- English

- عربي

Digging Into Derivatives Ahead Of The 2024 Presidential Election

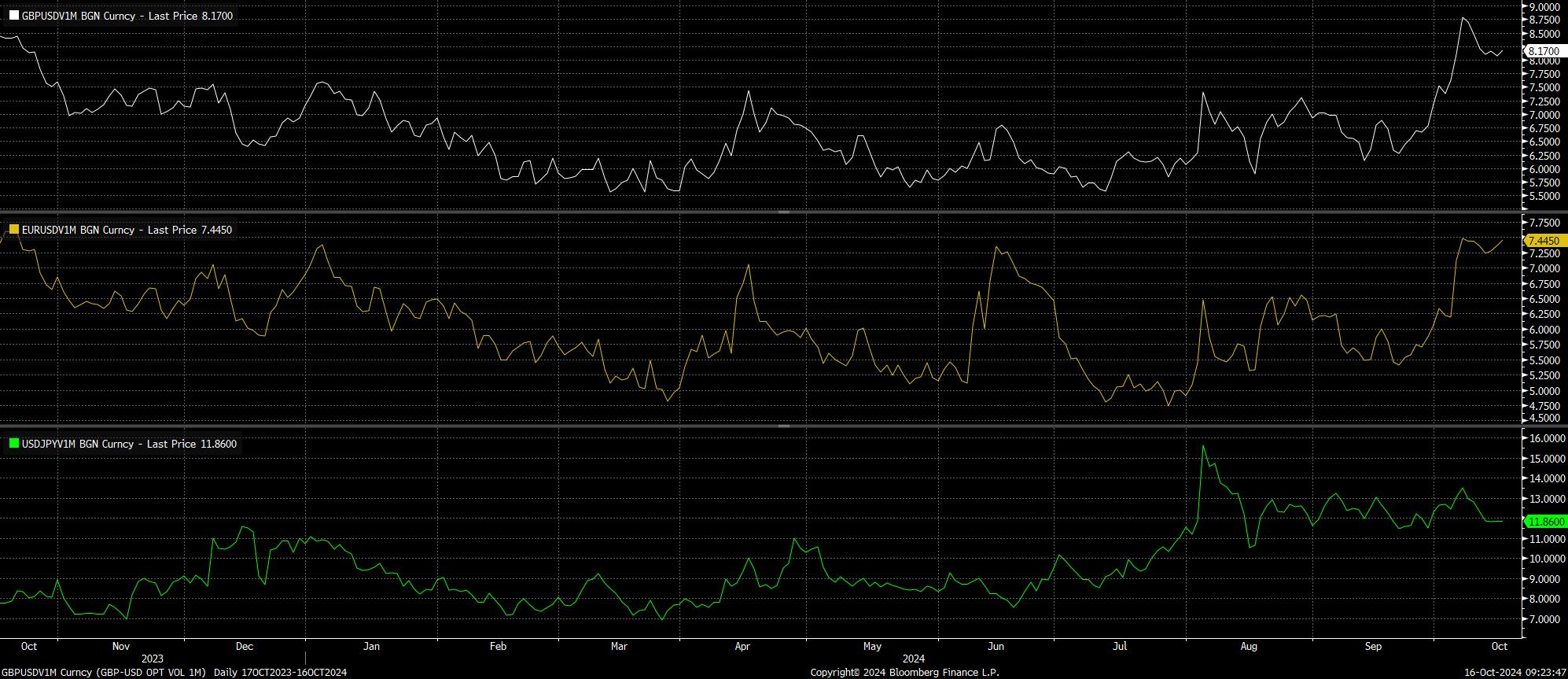

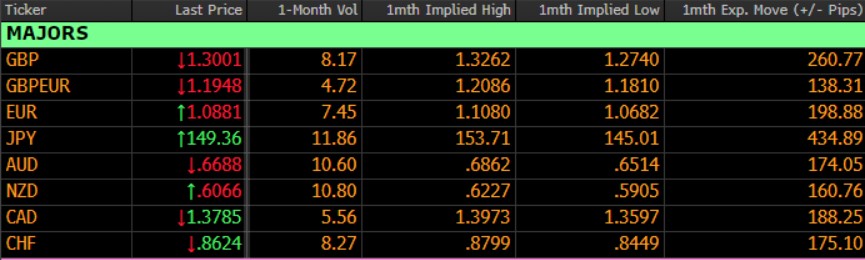

In the FX space, one-month implieds now cover the period over, and beyond, election day. Unsurprisingly, we’ve seen a tick higher in vol across G10 – EUR implieds trade close to one-year highs, while cable implieds have recently pulled back from their own 12-month peak.

Extrapolating the above to an implied trading range, we see markets pricing a move of +/- 2 big figures over the aforementioned tenor, across most G10 pairs. Of course, such a move is foreseen to within one standard deviation of confidence, and is by no means a barrier or upper limit as to the scale of market movement.

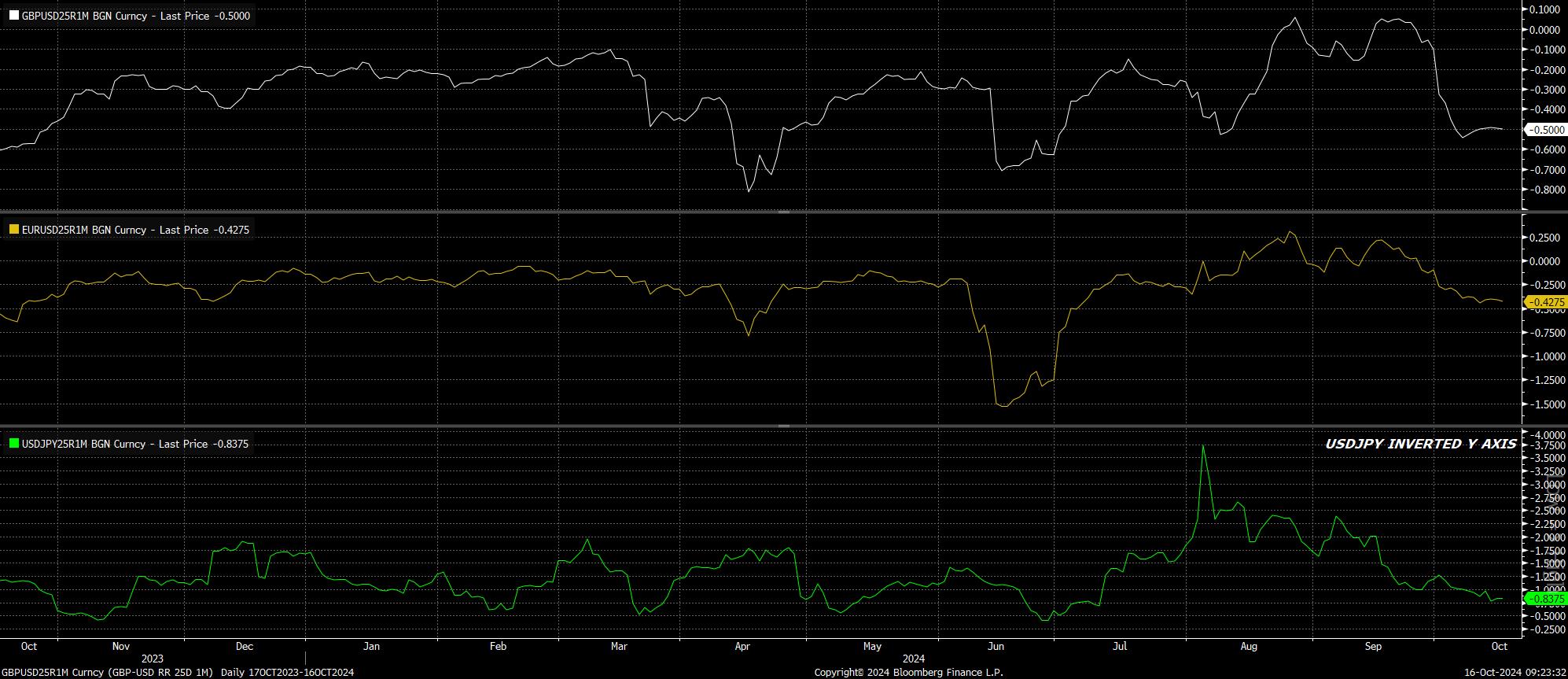

While implieds tell us nothing about a directional bias, risk reversals do. Riskies compare, for identical options (strike & tenor) the implied vol between puts and calls and hence, by extension, can be used as a gauge of demand for each type of option, and interpreted as the market’s view of the most likely direction of movement in spot by the time of maturity.

Here, we see an increasing demand for puts over calls in most G10 pairs, implying an increasing bias towards USD upside bets, over the next month. One-month EUR riskies trade at close to their most negative since the middle of summer, with cable riskies at their most negative in a couple of months. This, perhaps, is a representation of the so-called ‘Trump trade’, where bullish USD bets are ramping up in anticipation of former President Trump returning to the White House.

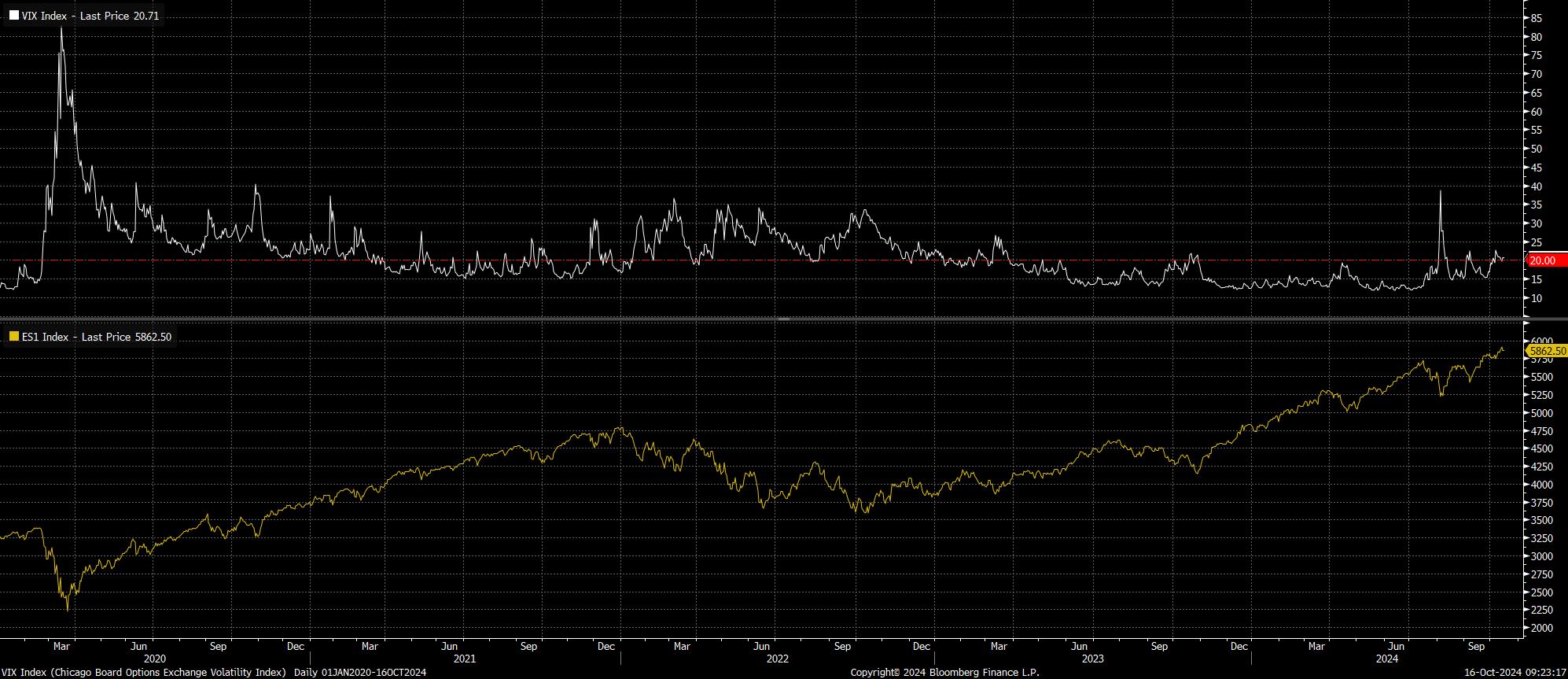

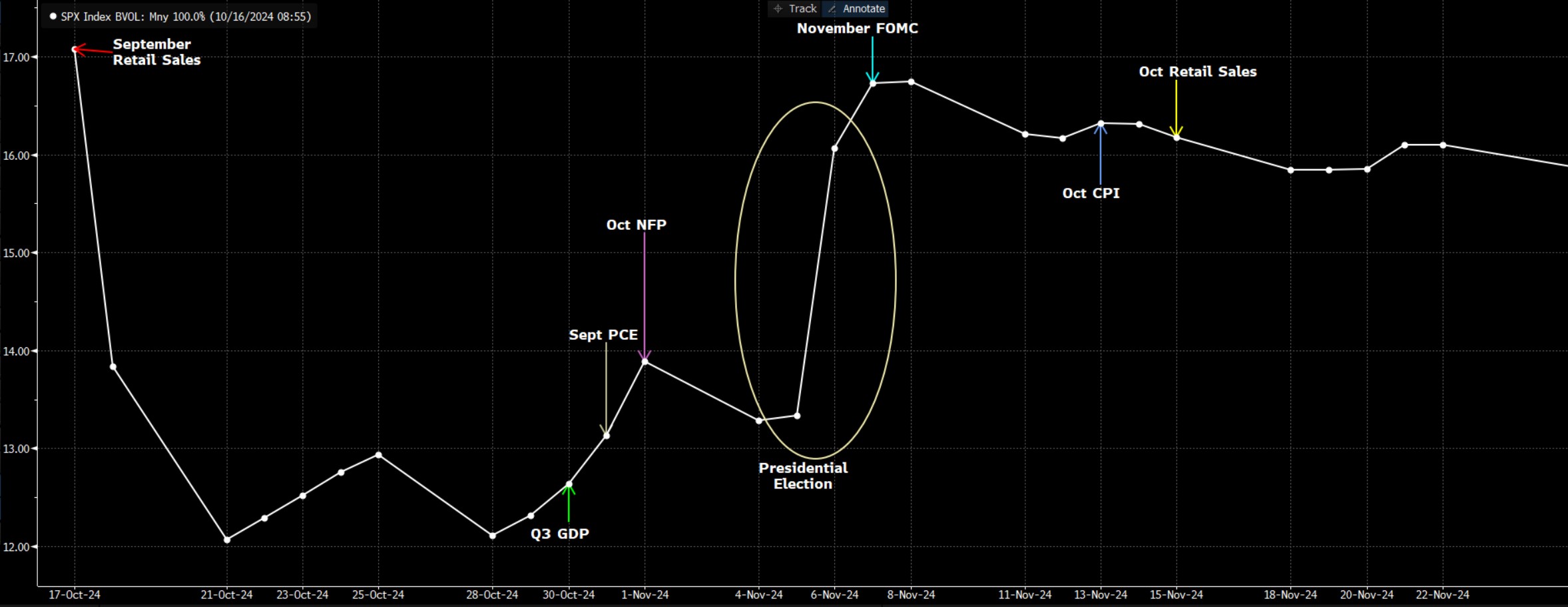

Turning to the equity space, we find the VIX residing happily north of the 20 mark. While such a level might typically be described as evidence of a fearful market, the recent rise is more structural in natura, owing to the index being a representation of 30-day implied vol, and that period now covering election day.

That said, it is a somewhat unusual scenario to see both the VIX and the S&P 500 moving higher in tandem, though said scenario does not stand as any kind of ‘sell signal’.

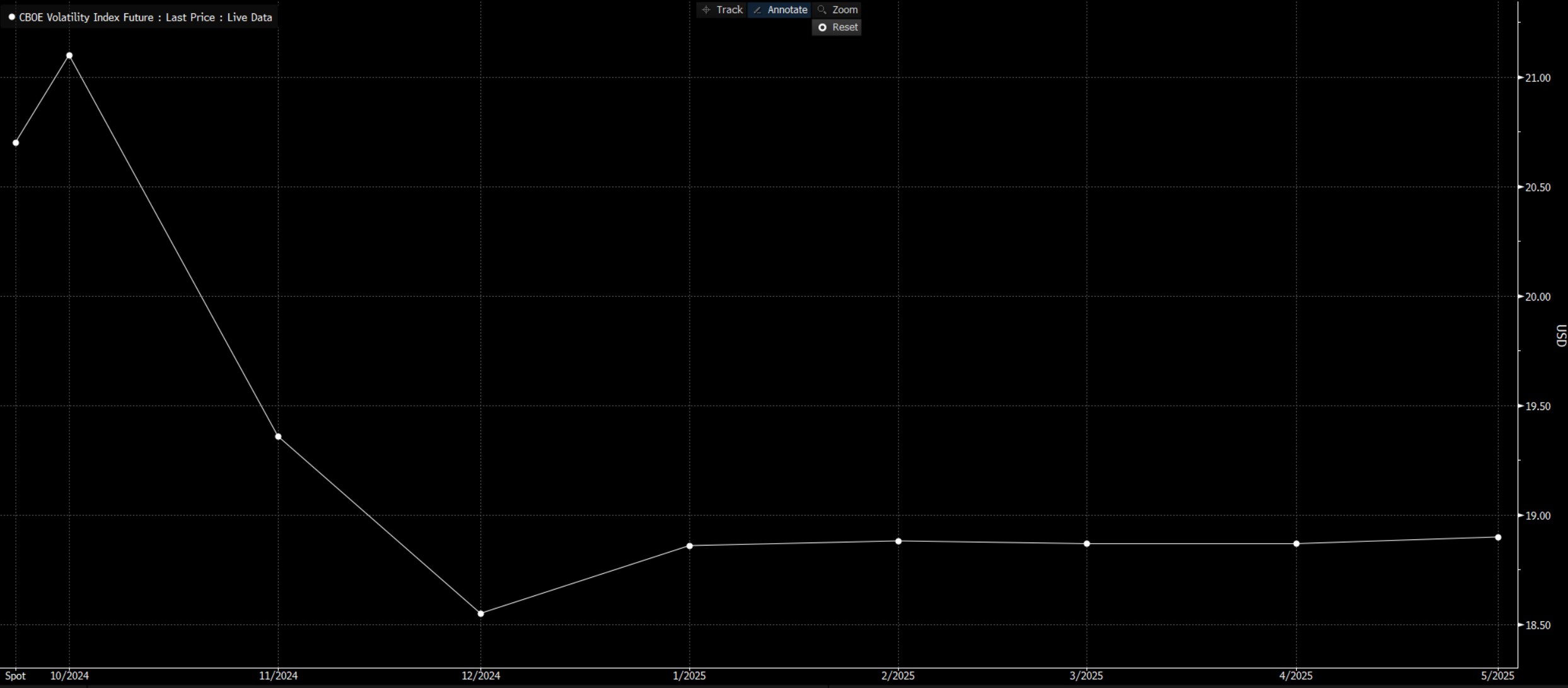

Sticking with the VIX, it’s notable how the futures curve still possesses a ‘kink’, whereby implied vol markedly falls off after the election-linked expiry. Bearing in mind that the US election result was, in 2020, not called by the Associated Press until the Saturday, participants could well be a little too complacent here.

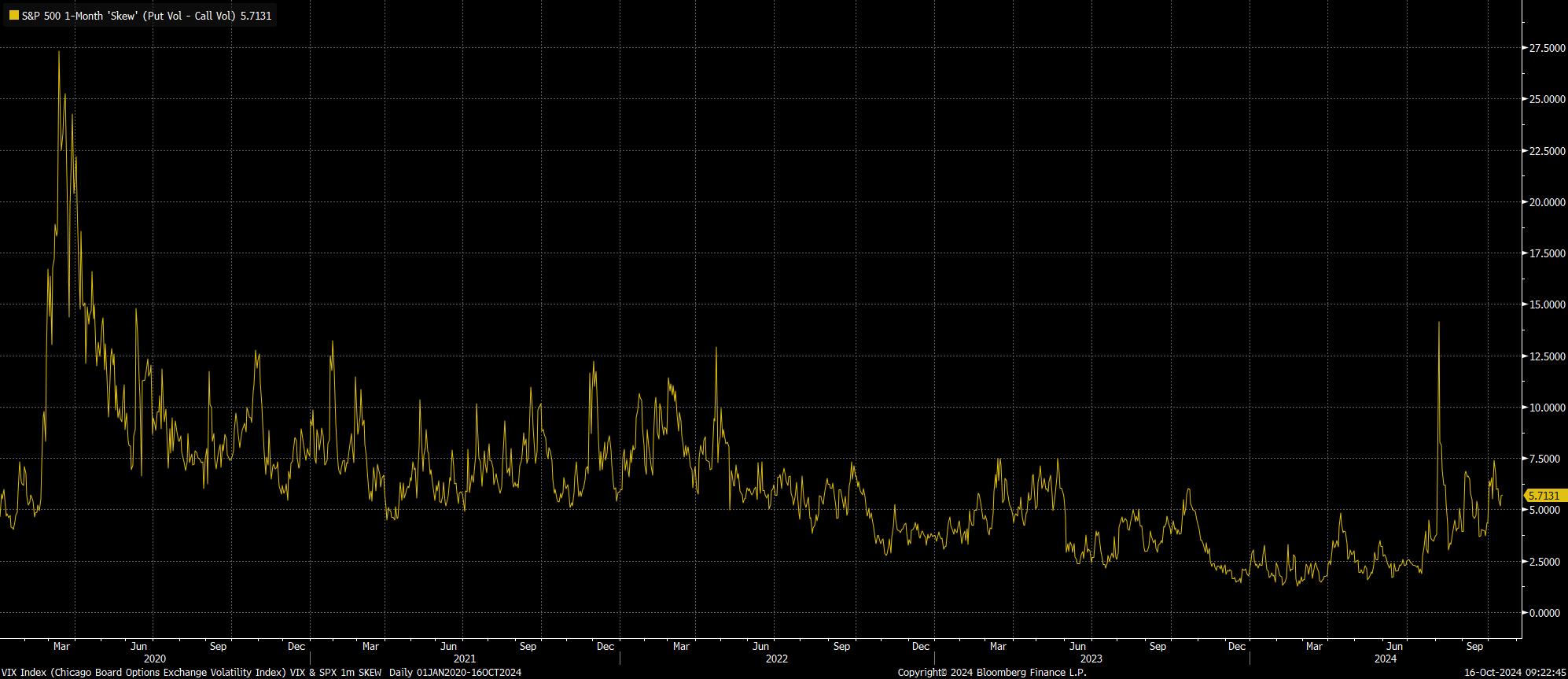

Again, the VIX provides little by way of directional bias, though a look at 1-month S&P 500 skew (put vol – call vol) shows demand for downside protection remains elevated, particularly in comparison to the sanguine mindset that participants adopted though the first half of the year.

Naturally, one would expect some of this increased activity in the derivatives arena to filter through into the underlying asset in the relatively near future. While, for instance, the path of least resistance continues to lead higher on Wall Street, it would not be particularly surprising to see participants take some profit off the table in advance of election day, seeking to minimise risk over the event itself. The same could be said of the FX space, where positioning, which currently leans significantly long USD, could lighten up a touch as well.

Of course, the election is not the only upcoming event risk for participants to contend with – earnings season rumbles on, while the October US jobs report on 1st November, and next FOMC meeting on 7th November, also loom large on the horizon.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.