- English

- عربي

Mixed NFP Means Markets Want More Cuts Than They’re Likely To Get

Market Thoughts – Monday 9th September

Where We Stand – Participants came into Friday hoping that the August US jobs report would provide some clarity on the magnitude of the rate cut (25bp or 50bp) to be delivered at the September FOMC. They left Friday, and entered the Fed’s pre-meeting ‘blackout’ period, with the outlook remaining a rather murky one.

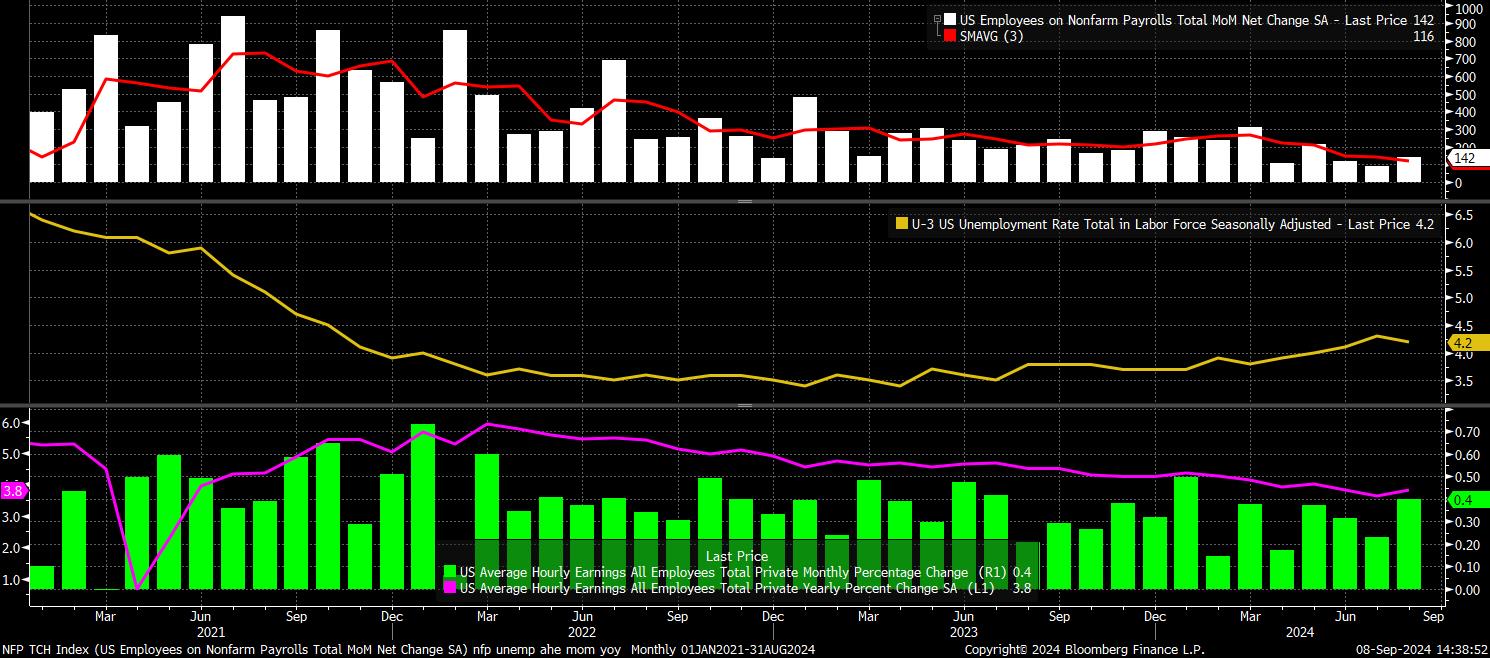

The US economy added 142k new jobs last month, close enough to the 165k consensus estimate, given the always-wide forecast range, though a net 86k downward revision to the prior two prints was a tough pill to swallow.

At the same time, unemployment dipped 0.1pp to 4.2%, as the temporary weather-related weakness from the July report was unwound, while earnings rose 0.4% MoM, double the pace seen in July, and a useful reminder that inflationary pressures have not yet entirely gone away.

Hence, the Fed’s remaining hawks can point to the latter two datapoints as reason to begin policy normalisation with a ‘run of the mill’ 25bp cut, while the doves will point to a continued weakening trend in headline jobs growth as reason for more decisive action, and a jumbo 50bp move.

Friday’s Fed speakers did little to clear up this debate, with both Williams & Waller noting that now is the time to begin cutting rates, while refusing to pre-commit to the size of the first rate cut.

In the short-term, this creates a potentially negative dynamic for risk assets. Participants seem to want a 50bp cut, and for the Fed to ‘get on with it’ and start to reduce rates. However, at the same time, participants are unsure that Powell & Co. are going to fulfil their wishes. Wanting more easing than is likely to be delivered - with my base case remaining a 25bp cut next month - will likely pose headwinds to equities in the run up to the 18th September FOMC decision.

In the longer-run, though, that policymakers still have >500bp of room to lower the fed funds rate, should conditions be deemed to require it, and policymakers having shown a clear desire to act forcefully when necessary, the ‘Fed put’ remains intact, reassuring investors to remain further out the risk curve, and seeing dips remain medium-term buying opportunities.

Back to Friday, the day’s price action was typical of that which provided more ‘noise’ than ‘signal’; another useful reminder as to why most intraday market moves are worth ignoring, in favour of a focus on longer-run trends.

A risk-off playbook was, nonetheless, in effect across the board. Stocks slumped with the S&P future notching a 4th straight daily loss, albeit while still managing to cling on to its 100-day moving average. Treasuries saw gains across the curve, led by the front-end where benchmark 2-year yields fell as much as 10bp on the day, plumbing fresh YTD lows.

This rally, though, was not the boon for gold, and headwind for the buck, that some may have expected. The yellow metal ended Friday in the red, back under $2,500/oz, in a move that had a tinge of position liquidation behind it. At the same time, the greenback ended the day unchanged against a basket of peers, despite having chopped around all over the place for most of the session. With the dovish repricing of Fed expectations having reached fresh extremes, as the USD OIS curve now discounts around 115bp of easing by year-end, the case for a more sustained dollar rebound on a paring of these expectations has grown stronger.

Overall, Friday’s data showed the labour market continuing to gradually normalise. Monetary policy, hence, should do the same. However, what we think policy should do, and what it will do, are not necessarily the same thing. We won’t have clarity on the latter for 10 sessions or so, likely leaving vol elevated, and markets choppy, for the next week or so.

Look Ahead – A quiet start to the week awaits, lacking in top-tier releases throughout the European and US sessions. In fact, the only release of note stands as the NY Fed’s monthly inflation expectations survey, which last month saw year-ahead consumer expectations fall to 2.97%, while the 3-year ahead metric declined to 2.3%, its lowest level since the inception of the series in June 2013.

While interesting, the data is unlikely to be of particular importance to markets more broadly, with conviction instead likely to be lacking ahead of this week’s main events – US CPI on Wednesday, and the ECB decision due on Thursday.

Apple’s annual iPhone launch event, named ‘Glowtime’ this year, might also attract a few headlines, with AI likely to feature heavily throughout the firm’s latest suite of products. As someone who is still struggling to use a ‘bog-standard’ iPhone, one laced with AI is just a little terrifying, though we must try our best to move with the times. In any case, such events have typically been classic ‘buy the rumour, sell the fact’ occasions, with AAPL stock having traded lower on 12 of 17 iPhone launch days.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.