- English

- عربي

October 2024 US Employment Report; Weather Causes Chunky Downside Surprise

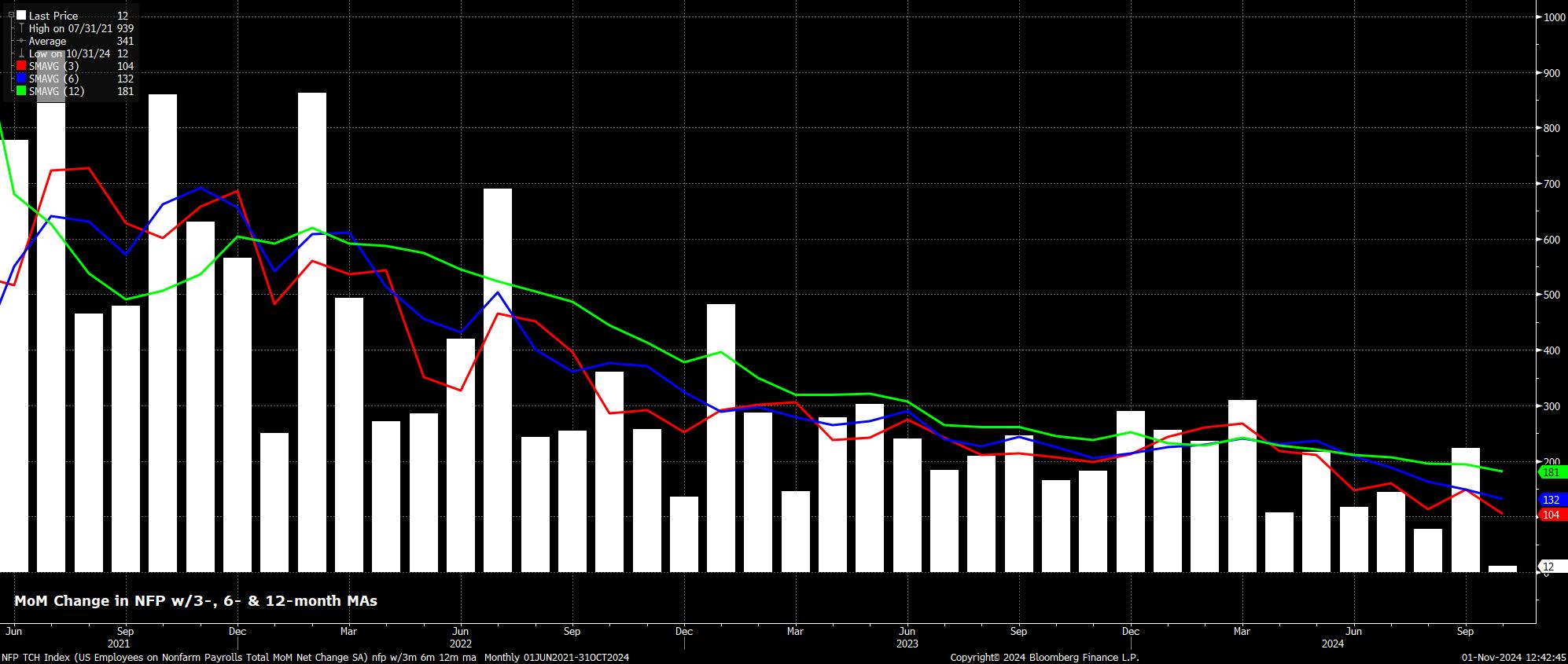

Headline nonfarm payrolls rose by just +12k in October (twelve thousand), a considerable slowdown from the pace seen a month prior, and well below consensus expectations for a +100k increase, though just inside the always-wide forecast range of -10k to +180k. At the same time, the September and August payrolls prints were revised by a net -112k, dragging the 3-month moving average of job gains to just 104k, a fresh cycle low.

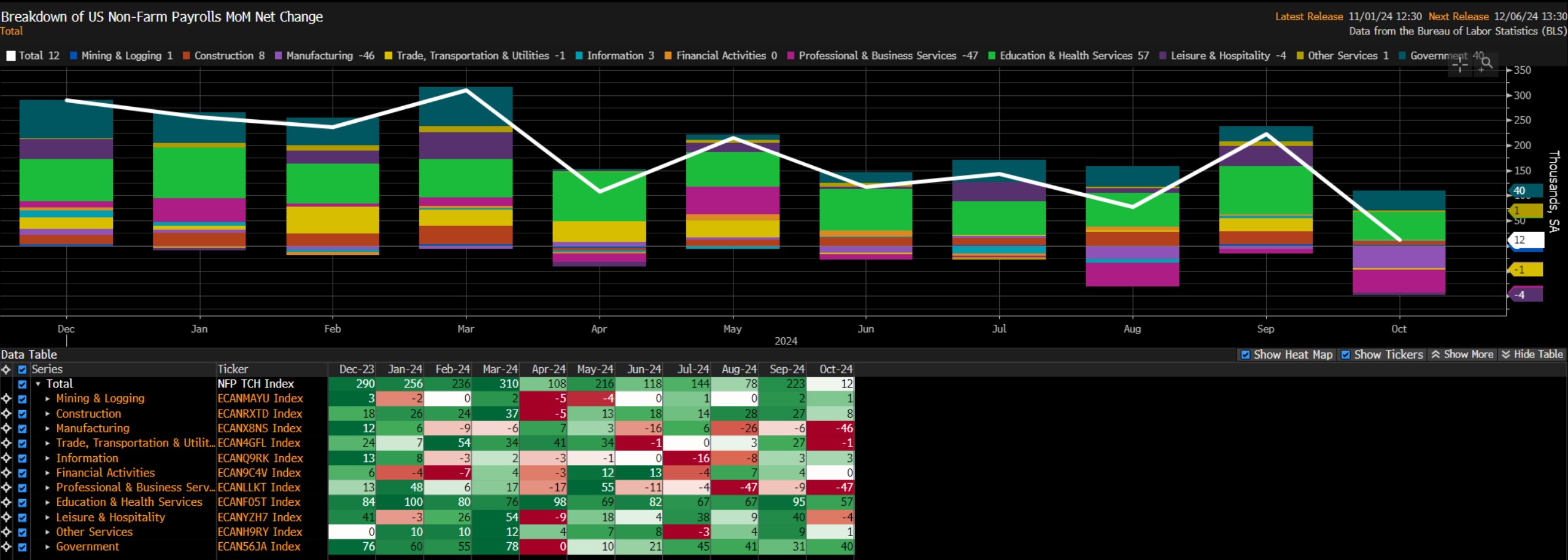

At a sectoral level, the most significant MoM job losses came in the Manufacturing and Professional & Business Services sectors, which lost around 50k jobs apiece. In contrast, government employment continues to underpin jobs growth, with Education & Health services, as well as Government payrolls themselves, the two biggest MoM contributors to employment growth.

Of note, the BLS stated that they were unable to quantify the precise impact of weather events on the report, though it is clear that there has been a significant detrimental impact from ‘Mother Nature’. Nevertheless, one would expect the bulk of this weakness to prove temporary, and be reversed in the November report.

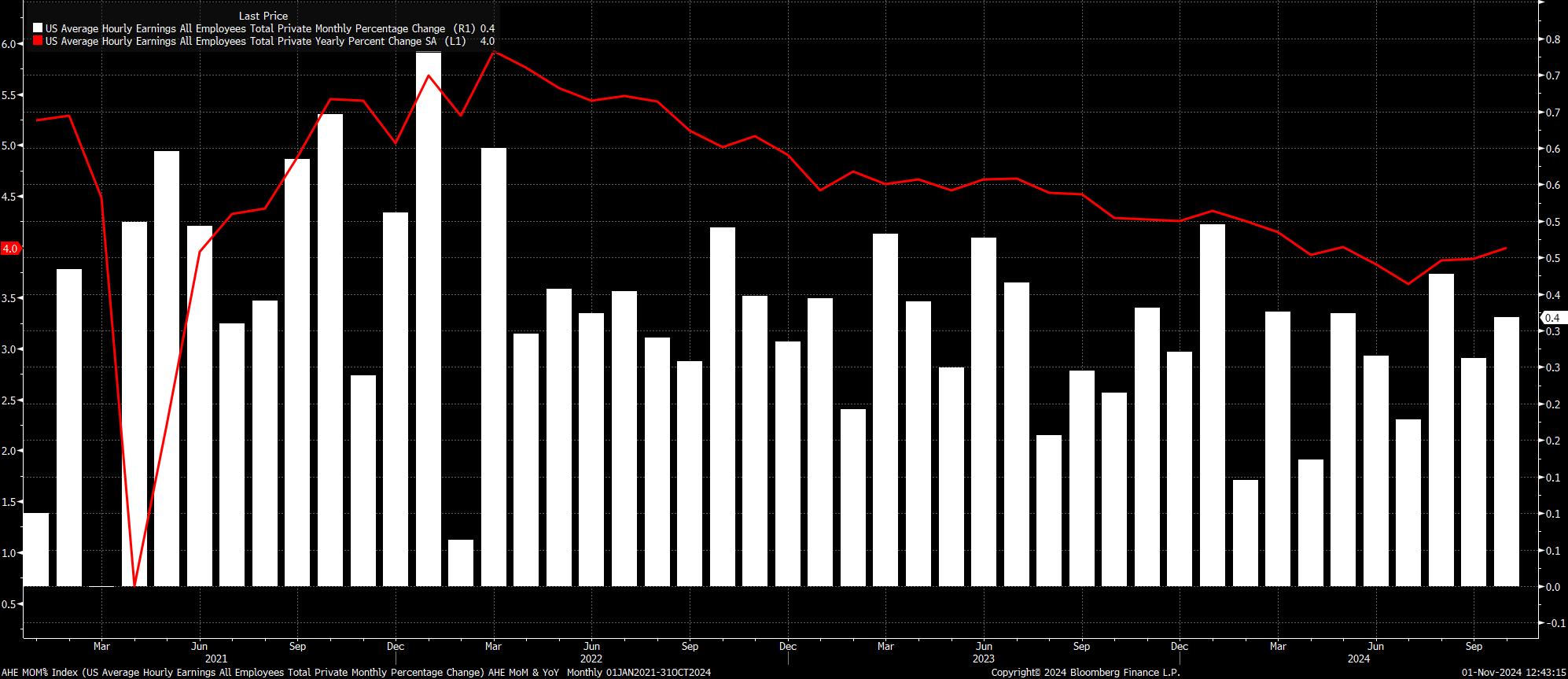

Staying with the establishment survey, the employment report pointed to earnings pressures remaining relatively cool. On the month, average hourly earnings rose by 0.4% MoM, likely a sign that job losses due to weather events disproportionately impacted those on lower incomes. On an annual basis, meanwhile, earnings rose 4.0% YoY, unchanged from the pace seen in September.

Of course, this pace of earnings growth is one that remains broadly compatible with a return to the 2% inflation target over the medium-term, on a sustainable basis. Consequently, earnings are likely to remain of relatively little concern to FOMC policymakers, who have already obtained sufficient confidence in inflation returning to target, having begun the process of normalising policy at the September meeting.

Turning to the household survey, unemployment held steady at 4.1% in October, bang in line with consensus expectations, and still somewhat below the 4.3% cycle high seen in July. This likely owes to those being temporarily unable to work still being classified as ‘employed’ in the HH survey, in contrast to how those workers are classified in the establishment survey.

Other measures of labour market slack, meanwhile, continued to point towards a gradual normalisation in overall employment conditions. Participation slipped 0.1pp to 62.6%,, while underemployment held steady at 7.7%.

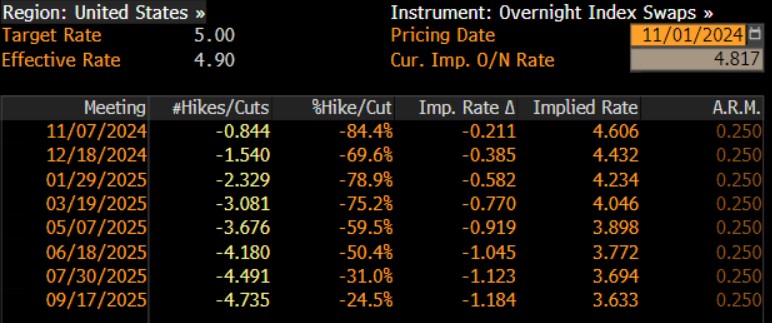

In reaction to the jobs report, the market underwent a very modest dovish repricing of Fed policy expectations. Per the USD OIS curve, the market now sees around an 85% chance of a 25bp cut from the FOMC next week, up from around 80% pre-NFP. Further out, the curve now sees a 50/50 chance of another such cut at the December meeting, up from around a 4-in-10 probability before the jobs report. By next September, the curve now prices almost 120bp of cuts, around 13bp more than prior to the payrolls print.

More broadly, the market reaction to the jobs report was choppy, with participants struggling to digest the figures.

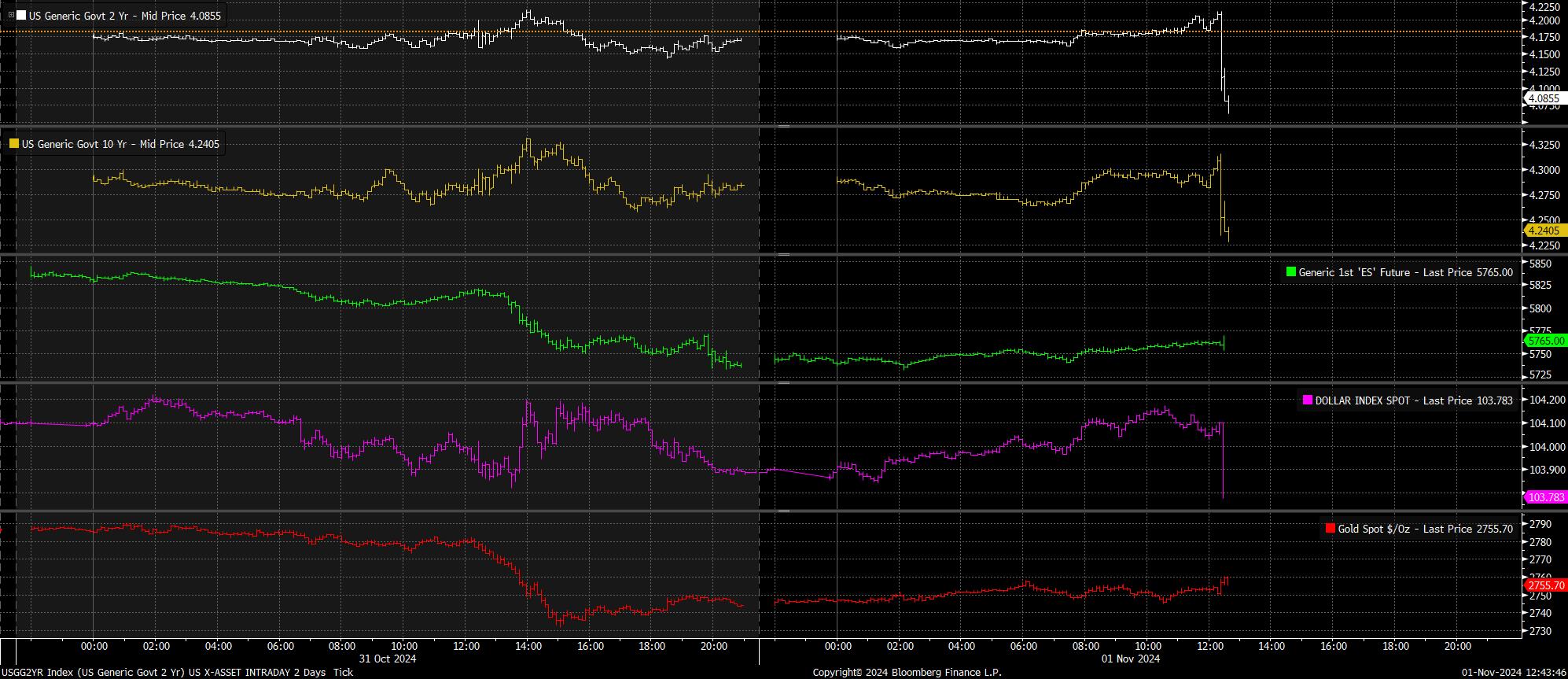

Treasuries, though, rallied hard across the curve, led by the front-end, with 2-year yields falling around 10bp from pre-release levels, with yields in the belly, and at the longer-end of the curve, rallying by around half this magnitude.

Elsewhere, stocks were indecisive, though the front S&P and Nasdaq futures both notched modest gains, holding close to earlier day highs. The dollar, in contrast, lost ground, with the DXY surrendering the 104 figure, and slipping back beneath the 200-day moving average, while gold found some modest demand.

Taking a step back, it seems unlikely that the October jobs report will materially shift the FOMC’s policy outlook, particularly with the figures likely to have been skewed by a range of one-off factors.

A 25bp cut next week remains on the cards, with further such cuts likely at every subsequent meeting, until the fed funds rate reaches a neutral level, around 3%, next summer. That said, were labour market conditions to weaken considerably, likely entailing a rise in unemployment north of the 4.4% year-end forecast, policymakers remain willing and able to respond with a larger 50bp move.

This, then, leaves the forceful ‘Fed put’ alive and well, which should continue to provide a strong backstop to sentiment over the medium-term. In the here and now, however, conviction could well be rather lacking, with political risk in the form of next Tuesday’s presidential election likely to cast a shadow over proceedings for the time being, and see participants continuing to take some risk off the table. Nevertheless, once the election outcome is known, the path of least resistance should again, convincingly, lead higher for equities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.