- English

- عربي

Summary

- Record Highs: Gold's bull run continues, with spot breaking above $5,000/oz for the first time

- Bullish Drivers: The bull case remains robust, amid healthy reserve & retail demand, as well as a pick-up in the 'sell America' trade

- Downside Risks: However, risks remain, with the rally having run a very long way, in a very short space of time, thus leading to a potential momentum unwind if enthusiasm towards bullion begins to fade

Spot gold has, this morning, traded north of $5,000/oz for the first time ever, as bullion continues its ascent at breakneck pace, bringing YTD gains to around 20%, before January has even come to an end.

_Da_2026-01-26_07-02-40.jpg)

Bullish Drivers Remain Numerous

Numerous factors continue to drive the yellow metal higher, the majority of which have now been in place for some time.

The most significant structural factor underpinning gold remains reserve demand, primarily from EM central banks, seeking to diversify holdings out of the USD/USTs. This, to be clear, is nothing new, with the PBoC having now bought gold for 14 months in a row, and this demand from reserve allocators having actually kicked-up a gear in the middle of 2022, upon the seizure of Russia’s FX reserves, which in turn was the trigger for gold’s traditional correlation with real/nominal yields to break down.

_go_2026-01-26_07-02-56.jpg)

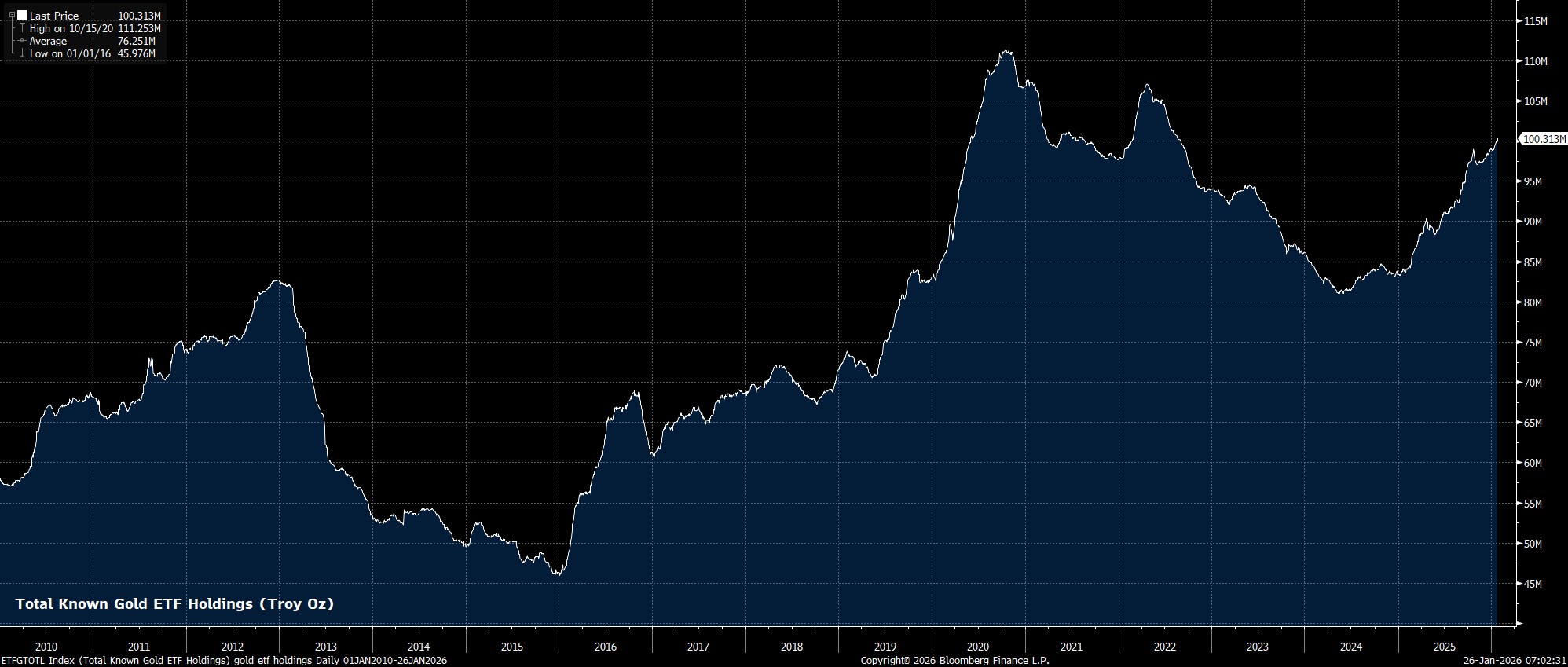

Retail demand has also been providing a tailwind, though. Gold ETF holdings, a useful proxy for retail demand, has now risen north of 100mln Oz, having risen almost nonstop since the start of last year. interestingly, though, said holdings remain some considerable way off recent peaks, not only that seen in 2022 amid a surge in geopolitical risk after Russia’s invasion of Ukraine, but around 10mln Oz below the peak seen at the tail end of 2020, in the midst of the pandemic.

Added to these bullish catalysts, the recent significant bout of USD weakness is providing a further tailwind for gold. Said dollar softness is, by and large, a reflection of the ‘sell America’ trade which has gathered steam in the FX space of late, and in turn reflects the dim view that participants, on balance, are continuing to take of President Trump’s unorthodox ‘escalate to de-escalate’ negotiating strategy, and constant on-again, off-again tariff threats. Increased geopolitical risk, chiefly centring around developments in the Middle East, are also helping to further fuel haven demand for gold, and metals more broadly.

_D_2026-01-26_07-02-13.jpg)

Picking A 'Top' Is A Fool's Errand

Naturally, spot printing $5k for the first time leads to questions as to whether this will prove to be ‘the top’.

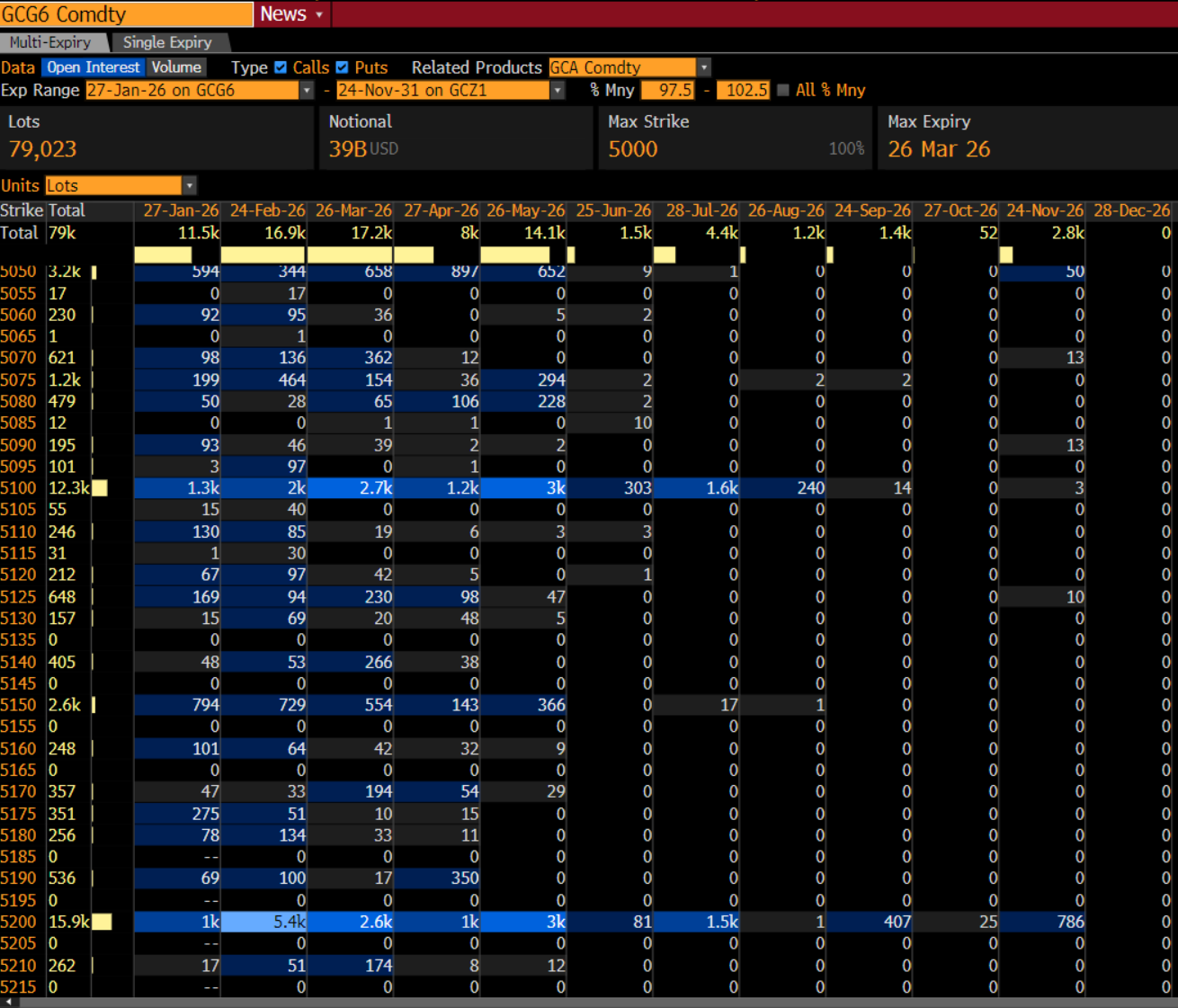

Frankly, trying to pick a top is something of a fool’s errand, particularly considering that one record high tends to beget many more, even more so in the momentum-driven markets that we’ve become used to in recent years. Having said that, with spot now being truly in ‘uncharted territory’, round numbers are likely to continue to provide some degree of psychological resistance, if nothing else, particularly with a notable clustering of option expiries around both $5,100/oz and $5,200/oz.

Downside Risks To Keep On The Radar

Of course, while the fundamental bull case outlined above remains a robust one, bullion is not without downside risks. In a market that has come so far, so fast, and with positioning so lopsided towards longs, there is the potential for a rather ugly momentum unwind if these fresh longs begin to bail on the emergence of some kind of bearish catalyst.

Several potential catalysts spring to mind that could create some selling pressure in the short term, chiefly if we were to see a return to some degree of policy orthodoxy in DC, or if we were to see geopolitical risks significantly subside. Elsewhere, with gold having traded so well in recent months, perhaps a broader de-risking is the biggest risk to the bull case in the short-term, if a VaR shock were to trigger margin calls, and result in forced selling of profitable positions.

Dips Appear To Be Buying Opportunities

That said, these are short-run factors, that are unlikely to materially dent the structural bull case for gold, and metals at large. I would, hence continue to view dips as buying opportunities, especially were spot to test the 50-day moving average on any pullbacks.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.