- English

- عربي

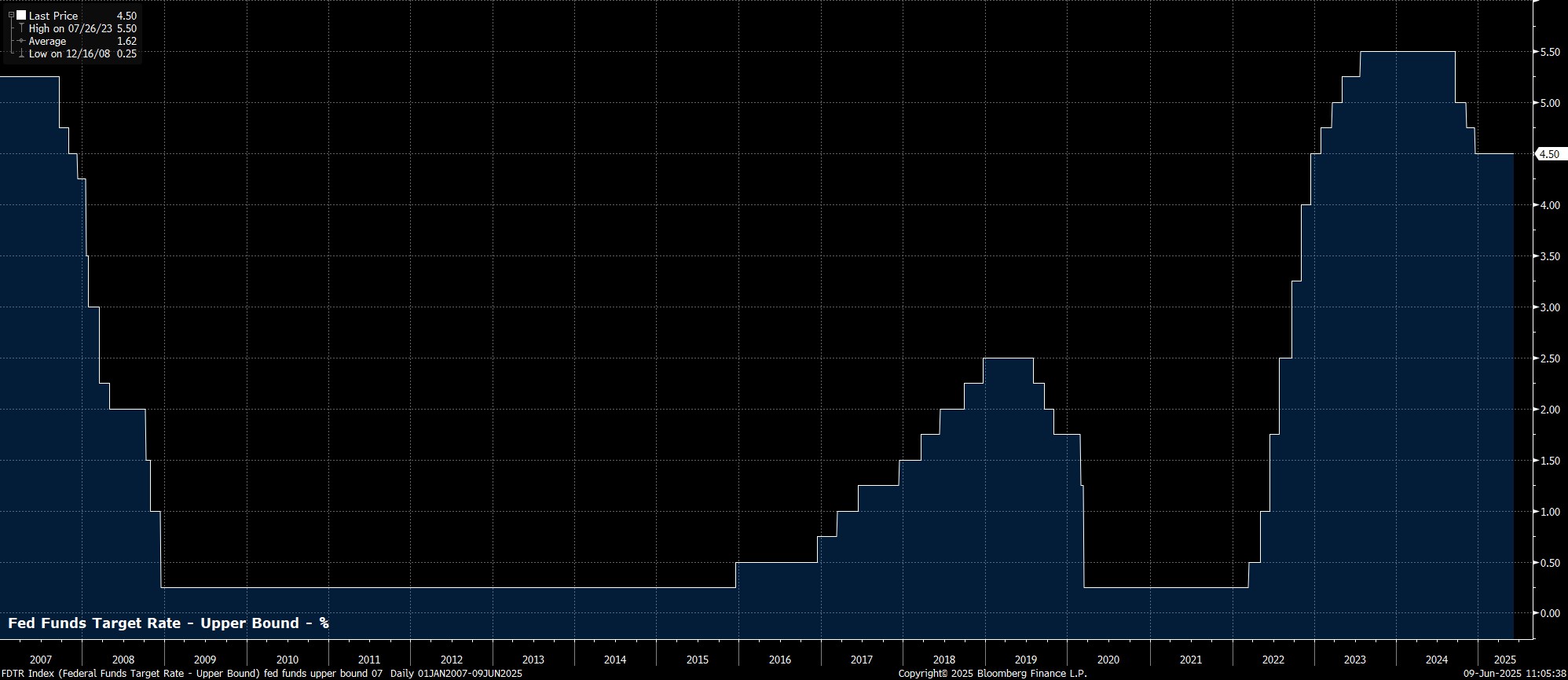

As noted, the target range for the fed funds rate should remain unchanged, at 4.25% - 4.50%, at the culmination of the June FOMC meeting, in what is set to be a unanimous vote among policymakers. That vote, though, will see Kansas City Fed President Schmid return in place of Minneapolis Fed President Kashkari, after the former missed the May meeting after the death of his wife.

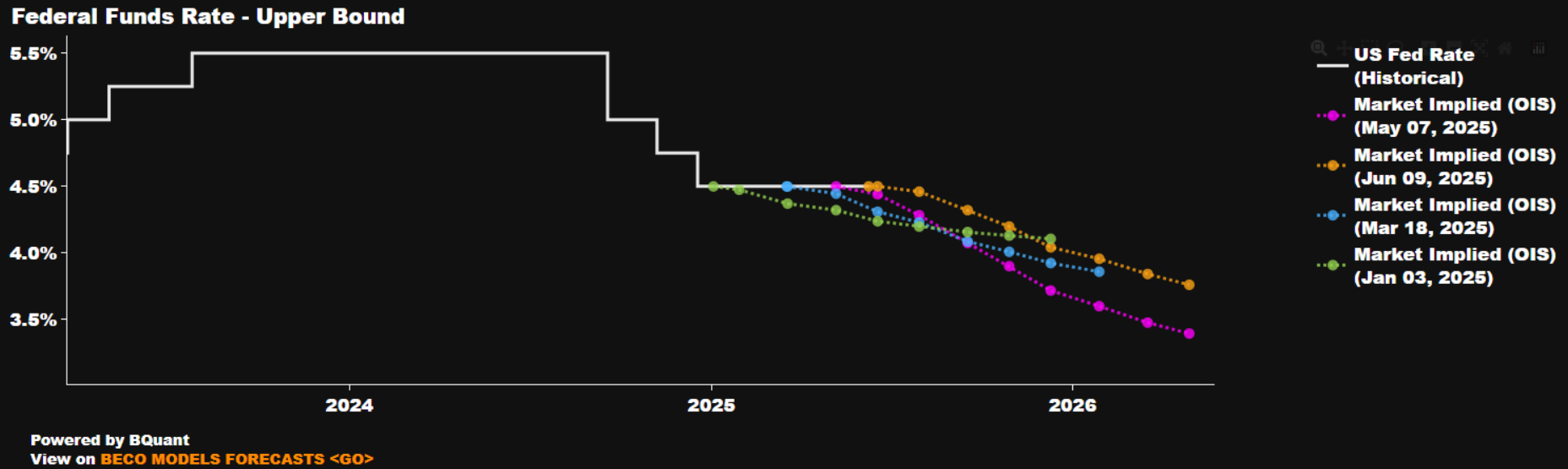

Money markets, per the USD OIS curve, price no probability whatsoever of any rate adjustments this time around, though said pricing is liable to shift a little, pending the outcome of the May CPI report. Further out, the curve does not fully discount the next 25bp cut until October, while discounting a total of 46bp of easing by year-end.

Accompanying the decision to hold rates steady will be the Committee’s updated policy statement.

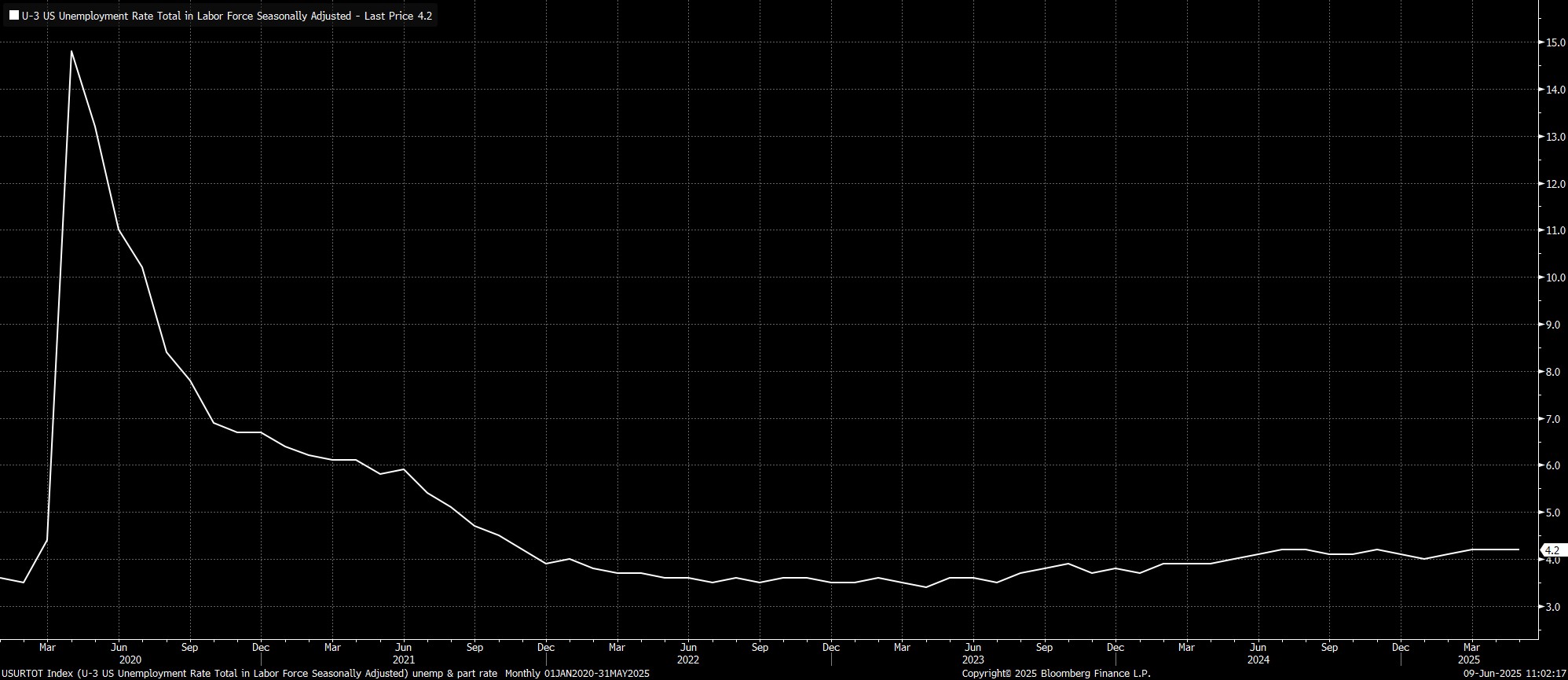

Here, commentary around the economic backdrop is likely to be broadly unchanged from that issued after the May meeting. As such, the statement is again likely to stress that economic activity has expanded at a ‘solid pace’, that the labour market remains ‘solid’, and that inflation remains ‘somewhat elevated’. Some housekeeping may take place, though, namely tweaking the line around swings in net exports having affected recent economic datapoints.

The Committee’s policy guidance is also likely to remain similar to that issued last time out, reiterating that policymakers will continue to take a data-dependent approach to future policy decisions. The statement will also likely again nod to the risk of risks of higher employment and higher inflation, though probably note that these ‘remain high’ as opposed to having ‘risen’ last time out. The same can be said of overall economic uncertainty, which is probably now viewed as ‘elevated’ as opposed to having ‘increased further’. These, though, are relatively minor grammatical changes, and shouldn’t be seen as inferring any shifts in the overall policy, or economic outlook.

In addition to the updated policy statement, the June meeting will also see the release of the FOMC’s updated Summary of Economic Projections (SEP). Some fairly substantial revisions from the prior SEP are likely here, given how significantly things have shifted politically, and economically, in the last three months. Furthermore, as Chair Powell has noted recently, the tariffs which have been imposed by the Trump Administration are larger than the Fed expected, even in their ‘upside’ scenario.

On inflation, expectations for both headline and core PCE are likely to be revised higher in each of the next three years. Though disinflationary progress has continued of late, the impact of tariff-induced price pressures is only just beginning to become clear, with a further rise in goods prices likely to continue through to the end of the third quarter, before gradually fading once more. While the longer-run PCE projection will remain at 2%, projections for both headline and core inflation metrics will probably run north of that target level in each of 2025, 2026, and 2027, with core PCE possibly topping 3.0% this year.

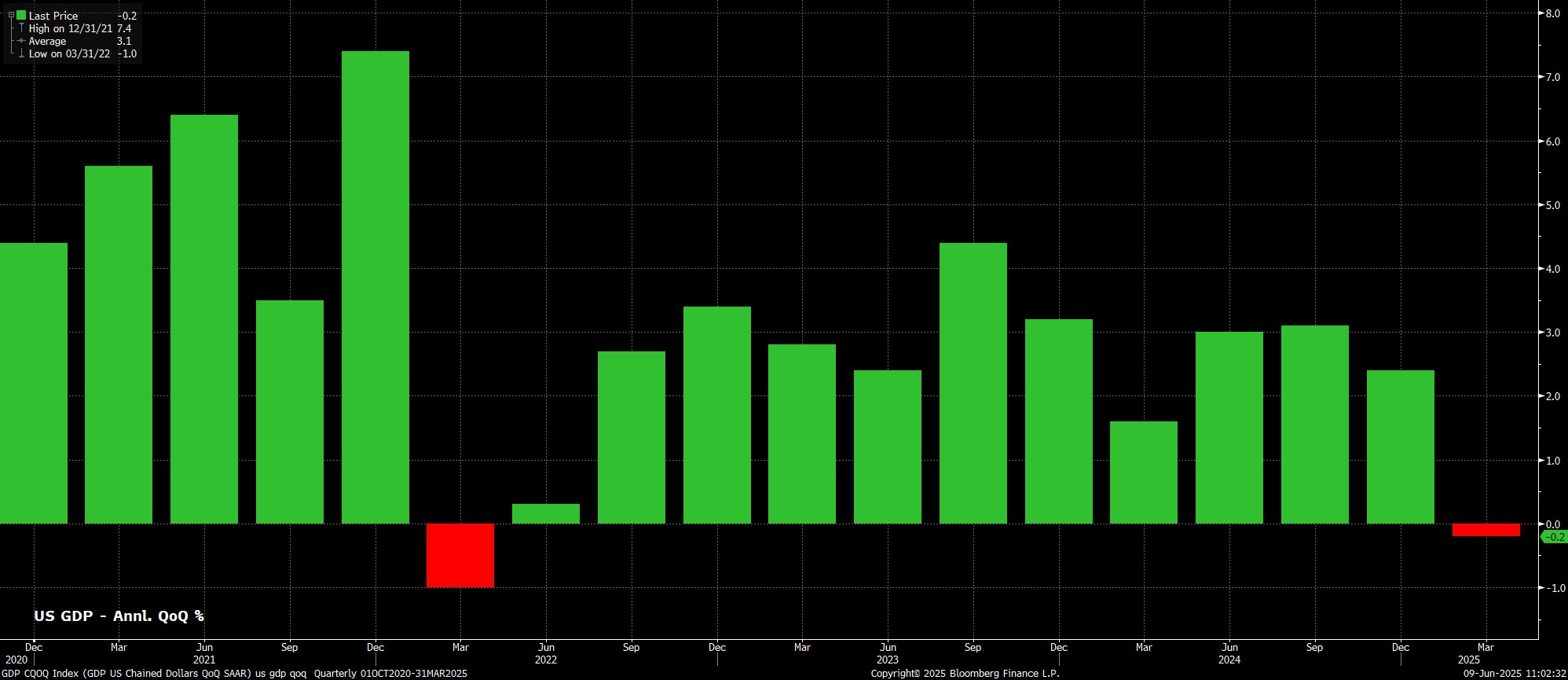

Meanwhile, along with a temporary ‘hump’ in inflation, tariffs are also likely to lead to near-term growth headwinds. Consequently, projections for GDP growth in 2025, and probably in 2026, are both likely to be revised a touch lower, though longer-run (aka trend) growth should remain unchanged, at 1.8%.

As for the labour market, the present inertia of relatively slow hiring, but also a lack of firing, will probably continue for the time being, particularly as firms seek to ‘hoard’ workers, despite ongoing economic uncertainty, amid a concern over how difficult re-hiring for skilled positions would be. Projections for the unemployment rate, hence, should be little changed across the forecast horizon.

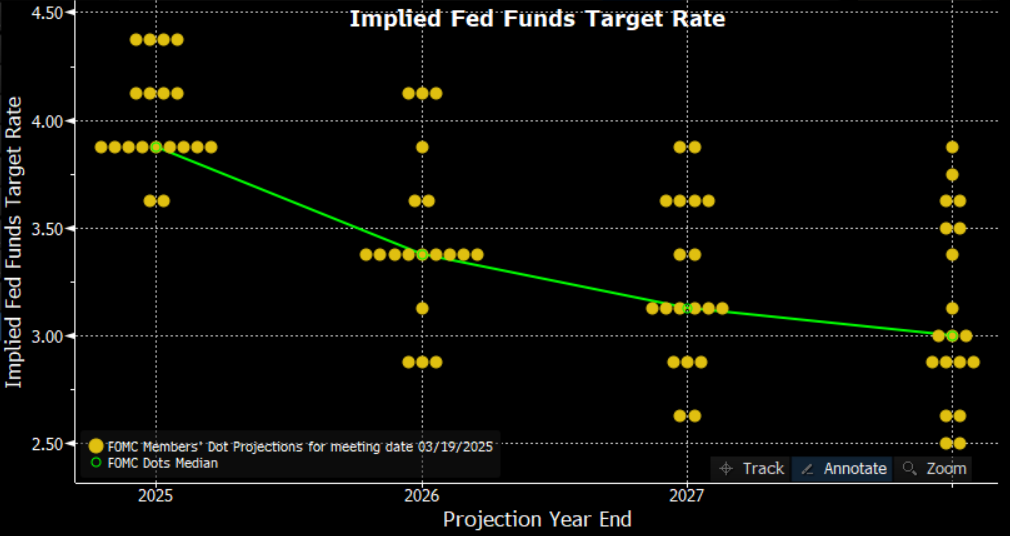

Putting all of that together, while particularly considering ongoing upside inflation risks, as well as policymakers’ desire to ensure that inflation expectations remain well-anchored, and a hawkish revision to the ‘dot plot’ seems likely.

Consequently, the 2025 median dot is likely to be nudged higher, to 4.125%, implying a median expectation for just one 25bp cut to be delivered this year. Importantly, it would require just two Committee members currently pencilling in two such cuts to revise their expectations in favour of one reduction in order to drag the median ‘dot’ higher by the same magnitude.

Further out, assuming that the 2025 median is nudged higher, the question then becomes whether the 2026 dot is also nudged to the upside, in order to maintain a consistent expectation for 50bp of cuts next year, or whether next year’s dot remains unchanged, implying a more back-loaded easing cycle. The base case leans towards the latter outcome, given expectations that tariff-induced inflation will prove temporary, allowing the easing cycle to resume in earnest. The longer-run dot, lastly, seen as a proxy for the neutral rate, should be held steady at 3.00%.

Tying all this together, at the post-meeting press conference, Chair Powell is likely to stick resolutely to his recent script, stressing that rates are in a ‘good place’, that the Fed is ‘well positioned’ to await further clarity on the economic outlook, and that policymakers ‘don’t need to be in a hurry’ to make any further rate adjustments.

Naturally, Powell will also play any political-related questions with a ‘straight bat’, refusing to be drawn on President Trump’s increasingly loud clamour for rate reductions, or on reports that Trump may soon be ready to name Powell’s successor, when his term expires next May. In the unlikely event that Powell does make any comments in this arena, the Chair will likely stress that policy will be set via an ‘objective analysis’ of incoming economic information.

On the whole, the June FOMC meeting is likely to be another placeholder for the Committee, who will retain their ‘wait and see’ approach for the foreseeable future. While policymakers will take some comfort from the resilient nature of recent economic data, the ongoing risk of tariff-induced inflation ensures that the FOMC will sit on their hands for the time being, seeking to ensure that inflation expectations remain well-anchored, despite elevated policy uncertainty. For the time being, any rate cuts before Q4 seem a very tall order indeed, with just one 25bp cut likely to be delivered this year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.