- English

- عربي

Nvidia Q4 2025 Earnings Preview: AI Growth, Stock Outlook & Forecast

Leading into Nvidia’s earnings, the heavy flow of impactful news has certainly made it challenging for market participants to confidently forecast revenues and gross margins and to ascribe a probability of Nvidia beating company guidance for the quarter.

Subsequently, after a period of uncertainty leading into February, we have sine seen a turnaround in sentiment, with Nvidia’s share price rebounding from $113 to fill the 27 Jan gap into $141.88. With its earnings due next week, the market is feeling more optimistic about Nvidia hitting us with strong numbers – not just in an absolute sense, but relative to market expectations.

Recapping What Went Down into Earnings

In late January the Deepseek scare saw Nvidia gap down and close 17% lower on the day, with investors formally introduced to the Chinese start-up.

Among other factors, the emergence of Deepseek has partly contributed to Chinese AI/tech plays significantly outperforming, with global capital pulled from a highly concentrated position in US tech/AI.

Additionally, the Deepseek news immediately promoted a strong response from the US Administration, raising investor concerns of impending export controls – a factor that will impact future sales of Nvidia’s Hopper GPUs. Compounding the uncertainty towards NVDA was a refocus on competition, with bullish strategic AI expansion plans heard from Broadcom, Marvell, Amazon and Meta.

However, since 3 February the market has reversed that position, with a renewed belief that Nvidia will compete strongly in both ‘training’, and ‘inference’ and as the rollout of Blackwell GPUs gathers pace through the second half of the year, Nvidia is fully expected to take share from the other AI plays.

Traders have also become more comfortable with the hyperscaler’s (Google, Meta, Microsoft, Amazon) capex plans for 2025, and the tailwinds are still set to feed into Nvidia’s sales from the uptick in investment spending from these mega-cap businesses. It’s a complicated and rapidly evolving theme – hence it’s been a hard one for many to price. Significant risk still hangs over the stock (notably from impending US export controls), but the recent price action suggests investors and the broader market are more confident in the upside risk to Nvidia’s sales growth and margins through the year, as well as its continued dominance in the GPU scene.

Traders are Primed for Volatility in Nvidia's Share Price

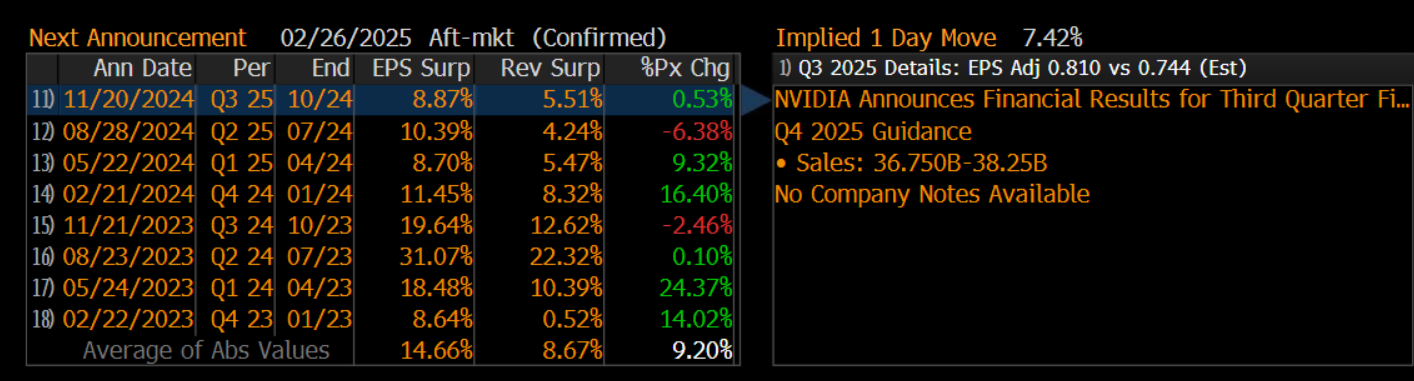

Traders are conditioned to seeing significant movement in Nvidia’s share price over earnings, with an average (absolute) 1-day percentage change over the past 8 quarterly reports of 9.2%.

Shares have closed higher in 7 of the past 10 quarterly reports - so while the investment case and the competitive landscape have evolved over that period, Nvidia does have exceptional form in pleasing investors at earnings.

Looking ahead, options pricing currently implies a move on earnings day (26 Feb) of -/+7.4%.

This implied move is certainly lower than the historical average 1-day change, however, if realised, it would still constitute a significant degree of movement for a $3.4t market cap company. An -/+7.4% move in Nvidia’s share price in the post-market session would also translate into a -/+0.6% move in the NAS100.

What’s Expected for Nvidia? The Consensus Expectations

The market will be most sensitive to the outcome of Nvidia’s Q425 revenue, as well as the guidance for the quarter ahead (Q126) and gross margins.

The Median Forecast (Analysts) for NVDAs Key Earnings Metrics

Company Guidance - In November (in the Q325 earnings report) management guided to Q425 sales of $37.5b -/+2% and gross margins of 73.5%.

3 weeks ago, the market was sceptical that Nvidia would meet the prior guidance for Q425 sales, and there was an even greater debate as to where they would guide for the quarter ahead (Q126).

That more pessimistic view has since shifted and with the market having had time to consider the company specifics with a clearer mindset, the position on the street is for Q425 sales of $38.24b and to guide to sales of $42.25b in Q126. These are the numbers Nvidia will likely need to beat to keep the share price ticking towards $150+.

Another Transformational Quarter

We are reminded that NVDA remains in a transformational period, with Hopper still accounting for the bulk of its current revenue - but that will evolve and with the Blackwell ramp increasing the Blackwell GPUs will drive its future sales growth.

Nvidia’s Developers Conference (GTC) on 17-21 March will also be a key date for investors, as this has previously been the stage for some major strategic announcements and traders typically like to buy the stock ahead of GTC.

The bottom line: Market players expect sizeable volatility on the day of NVDAs earnings, so while that level of expected movement can attract the traders, it also needs to be a core consideration for one’s position sizing over the earnings. For the share price to rise 7%+ we may need to see Q425 sales at or above $38.5b, with Q126 guidance of $42.5b, backed by firm commentary from CEO Jensen Huang that Blackwell is progressing well.

Should we see an -/+7% move play out, our US 24-hour share CFDs will capture that move in the post-market session, as well as any further flows that play out through Asia. For more information on our 24-hour share CFDs see the link for details.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.