- English

- عربي

Another Nail In The Coffin Of Fed Policy Independence

Well, Fed policy independence, it was great while we knew you.

President Trump’s announcement on Thursday that CEA Chair Steve Miran will be nominated to the Fed Board to fill the remainder of Governor Kugler’s term is yet another nail in the coffin of monetary policy independence in the US. In many ways, the appointment helps to reinforce what most market participants were already thinking – namely, that we are now dealing with a much more politically-influenced Fed, and a much less independent Fed, than we have seen in many, many decades.

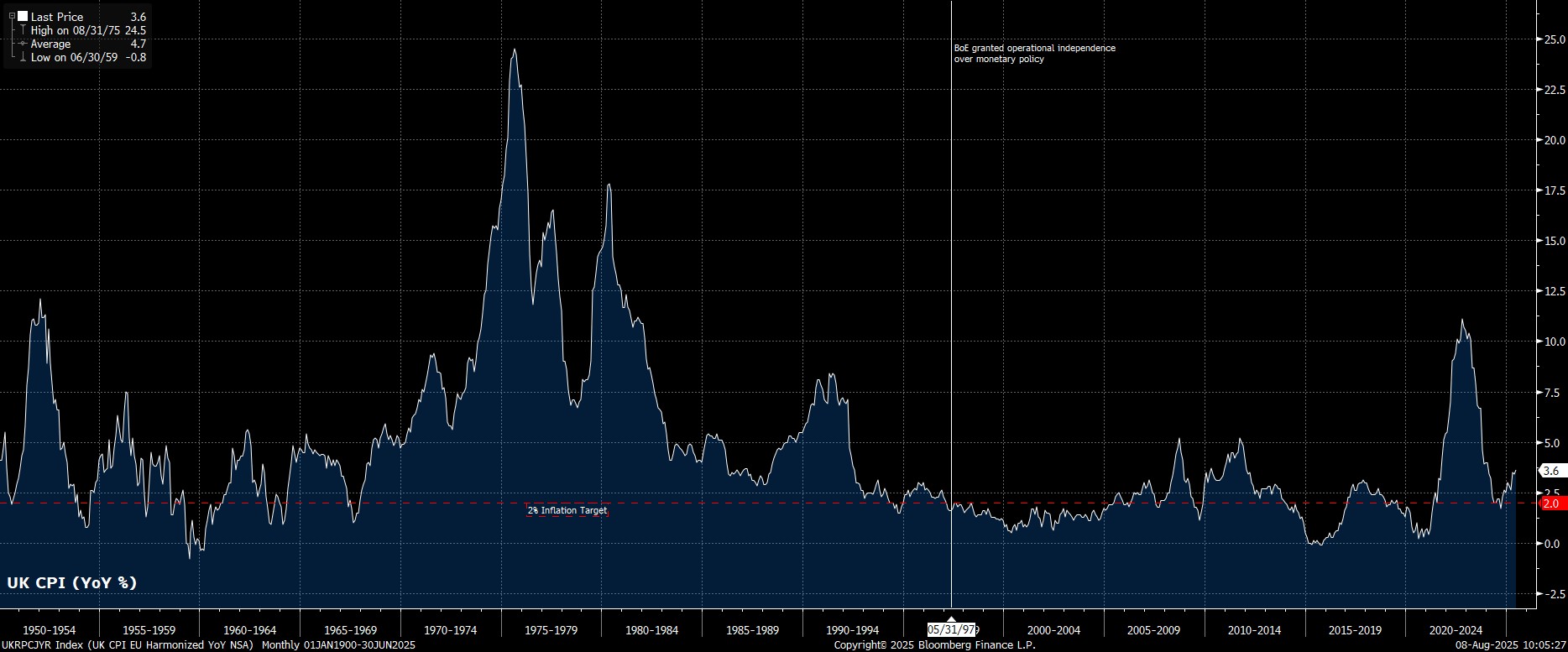

While the issue of policy independence has, for some bizarre reason, apparently become rather controversial of late, I will happily admit to being an unabashed supporter of giving central banks operational independence to meet their mandates, be that an inflation aim, or a dual mandate with a focus on the labour market too. A brief glance at the UK economy over the last few decades evidences this, with inflation (ex-covid) having become considerably more stable, and predictable, since Gordon Brown granted the BoE independence in the late 90s.

Hence, given the increased risks of an Erdogan-esque policymaking approach becoming more prevalent in DC, and the subsequent higher chances of inflation expectations becoming un-anchored, the greenback is likely to continue to face stiff, structural headwinds for the foreseeable. Especially considering that President Trump is unlikely to change his tune on this front any time soon. Naturally, the biggest beneficiaries here will be the EUR (likely much to the chagrin of Mme Lagarde!), as well as gold, where demand from reserve allocators in EM remains incredibly healthy.

From a policy perspective, in the short-term at least, Miran’s appointment probably won’t change especially much. In the eyes of most market-participants, Miran will have little-to-no credibility; this is not a slight against his economic ability or knowledge, but simply a logical consequence of such a politically-motivated choice on the President’s part.

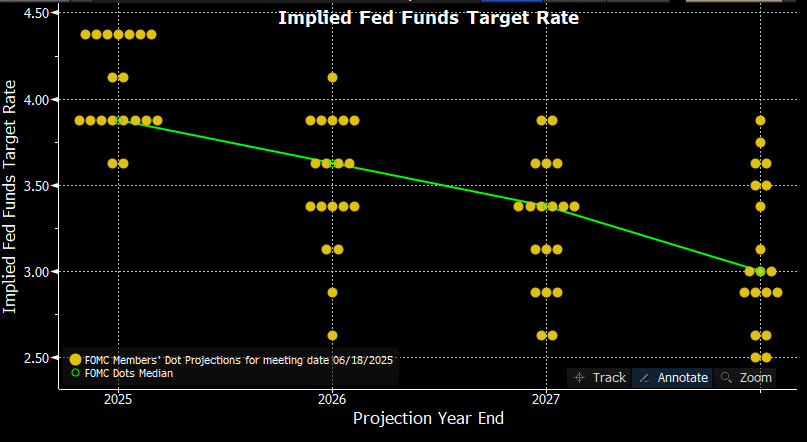

I’d imagine that, at least implicitly, Miran will have espoused as many dovish credentials as possible when interviewed for the role; despite, incidentally, being an uber-hawk who was dead against the Fed’s ‘jumbo’ 50bp rate cut around this time last year! In light of that, though, we can be pretty safe in the knowledge that not only will Miran be the most dovish ‘dot’ in the September SEP (if confirmed by then), but that he will probably also be voting in favour of the largest cut that he can plausibly make a case for at that meeting, and the ones after it, as well.

If there is an upside to all of this, it’s that Miran will only be in place for three meetings, or maybe a handful more if there are delays in confirming a permanent replacement for Gov. Kugler. At least this should limit any ‘damage’ that can be done.

Having said that, the appointment sets a clear tone for how Trump is going to be looking at other Fed vacancies – namely, who will replace Powell as Chair – going forwards. Clearly, loyalty to the President, both personally, and in terms of the Admin’s economic policies, is the number 1 selection criteria, as Trump seeks as much influence over rates as possible.

I do wonder, however, whether all of this might just make it a little more likely that Powell himself decides to see out his term as Governor once his term in the Chair’s seat ends next May. Powell has, rightly, been deliberately coy on the matter, despite continuing to face unjust, and unbecoming personal attacks from numerous Admin officials. Given how Powell views Fed independence as being of paramount importance, he may well decide that the best way to preserve that crown jewel of the US economy is to simply stay put. Doing so would, right now, look like a very wise idea indeed.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.