Analysis

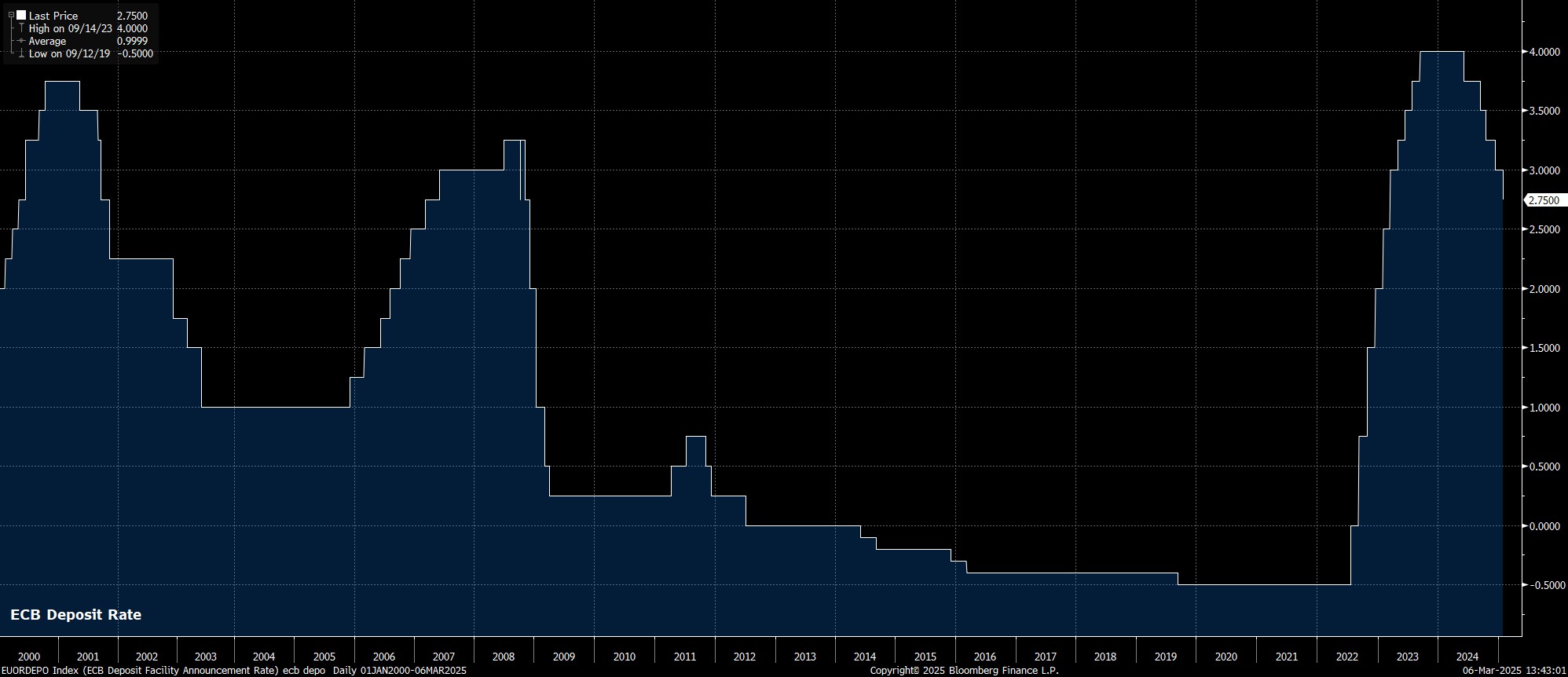

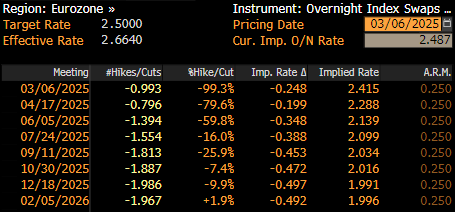

As expected, and had been fully discounted by financial markets, the ECB’s Governing Council delivered another 25bp cut at the conclusion of the March meeting, taking the deposit rate to 2.50%, and marking the sixth rate cut of the cycle.

Accompanying the decision to reduce rates once more was policy guidance that remained broadly unchanged from that issued in January. As such, policymakers reiterated that they will continue to follow a ‘data-dependent’ and ‘meeting-by-meeting’ approach to future rate decisions, stressing that there is no ‘pre-commitment’ being made to a particular policy path.

Importantly, with the deposit rate now sat at the top end of neutral rate estimates, the Governing Council noted that rates are “becoming meaningfully less restrictive”. This was a hawkish change to the policy statement, and one that Exec. Board Member Schnabel had been pushing for, which in turn is an implicit nod towards a slower pace of policy normalisation going forwards, raising the prospect of the ECB ‘skipping’ meetings as the journey towards the terminal rate continues.

Along with the policy statement, the March meeting also saw the ECB unveil the latest round of staff macroeconomic projections.

On inflation, forecasts were revised higher this year, with headline CPI now seen at 2.3%, before fading into 2026, to modestly undershoot the 2% inflation target next year. That said, the core CPI forecast was lowered 0.1pp to 2.2% this year, implying a belief in the underlying disinflationary trend.

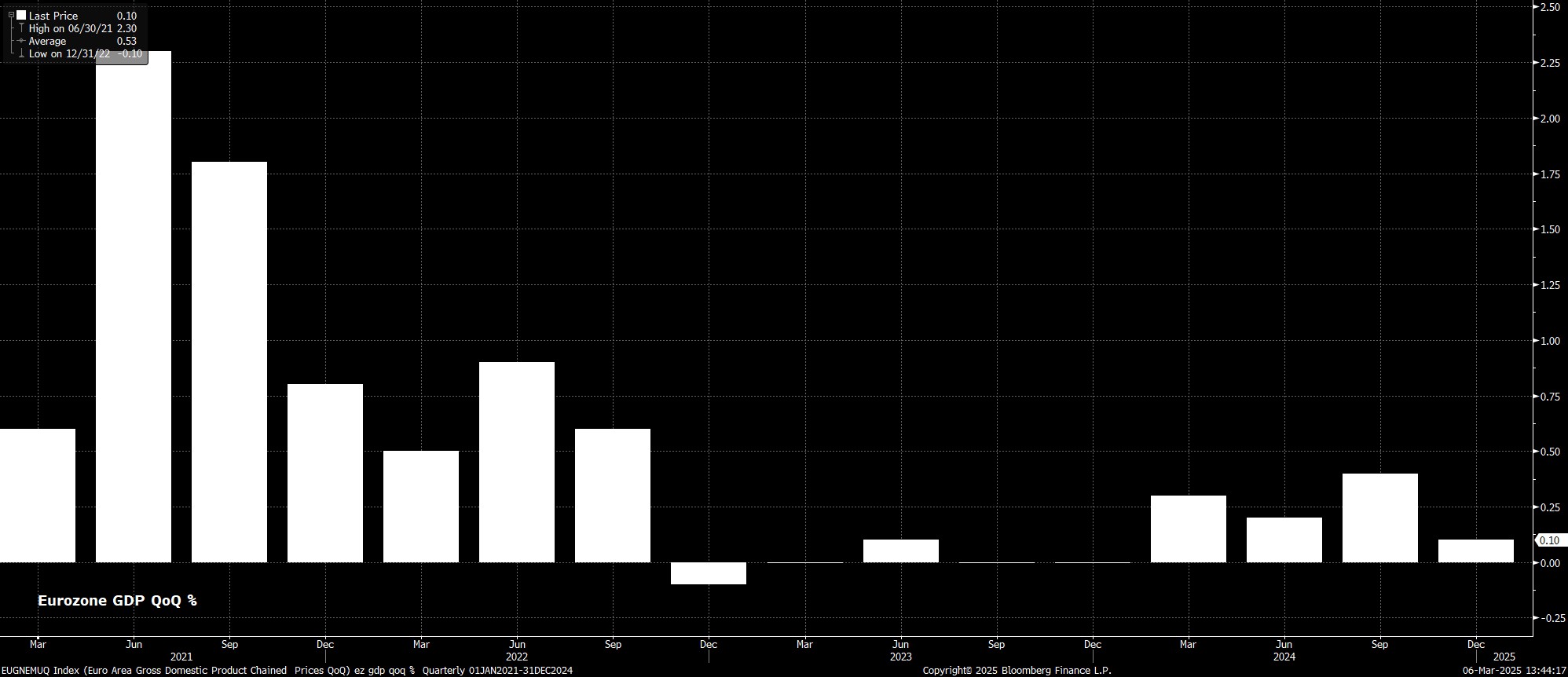

Meanwhile, on the growth side of things, the outlook has become more pessimistic, with GDP forecasts trimmed across the forecast horizon, with the projections now foreseeing growth of just 0.9% this year. Notably, these forecasts will have been modelled prior to the recent uplift in German, and other European, defence spending budgets, which may provide a boost to the economy more broadly.

After all of that, we were also treated to the usual post-meeting press conference from President Lagarde.

At the presser, which was very much one for the purists, Lagarde noted that the ECB are moving to an “evolutionary” policy approach, though offered no particular clarity on what that meant, going off on a tangent with a convoluted analogy involving oceanic currents. Answers on a postcard, please…

On the whole, with the ECB having now brought the deposit rate to the upper end of where neutral may lie, and having acknowledged that the policy stance is now less restrictive, the door to a slower pace of further easing has been pushed ajar. That said, the direction of travel for rates remains clear, and to the downside, with a move below neutral remaining distinctly possible, as the risk of undershooting the inflation target remains, and growth risks remain highly elevated.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.