- English

- عربي

Gold Outlook: Intensifying Risk Events Drive Sharp Market Volatility

.jpg)

Over the past week, gold experienced a classic “rise then retreat” pattern, consolidating within the $3,300 to $3,430 range and continuing its prior sideways trend. Last Tuesday, XAUUSD briefly challenged the key resistance at $3,430 but failed to break through, then consecutively fell below July’s high at $3,370 and the short-term 5-day EMA support, indicating persistent selling pressure above. However, bulls staged a renewed push early this week, regaining footing and testing the 50-day moving average.

If this moving average is convincingly breached, the previous high of $3,370 will serve as a critical intermediate resistance on the way to retesting $3,400; if the price retreats, $3,300 - the lower bound of the June consolidation zone - will provide important support.

From a trading perspective, gold currently sits at a crossroads between technical and fundamental forces. On one hand, signs of global trade easing and resilient short-term US economic data have boosted risk appetite, pressuring gold prices. On the other, ongoing geopolitical tensions, persistent inflation uncertainty, and continued central bank gold purchases keep bulls confident. Three major events—the tariff talks, Fed rate decisions, and nonfarm payroll reports—are lined up, likely to amplify gold price volatility.

Trade Tensions Ease, Safe-Haven Flows Retreat

A core market dynamic remains progress in tariff negotiations between the US and major economies. With the August 1 tariff pause deadline approaching, the US has secured key agreements with Japan and the EU: the US-Japan deal lowers import tariffs from 25% to 15%, supplemented by procurement lists and investment commitments; similarly, the US-EU agreement cuts tariffs on European goods from previous rates of 30%, and initially threatened 50%, down to 15%.

These breakthroughs have eased market concerns over escalating trade friction and reaffirmed the effectiveness of the TACO strategy. In other words, the shift from “threats and negotiations” to “agreement implementation” underscores the US preference to trade concessions for geopolitical and economic leverage. This change has sharply boosted risk assets in the short term, particularly attracting flows into US, Japanese, and European equities, thereby lifting risk appetite.

For gold, this means a temporary cooldown in safe-haven demand, with some funds rotating into stocks and higher-yielding assets, pressuring prices in the short run. Gold is transitioning from a “risk-off” driver to a “policy-expectation” driven phase.

Balancing Short-Term Pressure and Long-Term Support Amid Fundamental Divergence

While the market focuses on the short-term boost from trade easing for risk assets, structural risks behind these agreements should not be overlooked. First, tariffs tend to raise import costs over the long term, exacerbating global inflation pressures. Second, trade barriers may reduce global supply chain efficiency, hindering economic growth and potentially triggering recession risks.

This “initial inflation followed by later recession” scenario increases uncertainty around the Fed’s policy path. Currently, the risk of inflation rebound may keep the Fed cautious before a potential September rate cut, limiting gold’s near-term upside. However, if economic data deteriorate or growth outlook weakens, the path to easing could open quickly, providing upward momentum for gold.

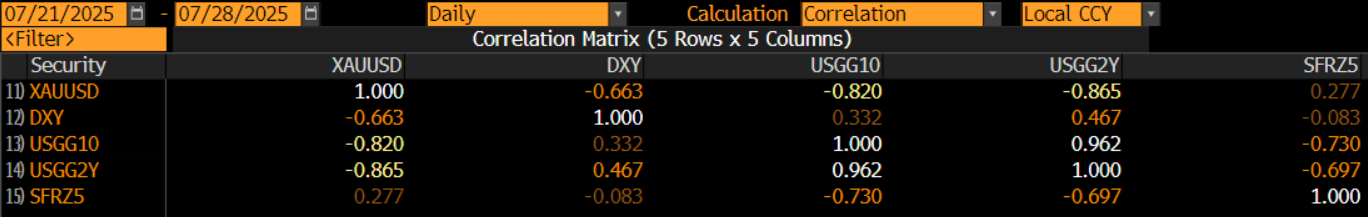

From a pricing standpoint, the negative correlation between gold, the US dollar index, and US Treasury yields was particularly evident last week. With the effects of Japan’s election fading, the yen has limited room for further depreciation, and tariff reductions may ease the European Central Bank’s urgency to cut rates in September. Given the significant weight of the yen and euro in the dollar index, their relative stability could cap dollar strength, which in turn may relieve valuation pressure on gold.

Geopolitical conflicts remain an unavoidable variable for gold markets. Unrest in the Middle East, the Russia-Ukraine war, and tensions in parts of Southeast Asia continue, reinforcing gold’s reserve appeal.

From a longer-term perspective, gold’s upward trend since early 2024 reflects a narrative shaped by weakening US economic resilience, heightened uncertainty around tariffs and other policies, and a growing government fiscal deficit.

Although the US has not officially entered recession and trade risks have marginally improved, the “One Big Beautiful Bill” bill only temporarily averts a government shutdown without resolving structural deficits. Challenges to US dollar credit quality have prompted global central banks to increase gold reserves, a key support factor for future gold prices.

US-China Talks Underway, Easing Emerges as Potential Consensus

Overall, gold remains range-bound as tariff easing and retreating safe-haven flows weigh on prices in the near term; yet fiscal deficits, central bank gold buying, and downward pressure on the dollar provide a solid floor. While short-term volatility is inevitable, this “bottoming in a range” phase sets the stage for medium-to-long-term gains.

In the coming week, a slew of key economic data and risk events will be released, with the most anticipated catalyst being the US-China meeting in Stockholm. Beyond tariffs, discussions are expected to cover China’s rare earth export controls and its strategy on Russian oil imports.

Given the US signal to trade tariff cuts for market access, and China’s declining export dependence on the US in H1, these talks are likely to focus more on implementation details than new escalations. Coupled with the negotiation templates set by Japan and the EU, although the August 1 tariff deadline remains a focus, overall market volatility may stay relatively muted. For gold, the cooling of safe-haven demand will likely continue to weigh on bulls.

That said, even if safe-haven demand subsides, gold may still find support within its range if the dollar index and Treasury yields do not rise sharply. The key lies in whether trade talks produce an “expectations gap” and if the Fed adjusts its path in response to evolving data.

Critical Data Ahead, Gold Awaits Direction

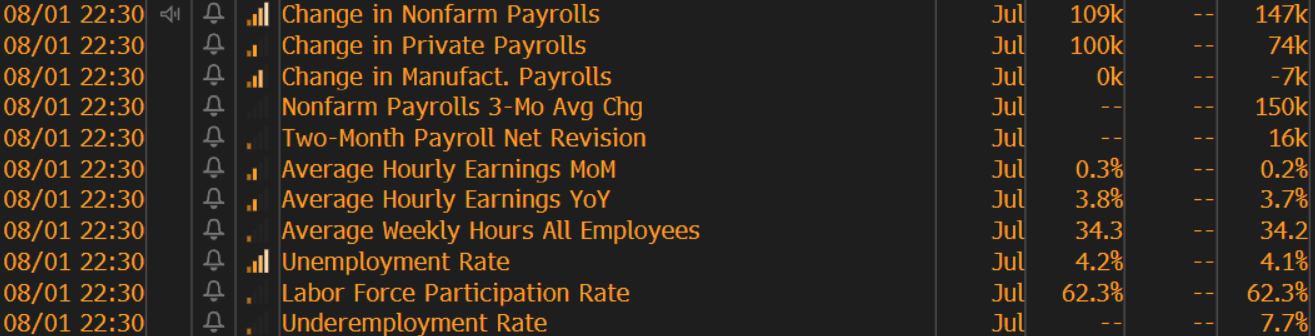

Besides tariff updates, this week will see three major data events: the FOMC meeting, US Q2 GDP, and nonfarm payrolls report—all posing multiple tests for gold’s trajectory. While a July rate cut is broadly discounted, the tone of the FOMC statement and Fed Chair Powell’s remarks will be key to gauging September’s policy stance.

If the FOMC expresses ongoing concern over sticky inflation or maintains strong confidence in economic resilience, markets may push back September rate cut expectations, pressuring gold. Conversely, if GDP data released the same day significantly undershoot forecasts (currently consensus at 2.4% QoQ growth) and Powell signals dovishness, rate cut expectations could reignite, boosting gold.

Core PCE inflation and nonfarm payrolls, released subsequently, are also critical. With June CPI showing modest inflation rebound, markets will closely watch payrolls for fresh clues on Fed policy.

Current consensus expects 110,000 new jobs, down from 139,000 previously, with unemployment edging up to 4.2%. Should actual figures fall well short - e.g., less than 100,000 new jobs and unemployment rising to 4.3% or higher - combined with an ongoing slowdown in inflation, the Fed could pivot sooner, opening a new upward window for gold prices.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.