- English

- عربي

Crypto Selloff: Bitcoin Breaks $112K as Liquidations and Liquidity Bite

Ethereum and Bitcoin have been at the heart of our crypto client flows, although there has also been good interest in several larger alts, with client orders now heavily skewed to the long side.

Bitcoin’s technical set-up getting airtime

The reasons behind the move have been questioned, but while many search for an exact explanation for the selling in crypto and the ease of the technical break in BTCUSD, to me this move is flow 101. In this case, price itself is the only fundamental a trader needs.

Here, crypto is no different from TradFi markets, where sentiment, flow, and liquidity drive short-term and intraday price moves.

A lack of raw demand: A buyer’s strike

On the demand side, buyers have simply gone missing and failed to make any real impact to stem the wave of selling pressure. Perhaps they were put off by the lack of follow-through buying in risk assets after Fed Chair Jay Powell’s perceived dovish remarks at Jackson Hole on Friday. There could also be concern around re-entering long positions ahead of Nvidia’s Q2 2026 earnings (tomorrow) and US core PCE (Friday).

We also know that, as month-end approaches, September is seasonally the worst month for Bitcoin returns—just as it is for US equities and US Treasuries.

While complicated and requiring knowledge of the plumbing of the US financial system, the US Treasury Department is in the process of rebuilding its Treasury General Account (TGA). This will ultimately lead to a fall in bank (system) reserves held at the Fed. In a nutshell, falling system reserves reduce liquidity in markets and is likely to put stress on funding markets.

Falling reserves could prove a non-event, but liquidity is like oxygen for markets. Reducing it, even when well telegraphed, could be a headwind for risky assets such as crypto.

Supply: A liquidation of extended long positions

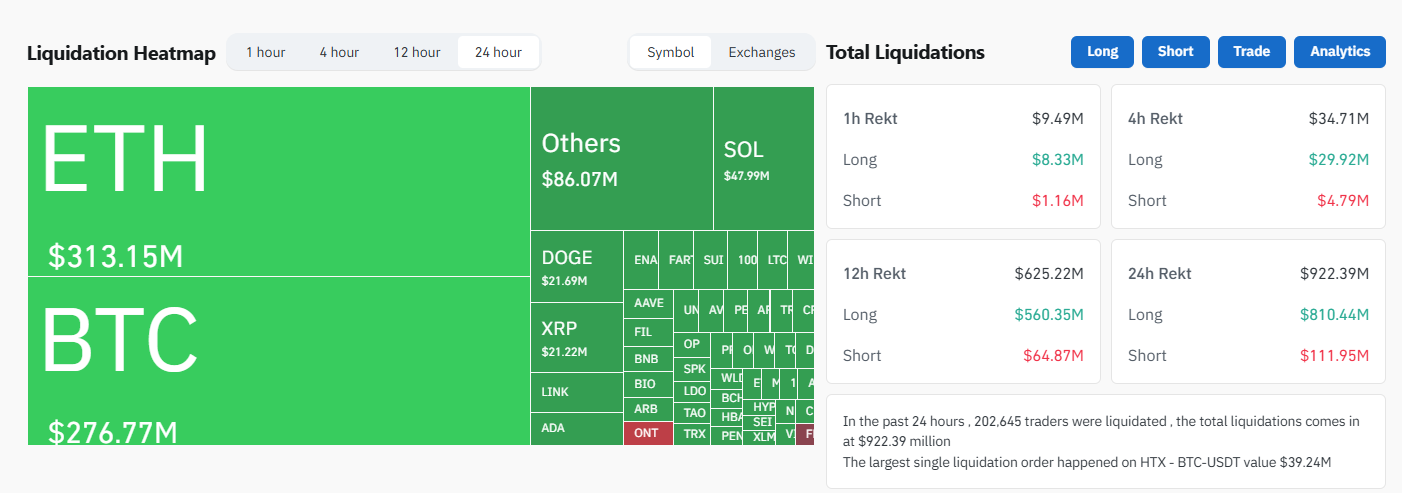

On the supply side, reports of whales cutting back their net exposure and putting through large sell orders at $111k and $110k added to a market already seeing momentum build to the downside. With prices falling, liquidations of leveraged positions took hold. Around a third of the near $1b in liquidations across exchanges came through ByBit – a predominantly derivatives exchange – justifying this narrative.

Liquidation Heatmap (source: Coinglass)

The key question now is how BTCUSD trades in the sessions ahead, and whether we see a firm daily close below the $112k former support level. Or, will we see consolidation and the selling pressure abate, offering bulls a cleaner position to reclaim the tape and push price higher?

A flush out of longs, but the long-term bull case remains in tact

The bulls will argue that a decent flush-out of overly extended long and leveraged positions is healthy, as no market rises in perpetuity. Many of the factors underpinning the recent bull trend remain intact, and one could argue that the big-ticket drivers have only grown stronger, further supporting the upside potential.

Ethereum treasury entities continue to hoover up circulating supply, with Bitmine and Sharplink aggressively accumulating. Bitmine, for example, now holds close to $9b of ETH and cash on its balance sheet. ETF inflows have also been consistently strong, and while that may not be the case today, the combination of treasury-company buying and ETF demand should remain a positive catalyst once this flush-out of extended longs and leverage has run its course. This leaves an important period ahead: longs want to see momentum shift so the collective can resume pushing BTCUSD and ETHUSD back to new highs. Shorts, naturally, are hoping for more liquidation and downside to come.

For me, until BTCUSD closes back above $112k and the 5-day EMA, it seems prudent to wait for the rip after the dip. Long positions, when trading short-term, hold a higher probability when momentum is building to the upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.