- English

- عربي

August 2025 US Employment Report: Locking In A September Cut

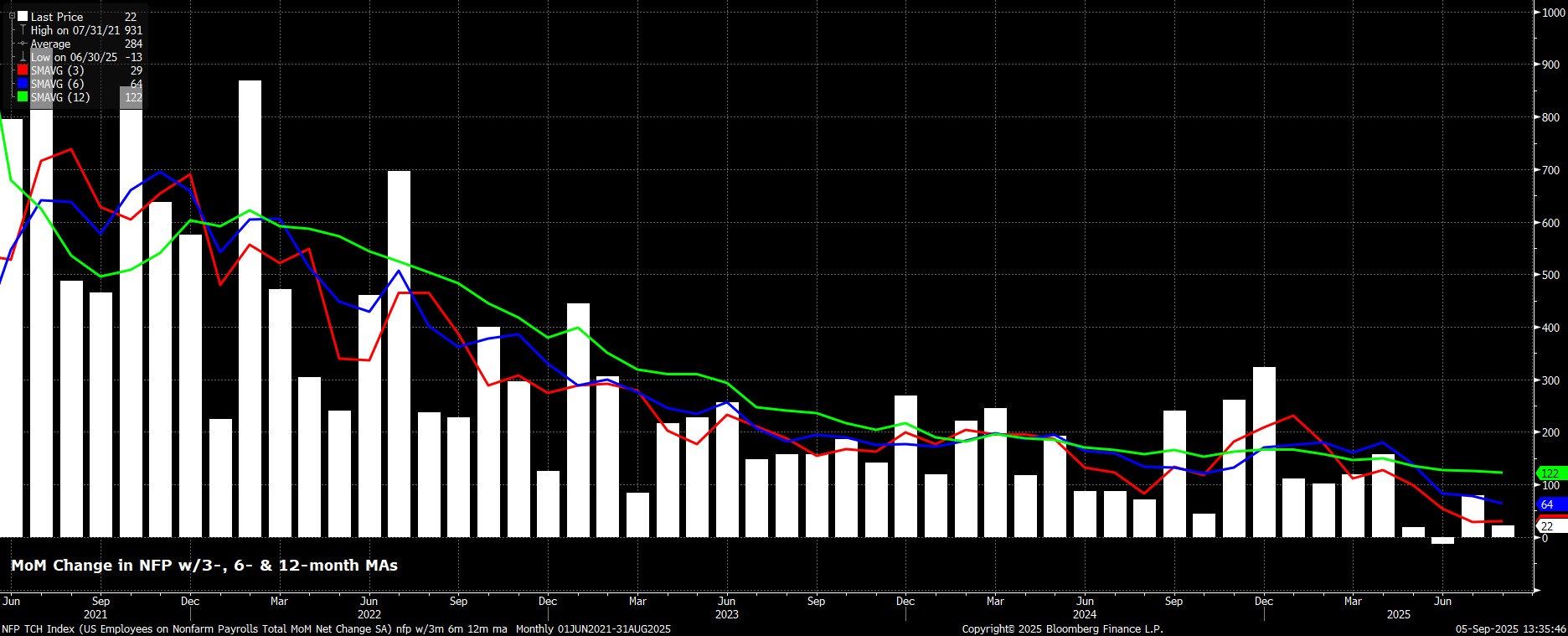

Headline nonfarm payrolls rose +22k last month, considerably below consensus expectations for a +75k increase, but within the typically wide forecast range of 0k to +115k. Concurrently, the prior two payrolls prints were revised by a net -21k, in turn taking the 3-month average of job gains to a rather dismal +29k, probably around half the breakeven pace.

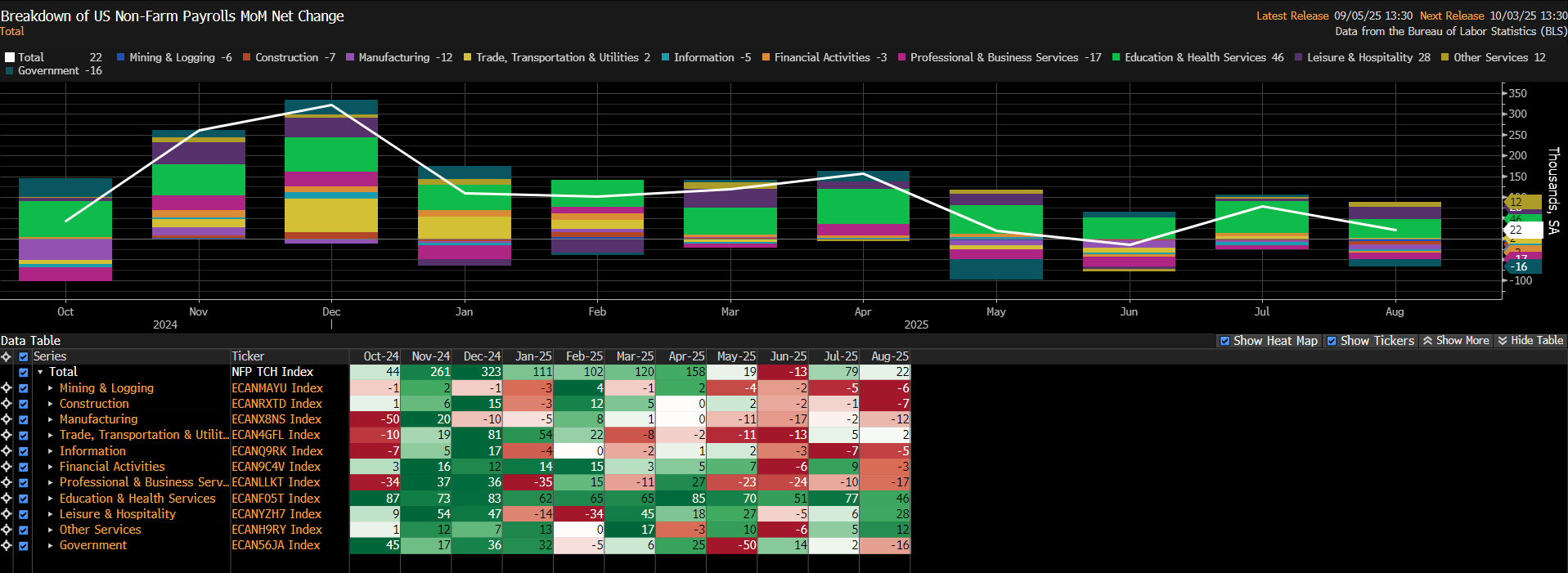

Taking a look under the surface of the payrolls print, things look rather glum. A majority of sectors saw employment decline in August, with those job losses led by Professional & Business Services, and Government employment. Once more, Healthcare (+46k) was the notable growth sector, and continues to prop up the headline figure at large.

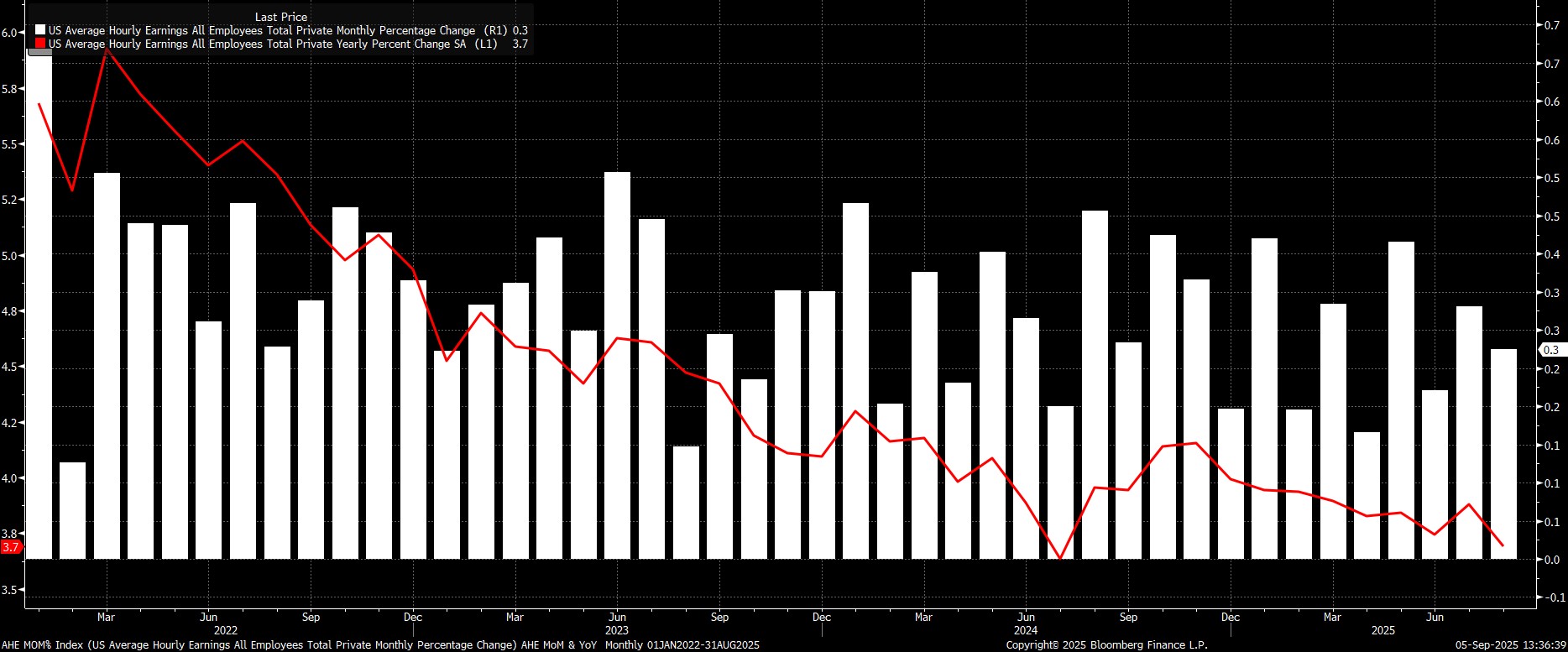

Staying with the establishment survey, the jobs report pointed to earnings pressures again remaining well-contained, reinforcing the FOMC’s long-standing view that the labour market is not a source of significant upside inflation risks at the current time.

Average hourly earnings rose 0.3% MoM, bang in line with expectations, which in turn saw the annual rate cool to 3.7% YoY.

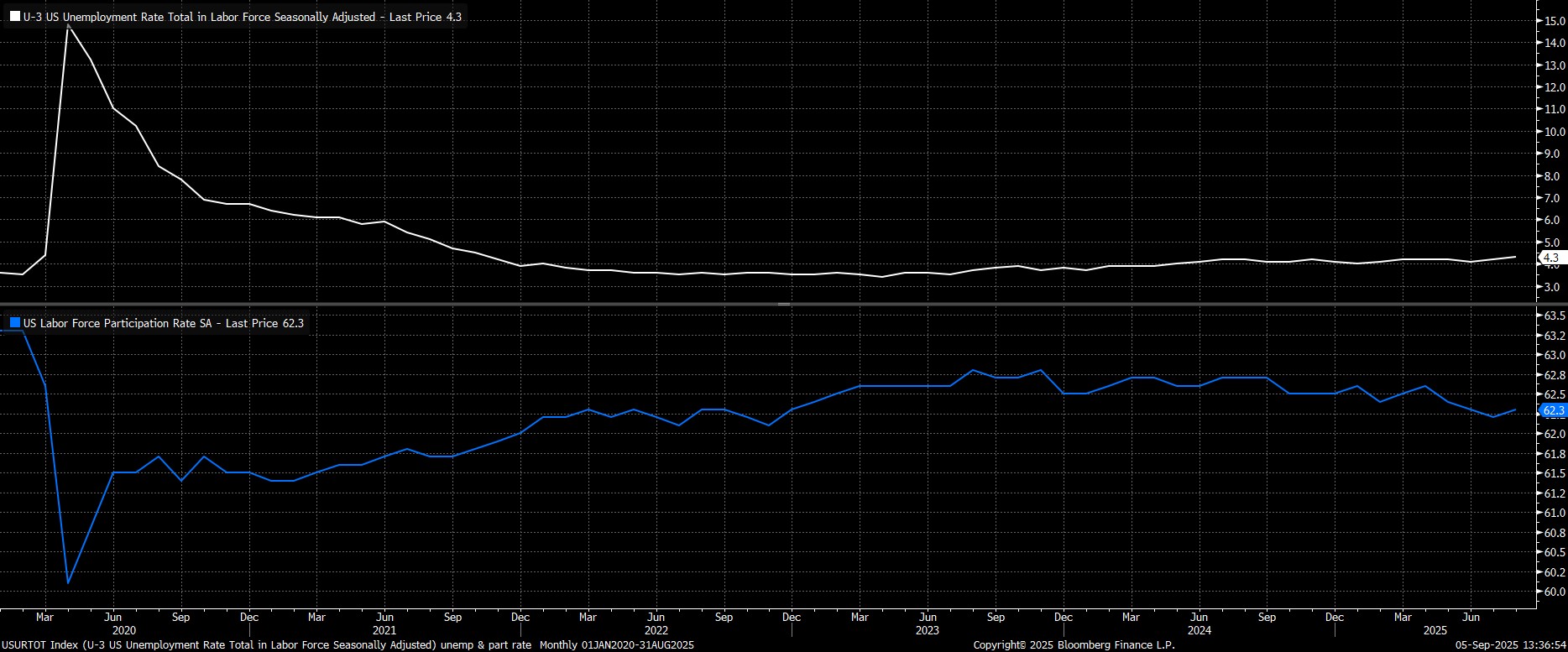

Turning to the household survey, headline unemployment rose to 4.3% last month, in line with expectations, and to a fresh cycle high. This, however, was accompanied by an unexpected rise in labour force participation, to 62.3%.

As has now been the case for some time, though, some degree of caution is still required in interpreting this data, as the BLS continue to grapple not only with a sharp decline in survey response rates, but also amid the rapidly changing composition of the labour force.

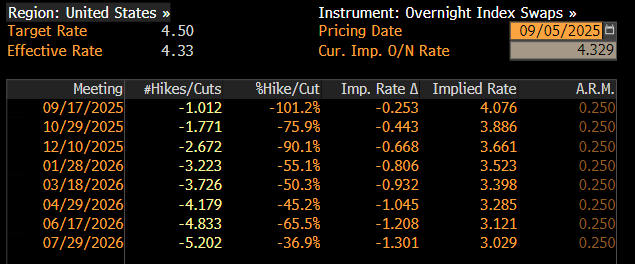

In reaction to the jobs report, market participants continue to fully price a 25bp cut in September, while also now pricing around 66bp of easing by year-end, up from 59bp pre-release, and implying around a 2-in-3 chance of three cuts being delivered this year.

Stepping back, the August jobs report does not materially alter the near-term FOMC policy outlook, and confirms that the labour market continues to lose momentum.

After Chair Powell’s dovish pivot at Jackson Hole, a 25bp cut at the September meeting remains locked-in, as the FOMC look set to take out ‘insurance’ against a loss of momentum in the labour market. While there are likely to be some dissenters in favour of a larger rate reduction, such a move shan’t command support from a majority of Committee members, given continued concern over upside inflation risks, and the desire to ensure that inflation expectations remain well-anchored.

Looking ahead, while the September ‘dot plot’ may give a clearer steer on the likely pace of easing through year-end, my base case is that the September cut will be followed with another such move at the December meeting. Risks to this view, though, arguably tilt marginally in a dovish direction, were material labour market weakness to emerge, though the bar to more aggressive easing is clearly a high one, with headline inflation having been north of target for four-and-a-half years, and being set to accelerate further over the next six months or so.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.