- English

- عربي

S&P 500 loses momentum as sentiment turns - what traders need to know

The Bull Case

Resilient Economy

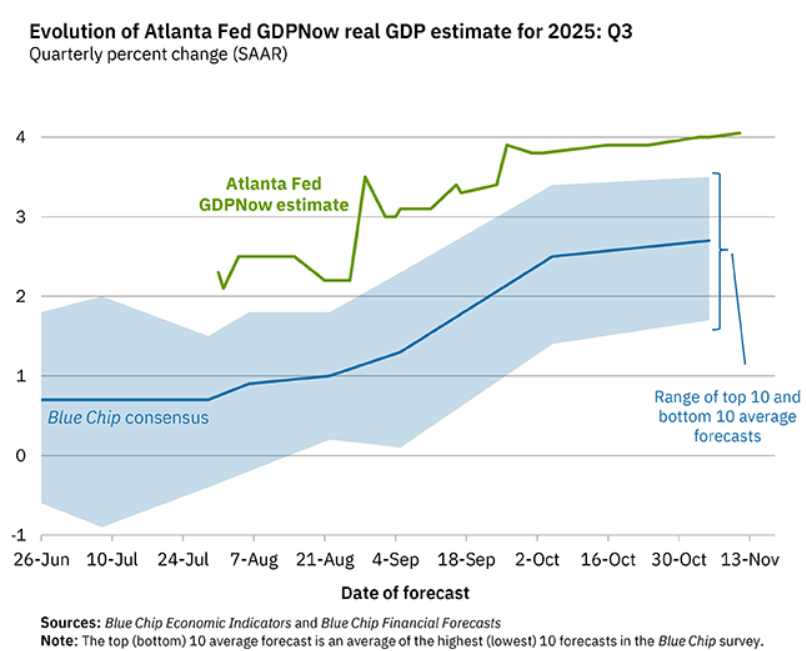

Despite plenty of pessimism, and a record-long government shutdown, the US economy continues to defy most expectations. The Atlanta Fed’s GDPNow model points to the economy having expanded by 4.1% on an annualised QoQ basis, following similarly rapid growth of 3.8% in the second quarter. Meanwhile, more timely metrics, such as the ISM PMI surveys point to the services sector continuing to expand at a solid clip, while consumer spending remains robust into the holiday period, with Mastercard data pointing to sales having risen 3.5% YoY last month.

Robust Earnings

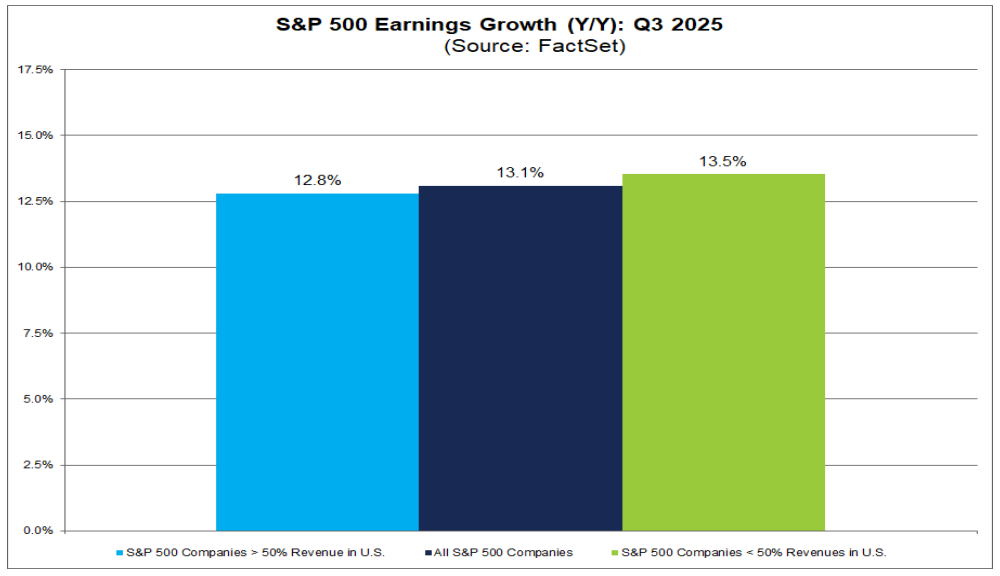

Third quarter earnings season has been a solid one, with 92% of the S&P having now reported. Not only did 8-in-10 firms report a positive EPS surprise, but the index as a whole is on track for earnings growth of around 13% YoY, a figure that would mark the fourth consecutive quarter of annual earnings growth. Corporates also appear less concerned about downside risks, with mentions of ‘tariffs’ on earnings calls having fallen by a third compared to the second quarter, while net profit margins have risen to their highest, for the index, in at least 15 years.

Looser Monetary Backdrop

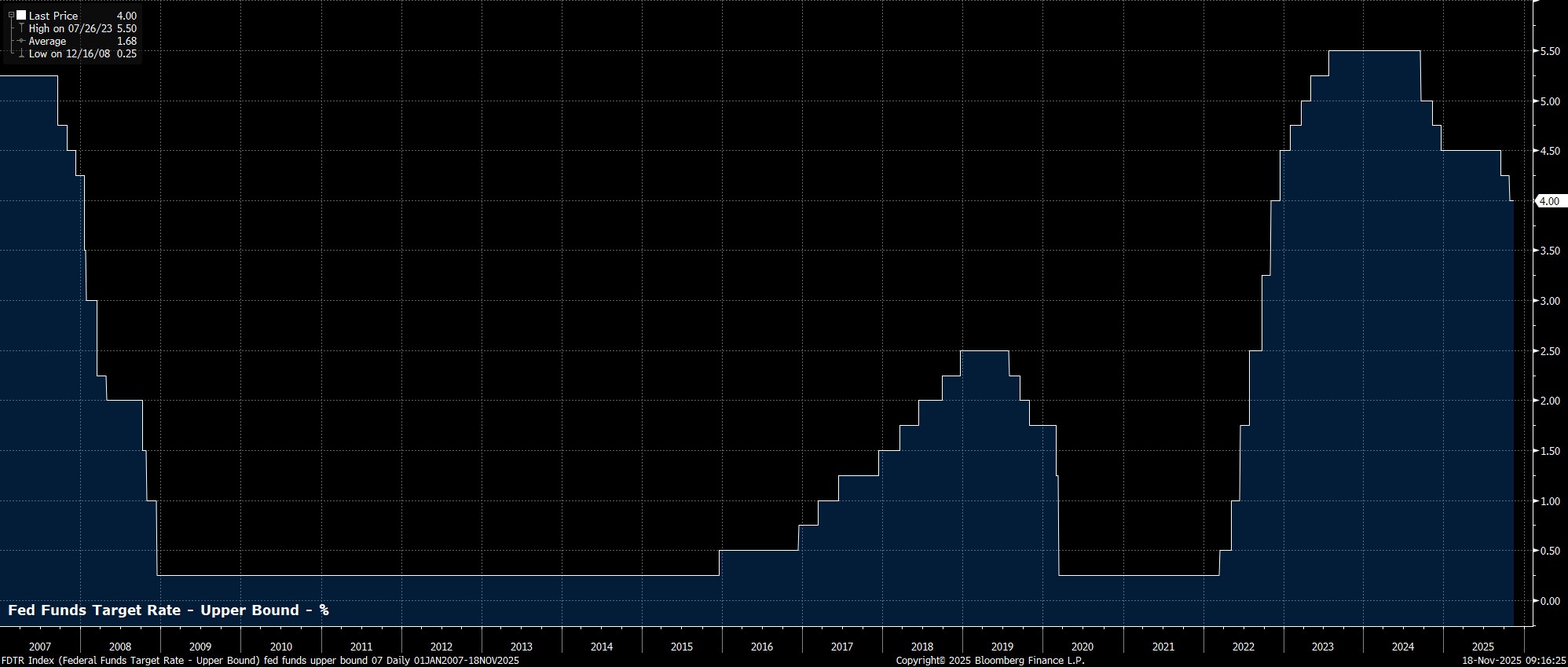

The FOMC, despite some hawkish remarks from regional presidents in recent weeks, retain a clear bias towards an easier policy stance. Having delivered 25bp cuts to the fed funds rate in both September and October, another rate cut in December remains on the cards, as the ‘core’ of the Committee continue to favour supporting a stalling labour market, and remain relatively unperturbed by potential upside inflation risks. Even without a December cut, the direction of travel over the next year is clear – the fed funds rate is on its way back to neutral (3.00% - 3.50%), and the balance sheet is bottoming out at neutral (approx. 20% of GDP).

Cooler Trade Tone

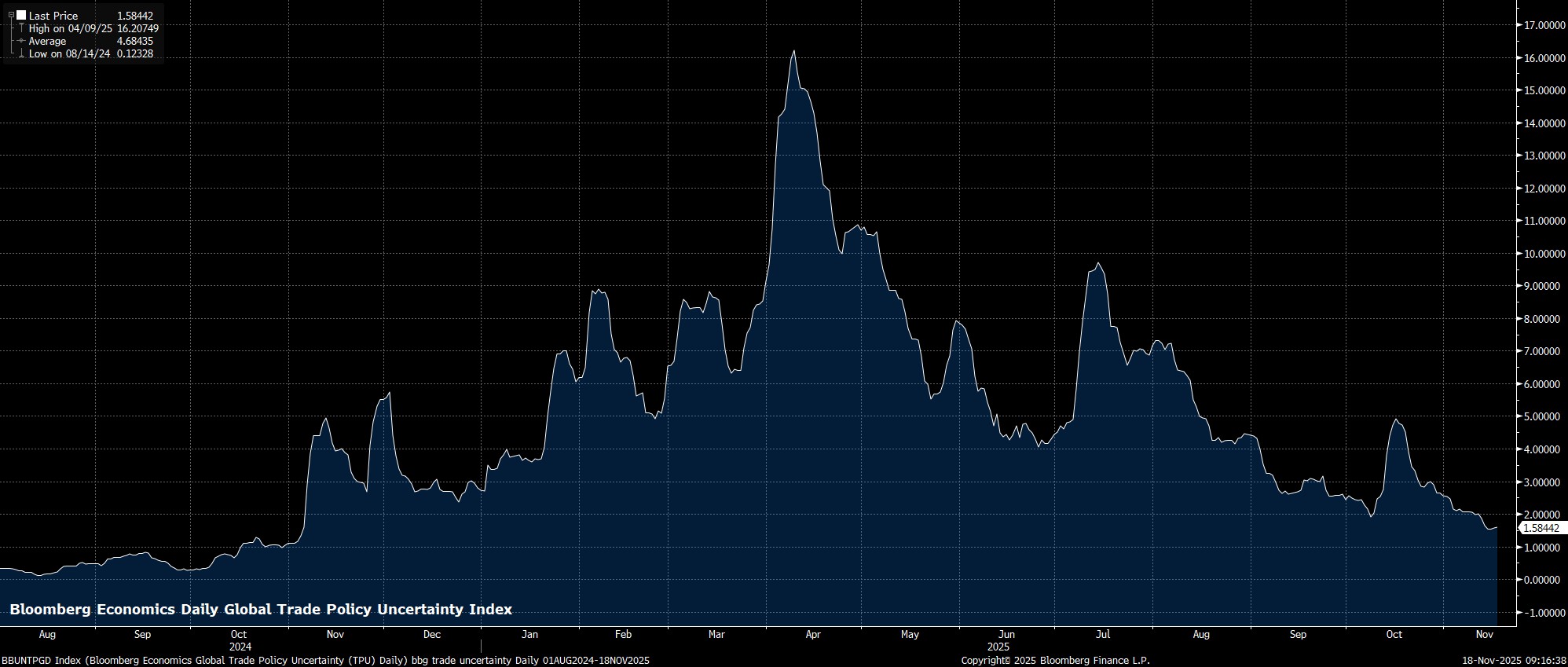

Though the trade war is far from over, an overall calmer tone continues to prevail, particularly since the US and China agreed to a one-year ‘truce’ at the tail end of October, allowing market participants to price out the risk of potential escalation. Furthermore, the Trump Admin have not only pledged not to enact further tariffs while the Supreme Court hear the IEEPA case, but also seem to be adopting a more dovish tone on the whole issue, having recently rolled back tariffs on various products such as coffee and bananas, amid an increasing focus on the cost of living into next year’s midterms.

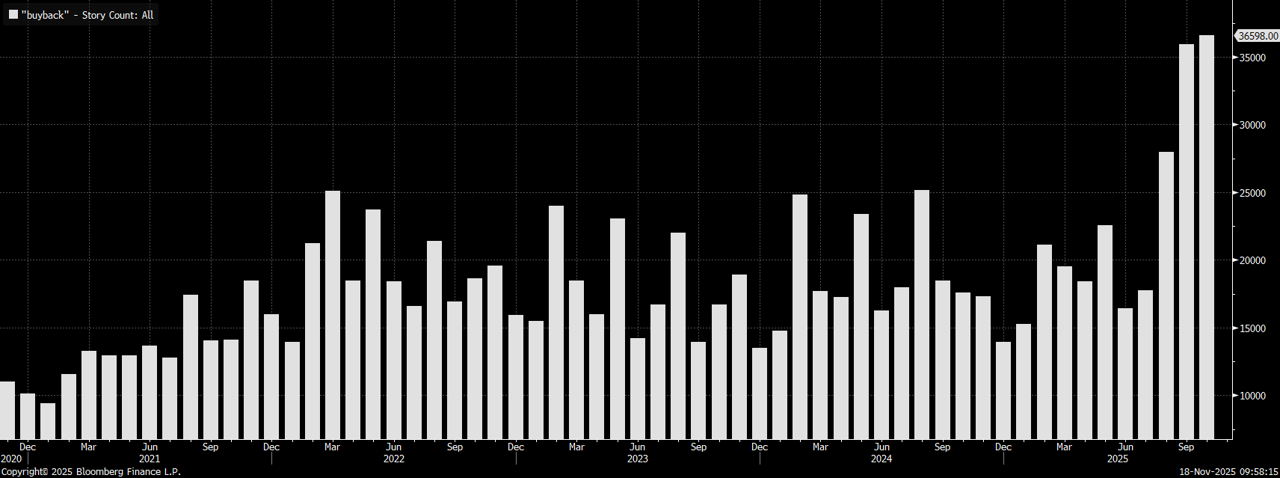

Corporate Buybacks

As earnings season has now, essentially, concluded, we are right in the heart of the corporate buyback window, with the blackout period having come to an end earlier this month. November and December, historically, prove to be the strongest months for buyback execution, with US firms having already issued buyback authorisations at the fastest pace on record this year. This price-insensitive VWAP executed demand should provide equities with a strong helping hand.

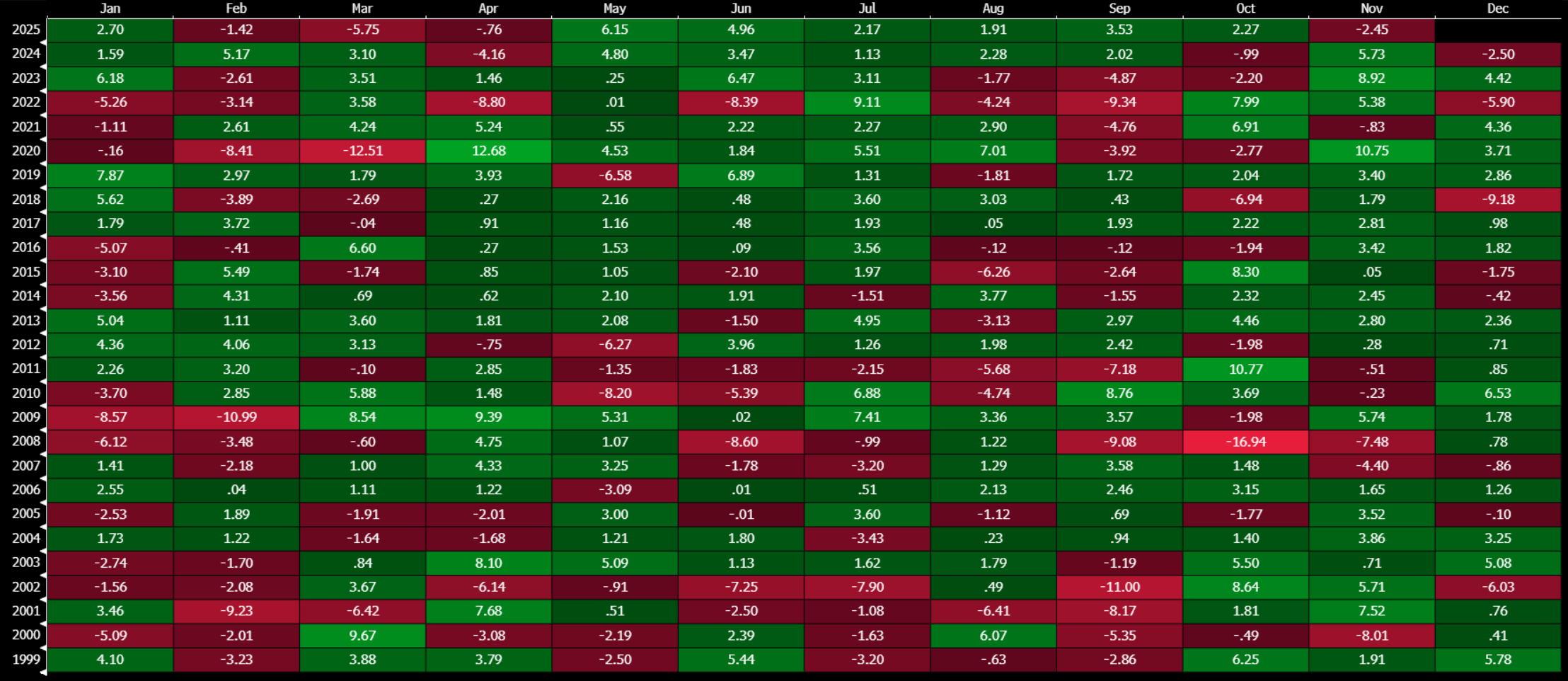

Seasonality

While November hasn’t lived up to its reputation as being the S&P’s best month of the year, with the index in fact set for its biggest November decline since back in 2008, a look forward suggests that some relief could be on the cards. Since 2000, in the six years when the S&P 500 notched a monthly decline in November, that was followed on five occasions by a monthly advance in December. The sole exception to that rule was 2007, though there were quite obviously idiosyncratic factors (the GFC!) which played a role in that.

The Bear Case

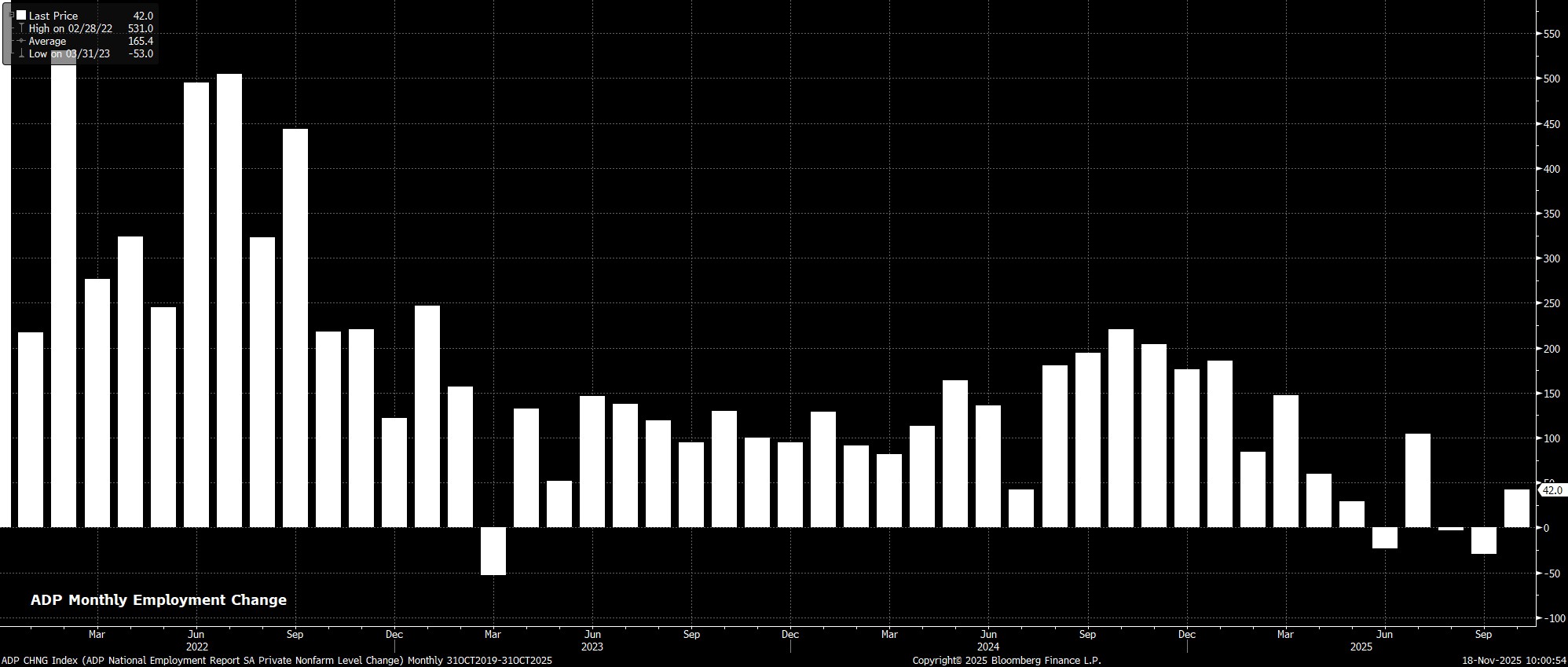

Labour Market Jitters

Though the government shutdown has put paid to the release of official employment data, private sector surveys have pointed to the US labour market continuing to stall. ADP reported an average weekly decline of around 11,000 jobs in the four weeks to the end of October, while Revelio Labs’ proprietary labour market gauge showed payrolls having fallen by 9k last month. Though the overall labour market mood remains one of ‘no hiring, no firing’, participants may be increasingly concerned that the balance tilts more notably towards layoffs in the months ahead, in turn posing a headwind to consumer spending.

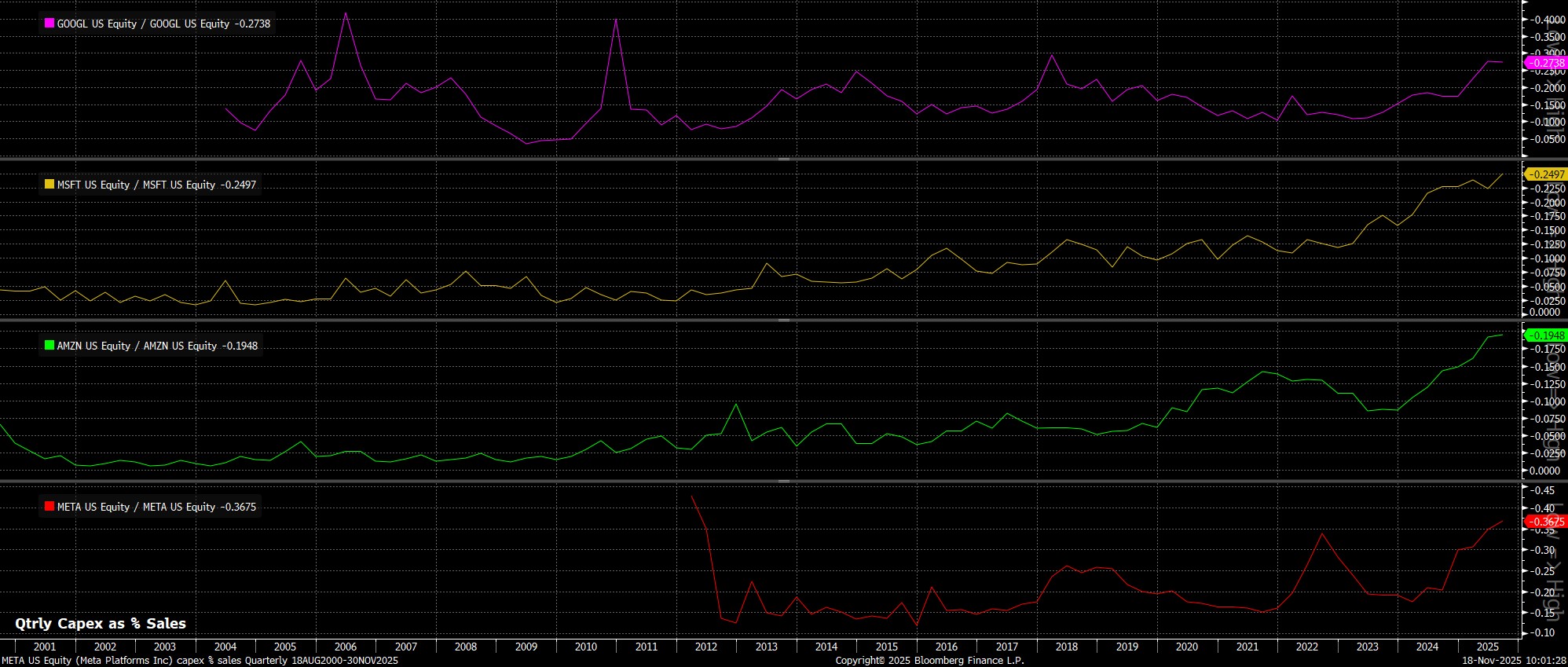

AI RoI

Enthusiasm towards the AI frenzy has cooled, with the market moving from a mindset of ‘all capex is good capex’, to one where questions are increasingly being asked about hyperscalers’ incredible pace of spending. Not only do these questions centre on RoI, both the degree to which a return will be generated, as well as the timeframe during which that return is likely to arrive, but there are also increasing concerns over the manner in which this spending is being financed, with ‘big tech’ names increasing issuing debt, as opposed to financing this capex from free cash flow, in turn fuelling concerns over the sustainability of the move.

Narrow Breadth

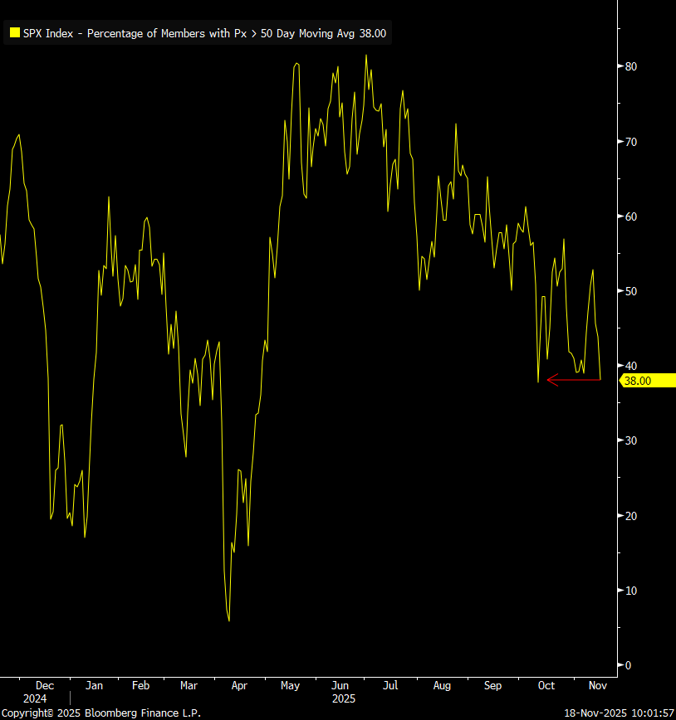

The market has been incredibly concentrated for some time, though concerns over this narrow breadth appear to have reared their head once more. Not only do the largest 5 stocks in the S&P comprise a whopping 30% index weight, but market internals are increasingly flashing amber warning signs. Just 38% of index members now trade above their 50-day moving average, the lowest level in a month, while less than half the index is trading above its 200-day moving average, the lowest such proportion since mid-summer. Furthermore, as of Monday’s close, just 4% of the index had printed new 4-week highs, compared to the 20% trading at fresh 4-week lows.

Exhaustion

Undoubtedly, stocks have come a long way this year, with the S&P still up around 15% despite the recent pullback, and having rallied a whopping 35% from the lows seen in early-April. Hence, there is not only likely to be a degree of exhaustion among market participants, given the breakneck speed of the rally seen over the last seven months, but that move will also likely leave many wondering why they should continue to chase the market higher from here, or attempt to ‘catch a falling knife’, with just four or so weeks left of 2025. Many, if not most, will view that as a very unfavourable risk-reward calculation, and potentially decide to retire to the sidelines as a result.

_Daily_2025-11-18_10-03-21.jpg)

Technicals

While market internals have started to look a little sorry for themselves, the technical backdrop is doing so as well. Monday saw the S&P 500 close beneath the 50-day moving average for the first time since late-April, snapping the 2nd longest streak above that level in the last 25 years, with dip buyers either unable, or unwilling, to defend a level which has strongly defined the uptrend for most of the year. In turn, this may give equity bears a degree of near-term control, with the week following a close under the 50-day MA having seen the S&P extend losses on around two-thirds of occasions in the last three years.

_Daily_2025-11-18_10-04-21.jpg)

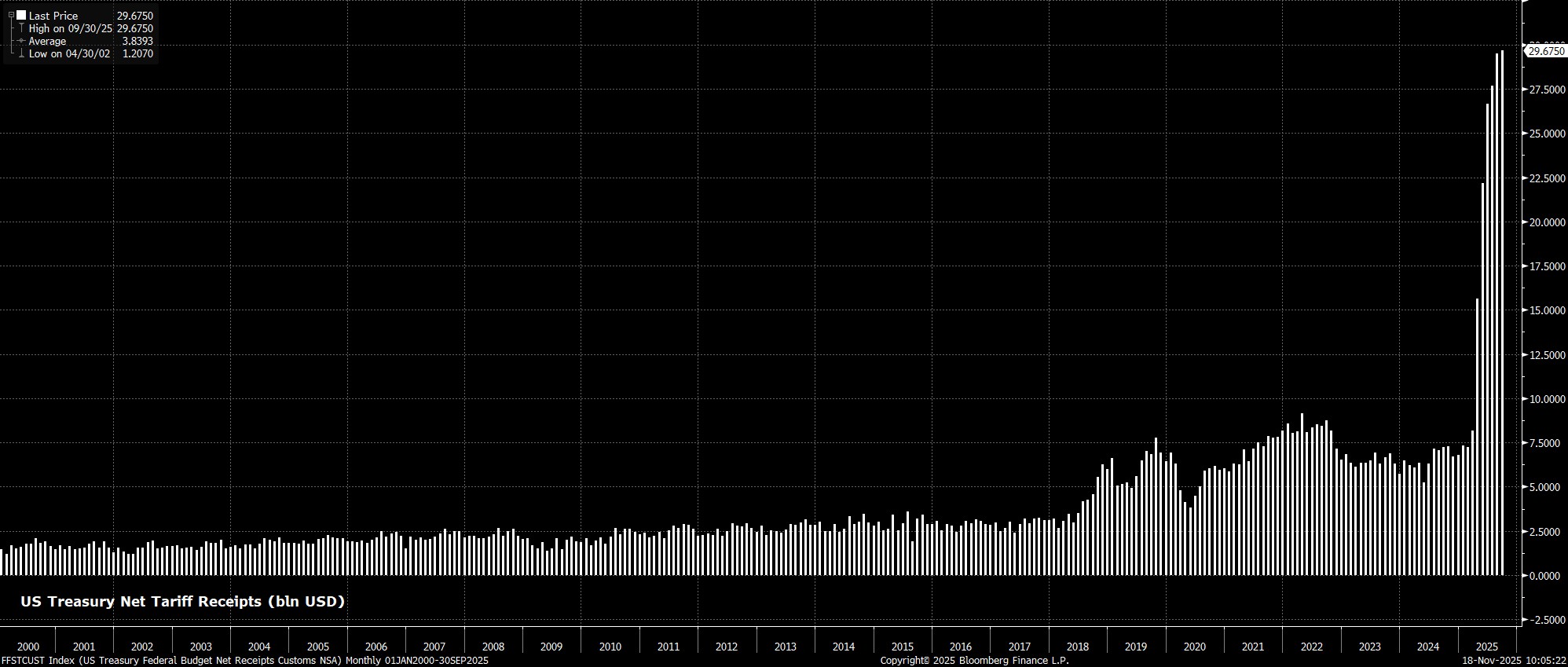

Tariffs

Though a calmer tone on trade is part of the bull case, the whole tariff issue might well have a sting in its tail, amid an ongoing Supreme Court case over the legality of the IEEPA tariffs, and President Trump’s ability to impose trade levies due to a supposed ‘economic emergency’. Initial oral arguments in the case saw justices appearing to take a sceptical view of that argument, potentially leading to the tariffs in question being ruled as illegal, which in turn may open the door to claims for refunds on tariffs that have previously been paid. Said refunds, if necessary, could run to somewhere around $200bln, inevitably causing a spike in both Treasury yields, and bond vol.

Funding Markets

Concern has also increasingly emerged in recent weeks as to tighter conditions in US money markets, with the EFFR-IORB spread at its tightest since the start of 2021 (being on the verge of flipping above zero), and with bank reserves continuing to drain from the system, sitting at pre-pandemic lows both when compared to GDP, and to commercial bank liabilities. Though the FOMC have taken the pro-active step to end balance sheet run-off at the start of December, notable concern persists as to whether this decision might’ve come too late, especially in the run-up to what are always tight funding conditions at year-end.

Conclusion

A cursory glance at the above lists quite obviously points to a greater number of bearish, than bullish factors. That is, however, almost always the case.

On net, my view remains that those bullish catalysts carry significantly more weight than their bearish counterparts, with the question then turning to what catalyst may emerge to permit the market to climb that ‘wall of worry’ once again. Perhaps, cleaner positioning after this stock swoon, coupled with the passage of both Nvidia earnings and the September jobs report might do the job, allowing participants to take a trip along the ‘path of least resistance’ once again, which continues to lead to the upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.