- English

- عربي

Cutting through some of the noise, in such a situation, can help to identify what’s actually driving the market under the surface.

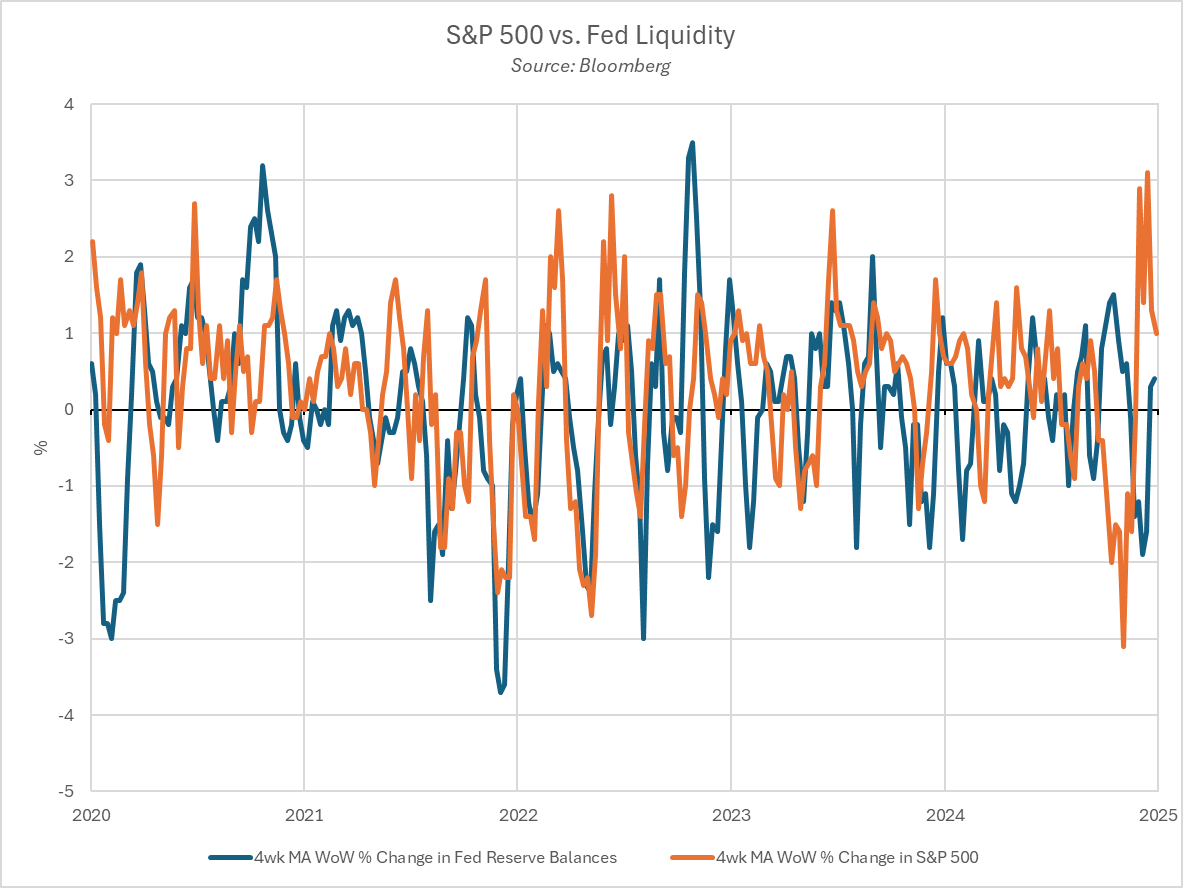

In contrast to recent years, and in fact the entire post-GFC period, where changes in liquidity provision from central banks have been the main factor driving shifts in sentiment, that relationship has fallen apart since ‘Liberation Day’ at the start of April. While the Fed having trimmed the pace of QT will have helped to provide something of a backstop to risk assets, its effect has not been as pronounced as in years gone by.

If not liquidity as a driver, then what?

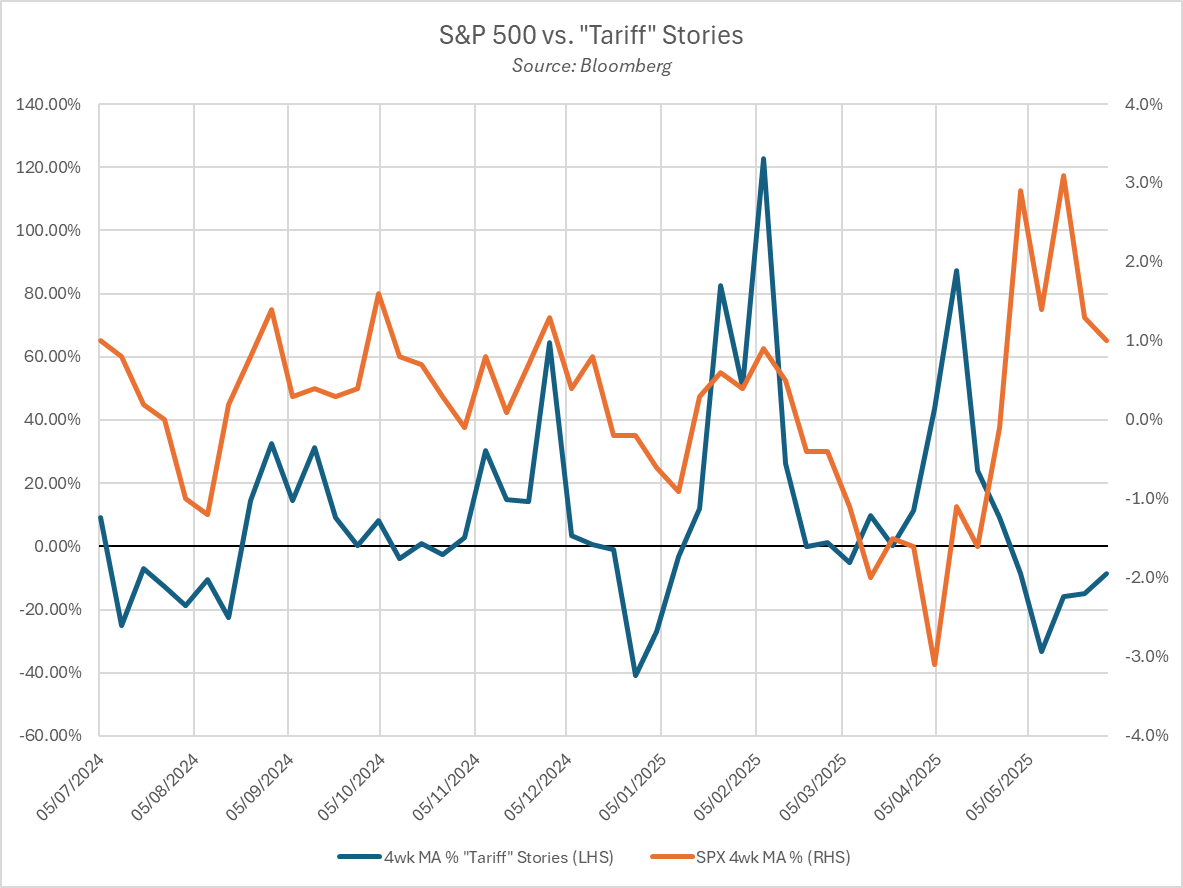

Tariff news is an obvious catalyst, but there is a distinction that must be drawn here. A simple comparison of the volume of headlines to S&P 500 PnL glosses over the nuance that may be contained within this news flow – i.e., a tariff headline could be an escalation, a rollback, or news of a deal being done. Perhaps unsurprisingly there is little by way of correlation here.

The same logic applies if we compare market moves, to the volume of ‘Truth Social’ posts from President Trump. While Trump loves to post incessantly on social media, once again it is difficult to distinguish within the data between those posts of a positive, and of a negative nature, before even considering the messages which fall half into each camp.

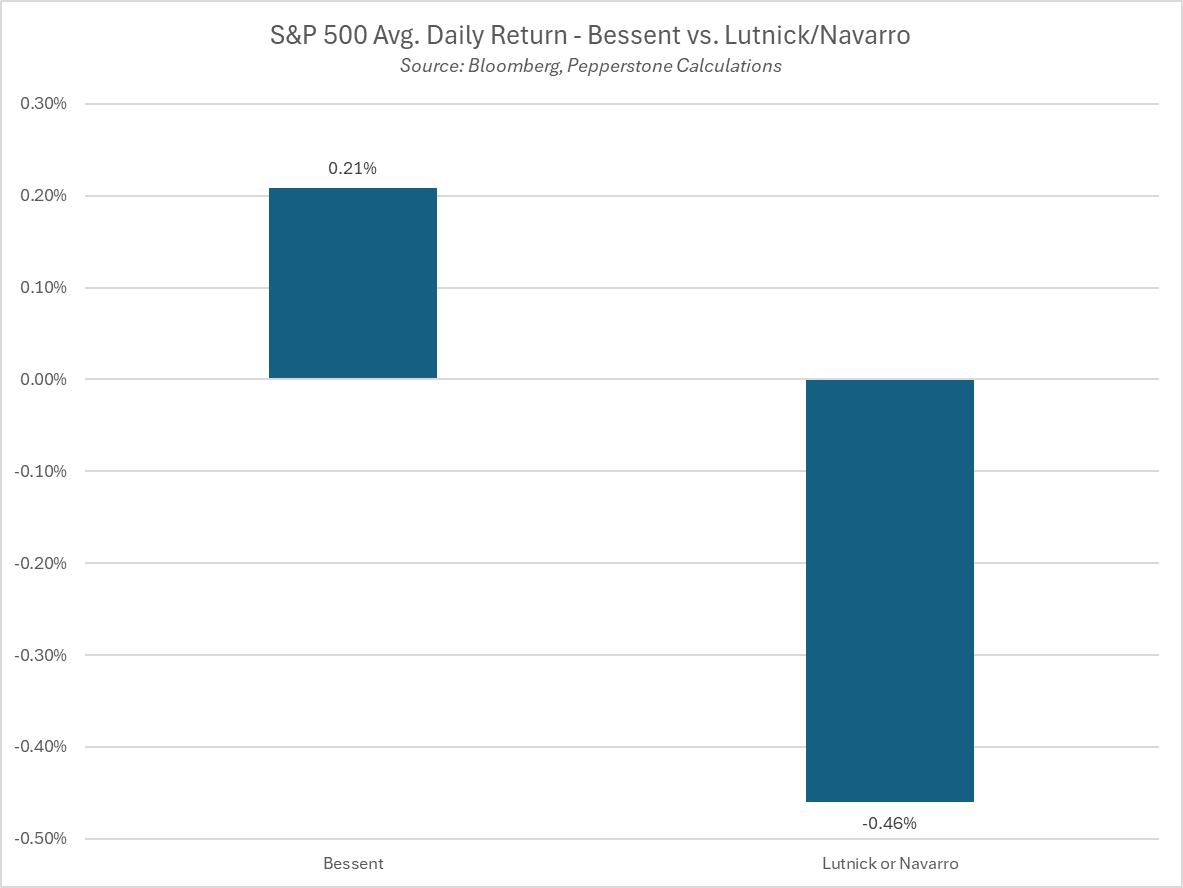

Maybe the easiest, if a little crude, method of introducing some nuance into the analysis here is to consider who is speaking at a given time. Typically, Treasury Secretary Scott Bessent is viewed as a more moderate voice on the issue of trade, the ‘adult in the room’ if you will. On the contrary, Commerce Secretary Lutnick is seen as a more hawkish voice, as is WH Adviser Peter Navarro, who has been a longstanding critic of trade deficits, and fan of sizeable tariffs.

This analysis produces a clearer conclusion. Since the start of the year, on the 75 days when Bessent has dominated the airwaves, the S&P has closed in the green on 45 occasions, with an average gain of 0.2%. In contrast, on the balance of days when Lutnick or Navarro has owned the agenda, the S&P has averaged a decline of around 0.4%, including the biggest single-day drop of the year.

It should go without saying, but this shouldn’t be used as a trading signal or indicator on its own. Still, the general theme is one where the more Bessent speaks, the more conciliatory the tone is likely to be, hence the more market-friendly those comments should prove.

This could be me stating the obvious a bit, however the above is an important point. For the time being, at least, market participants are satisfied to simply hear positive rhetoric that deals are close to unlock equity gains, as opposed to having a need to see actual, concrete progress towards those exact deals. This is particularly important in the context of the ‘TACO trade’ (Trump Always Chickens Out), as those U-turns continue to be cheered, but also happen in increasingly rapid fashion.

Another interesting takeaway from all of this data is that Bessent’s domination of the airwaves has picked up significantly over the last couple of weeks. It is unlikely to be a coincidence that this has occurred at the same time that we’ve moved a long way past the peak in terms of trade uncertainty, and as the direction of travel has increasingly turned towards the direction of deals being done.

So long as this remains the case, and so long as incoming earnings and economic data remain as solid as they have thus far, market participants are likely to remain in ‘dip buying’ mode, with any weakness retracing in relatively rapid fashion. Clearly, it’s too early to say that the economy is ‘out of the woods’ on the trade front, but for market participants at least the worst is now behind us, and the bulls are in the driving seat.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.