- English

- عربي

Gold Outlook: Geopolitical Risks Lift Safe-Haven Demand, Non-Farm Payrolls in Focus

.jpg)

Over the past two weeks, gold has experienced heightened volatility due to thin market liquidity during the holiday period. Last weekend, a sudden escalation of geopolitical tensions in Latin America provided a short-term boost for bulls. Meanwhile, medium- to long-term bullish drivers remain intact, with inflation hedging demand and USD credit protection continuing to underpin gold.

Looking ahead to this week, traders will closely monitor the evolution of geopolitical developments, alongside upcoming US economic releases, including the December ISM manufacturing and services PMIs and the Non-Farm Payroll report. These factors are expected to collectively influence gold’s opening performance in 2026.

Technical Observation: Gold Gaps Higher, Eyes on $4,400

Gold exhibited notable volatility over the holiday period. During the Christmas week, prices surged, breaking October’s high of $4,381 and reaching a new record of $4,549, marking a roughly 4.5% weekly gain.

However, bullish momentum failed to extend into year-end. On December 29, intraday retracements reached $250, erasing the prior week’s gains, yet gold still closed 2025 up around 65%.

Compared with major fundamental updates, this volatility mainly stemmed from limited liquidity during the holidays. As traders return to their desks, volatility may normalize.

This week, gold gapped higher at the open, with bulls regaining control and testing the key psychological level of $4,400. How prices react around this level will be a critical indicator of whether upward momentum can continue.

A close above $4,400 would likely open further upside, potentially targeting $4,450 and even $4,500. Conversely, failure to hold above this level could limit the sustainability of the rally. Combined with clear bearish divergence signals on the daily chart, the market could remain range-bound between $4,300 and $4,400 this week.

Safe-Haven Demand Rises, But Duration Remains Uncertain

Over the weekend, the US conducted a raid on Venezuela, with President Trump reporting that Maduro and his spouse had been detained and sent to the United States. This news caused a short-term shock to global markets.

Rising geopolitical tension, security concerns in Latin America, and potential disruptions to US foreign policy credibility and oil supply temporarily boosted safe-haven demand, pushing gold higher.

However, the duration of this impact on gold prices is worth considering. While the US has maintained the Venezuelan oil embargo, it has indicated the situation will not escalate further, suggesting actual supply disruptions may be limited. Unless critical oil and gas infrastructure is materially damaged, the medium-term supply-demand balance is unlikely to shift significantly, and safe-haven demand triggered by potential oil supply shortages may prove short-lived.

Historical experience also shows that market reactions to similar sudden events are often brief. For example, on June 22, 2025, the US carried out a weekend airstrike on Iran. Gold opened the following Monday with only a 0.02% gain and closed the week down 2.8%.

Although this US raid is not fully comparable to previous risk events, as long as tensions in the Caribbean do not escalate, the weekend incident is unlikely to provide sustained support for safe-haven demand.

That said, the tail risks from geopolitical tensions should not be ignored. Regional conflicts could influence broader international relations, including China-Russia dynamics, and potentially affect the global political landscape, offering ongoing support for gold.

Focus on Geopolitics and US Economic Data

Overall, gold volatility over the past two weeks has been significant due to thin holiday liquidity. The Venezuelan geopolitical escalation provided a short-term boost to safe-haven demand, but its impact may be limited. Looking medium-term, shifts in the global political landscape, further Fed rate cuts, and central bank gold purchases continue to support the bullish case, with dip-buying remaining popular among traders.

This week, markets will closely watch the development of geopolitical events. At 2:00am AEDT on January 6, the UN Security Council will hold an emergency session regarding the US-Venezuela incident, and statements from major economies could create market volatility. Ongoing US-Iran tensions could also support gold buying.

In addition, several key US economic releases are scheduled this week, including December PMI data and employment figures. Among these, the December Non-Farm Payroll report will attract the most attention, marking the first full monthly data release since the end of the US government shutdown.

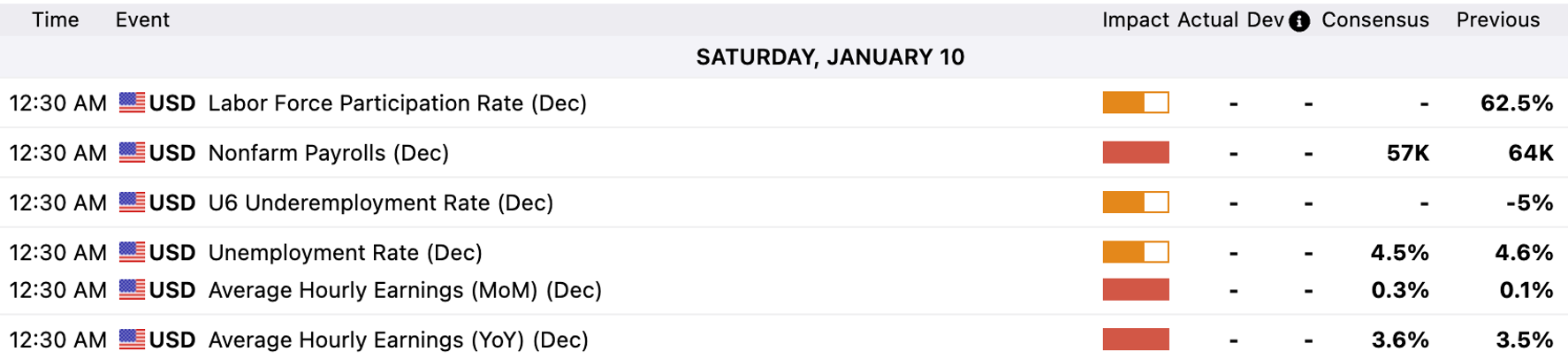

Market consensus expects a 57,000 increase in payrolls, below the prior 64,000, with the unemployment rate slightly falling 0.1% to 4.5% and average hourly earnings rising 0.3% MoM.

If the data shows a strong labor market—for instance, a 50,000–70,000 increase in payrolls with unemployment at 4.5%—it could reinforce the Fed’s cautious approach to rate cuts, weighing on gold. Conversely, a weaker labor market, such as a 40,000 increase and unemployment at 4.6%, might prompt the Fed to reconsider rate cuts, providing a modest boost to gold.

Potential announcements concerning the next Fed Chair may also influence gold. Given the multiple uncertainties at play, traders would be wise to focus on careful position management.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.