- English

- عربي

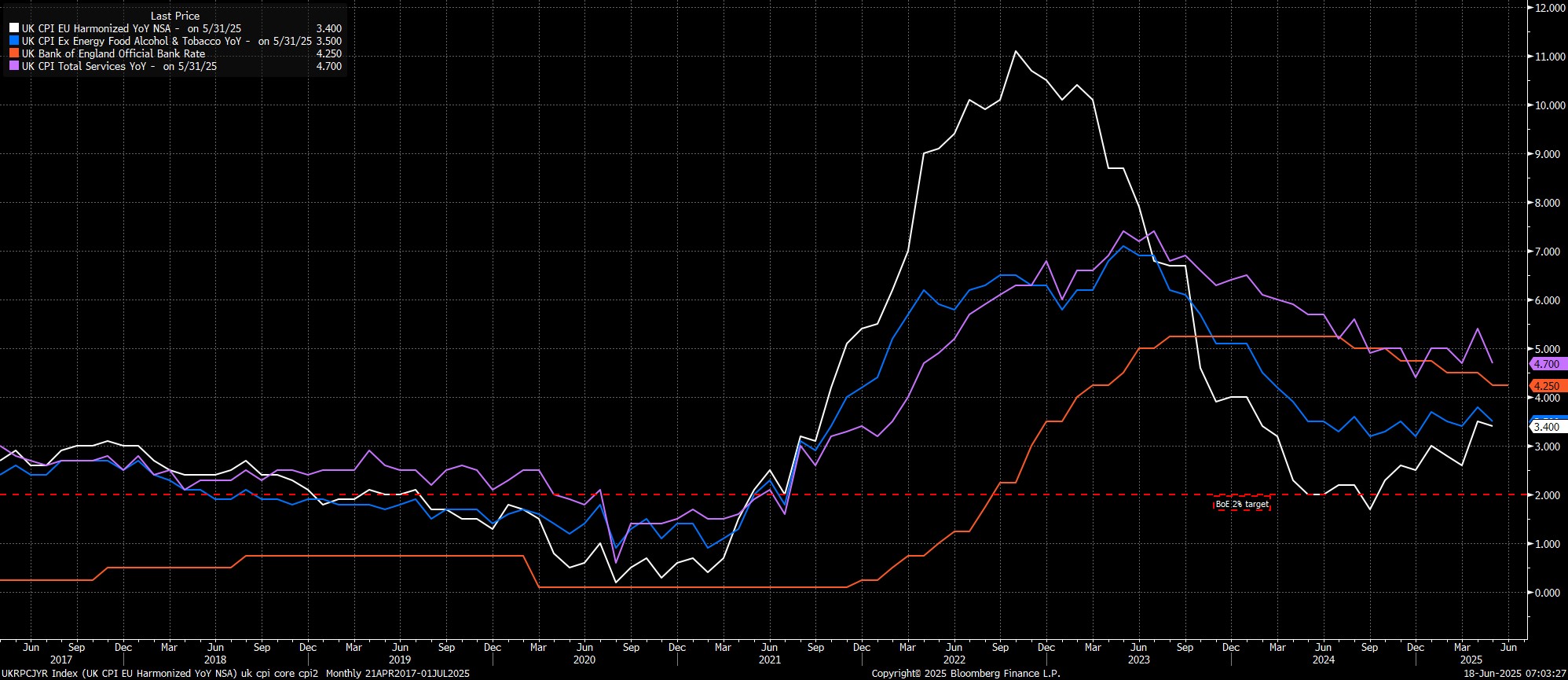

Headline CPI rose 3.4% YoY in May, bang in line with the BoE's latest forecasts, while core prices, excluding food and energy, rose 3.5% YoY over the same period, a notable decline from the 3.8% annual pace seen in April. Meanwhile, the closely watched services CPI metric cooled significantly, to 4.7% YoY, also in line with the Bank's expectations.

This cooling came primarily as a result of the April data having been skewed higher by a number of one-off factors, including higher airfares, as well as the annual round of index-linked price rises at the start of the fiscal year. These factors unwinding, along with the ONS correcting a miscalculation of the impact of vehicle excise duty changes last time out, combined to drag the various price metrics lower.

Still, it is difficult to envisage today’s data materially altering the outlook for BoE policy, ahead of the next MPC policy announcement tomorrow, even if the April print now seems like the peak for the year. While policymakers would’ve had advanced sight of the inflation metrics on Monday, there is likely to be little within the figures to encourage policymakers to move away from the longstanding ‘gradual and careful’ guidance around future policy easing.

Hence, Bank Rate is set to be maintained at 4.25% tomorrow, albeit with at least 2, and possibly 3, MPC members likely to dissent in favour of a 25bp cut. The next such cut is unlikely to be delivered until August, as policymakers continue to fret about the risks of inflation persistence, and stubborn price pressures becoming embedded within the UK economy.

Those worries, though, are likely misplaced, particularly with the labour market weakening at a worrying rate of knots, seeing significant slack begin to emerge, and likely limiting the ability of firms to pass on higher costs. Hence, especially with risks to the outlook overall continuing to tilt to the downside, the Bank’s current approach of ‘burying its head in the sand’ is clearly on borrowed time, with faster cuts, and potentially cuts in bigger clip sizes, increasingly likely from the autumn.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.