- English

- عربي

It could, perhaps, be considered something of a stereotype, but Europeans do appear to enjoy a long, calm, and uninterrupted break during the summer.

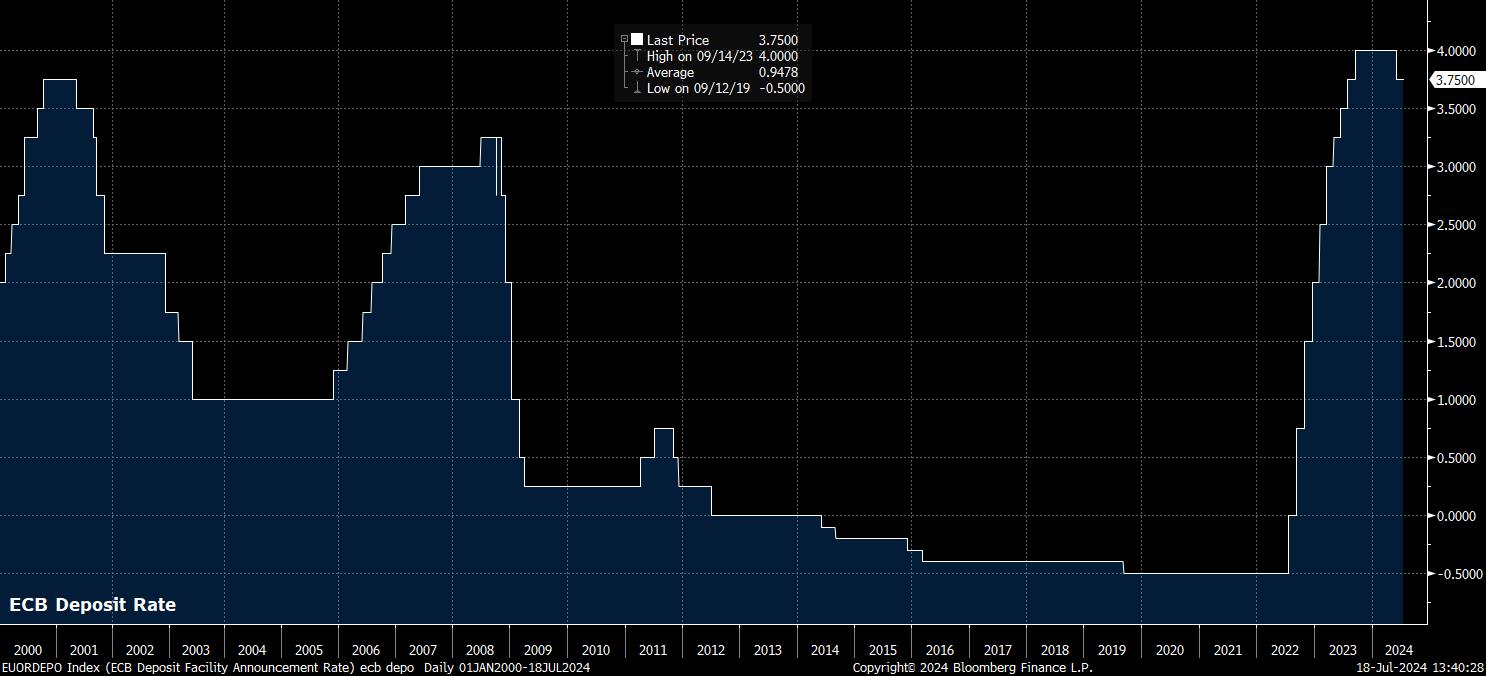

Such a break is exactly what the ECB’s Governing Council (GC) appear to have engineered for themselves after today’s policy decision having, as expected, kept all policy settings unchanged, maintaining the deposit rate at 3.75%, after delivering this cycle’s first 25bp cut at the prior meeting in June.

Having not ‘rocked the boat’ in terms of rates, policymakers took a similar stance when it comes to forward guidance. After, in March, boxing themselves in to a June cut having effectively pre-committed to such action, the GC seem to have learnt their lesson, now choosing to maintain a significantly greater degree of optionally, and flexibility, when it comes to future policy shifts.

By and large, the statement guidance was a repeat of that issued after the June meeting. Once more, policymakers affirmed a ‘meeting-by-meeting’ and ‘data-dependent’ approach to future decisions, while not ‘pre-committing’ to a particular rate path. Decisions on said path are again set to be based on an assessment of the inflation outlook; underlying inflation dynamics; and, the strength of policy transmission.

The first of these factors hints strongly at a desire to only remove further policy restriction in line with the quarterly publication of updated staff macroeconomic projections. Hence, with disinflation continuing, and set to achieve the 2% target in the second half of next year, another 25bp cut in September, followed by a third such cut in December, remains the most likely scenario. This is also a scenario that the EUR OIS curve already almost fully discounts.

In a similar vein to the policy statement, President Lagarde also gave little away at the post-meeting press conference, reiterating that policymakers were not pre-committing to a particular rate path, while also hinting at action after the summer break, noting that the ECB will have “a lot more information” in coming weeks and months. Lagarde also noted that the question of what the ECB will do in September is “wide open”.

Unsurprisingly, with Lagarde having stuck to the script, and the policy statement being a ‘copy and paste’ of that released a month ago, eurozone assets showed next-to-no reaction to the goings-on in Frankfurt.

_e_z_intra_2024-07-18_14-19-53.jpg)

In short, policymakers sought not to ‘rock the boat’ before disappearing off to the beach for their annual summer break. Nevertheless, providing incoming inflation data continues to show further signs of disinflation, further easing remains on the horizon, with the GC primed to deliver this cycle’s next cut in eight weeks’ time.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.