Analysis

Unlike the large majority of our extensive currency pairs, these currencies (ex-MXN) may not trade for the full 24 hours a day, five days a week – so this can have implications for gapping risk and one’s ability to continuously react to news.

Spreads are typically wider than EURUSD or GBPUSD, and this can look daunting, especially to scalpers and higher-frequency traders. However, traders are handsomely compensated by the relatively expansive daily high-low trading ranges, and higher volatility.

What does interest many traders is the fact that they are compensated by the relative ease by which prices move. This can be highly attractive for day traders; many of whose strategies see improved performance through increased range expansion and through periods of aggressive trending intraday price action.

We see these trading conditions in play at present, with FX volatility having been given a shot in the arm, where subsequently we’re seeing huge moves in our LATAM currencies.

LATAM FX – preferred vehicles for expressing tactical trading opportunities

- Trading market sentiment and changes in volatility

- Default carry trade currencies

- High sensitivity to moves crude and copper

- Trading sentiment towards China through LATAM FX

A high-beta play on market sentiment

In the recent environment of playing defence during the recent bout of risk aversion, tactical traders have expressed this through shorting higher-risk currencies. The COP, MXN, BRL, and CLP are right up there as the highest volatility currencies in our universe.

LATAM currencies are therefore excellent risk proxies and will typically outperform when equities are rallying and attract greater selling flow when risk aversion strikes.

For example, the 10-day rolling correlation between the MXN and the VIX index (30-day implied volatility of the S&P500) sits at 0.70 – this relationship is significant and the highest of any of the FX plays in our extensive universe.

.png)

Default ‘carry’ currencies

While a rampant sell-off in US Treasuries has been behind the recent insatiable grab for USDs, the higher volatility seen in markets has seen high ‘carry’ (interest rate) currencies under pressure. LATAM FX – with such relative high interest rates – has seen big interest from traders looking to short high-carry currencies.

Low market volatility and positively trending equity indices are an essential backdrop for hedge funds to be long ‘carry’ as a trading strategy. However, with the VIX pushing into 20% amid an 8.5% drawdown in the S&P500 futures, the market was quick to unwind these trades, opting for more defensive strategies than obtaining the income offered through interest rate differentials.

An additional fundamental rationale behind the selling in CLP, COP, MXN, and BRL is that many of the corresponding LATAM central banks are now well into their easing cycle. As we see through interest rate swap pricing, these central banks are expected to keep cutting rates, with the Chilean central expected to cut by a further 50bp at the 26 Oct meeting. The Columbian central bank expected to cut by 25bp or 50bp by year-end and in Brazil a further 100bp cut by year-end.

Sensitivity to terms of trade

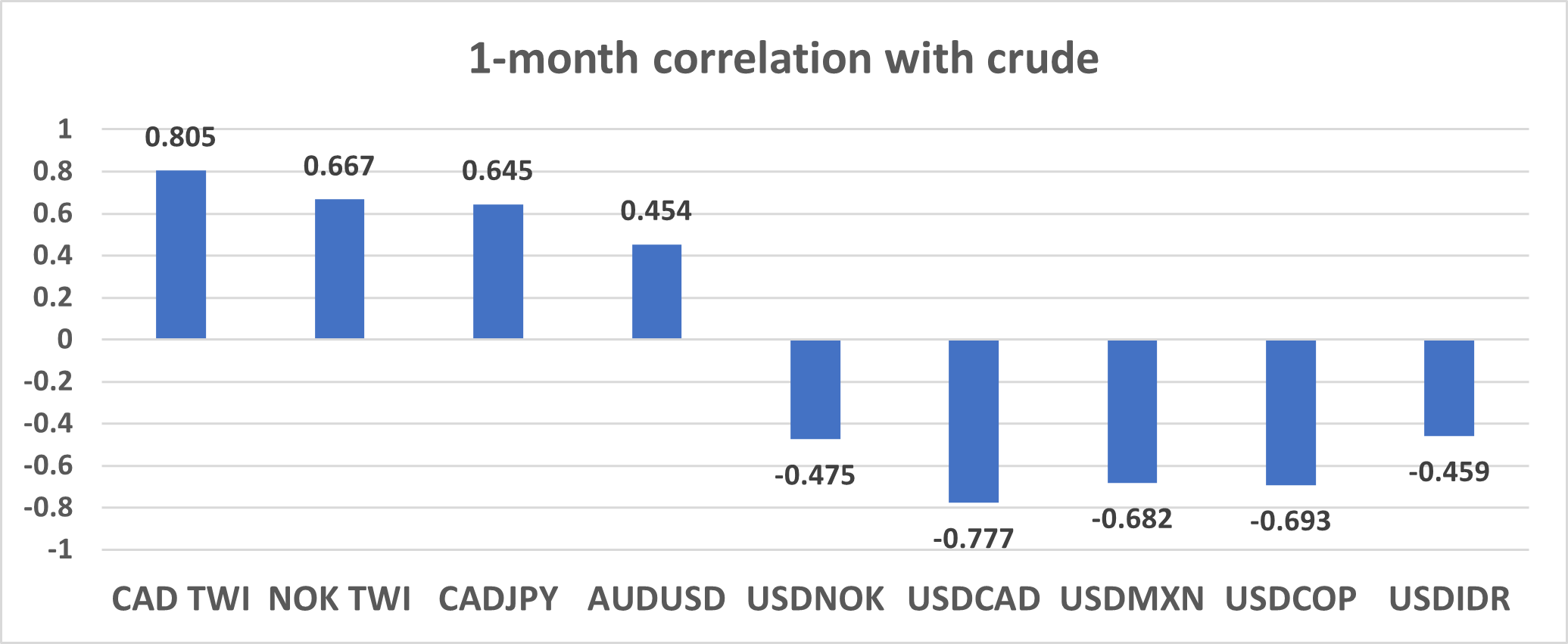

Tactically traders can express a view of crude through the COP and MXN, given their status as ‘petrocurrencies’. We can see both currencies hold a very tight statistical relationship with Brent and US crude. Many will also trade the CAD or NOK as an expression on the direction of crude through the currency channels. However, for those with higher risk tolerance, the COP and MXN will typically have greater percentage changes on the day.

A China proxy

The CLP (Chilean peso) primarily takes its direction from market sentiment but can at times have a strong correlation with copper, given Chile is the world’s largest producer of copper. When nearly 40% of Chile’s total exports are traded with China, the CLP – like the AUD and NZD – will act as a China proxy. For example, when we see a reaction to a Chinese economic data release, or when we see outsized moves in the yuan or equity markets, we can often see this impact the CLP.

Again, this can make the CLP a compelling higher-risk tactical thematic expression for traders.

Put LATAM FX on your watchlist

For those with higher risk tolerance and whose strategy permits, our LATAM currencies could be compelling trading vehicles. Not only do they have increased movement, but they are great expressions of a macro thematic. Take a look at the range and familiarise yourself with them today.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)