- English

- عربي

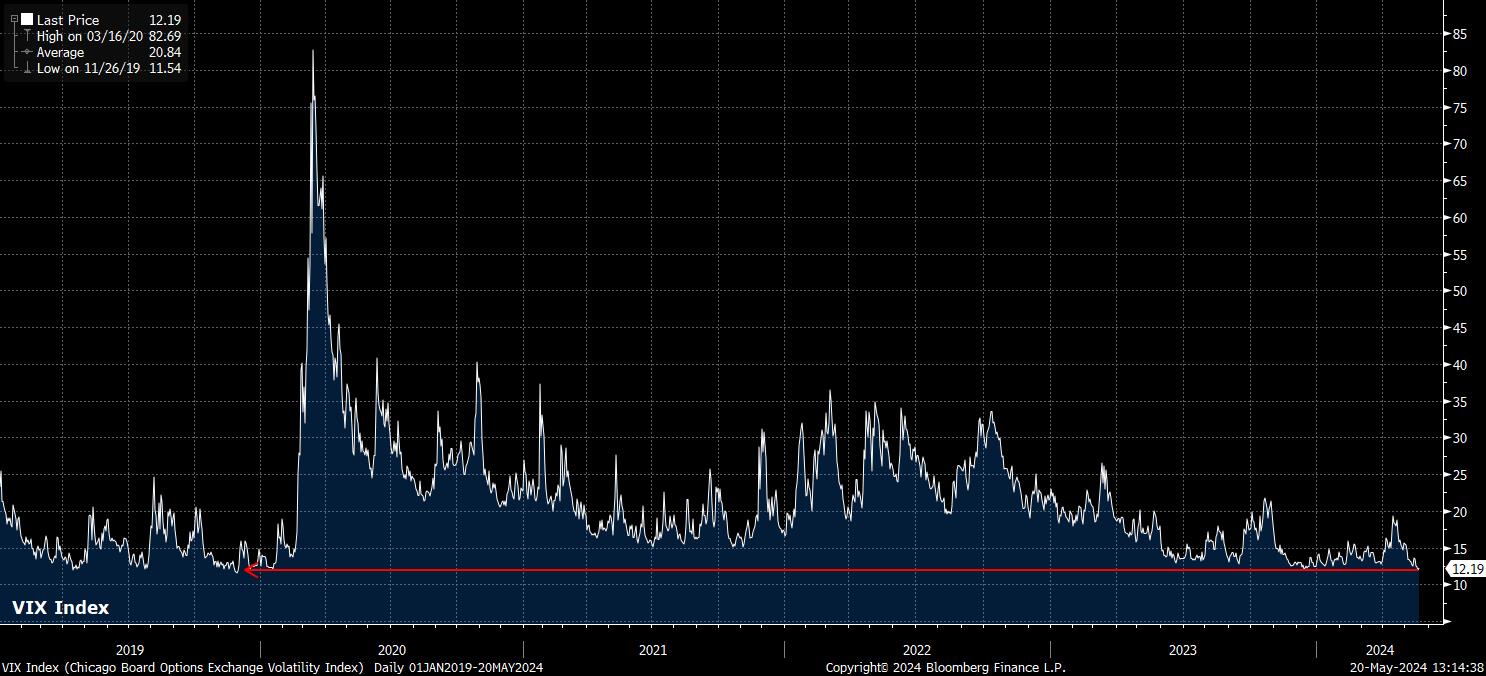

Sitting down to begin a new week, it’s always useful to take a look at implied vols, as a gauge of how the market views the balance of risks as trade resumes after the weekend. Doing so this week yields a scorecard that displays distinct ‘summer markets’ vibes.

.png)

There are likely a few reasons behind the relatively low vol environment that currently exists – with realised vols also subdued – and which the market believes is likely to persist.

Firstly, event risk; or, to be more precise, the lack of it. After last week’s US CPI figures, which likely provided some welcome relief for the FOMC, as the core YoY print fell to its lowest level since May 2021, this week’s Stateside docket is relatively barren. While there will be a cacophony of Fedspeak, it’s tough to imagine much, if any, of this significantly moving the needle, especially when the FOMC’s reaction function is by this stage incredibly clear, and with a single promising inflation figure far from meeting the bar for the FOMC to have “confidence” in price pressures moving sustainably back towards the 2% target.

Geopolitical risk also appears somewhat diminished, with markets remaining rather unperturbed by ongoing developments in the Israel-Gaza conflict, particularly with any impact on energy limited at best. The weekend death of Iran’s President, however, is something important to have on the radar, particularly if regional relations were to deteriorate further upon the appointment of a successor, whoever that may be. This is, however, a longer-run theme, which is not especially tradeable at this stage.

Relatively low levels of FX vol, however, are not necessarily a bad thing. Were vol to remain subdued, carry trades are likely to remain in vogue, with said strategies benefitting from relatively steady price action, which reduces the risk of carry being wiped out by adverse market moves.

Such a preference towards carry positions is likely to continue to pose headwinds to lower-yielders within the G10 complex, namely the JPY and the CHF, very much in keeping with the prevailing theme over the last month or so.

It’s not only the FX space, however, which displays the aforementioned ‘summer markets’ theme.

On Wall Street, where stocks rose to new records after last week’s CPI print, trading volumes have thinned significantly. Friday saw S&P 500 volumes around 15% below the 20-day average, while the 15-day average of S&P futures volume sits at its lowest level since the start of April.

Unsurprisingly, this has also been accompanied by a fairly noticeable decline in vol, with the VIX ending Friday’s session below the 12 handle, for the first time since the tail end of 2019. In this environment, the path of least resistance is likely to continue to lead to the upside, particularly with the policy backdrop remaining supportive, and earnings growth resilient.

Low vol, however, is certainly not a characteristic that the metals market is displaying right now, with spot gold having rallied to fresh record highs amid relentless Chinese demand, while LME copper has also surged to an all-time high amid an ongoing short squeeze, and continued expectations of incredibly tight supply. Pepperstone’s Head of Research, Chris Weston, discusses these factors and more in his latest video - https://youtu.be/mscYzfEGFDE?si=J1q5QhqGR80ZA_f9

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.