- English

- عربي

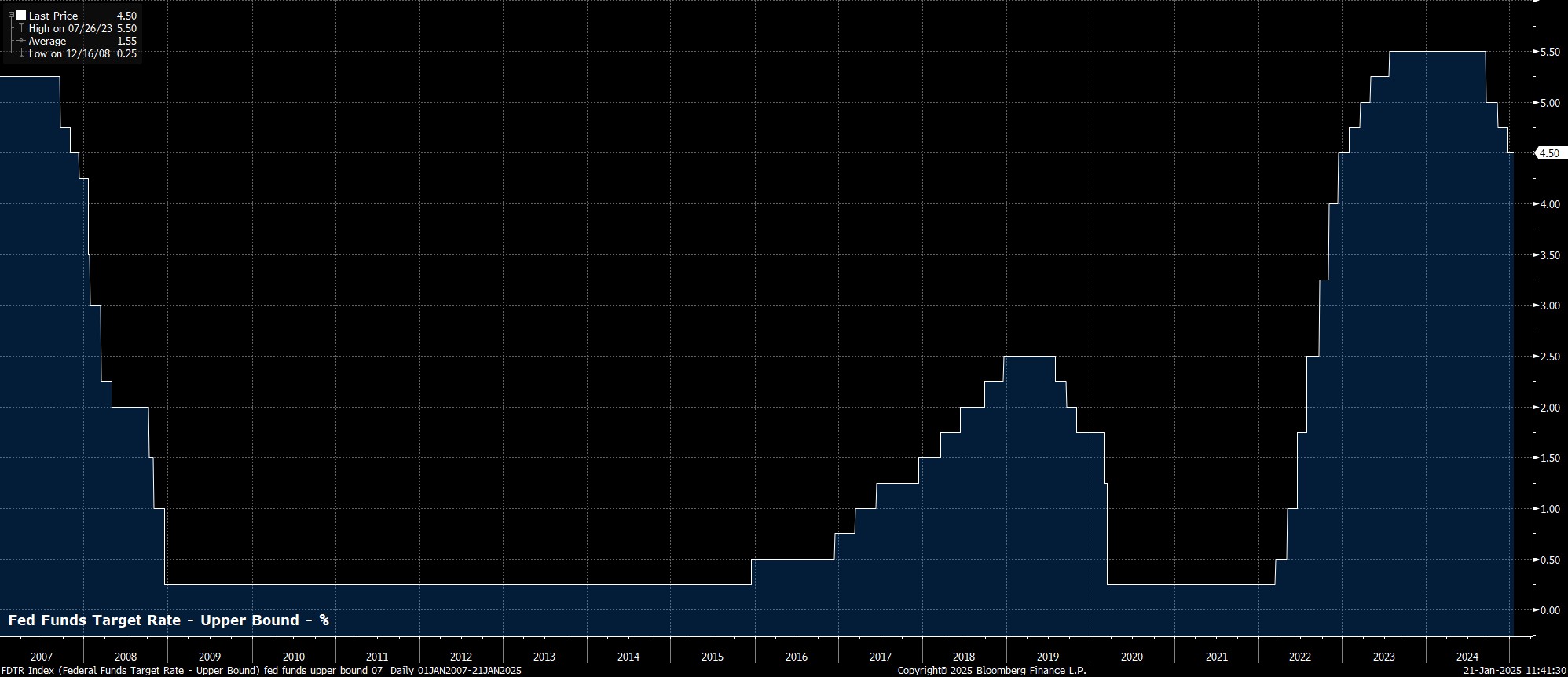

As noted, the Committee are likely to maintain the target range for the fed funds rate at 4.25% - 4.50% at the first meeting of 2025, ‘skipping’ the January meeting, having delivered three consecutive cuts, and 100bp of easing in total, at the tail end of last year.

The decision to stand pat on policy is likely to be a unanimous one. It is, however, worth remembering that the January meeting, as always, will see the annual rotation of voting rights among FOMC members.

Regional Fed presidents Barkin (Richmond), Bostic (Atlanta), Daly (SF), and Hammack (Cleveland) will lose their voting status this year, being replaced by Collins (Boston), Goolsbee (Chicago), Musalem (St Louis), and Schmid (Kansas City). Overall, this tilts the Committee in a marginally more hawkish direction than that seen last year, with Musalem and Schmid, in particular, having made notable hawkish remarks in recent months.

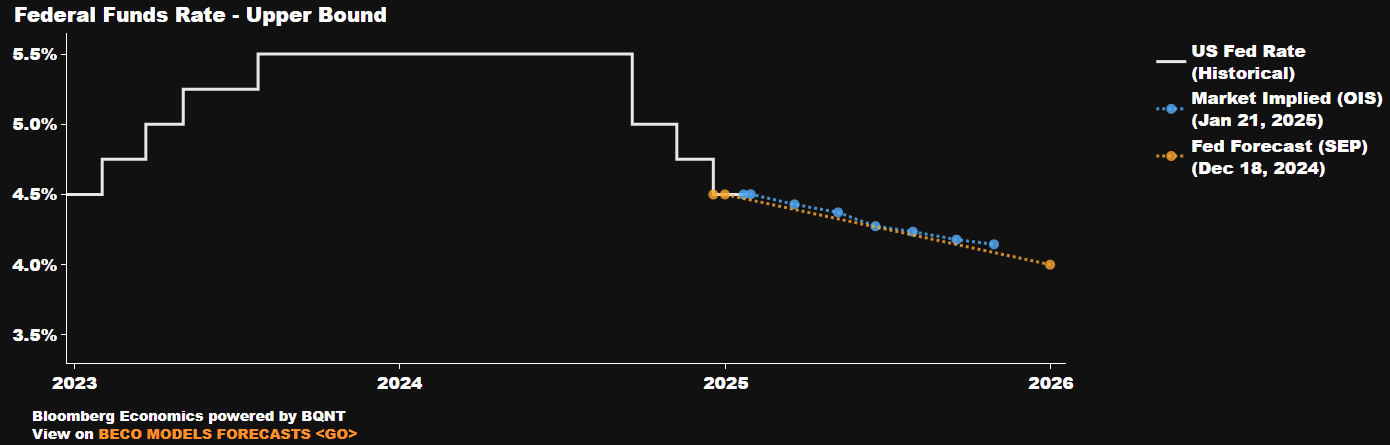

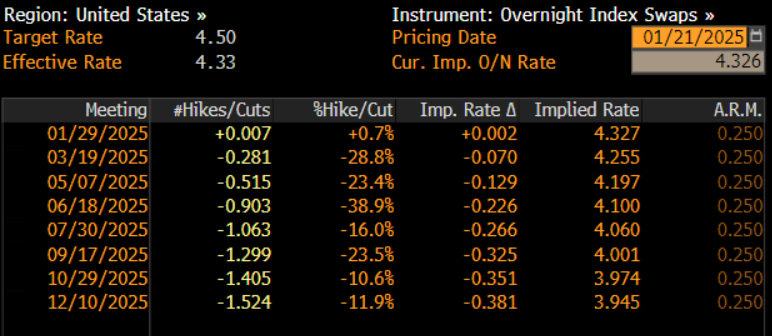

In any case, besides the change in voting members, the Committee’s statement is likely to be broadly similar to that issued in the aftermath of the December meeting. Hence, in terms of policy guidance, the statement will likely reiterate the FOMC’s data-dependent approach to future rate decisions, leaving the door open to either a prolonged pause in the easing cycle, or a return to rate cuts in short order. Money markets, incidentally, don’t fully price a 25bp cut until July, while only implying around an even chance that the ‘dot plot’ median projection of 50bp of easing this year is indeed delivered.

Meanwhile, the Committee’s assessment of current economic conditions is also likely to, broadly, be a ‘cut and paste’ of that issued almost a month ago.

As such, inflation is again likely to be described as having “made progress” back towards 2%, albeit while remaining “somewhat elevated”. December’s core CPI print, along with the PPI figure, were both a touch cooler than participants had expected, with the former notching its slowest annual increase since last summer. That said, the components of those releases which feed into the Fed’s preferred PCE inflation metric were a touch on the hot side, which will likely temper optimism for now.

Furthermore, recent indicators reinforce the Committee’s view that economic activity is expanding at a “solid pace”. Retail sales, per the control group metric, rose a notable 0.7% MoM in the final month of last year, while industrial production rose a substantial 0.9% MoM over the same period. In addition, both the ISM manufacturing and services indices surprised to the upside in December, printing 49.3 and 54.1 respectively.

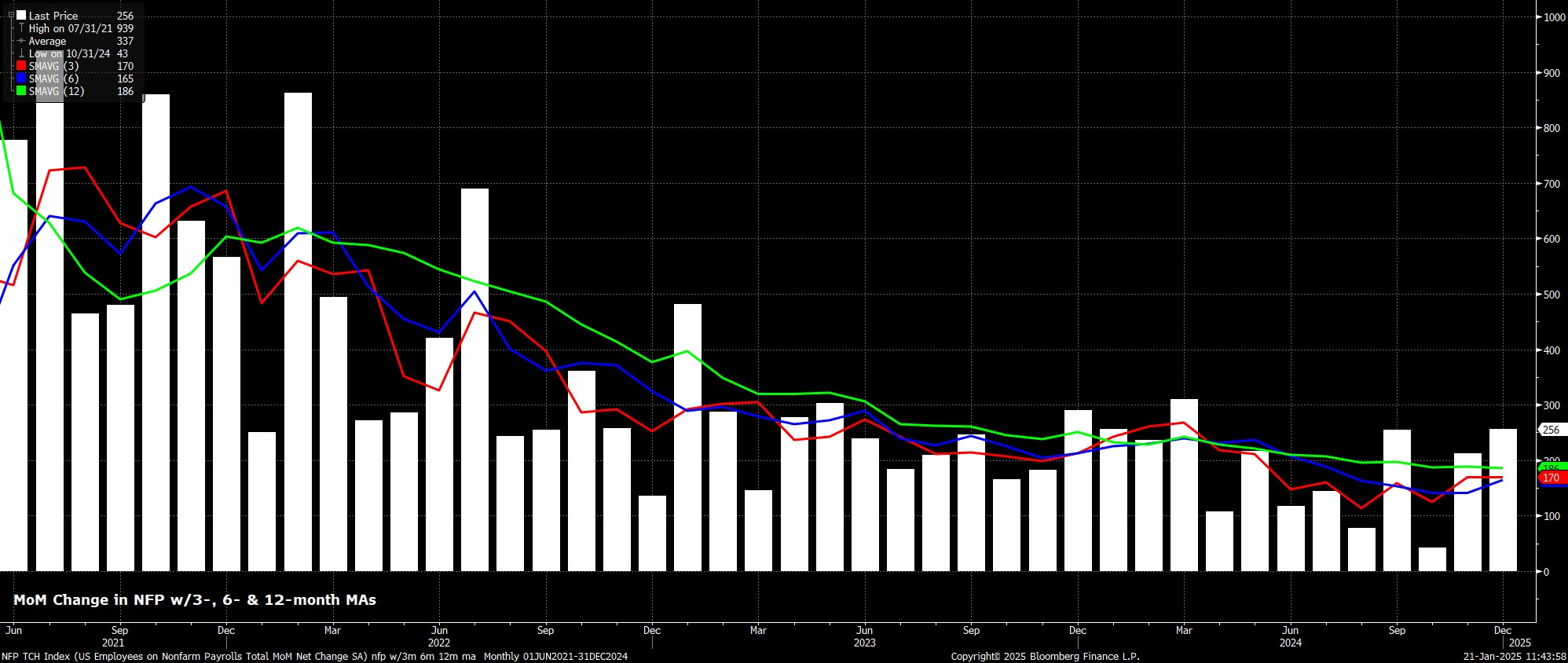

It is, though, on the labour market where the Committee’s commentary may become marginally more upbeat from the current assessment of conditions ‘generally easing’.

Headline nonfarm payrolls rose by a chunky +256k in December, the fastest pace in 9 months, while unemployment unexpectedly fell to 4.1%, as earnings growth cooled to 3.9% YoY. All in all, data of that ilk is reflective of ‘goldilocks-esque’ labour market conditions, though policymakers will likely not want to over-react to a single month’s worth of data.

Looking forward, against that backdrop of continued broad-based economic resilience, the key question for market participants is whether January’s ‘skip’ morphs into a more prolonged pause in the easing cycle.

Naturally, policymakers will remain in a data-dependent stance, though the threshold for further rate cuts is likely lower than participants had previously thought. Influential Governor Waller noted recently that the December CPI figures were “very good”, and that more data of that ilk could result in further cuts to the fed funds rate in the first half of the year, with said cuts even coming as soon as March.

Nevertheless, policymakers are likely to want to see substantial further disinflationary progress, along with greater clarity on the upside inflation risks surrounding the Trump Administration’s trade and tariff policies, in order to unlock another rate cut. At present, with the economy ‘ticking along’ well, there isn’t exactly a pressing need to deliver further immediate policy easing.

On that note, Chair Powell is highly unlikely to make any firm commitments to a future policy path in his remarks at the post-meeting press conference, instead re-iterating that policy is not on a pre-set course, and that risks to the dual mandate remain “roughly” in balance. That said, on a broader level, Powell should still repeat that policy continues to move towards a more neutral stance, and that as rates near said level, the Fed can afford to be cautious in making future rate adjustments.

Of course, questions on the political backdrop are also likely to be posed, though Powell will likely play these with a ‘straight bat’. Policymakers will need time to assess the specifics of President Trump’s tariff policies, and how they will impact risks to either side of the dual mandate. Furthermore, Powell will remain resolute in ensuring that the FOMC is not subject to political interference, either in terms of policy shifts, or appointments to the Committee.

Taking a step back, risks around the policy outlook this year are considerably more two-sided than those seen last year, with a hawkish risk having been re-introduced to the policy path. Consequently, the comfort blanket of a ‘fed put’ which has been ever-present for risk assets over the last 18 months or so is no longer present, and fades further each month that incoming data remains solid. While solid economic growth, and subsequent solid earnings growth, should see the path of least resistance for equities continuing to lead to the upside, said path will likely be bumpier and more volatile than participants have become familiar with, as policy uncertainty mounts on both the monetary, and fiscal, fronts.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.