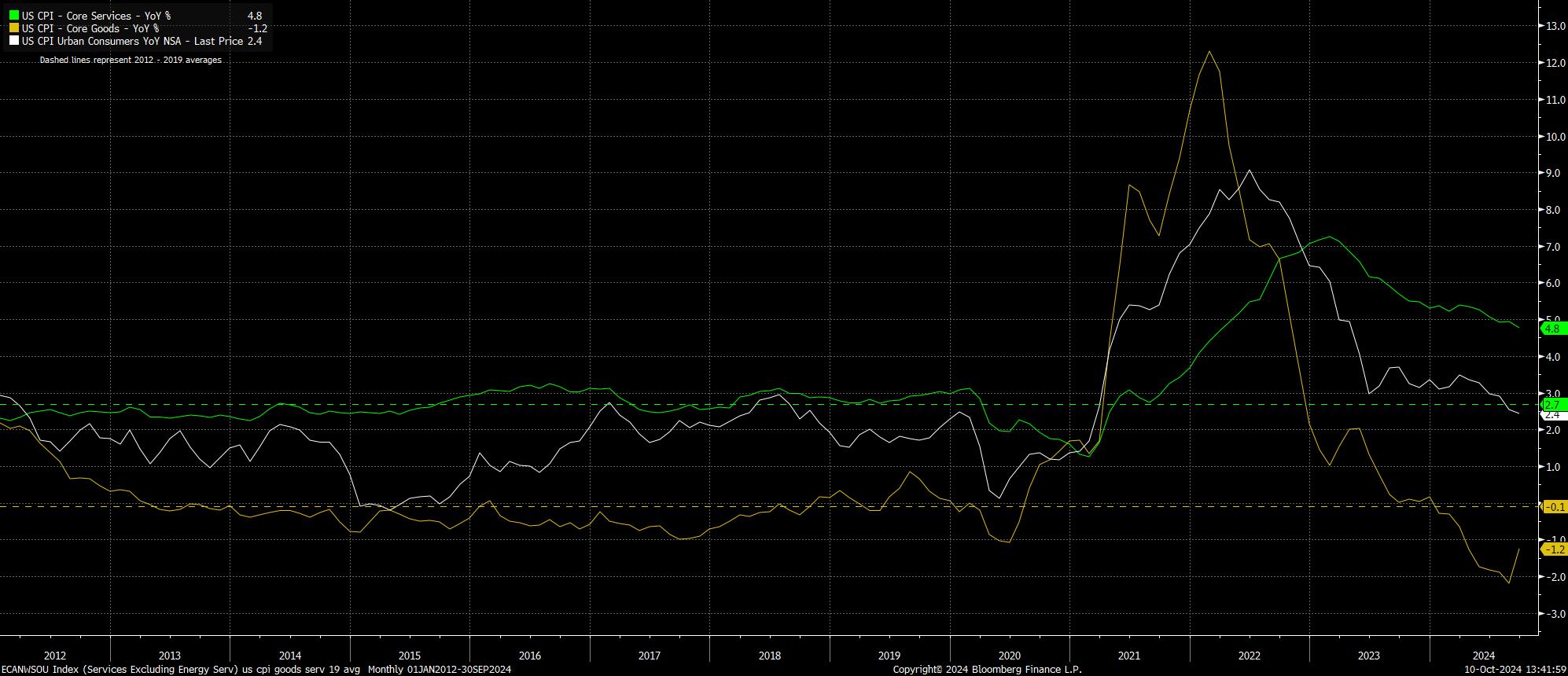

Digging into the data, and in what is likely to be pleasing news for the FOMC, September saw a further slowing in the pace of services inflation, with services CPI rising 4.8%, the slowest pace since March 22, though the pace of goods deflation slowed to -1.2% YoY, perhaps driving the upside surprise.

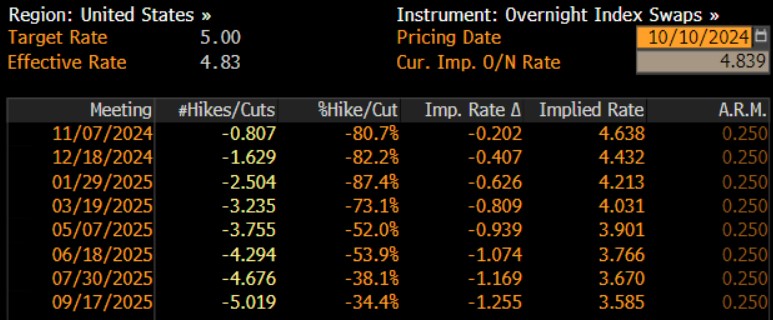

In the aftermath of the figures, the USD OIS curve repriced sharply in a dovish direction, though this owed more to a much softer than expected set of weekly jobless claims figures, as opposed to anything in the CPI report. Nevertheless, the USD OIS curve now prices around an 85% chance of a 25bp cut next month, compared to a 73% chance before the CPI figures were released.

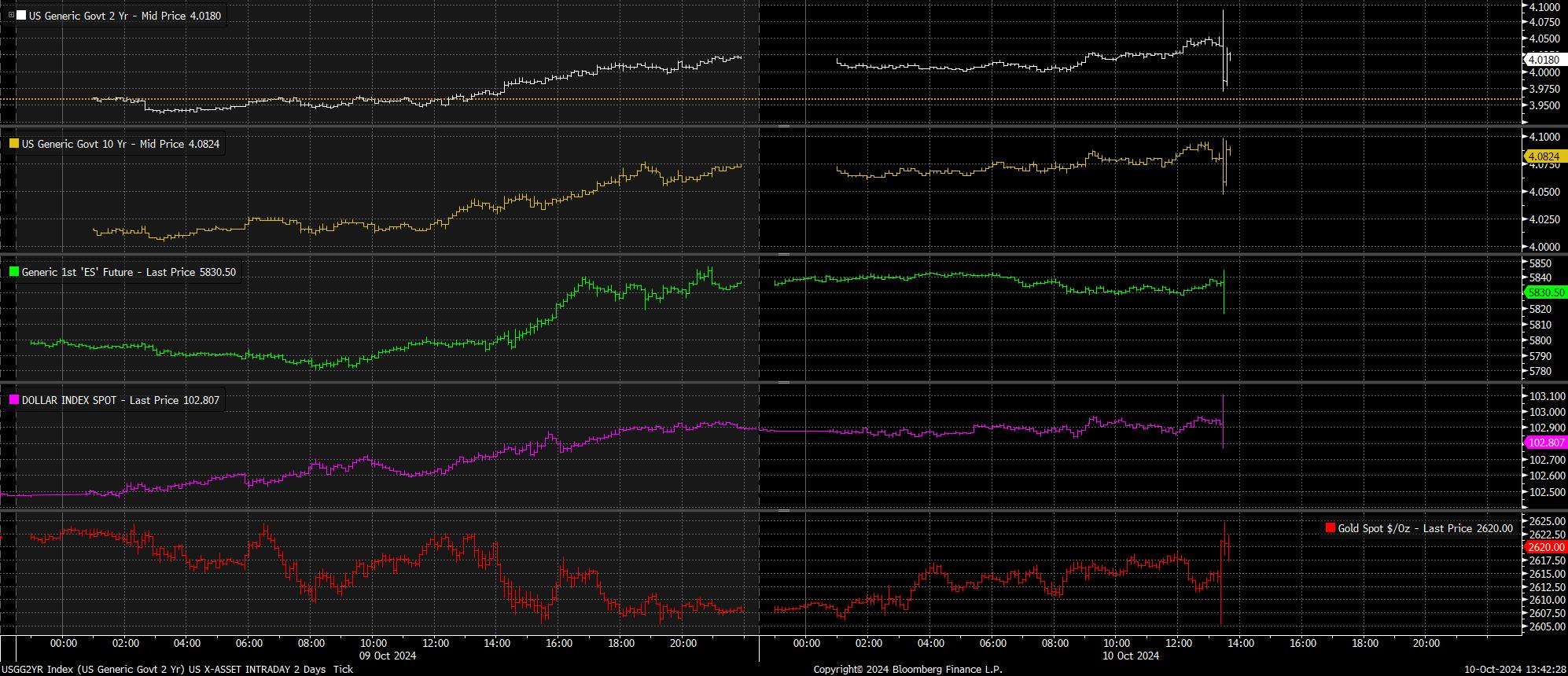

That claims data appeared to be the catalyst for the majority of the market moves seen in the aftermath of the CPI report – with Treasuries rallying hard, led by the front end of the curve, as equities saw some downticks, taking the front S&P future to a day low. These moves, though were pared relatively quickly.

On the whole, despite the figures being hotter than expected, it seems highly unlikely that the September CPI figures will materially alter the FOMC policy outlook. With policymakers having already obtained sufficient confidence in a sustainable return towards the 2% inflation target over the medium-term, the labour market has now become the primary determinant of future policy shifts, with risks to each side of the dual mandate having come back into better balance.

As a result, despite the stronger than expected September jobs report, and given continued disinflationary progress, 25bp cuts at each of the remaining 2 FOMC meetings this year, with that cadence of cuts likely to continue into 2025 as well, until the fed funds rate returns to a roughly neutral level around 3% next summer. Of course, were the labour market to materially weaken, likely defined as unemployment rising north of the 4.4% September SEP year-end forecast, the prospect of larger 50bp cuts remains on the table.

This, in essence, is the ‘Fed put’, which persists in a forceful and flexible form, and continues to provide participants with confidence to reside further out the risk curve, while also leaving equity dips to remain relatively shallow, and viewed as buying opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.