- English

- عربي

Markets rejoice as a goldilocks backdrop see traders' pile into risk assets

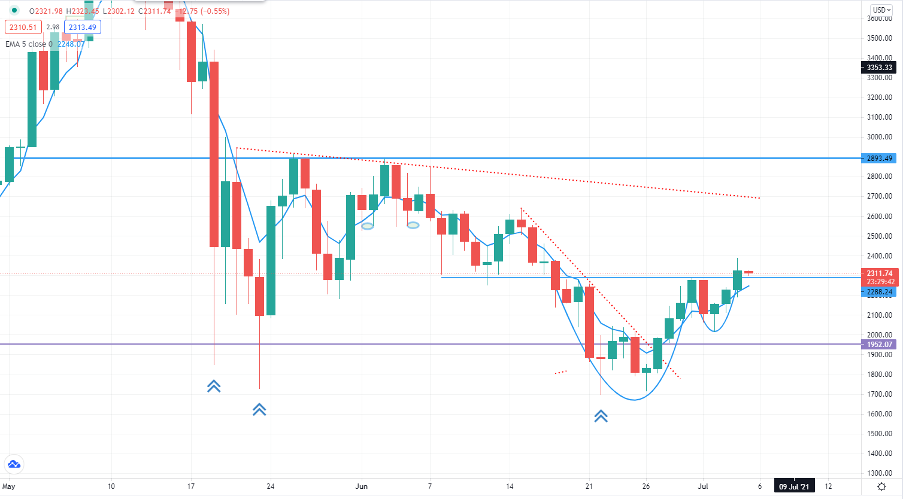

While the low participation rate (of 61.6%) and an unemployment rate of 5.9%, were enough to cause a solid sell-off in the USD – in fact, we saw outside day price reversals in USDCHF, USDX, USDSEK, AUDUSD, and NZDUSD. We also saw these reversals in the price action play out in industrial metals, 2 and 5-year US Treasuries and a bearish reversal in the Russell 2k. Liquidity darlings, such as Crypto look good and Ethereum, especially have worked of late and is eyeing a more convincing break of a cup and handle pattern.

(Source: Tradingview)

One to watch, to see if follow-through USD selling plays out, but talk of ‘goldilocks’ and ‘nirvana’ type conditions have made their way around liberally. Certainly, the 3bp decline in US real rates to -92bp is always going to act as a headwind to the USD at a time when it was undergoing some sort of bullish trend, and this will be one to watch as its looks to push lower. Recall, economists not only see real rates going higher, but it’s really the extent of the move higher that is the point of conjecture. Gold has also liked this backdrop, as has the NAS100 which is a powerhouse and is now +16% YTD (+22% in AUD terms).

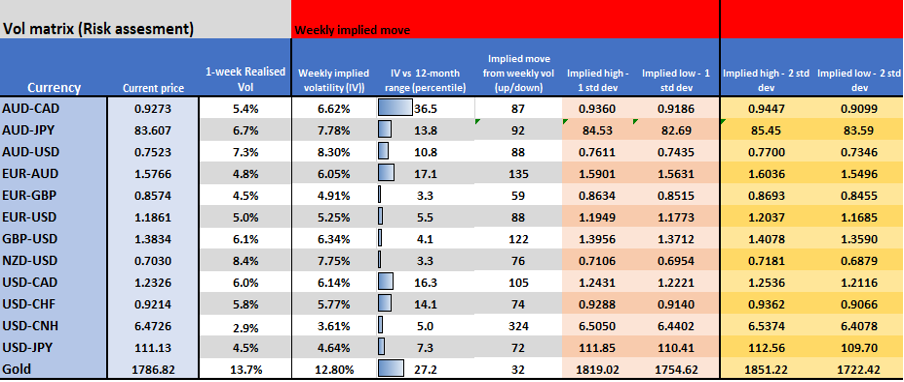

As per my weekly implied volatility matrix, volatility is shot to pieces - investors relish this, while traders’ see the lack of movement in a more challenging light. The VIX sits 15.07% having been as low as 14.25% on Friday, while 10-day released volatility in the S&P 500 is a meagre 4.5%. EURUSD 1-month implied vol sits 5.19%, so wherever you look statistical and implied movement in any instrument is shot to pieces. It's no surprise we’ve seen records when it comes to companies raising cash through listings this year, especially when credit spreads are multi-year tights and bond yields are headed lower.

We’ve seen the S&P 500 print a seventh straight all-time high and one has to ask how can things get any more bullish than that? Rotation among equity sectors is rife - a sign of a bullish market - high yield corporate credit yields close to zero when adjusting for inflation expectations. This is just pushing investors out of the risk curve and into equities.

The bond and equity correlation has picked up (the 1-year correlation is now positive), trend-following funds are long risk to the hilt. Life is good, but is it too good?

Didi – one place where movement looks assured

Well, one place where I would be looking for movement is Didi. We launched Didi to clients last week and have seen good interest from clients. I suspect this will also be true of Robinhood when it lists, although the flow there will be two-way and there will be a more intense appetite to short that name. Certainly, it seems the Chinese authorities are not enthused, launching a cybersecurity investigation and subsequently blocking them from the App store on grounds it had leaked data of its citizens. This could be a near-term impact on its revenue from China, although one suspects this won’t go on too long.

There's been reports of one legal firm encouraging shareholders with losses to amount class actions, although this needs more investigation. There's a number of rumour and scuttlebutt flying around on Didi but given its backing it would not surprise to see any pronounced near-term weakness, derived from this piece of news flow, as a buying opportunity. It certainly goes some way to justifying the valuation discrepancy that arrive from Chinese companies listed in the US vs US competitors.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.