- English

- عربي

July 2024 ECB Preview: Biding Time Until The Next Cut

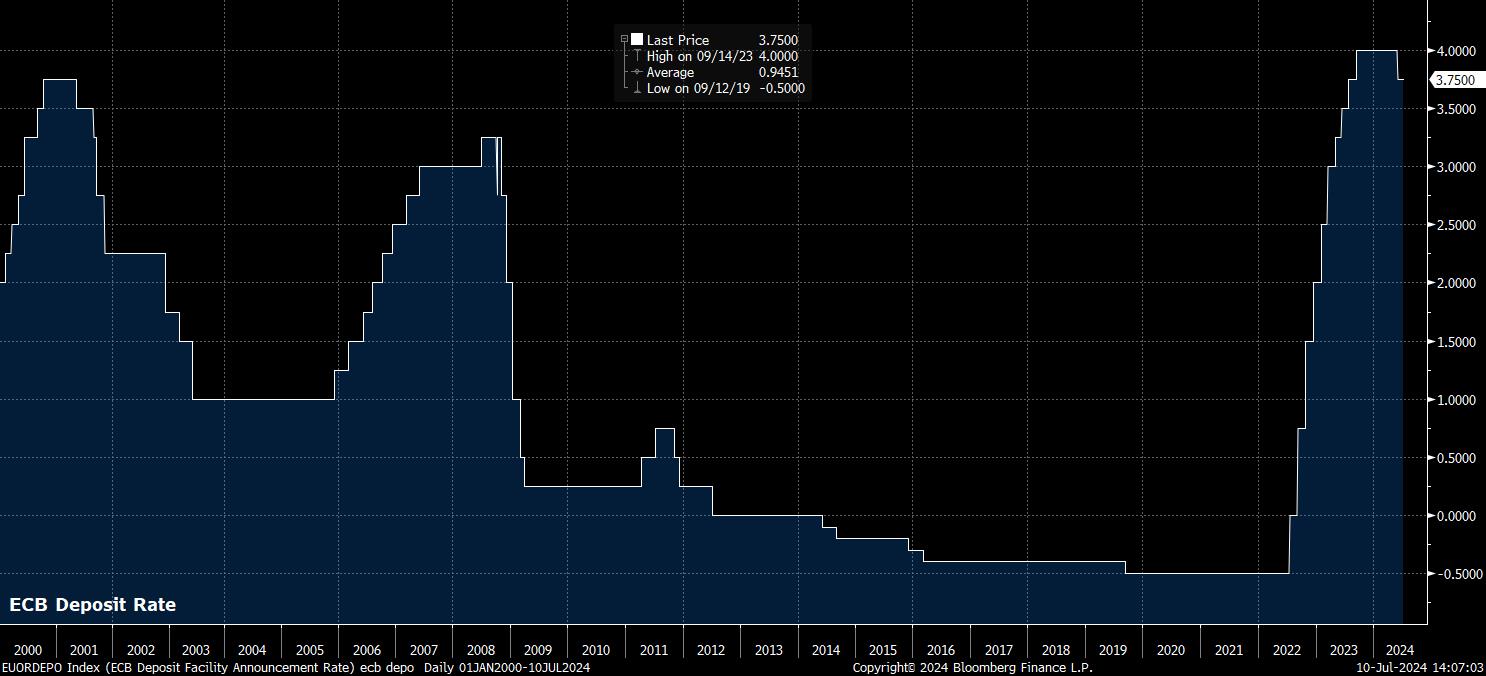

As noted, the ECB’s Governing Council is set to hold policy settings steady at the conclusion of the July meeting, therefore leaving the deposit rate at 3.75%, where it has stood since policymakers delivered the first rate cut since 2019 last month. Money markets, unsurprisingly, price next-to-no chance of any shift in rates this time around, though the EUR OIS curve does imply just under an 80% probability of a 25bp cut by September, while also discounting a touch over 40bp of easing by the end of the year.

Given the expected lack of policy shifts, with plans to reduce PEPP holdings also set to remain in line with the previously announced taper, focus should fall on the guidance that policymakers issue for future decisions.

In contrast to the first quarter of the year, where policymakers were content to pre-commit to a June cut as far back as the March meeting, such explicit forward guidance appears highly unlikely. Instead, the GC will likely reiterate the ‘data-dependent’ and ‘meeting by meeting’ approach by which decisions continue to be taken, as has been the ECB’s script for some time now.

Such a commitment should, once more, be accompanied by a pledge to keep rates “sufficiently restrictive for as long as necessary” to bring inflation back to target. Of course, despite having delivered a rate cut, policy is still seen – by most policymakers – as restrictive, with recent ‘sources’ stories having indicated a belief among rate-setters that said restriction would remain even after another 2 or 3 cuts were delivered.

Any further decisions to cut, of course, will continue to depend on the three factors with which ECB ‘watchers’ have now become highly familiar – namely, policymakers’ assessment of the inflation outlook; underlying inflation dynamics; and, the strength of policy transmission. The first of these hints, rather clearly, suggests that each round of staff macroeconomic projections will be key in determining both whether, and when, further cuts should be delivered.

While policymakers, per the June macroeconomic projections, don’t see a return to the 2% target until the second half of 2025, recent data has been disappointing. While headline CPI did slip 0.1pp to 2.5% YoY last month, core CPI remains more stubborn, at 2.9% YoY, and services CPI, running at just over 4% YoY, is likely also causing some degree of consternation, particularly among the GC’s hawks.

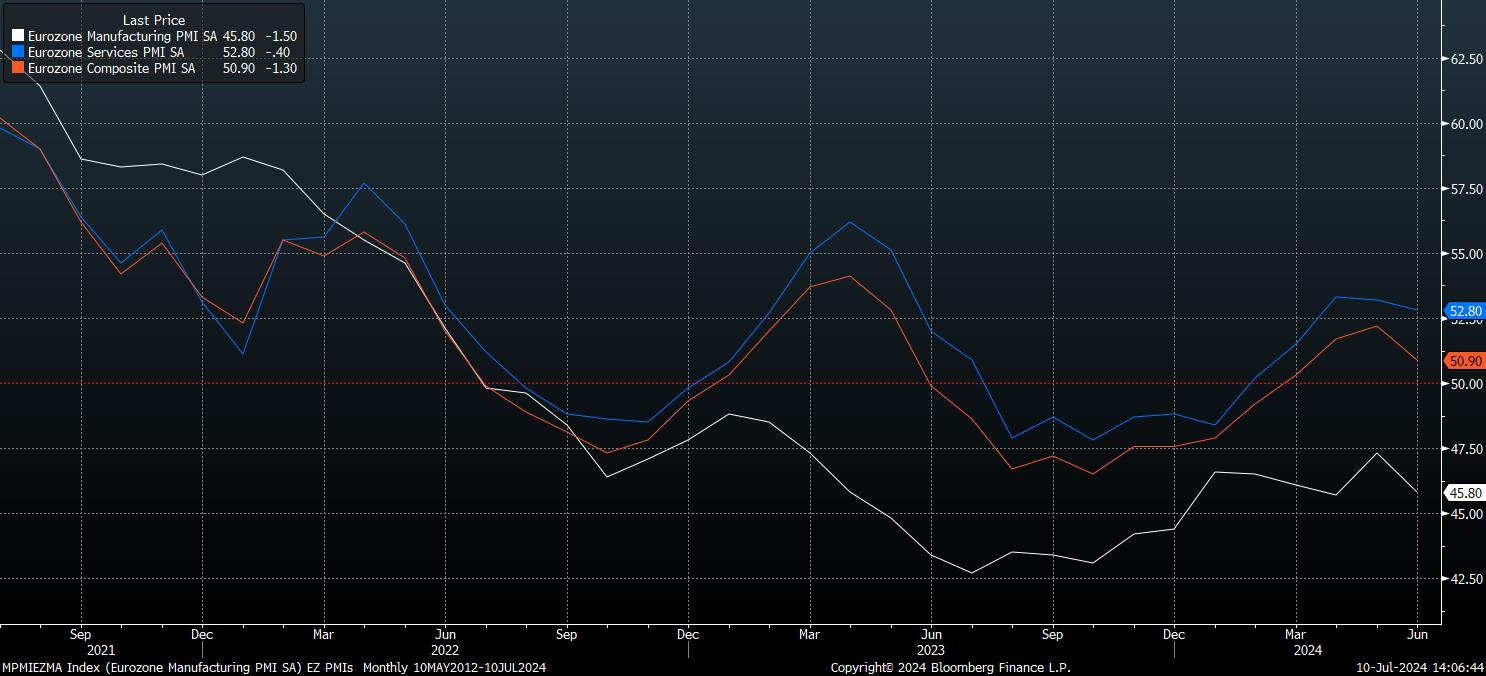

Meanwhile, on the growth side of the economy, economic momentum appears to be waning a touch, somewhat threatening the ECB’s punchy 0.9% 2024 GDP growth forecast.

The latest PMI surveys were something of a mixed bag, with the services and composite gauges touching three-month lows, albeit while remaining north of the 50.0 boundary mark between expansion and contraction. The manufacturing sector, however, continued to contract on an MoM basis, extending a run of consecutive contractions which begun in July 2022, falling to a 2-month low 45.8. Clearly, a rather sharp pick-up in activity is required to avoid a downgrade to the aforementioned GDP forecast, during the next round of projections in September.

Said projections, rather nicely, bring us to the two key questions that will be posed, though likely not fully answered, at the July ECB meeting.

Firstly, there is the question of when the next rate cut is likely to be delivered. September remains the base case here, with most ECB policymakers likely preferring a relatively ‘slow and steady’ quarterly pace of normalisation. This would also leave a further 25bp cut, in December, on the cards, while also seeing the ECB ease at, broadly, the same pace as G10 peers, with the first BoE cut likely in August, and the first Fed cut likely a month later. Of course, while this is the base case, Lagarde & Co are unlikely to outline a concrete commitment to such action in advance.

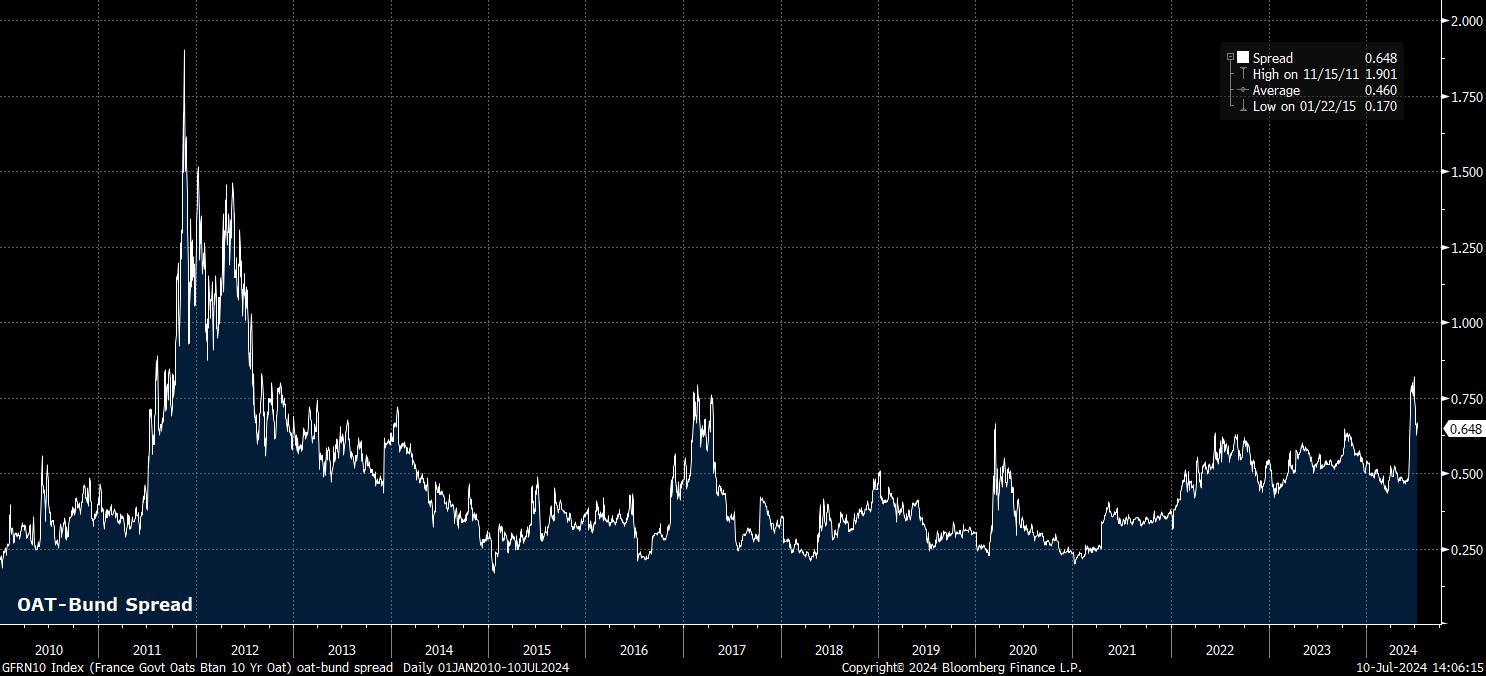

Secondly, there is the question of France. While market nerves over the French political backdrop have cooled somewhat since the initial concern over a Le Pen-led RN majority in snap legislative elections called after President Macron suffered a disastrous EU election result, the political situation remains far from resolved. With the ‘far left’ now in pole position to lead the next government, and the fiscal backdrop remaining fragile, concerns over the deficit should persist.

While the OAT-Bund spread is now some 20bp off the wides seen a few weeks ago, and Lagarde is unlikely to be drawn on domestic political matters, questions over when, and indeed if, the ECB would be prepared to use the TPI should feature frequently at the post-meeting press conference.

By and large, though, said press conference is unlikely to see much in the way of fireworks, with Lagarde set to stick to the aforementioned data-dependent script, seeking not to rock the boat before she, and other policymakers, depart for the annual summer break.

Consequently, it’s tough to imagine the July ECB meeting being any sort of game-changer for the EUR – which should remain rangebound – or for other European assets, in either the equity or FI spaces.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.