- English

- عربي

June 2025 ECB Preview: Trade Uncertainty Keeps The Doves In Command

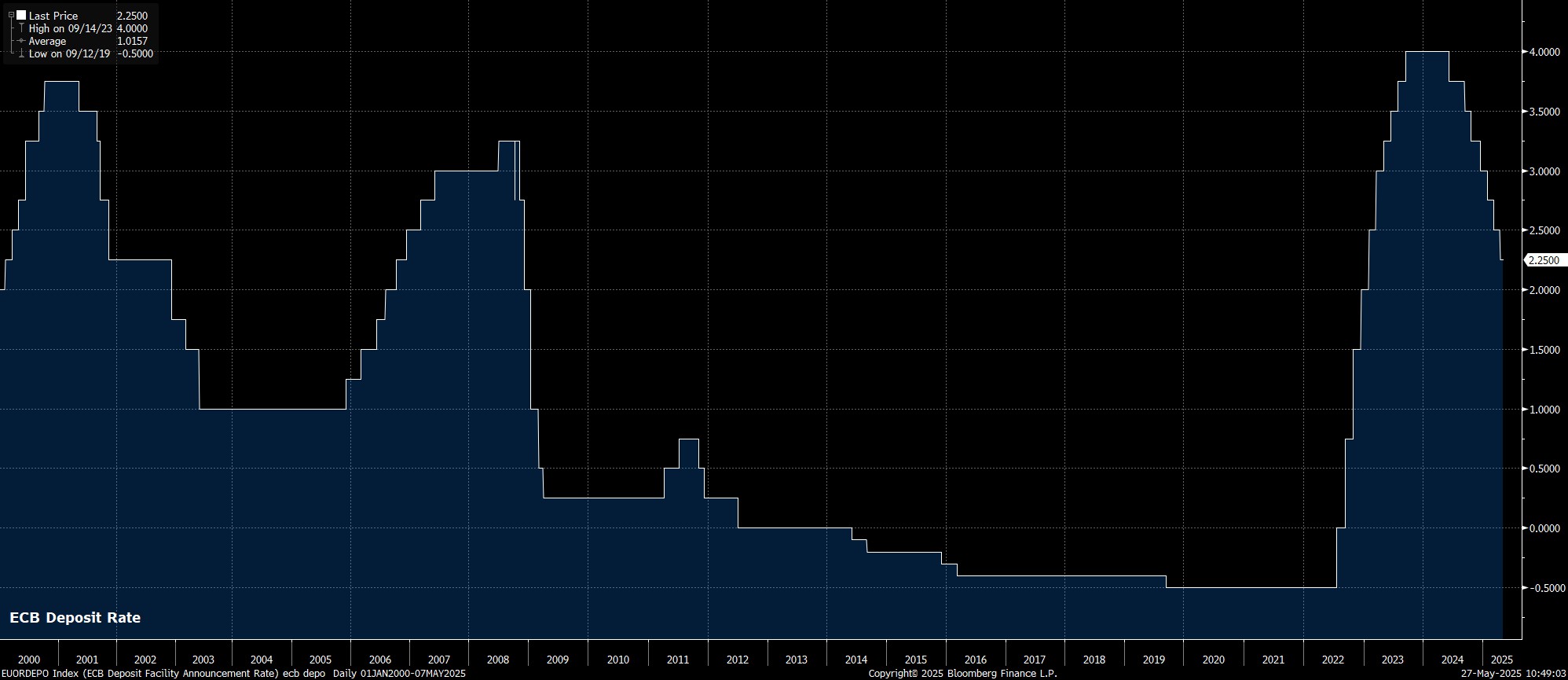

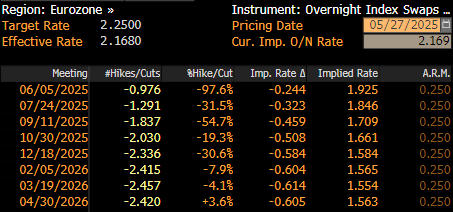

As noted, the Governing Council should deliver another 25bp cut at the conclusion of the upcoming policy confab, in turn lowering the deposit rate to 2.00%, and marking the 4th cut of 2025, and the 8th cut of the cycle so far. Money markets, per the EUR OIS curve, fully discount a cut this time around, while also pricing a total of 60bp of easing by year-end, even if the next 25bp reduction is not yet fully priced until October.

Accompanying the decision to lower rates, should be a policy statement that remains broadly unchanged from that issued after the April meeting, especially with economic uncertainty remaining just as elevated as it was last time out.

Consequently, policymakers are likely to reiterate that future decisions will be taken using a ‘data-dependent’ and ‘meeting-by-meeting’ approach, while also stressing that policy isn’t on a ‘pre-set’ course. Language around the degree of policy restrictiveness was omitted last time out, and is likely to be so again, especially with the deposit rate now sitting in the middle of the 1.75% - 2.50% band within which policymakers estimate neutral sits.

The June meeting will also see the ECB release the latest round of staff macroeconomic projections, which are likely to be significantly revised compared to the prior round in March, owing primarily to the huge degree of trade and tariff-related uncertainty that has prevailed since the prior forecast round.

To recap, as at the time of writing, imports of EU goods into the United States are currently subject to a 10% tariff, though this levy is due to rise to a whopping 50% on 9th July, if a trade deal, or another pause, isn’t agreed between the two before that date. That 50% levy, announced by President Trump on social media in late-May, is ostensibly due to the EU’s apparent slow progress in trade negotiations thus far, though serves to re-emphasise the ever-changing and unpredictable nature of trade policy.

This, in itself, will pose a significant economic headwind across the globe, with business and consumers alike set to postpone significant investment decisions and purchases, until a more concrete economic outlook begins to emerge. That said, in the meantime, the impact of tariffs on the eurozone economy is relatively simple to envisage – slower growth, and lower inflation, with just the magnitude of those declines in question.

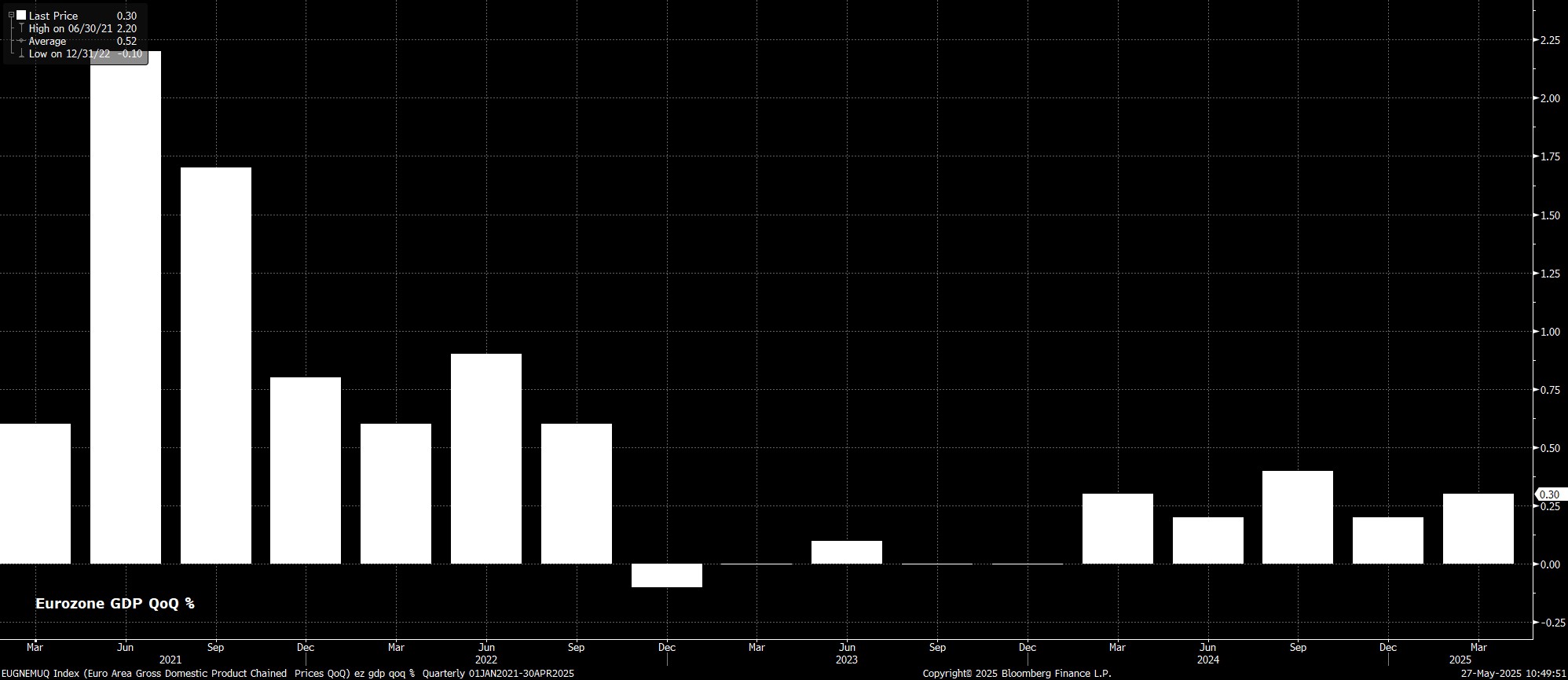

With that in mind, the latest round of economic projections are likely to see the GDP growth profile revised lower in both this year and next. While output in Q1 was boosted by a surge in exports as firms attempted to ‘front-run’ the aforementioned tariffs, growth headwinds are now beginning to intensify, as shown by the May composite PMI figure, which slumped back below the 50 mark, to a 6-month low. Sources reports, from mid-April, indicated that ECB staff foresaw a growth hit of between 50bp – 100bp as a result of tariffs, though this estimate is likely to have evolved since.

Meanwhile, on inflation, while the drop in demand caused by trade tensions, coupled with the potential for goods to be ‘dumped’ on the eurozone from countries like China, are notable disinflationary forces, their impact is likely to be compounded by the significant strengthening in the EUR of late.

In the March projections, EUR/USD was assumed to trade at 1.04 over the entire horizon, with the euro nominal effective exchange rate (NEER) seen steady at 122.2 over the same period. Instead, EUR/USD has rallied strongly towards the 1.15 handle, while the ECB’s EUR NEER index is only just shy of record highs around 129.25. Combining these factors should see a lower inflation profile through the forecast horizon, with the 2% target still being achieved this year.

Besides the latest projections, and the potential for ‘sources’ stories at any time, focus will also fall on President Lagarde’s post-meeting press conference.

Here, though, Lagarde is unlikely to, and frankly would find it difficult to, add significant new information to the overall discourse. Lagarde will likely stress the data-dependent nature of ECB policy, while reiterating a need for ‘agility’ owing to the huge uncertainties which remain on the economic outlook. Clearly, there will be no overt pre-commitment to a particular policy path, nor to the timing of potential further rate cuts.

Other areas of interest at the presser are likely to include Lagarde’s view on the recent EUR strength, whether the decision to deliver a 25bp cut was unanimous, and if a larger cut was potentially under consideration.

Taking a broader view, it is clear that a combination of mounting downside growth risks, a lower inflation profile, and continued elevated trade uncertainty, is likely to lead to further rate cuts in the months ahead. Another cut, to the bottom end of the neutral range, seems nailed on before the summer is out, with a move below 1.75% increasingly likely before year-end, particularly if the degree of prevailing uncertainty fails to lift significantly, and the outlook remains so dour.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.