- English

- عربي

Nvidia Q325 Earnings Preview: AI Trends, Market Expectations, and Trading Opportunities

.png)

As many who have traded Nvidia’s prior earnings will attest, earnings are historically where big moves play out on the day, with the AI-giant influencing sentiment towards the broader semiconductor space, as well having a big effect on the NAS100 and S&P500.

Key timings: Nvidia report after-market on 20 November (20 Nov at 21:20 GMT / 21 Nov 08:20 AEDT)

Nvidia options imply another big move on earnings

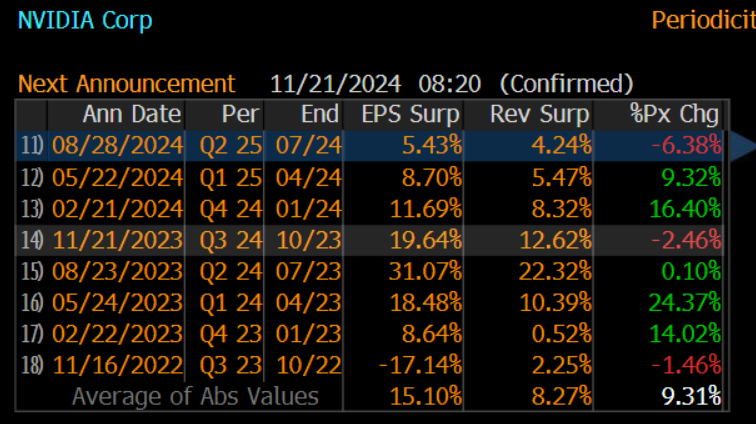

While pricing is dynamic and may well change by Wednesday, Nvidia options currently imply an -/+8% move on the day of earnings. This is clearly a punchy implied move for any stock, let alone one with a $3.6t market cap.

Guiding expectation for the implied move is the form guide, where we can see that Nvidia has seen average (absolute) moves on the day of reporting quarterly earnings of 9.3%.

Such elevated levels of expected movement can be a drawcard for traders who are attracted to sizeable intraday moves in equity and want the liquidity that is seen in Nvidia’s order book.

Large implied moves are also a major consideration for one’s risk management and when assessing position sizing and the distance to the stop loss.

Reviewing Consensus Market Expectations

The extent of the rally/sell-off is typically a function of the outcome of earnings, and the guidance for the following reporting quarter, relative to market expectations and positioning.

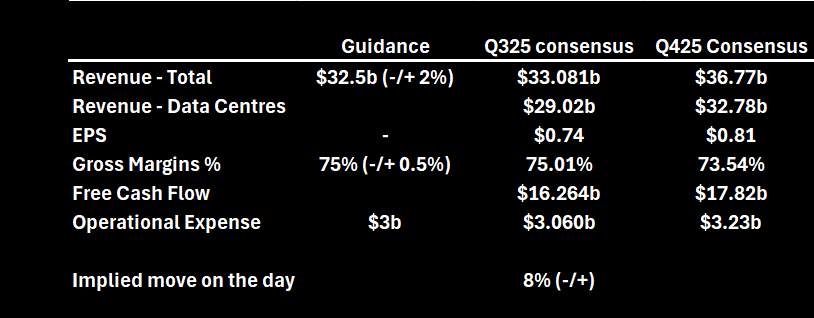

For this reporting quarter (Q325), the analysts’ consensus expectations (shown below) are largely in line with the guidance Nvidia provided in the prior Q225 earnings report (seen on 28 August).

For example, we see expectations for Nvidia’s group revenue at $33.08b, just 2% above the guidance provided in the Q225 earnings. The market then expects guidance for the next reporting quarter (Q425) of $36.77b, representing a potential increase of 11% q/q, with the data centres segment representing the large percentage of those sales.

Nvidia has such an incredible pedigree in beating their own guidance (and consensus expectations) on sales and earnings that traders have become conditioned to blockbuster numbers, which always beat – subsequently, market participants historically position for better-than-expected numbers and that raises the bar even further.

Reduced expectations for a significant beat to consensus expectations

In this earnings report, expectations are set lower than in past reports, and forecasts from analysts and investor positioning sit at the lowest premium to prior company guidance for many years. In theory, this newfound confidence to model and forecast sales, margins and earnings suggests the real potential for Nvidia to deliver an upside surprise, which could promote a significant move in the share price.

Of course, the company guidance for the following reporting quarter (i.e. Q425) will also determine the extent of move in Nvidia’s share price on the day. The market lives in the future, so the collective will want new intel that suggests that sales growth is not just on track but could be higher than consensus forecasts.

Focus will also fall on CEO Jensen Huang views in the post earnings call, where he’ll offer his take on how the business is tracking, the rollout of Blackwell and other GPUs and new developments in the pipeline. Huang will no doubt be incredibly positive and upbeat, and there are few CEO’s who know how to hit the right notes with investors.

The market wants clarity on the direction of margins

Q325 gross margins are expected to drop to 75.01% and are expected to continue falling towards 73% over the next two quarters. These are still obviously incredibly healthy margins for any business, but the market is now well conditioned to such impressive margins that the investment case resides on its ability to sustain these margins and offset any deterioration with increased volumes.

The jury is out on whether margins are in longer-term decline or due to rise once again. A more stringent regulatory response is a potential landmine and one that is hard to model. Competition is also likely to increase, which could impact margins as the AI giant may need to become more competitive in its pricing.

Conversely, the supply constraints that have held sales of Blackwell GPUs back will soon ease and should result in stronger sales growth in the quarters ahead. It could also see margins pushing back towards 75% in the Q226 results. Either way, the fact Nvidia currently trades at ATHs, despite greater attention on US election expressions, shows the broad collective still love the story and view Nvidia as the best-in-class AI/semi play.

Put Nvidia 24-hour CFD on the radar

Traders can pre-position for Nvidia’s earnings and react dynamically to the news or the price action through Pepperstone’s Nvidia 24-hour CFDs. 24-hour CFDs offer around-the-clock pricing (5 days a week) for traders to take a position and manage exposures before, through and after Nvidia’s earnings. For more information click here

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.