- English

- عربي

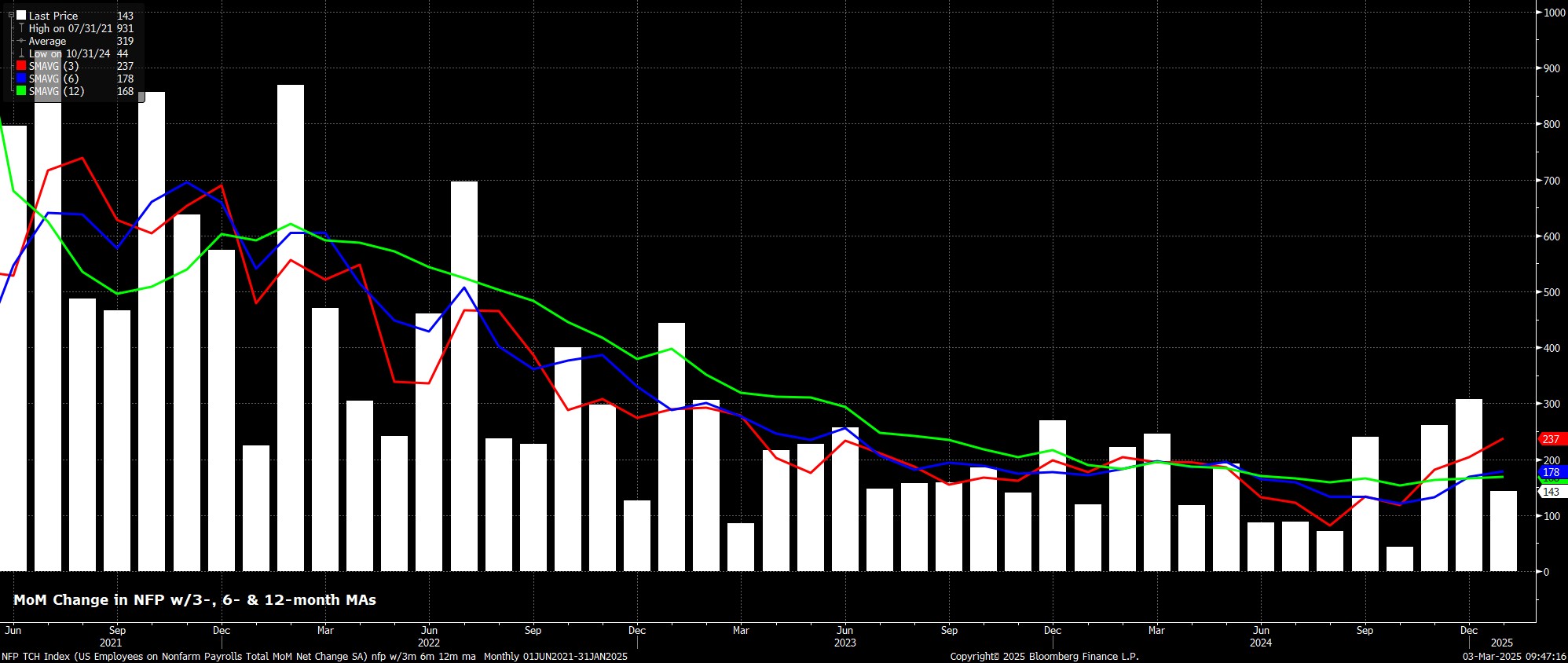

Headline nonfarm payrolls are set to have risen +160k in February, a modest rebound from the +143k pace seen a month prior, albeit considerably below the 3-month moving average of job gains which, at +237k, stands at its highest level in almost two years. As is typically the case, though, the range of estimates for the payrolls print is a wide one, from +100k on the low, to +300k on the high.

Risks to the consensus figure seem broadly balanced.

Jobs growth in January was depressed by a handful of one-off factors, including wildfires in California, and an incredibly cold snap across swaths of the United States during the survey week. Though wintry weather persisted into February, at least some of this weather-related weakness is likely to be unwound this time around.

Meanwhile, from a political perspective, the February report will likely be far too early for the full effects of the Trump Administration’s ‘DOGE’ job cuts to become known. Those who accepted a buyout package will be paid until end-September, hence will still count as ‘employed’ until then, while those on probationary contracts who have since been laid off will have mostly received a pay cheque in the week of the 12th, hence shan’t fall off payrolls figures until the next report.

That said, the immediate federal hiring freeze introduced by Trump upon taking office may pose a modest headwind to payrolls growth, albeit likely only a modest one, with federal jobs having, on average, added less than 10k to headline payrolls over the last year.

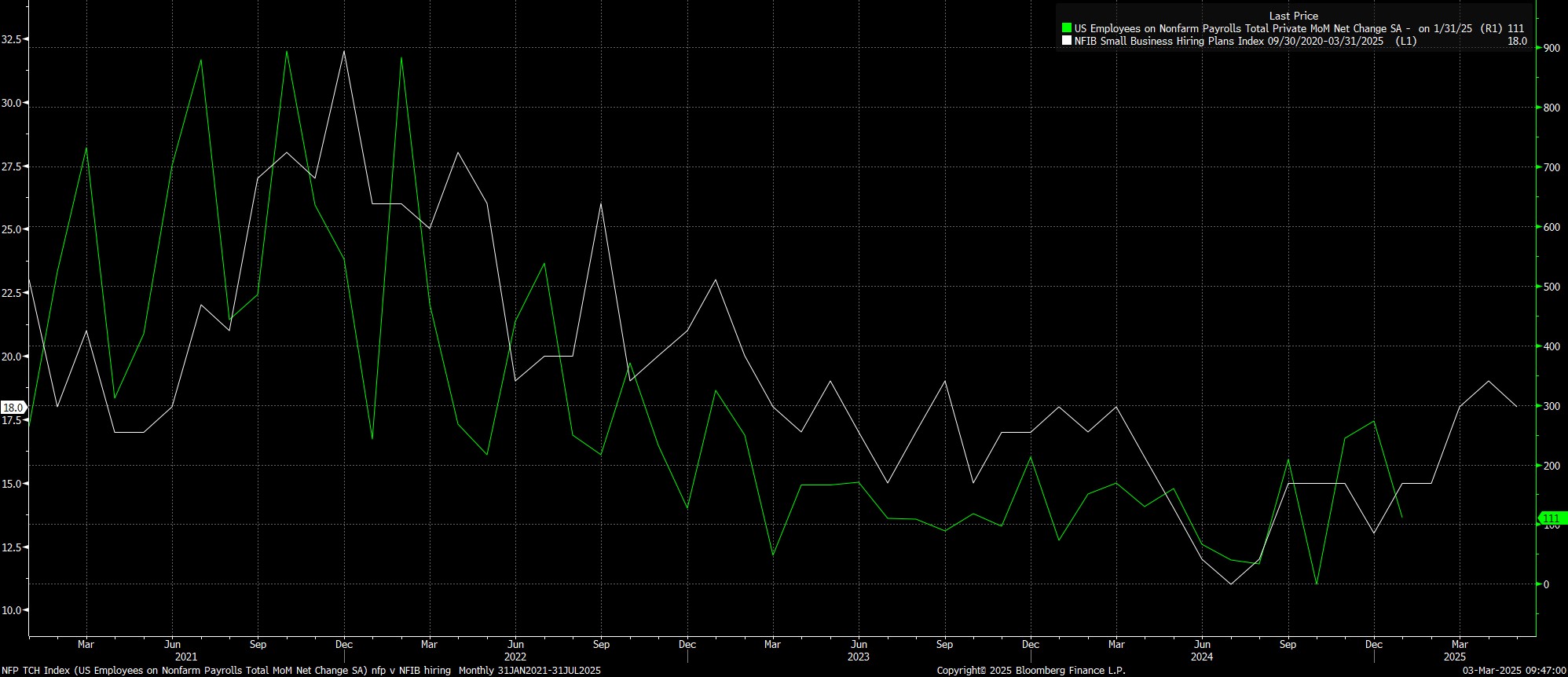

Turning to leading indicators for the jobs report, most have held largely steady since the January data was released, though the latest ISM manufacturing and services surveys are yet to be released, as at the time of writing.

In any case, initial jobless claims fell a modest 3k from between the two survey weeks, while continuing claims rose by 12k – both moves which, in the grand scheme of things, are inconsequential and provide little by way of signal. Likely of more value is the NFIB’s hiring indicator, which has been a relatively reliable predictor of payrolls growth this cycle. This time around, the index points to above-consensus jobs growth of around 175k, assuming that government payrolls growth is at, or close to, nil.

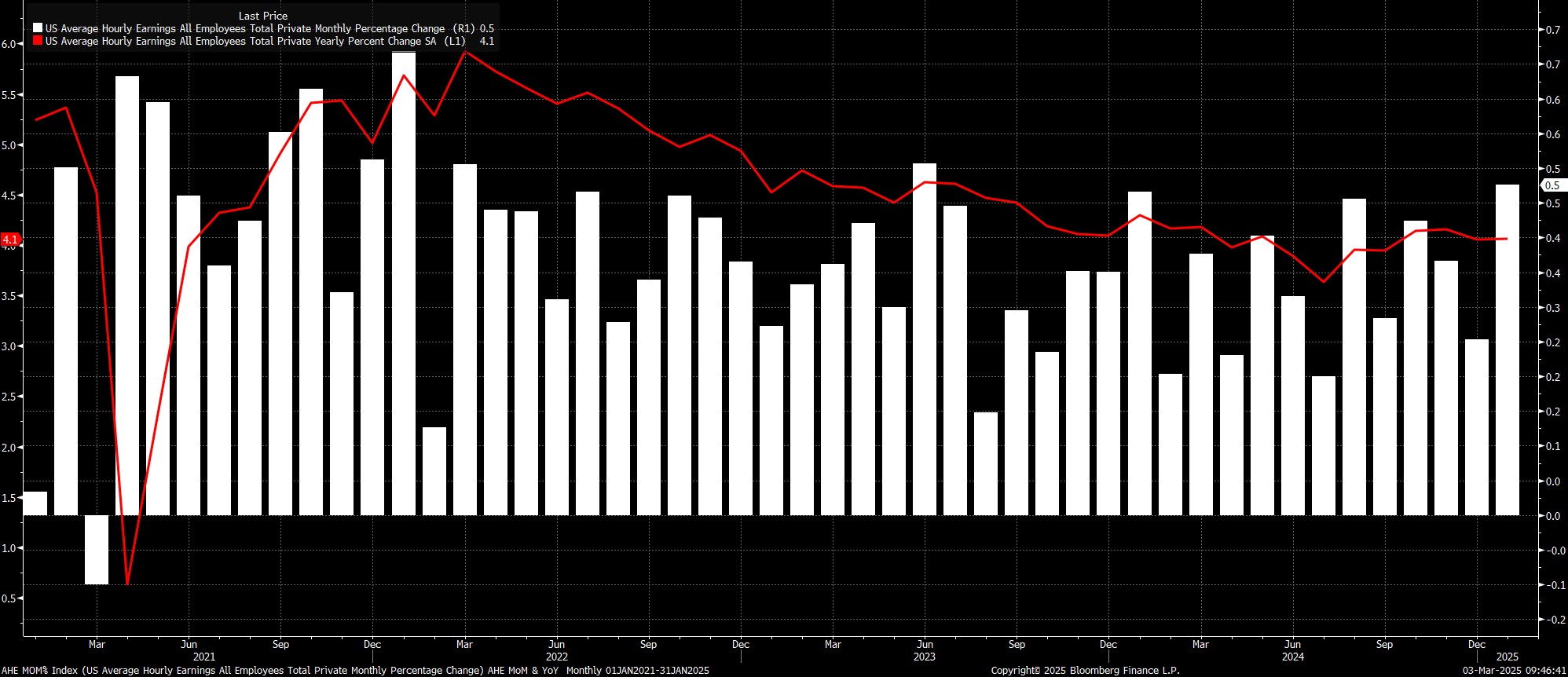

Sticking with the establishment survey, average hourly earnings growth is set to cool 0.2pp to 0.3% MoM in February, though this will almost certainly come as a result of workweek hours rebounding to a more normal level, having hit a post-covid low in January due to the aforementioned one-off factors. On an annual basis, earnings are set to have risen 4.1% YoY, an uptick from the 3.9% YoY seen last time out, though base effects are likely a driver here.

Figures roughly in line with these expectations are unlikely to be of particular concern to FOMC policymakers, and would largely reinforce the view that the labour market is not presently a source of upside inflation risks.

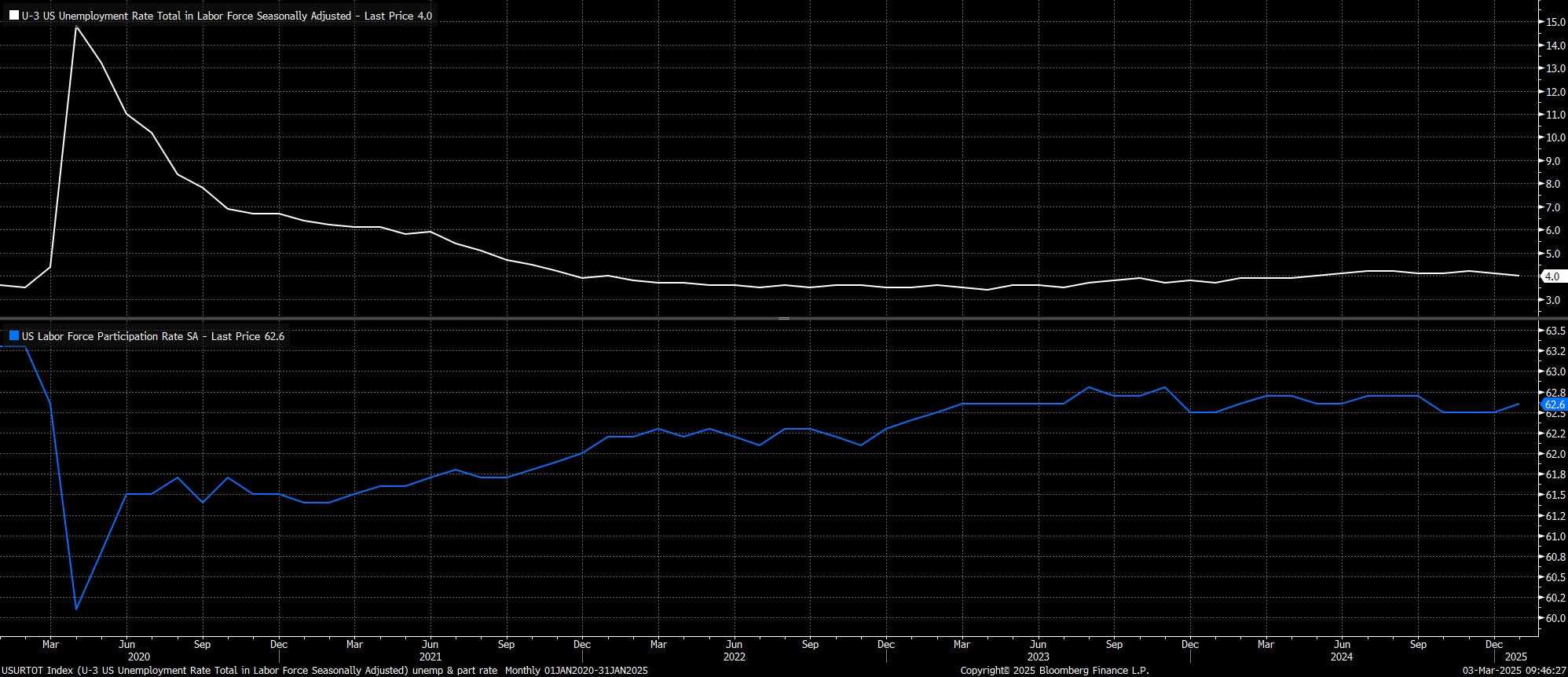

Turning to the household survey, the aforementioned one-off factors are unlikely to have as much of an impact on the figures, with the HH survey typically much less skewed by such distortions than its establishment counterpart. That said, the HH survey continues to grapple with data volatility of its own, largely owing to the BLS’ difficulty in modelling and accounting for the impacts of immigration, and falling survey response rates.

Despite those issues, unemployment is set to have held steady at 4.0% last month, with labour force participation also seen remaining unchanged at 62.6%. Recent jobless claims figures point to little chance of a substantial uptick in unemployment, though risks to consensus are probably still tilted marginally towards a softer outturn.

On the whole, though, the February jobs report is unlikely to be one that materially moves the needle in terms of the Fed policy outlook. FOMC members have been incredibly clear of late that policy is firmly on hold for the time being, with policymakers needing to see “real” inflation progress, or “some” labour market weakness, in order to take further steps to lessen the degree of policy restriction. Unless, or until, either of those factors emerge, a ‘wait and see’ approach will continue to be taken, as policymakers assess the impacts of the Trump Administration’s fiscal policies.

Though the jobs report may not have a major impact on the policy outlook, it has the potential to be more of a market-moving event than has been the case in recent months. Principally, this is due to the prevailing narrative around the US economy at present, where jitters over economic growth have intensified, particularly after a couple of dismal consumer sentiment/confidence prints. Consequently, market participants will likely be in no mood to forgive any downside jobs surprises, which would only serve to further intensify growth concerns, and spark a further increase in haven demand.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.