- English

- عربي

February 2026 ECB Preview: Standing Pat To Start The Year

Summary

- Standing Pat: The ECB will hold the deposit rate steady at 2.00% at the conclusion of the January confab, with the easing cycle over

- Largely Unchanged Outlook: Inflation remains on track to marginally undershoot target this year, while upside growth risks stem primarily from German fiscal stimulus

- Emerging Risks: Simmering trade tensions, and further gains in the EUR, pose risks that the Governing Council will keep on the radar moving forwards

Rates On Hold

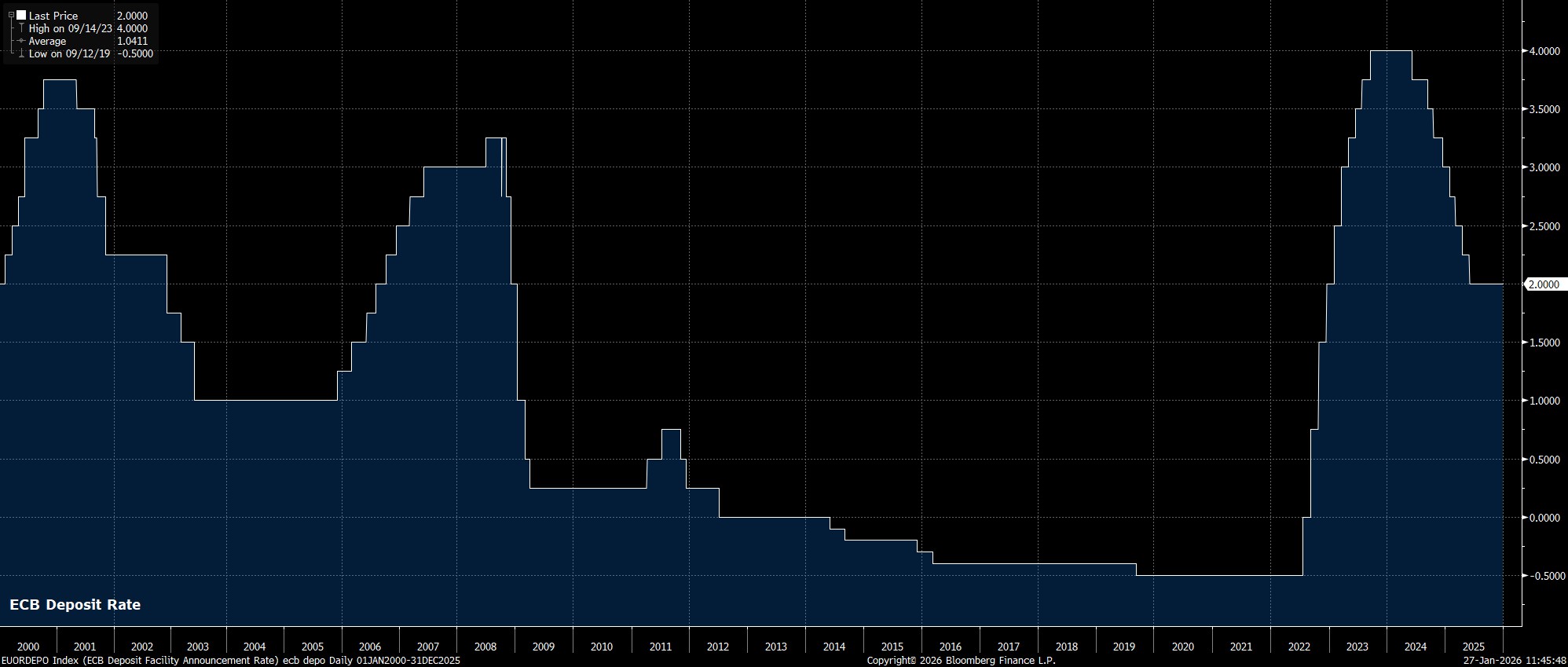

As noted, the GC are set to hold all policy settings unchanged at the conclusion of the February policy meeting, maintaining the deposit rate at 2.00%, a level where it has stood since early last summer.

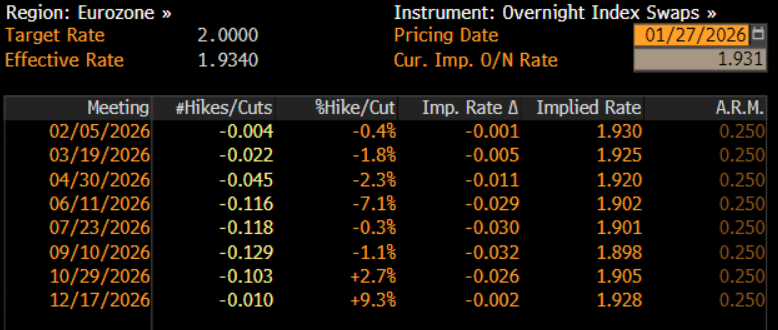

Such a decision is almost certain to be a unanimous one among Governing Council members, with no recent public remarks suggesting that any ratesetter sees an imminent need to adopt a more accommodative policy stance. Money markets, meanwhile, are also certain of a decision not to make any shifts this time out, with the EUR OIS curve pricing a very modest 4bp of easing by year-end, largely reflective of participants hedging a degree of macro tail risk.

Familiar Guidance To Remain

Accompanying the decision to stand pat will be policy guidance with which participants have now become very familiar indeed.

As such, the updated policy statement will, largely, be a ‘carbon copy’ of that issued after the December decision. Namely, the GC will reiterate that policy decisions will continue to be taken on a ‘data-dependent’ and ‘meeting-by-meeting’ basis, with policymakers also making no ‘precommitment’ to a particular policy path going forwards. None of this should come as any surprise at all to market participants, and very much represents a continuation of the ‘status quo’.

Fresh Risks Have Emerged Since Christmas

While the ECB are highly unlikely to make any shifts to their policy stance, or accompanying policy guidance, a couple of fresh developments since the prior confab do make for a somewhat murkier economic outlook than had been foreseen at the tail end of last year.

Resurgent tariff risks are perhaps an obvious one on this front, especially considering the recent threats made by the Trump Administration to impose a 10% tariff on various European nations, rising to 25%, over the issue of Greenland. While these tariff threats were later walked back, in what can be described as another ‘TACO moment’, the threats themselves speak to the degree of policy volatility, and broader economic uncertainty, having increased once more.

In a similar vein, these, plus numerous other, tariff threats made by President Trump in recent weeks have sparked a broader ‘sell America’ trade, with market participants re-considering their US exposures amid the constant tariff flip-flopping. This, in turn, has driven a significant strengthening in the EUR, with spot EUR/USD pushing towards the $1.19 mark, and the ECB’s EUR NEER index moving back towards the record highs seen at the back end of last year, a move helped by significant JPY weakness as well.

While the ECB do not explicitly target FX rates, and President Lagarde is likely to reiterate that fact at the post-meeting press conference, policymakers must nonetheless take account of market developments, particularly considering the disinflationary risks posed by a significant bout of EUR strength. Outgoing Vice President de Guindos has previously suggested $1.20 as a level that, above which, things get “complicated”, so that naturally stands as a ‘line in the sand’ that bears close watching.

Macro Backdrop Little Changed

Despite these fresh risks, the overall macro backdrop has not shifted significantly since the prior meeting, and forecast round, at the end of 2025.

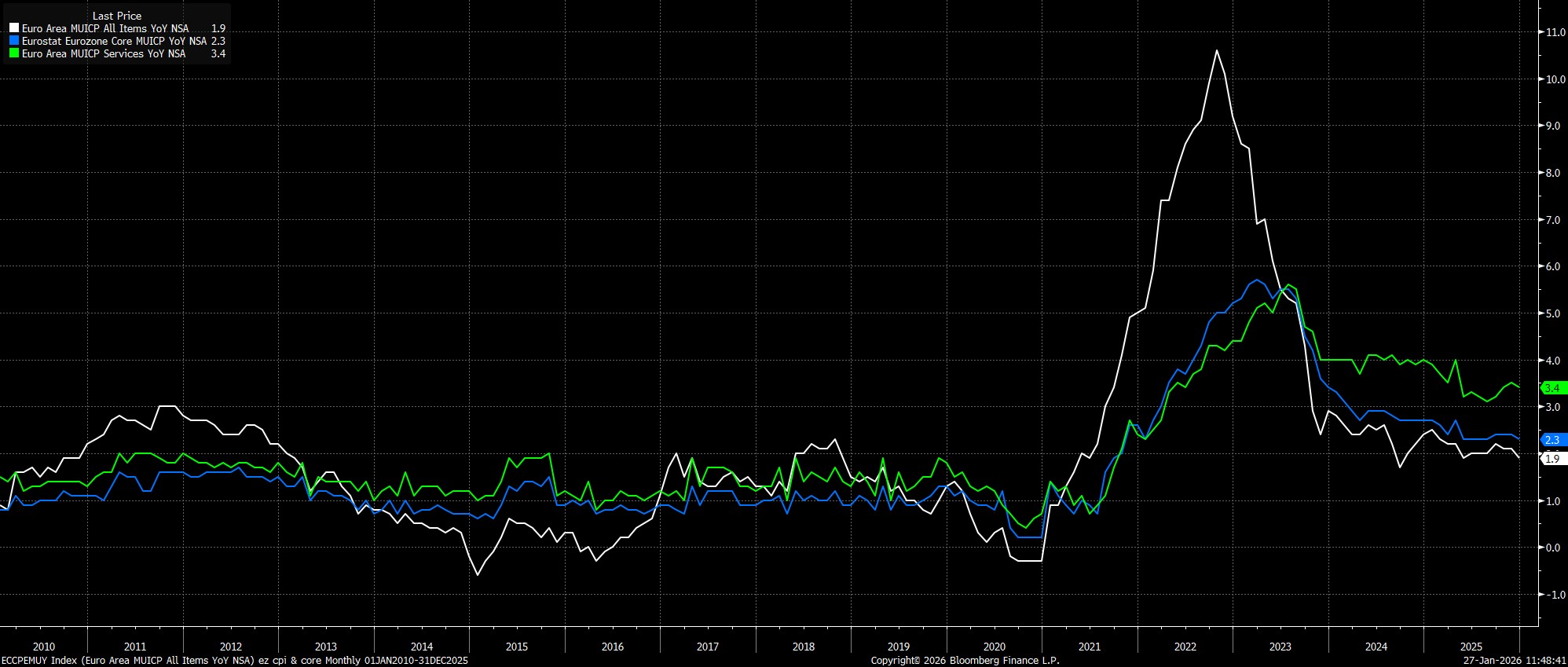

As a result, headline inflation remains on track to modestly undershoot the 2% aim this year, and next, with a notable base effect from energy prices still on track to push headline CPI substantially lower in the first quarter of this year. Policymakers are, by and large, likely to look through this as a one-off temporary factor that does not significantly influence the overall policy trajectory, though some of the GC’s more dovish members may use this, especially if combined with a further downgrade to the inflation profile at the March meeting, to push for a more accommodative stance. That, however, is a matter for another time.

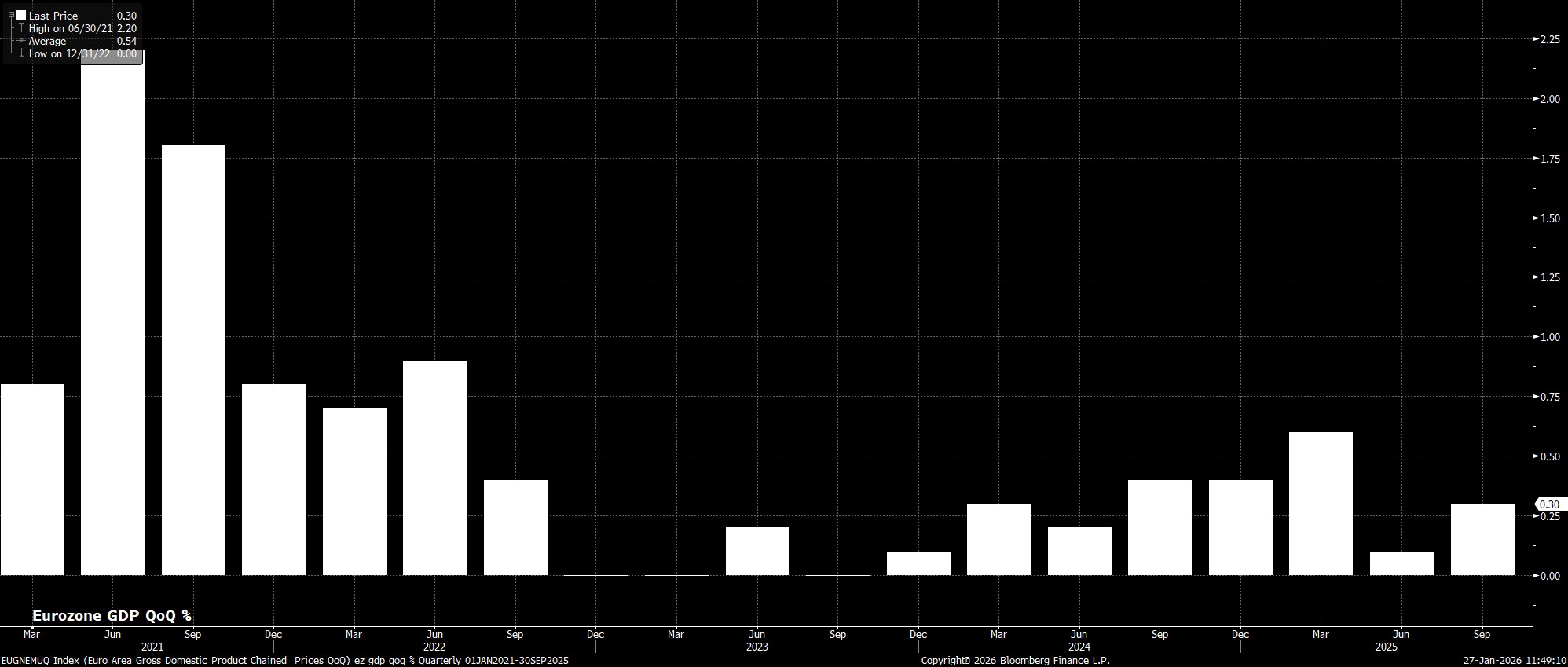

On the growth side of things, Q4 GDP is yet to be released at the time of writing, though should point to the economy having expanded by around 0.2% QoQ in the final three months of the year.

Looking forwards, little data has yet to be released referencing 2026, though the latest round of PMI surveys pointed to a relatively robust underlying economy, with both the services and composite output metrics remaining north of the 50 mark. Key for the year ahead, however, will be the evolution of the German economy, chiefly the impact that much-anticipated fiscal stimulus may have in boosting the fortunes of the eurozone’s economic engine room.

Lagarde Will Stick To The Script

Reflecting on this, at the first press conference of the year, President Lagarde is likely stick resolutely to a very familiar script.

With this in mind, Lagarde is likely to reiterate that policy remains in a ‘good place’, while mirroring language used in December that such a place is ‘not static’, at the margin building a degree more optionality into the policy outlook. Besides this, Lagarde will likely repeat that policymakers are not yet discussing anything regarding either rate hikes, or rate cuts, while also repeating that no ‘pre-commitment’ is being made on the future policy path.

Looking Forward

Frankly, the January ECB confab could well prove to be something of a dull affair, with no policy changes, or guidance shifts, on the cards. This, though, will serve to reinforce my base case that the easing cycle is at an end, and that the ECB will maintain the deposit rate at its 2.00% terminal level for the foreseeable future. While the next move is likely to be a rate hike, that is a discussion for next year, and likely late 2027 at that.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.