Analysis

Macro Trader: Musings on Risk, A Low Vol Grind Higher

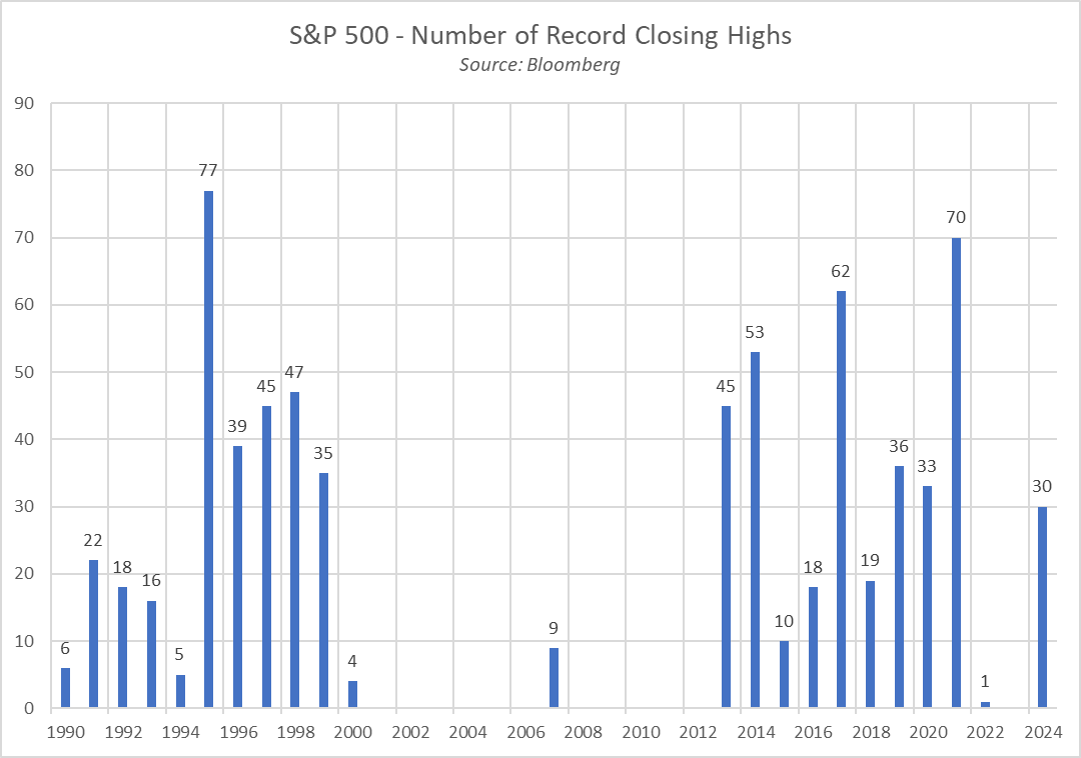

The S&P 500 has, at the time of writing, notched 30 record closes this year, the most since the 70 ATHs notched back in 2021. On a proportional basis, the benchmark index has closed at a record on 26% of all trading days in 2024. If the market were to keep up this pace for the entire year – which, of course, is by no means guaranteed – it would represent the third best year on record, after 1995 and 2021, in terms of the percentage of trading days on which the market scored a new record close.

On a similar note, it was interesting to see, on Monday, both the S&P 500 and Nasdaq 100 end the day in the green, despite Nvidia – dubbed by some as the ‘most important stock in the world’ – closing in the red. This is not a unique phenomenon, but it is relatively rare. This year, the S&P has ended in positive territory, with NVDA down on the day, just 16 times, while the Nasdaq has done so just 11 times. Perhaps one that may put to rest a few fears about narrow breadth and the high degree of market concentration.

_spx_sp_2024-06-18_17-09-47.jpg)

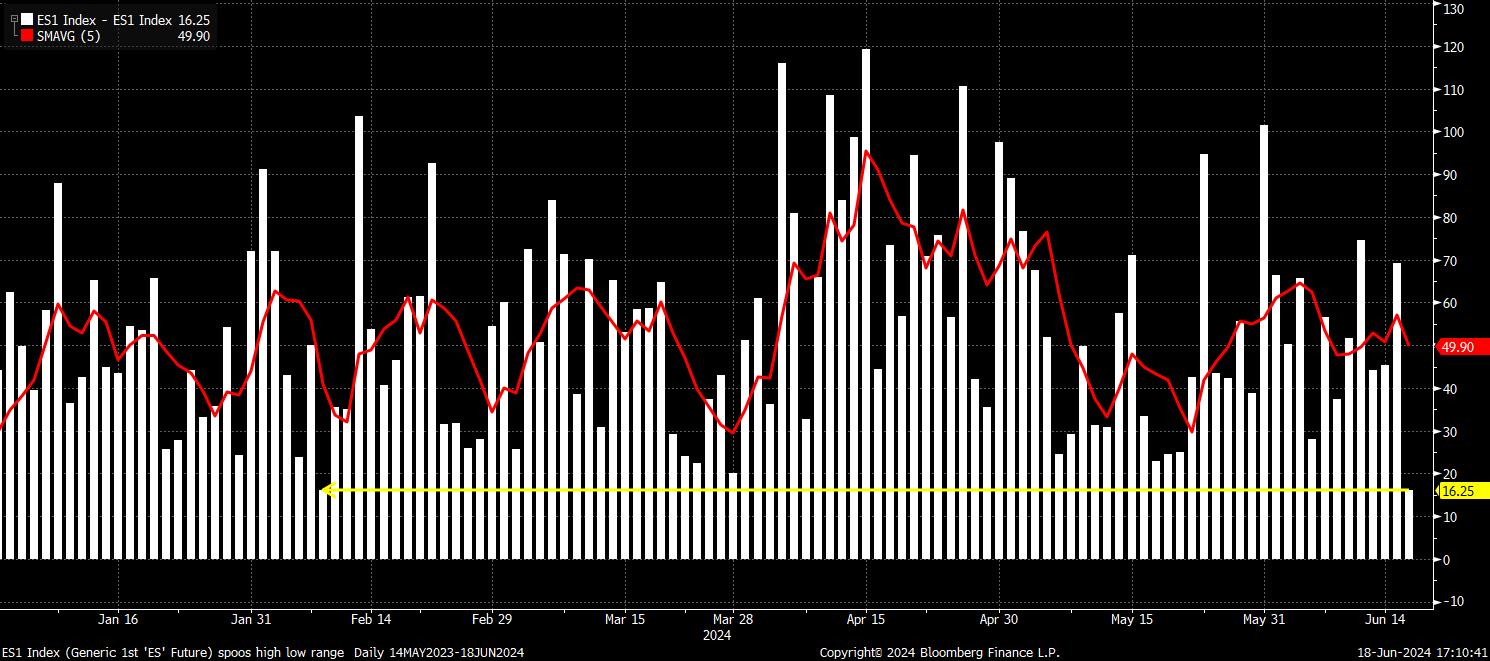

In any case, the market seems to be getting into a holiday mode. The front S&P contract, again at the time of writing, has traded just a 16pt high-low daily range, the tightest such range since early-February. There might be more than the upcoming market closure at play here, though, with summer approaching (the impact of the EURO 2024 football shouldn’t be underestimated in dampening vol!), and the Fed – effectively – out of the equation until September. Tight ranges, low vol, and a steady grind higher in the broader market are themes we will likely have to get used to.

Seasonal trends, incidentally, support the idea of a steady grind higher, though of course such trends should never be solely relied upon as the backing for a trade. Over the last five years, July has – on average – proved to be the 2nd best month of the year for the S&P 500, with the index having ended the month in the green for 9 years in a row. Pedigree for the Nasdaq 100 is even stronger, with the index having rallied in July for 16 years on the spin. Couple this with the ‘Fed put’ remaining as flexible, and forceful, as it has done all year, and the ‘path of least resistance’ should continue to lead to the upside for equities, with dips likely remaining shallow in nature, and being bought into rapidly.

Some, at this stage, may cry ‘the market is overbought!’. And, they’d be right – the Nasdaq 100’s 14-day RSI currently resides just north of 80, well above the 70 handle which typically sparks such cries, and its highest level since 2018. Those seeing this as an automatic reason for the market to pullback, however, may well be disappointed – since that year, on a sample of 42 times that the RSI has crossed above 70, the index has delivered a positive one-month return 7 out of 10 times.

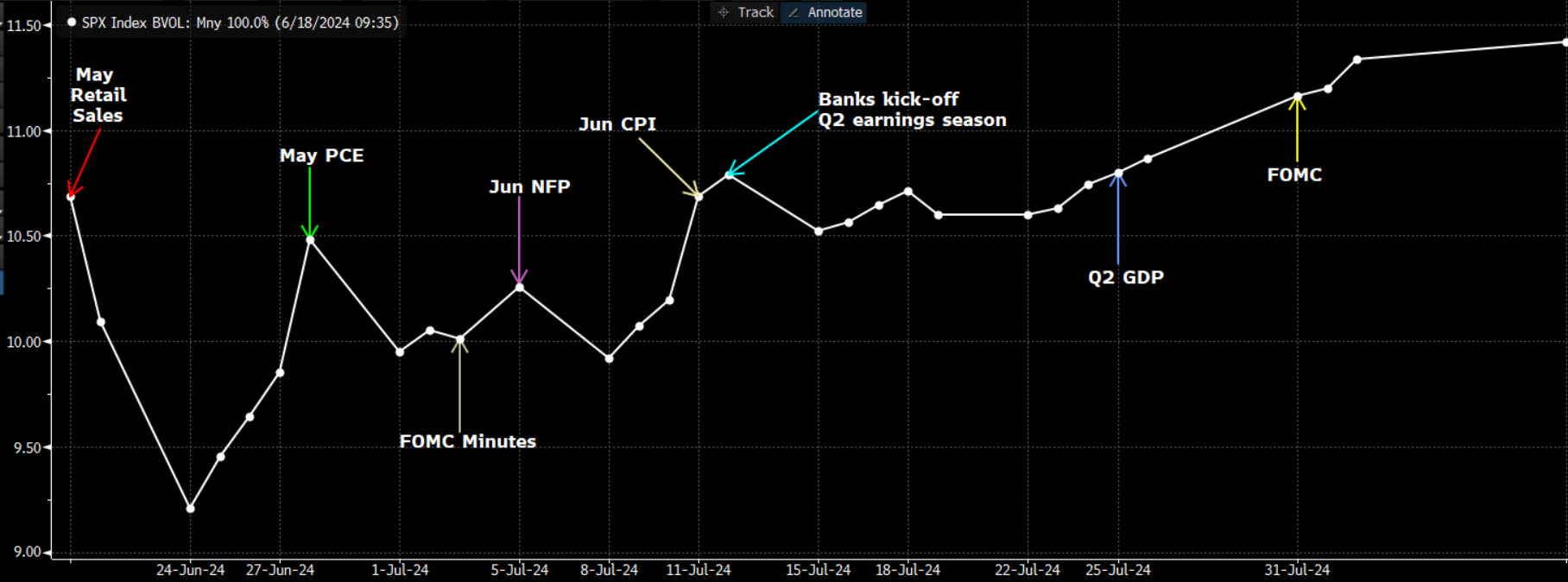

To wrap up, a look at forward vols. The May PCE print, next Friday, is clearly the next significant risk for markets to navigate, though with the figure being relatively easy to extrapolate from the CPI & PPI metrics – most models point to the core deflator rising 2.6% YoY – the data should already be well-discounted by market participants. Hence, we may have to wait for the June jobs report (5th July), or the June CPI print (11th July – what a great birthday present!) before some vol is injected back into the market, at least if the source of that vol is to be a macro catalyst.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.