- English

- عربي

Oracle’s AI Ambitions Face Funding Pressure as Data Center Plans Come Under Scrutiny

Oracle’s investment narrative has entered a more complex and less forgiving phase where the scale of its artificial intelligence ambitions is colliding with the realities of capital intensity, balance sheet scrutiny and investor confidence. The nearly 6% decline in Oracle shares this week reflects not a single headline risk but a broader reassessment of how smoothly the company can translate its enormous AI driven backlog into sustainable earnings.

Blue Owl's Exit Exposes a Financing Fault Line

The immediate catalyst was a report that Blue Owl Capital, Oracle’s largest data center investment partner, has decided not to back a proposed $10 billion, 1 gigawatt data center in Michigan. The facility was intended to support OpenAI workloads and anchor Oracle’s expanding AI infrastructure. Blue Owl’s withdrawal introduces a funding gap and places the project’s financing structure under question, despite Oracle maintaining that negotiations on the equity portion are ongoing. While the project has not been formally abandoned, the loss of a cornerstone investor pressures timelines and raises doubts over whether replacement capital can be secured on comparable terms.

Importantly, this episode is not occurring in isolation. It seems private lenders have become increasingly cautious about Oracle’s rising debt levels and the magnitude of its capital expenditure tied to AI infrastructure. This caution reflects a broader shift among financiers who are reassessing the risk return profile of large scale AI investments particularly as questions around monetization timelines and utilization rates persist. In that sense, Blue Owl’s decision is less a verdict on Oracle alone and more a signal of tightening financial conditions for the AI infrastructure trade and concentration level in this sector.

Near-Term Earnings Friction Versus Long Term Signal

This backdrop collides with an earnings profile that, while directionally constructive, remains uneven in the near term. Oracle’s most recent fiscal second quarter delivered a familiar pattern in strong long term signals offset by softer in quarter fundamentals. Total revenue grew 14% YoY, but missing consensus expectations and resulting in also a miss in operating income and free cash flow. Cloud services and license support growth, the key revenue engine, undershot expectations as the dominant driver for the miss. Hardware and services revenues were relatively stronger but not enough to offset concerns around cash flow.

Yet to focus on last quarterly noise could miss Oracle’s shift underway. Oracle posted another step function increase in remaining performance obligations, adding $68 billion in the quarter and lifting total backlog to approximately $523 billion. This figure is extraordinary by any standard and underscores the scale at which hyperscale and frontier AI customers are committing to long duration Oracle Cloud Infrastructure capacity. Management highlighted tangible progress on delivery, handing around 400 megawatts of new data center capacity.

Capital Intensity and the Financing Constraint

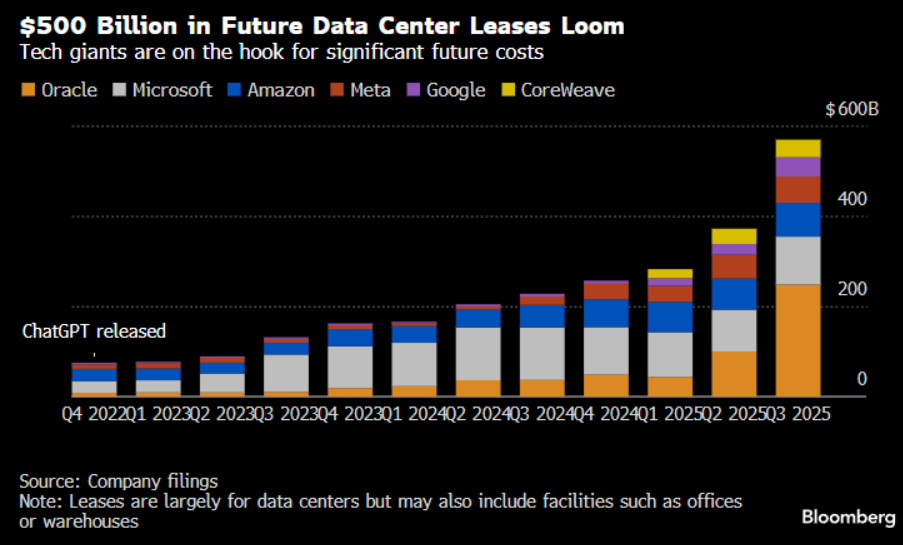

To address investor concerns around capital intensity, Oracle has increasingly emphasised flexibility in its funding model. Management pointed to mechanisms such as chip leasing arrangements with vendors and back loaded procurement structures, arguing these tools materially reduce upfront cash requirements versus the $100 billion in cumulative spend that is estimated. Even so, fiscal 2026 capital spending is still expected to exceed $50 billion, with the possibility of higher outlays in fiscal 2027. This level of investment clearly keeps free cash flow under pressure and magnifies sensitivity to financing cost changes.

This is where the Michigan data center setback matters most. Oracle’s ability to convert its backlog into revenue is more than an operational question but it is more and more a funding question. Markets, in particular private lenders, are now discriminating balance sheet potential health issues among hyperscalers as a key differentiator. For example, Amazon recently increasing its own investment in OpenAI which only reinforces the idea that capital may gravitate toward providers with deeper pockets and more internally funded expansion capacity.

Out-Year Visibility and a Split Investment Narrative

Looking through the cycle, the market’s anxiety is less about fiscal 2026 and more about the out years. Forecasts for the next 12 months remain largely intact but visibility deteriorates materially beyond fiscal 2027 when the bulk of Oracle’s OpenAI related backlog is expected to be recognised. If capacity expansion is delayed, power availability becomes constrained and financing costs likely rise further, revenue realisation could shift right to a further years in the future.

At the same time, it would be premature to dismiss Oracle’s strategic progress. The company has effectively established itself as the fourth hyperscale cloud provider with infrastructure as a service growing at more than 60% YoY. Over the medium term, as capacity constraints ease, growth could accelerate meaningfully from mid 2026 onward, with projections placing fiscal 2028 revenue above $125 billion.

Oracle now presents a two-track investment narrative. On one side sits a vast, highly visible AI driven backlog and a hyperscale platform. On the other lies near term earnings volatility, heavy capital demands and increasing scrutiny over how those ambitions are financed. The Michigan data centre episode crystallises this tension. The opportunity remains substantial, but the path to monetization is becoming narrower, more capital dependent and less forgiving of execution missteps.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.