- English

- عربي

In equity land, the US30 is where the big moves are playing out, with the index in beast mode and a mere 1.9% away from its all-time highs. The S&P500 also closed higher for a fifth consecutive week and our US500 index now eyes a test of the 27 July high of 4611, where price action throughout last week suggests further juice in the rally is still possible.

What concerns me is that these markets are rich in positioning, valuation and technically overbought.

Market internals are very frothy, with 57% of stocks closing at a 4-week high, 85% of stocks above the 50-day MA, and 32% of stocks with an RSI above 70 – levels that typically signal an overloved market and a potential reversal. Valuations are also lofty, with the S&P500 trading on 21.4x forward earnings, although that is more of a 2024 story.

Positioning is becoming extreme, with CTAs now max long and shorts having covered hard. Downside protection/hedges have been rolled right off, where the volatility markets have pulled back to the point where many are feeling its cheap and prudent to buy short-dated puts or put spreads.

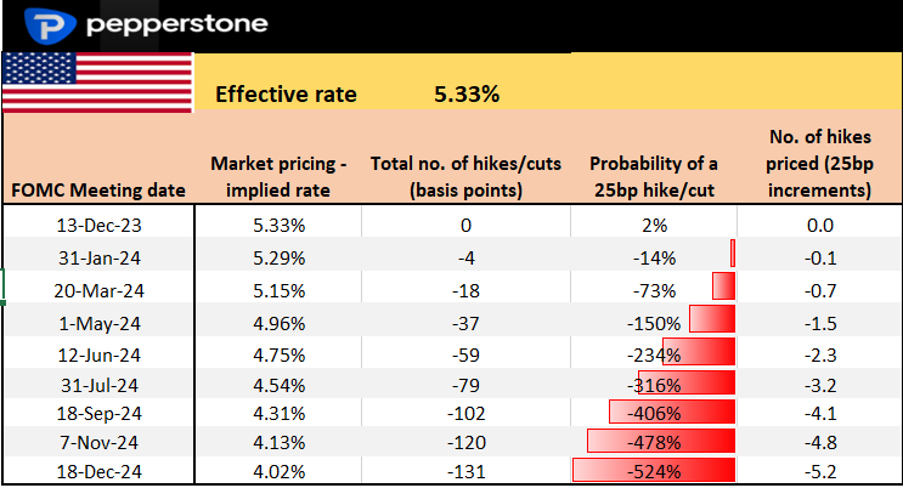

US rates and swaps are rich (see above), notably on the starting point for Fed easing, with the March FOMC meeting now priced at a 70% chance of a cut. We can also look further out and see over five 25bp cuts priced by the end of 2024. The move in short-end rates has been swift, and the USD has followed in earnest. It suggests that the skew in the risk and the potential direction of travel is shifting, and if any of the US data points this week – notably US payrolls - come in above consensus then USD shorts will part cover and those positioned long of Treasuries may too – equity will be sensitive to any move higher in yields.

So the chase in risk into year-end heats up but what is extreme can become more so, with the market's elastic band getting pulled back to greater and greater levels. On balance, it feels like long risk is still tactically the right position, but the higher it goes the more the ‘January effect’ will kick in and the more pronounced the position squaring and risk drawdown could play out – as liquidity thins out it could be a very lively period ahead.

A turn is coming, but timing it is where the money will be made.

Good luck to all….

The marquee event risks for the week ahead:

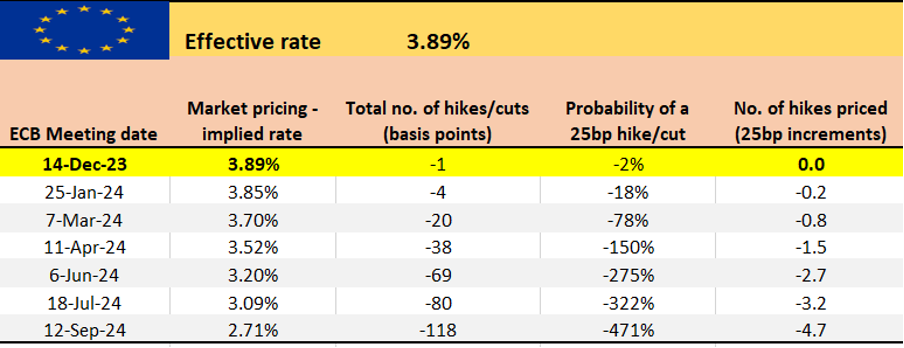

ECB President Lagarde speaks (01:00 AEDT) – the EU swaps market prices 20bp of cuts as soon as the March ECB meeting and 114bp (nearly 5) cuts 12 months out – will Lagarde push back on this dovish pricing, and will the market believe her?

Tokyo CPI (Tuesday 10:30 AEDT) – the median estimate is we see headline inflation at 3% (from 3.3%) and core 3.7% (3.8%). This shouldn’t move the JPY unless it’s a speculator beat/miss, but the BoJ will be watching this closely.

RBA meeting (Tuesday 14:30 AEST) – the market prices no hikes at all for this meeting, so it will be down to the tone of the statement and whether the 8bp of hikes priced for the February RBA meeting are correctly priced. It’s hard to see any major deviation from RBA Gov Bullock's recent communication, so the meeting should be a low-volatility event for the AUD or AUS200.

US JOLTS job openings (Wednesday 02:00 AEDT) – the market looks for a slight cooling in job openings, with 9.3 million job openings eyed (9.55m). The USD could be sensitive to this print and prone to short covering if we see above 10m job openings.

US ISM services (Wednesday 02:00 AEDT) – the consensus is that we see expansion in the US service sector, with consensus at 52.3 (51.8). A downside read towards 50 (the growth/contraction divide) could see further buyers in US Treasuries and keep the pressure on the USD. If the data comes out inline or above consensus then USD shorts could cover. The sub-components of the report matter, notably in new orders and employment. If the employment sub-component comes in under 50, then it could impact expectations and positioning ahead of nonfarm payrolls (NFP).

Australia Q3 GDP (Wednesday 11:30 AEDT) – It’s hard to see this influencing the AUD too intently, but it is a small risk for those running AUD exposures over the event. The market eyes GDP at 0.4% qoq / 1.8% yoy.

US ADP employment change (Thursday 00:15 AEDT) – with NFPs on Friday the market should be less sensitive to the outcome of the ADP report. With the consensus at 120K jobs, a big beat/miss could impact the USD, as expectations for the NFP change.

Bank of Canada meeting (Thursday 02:00 AEDT) – the market prices no change in policy at this meeting, so it’s the guidance and tone of the statement that matters more. CAD swaps price an 80% chance of a 25bp cut by the March meeting and nearly 5 cuts priced by end-2024.

China trade data (Thursday – no set time) – the market looks for import growth of 4%, and exports to fall 1.5%. The market will look for signs of internal demand, so could be sensitive to any beat/miss in the import print.

US nonfarm payrolls (Sat 00:30 AEDT) – the marquee event risk for the markets this week. The median estimate is for around 180k jobs, with the economist's estimates ranging from 240k to 100k. We will also look at trends in revisions to the prior reads, as this will also affect the 3-month average. The market could be sensitive to the U/E rate which is expected to remain unchanged at 3.9% - a 4-handle on the E/U rate would get the market talking and likely hit the USD. Also, consider average hourly earnings are expected at 0.3% mom/4% yoy. I would argue the USD would rally harder on a big NFP print, than selloff on a weaker print.

China CPI/PPI (Sat 09:30 AEDT) – The data falls when markets are closed, so there is some gapping risk in Chinese assets and their proxies. Here the market looks for CPI at -0.2% and PPI inflation at -3%. Amid the disinflationary/deflationary backdrop, there are increasing calls for further monetary policy easing.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.