- English

- عربي

A Traders’ Weekly Playbook: Central Banks, AI Earnings, and Market Setups to Watch

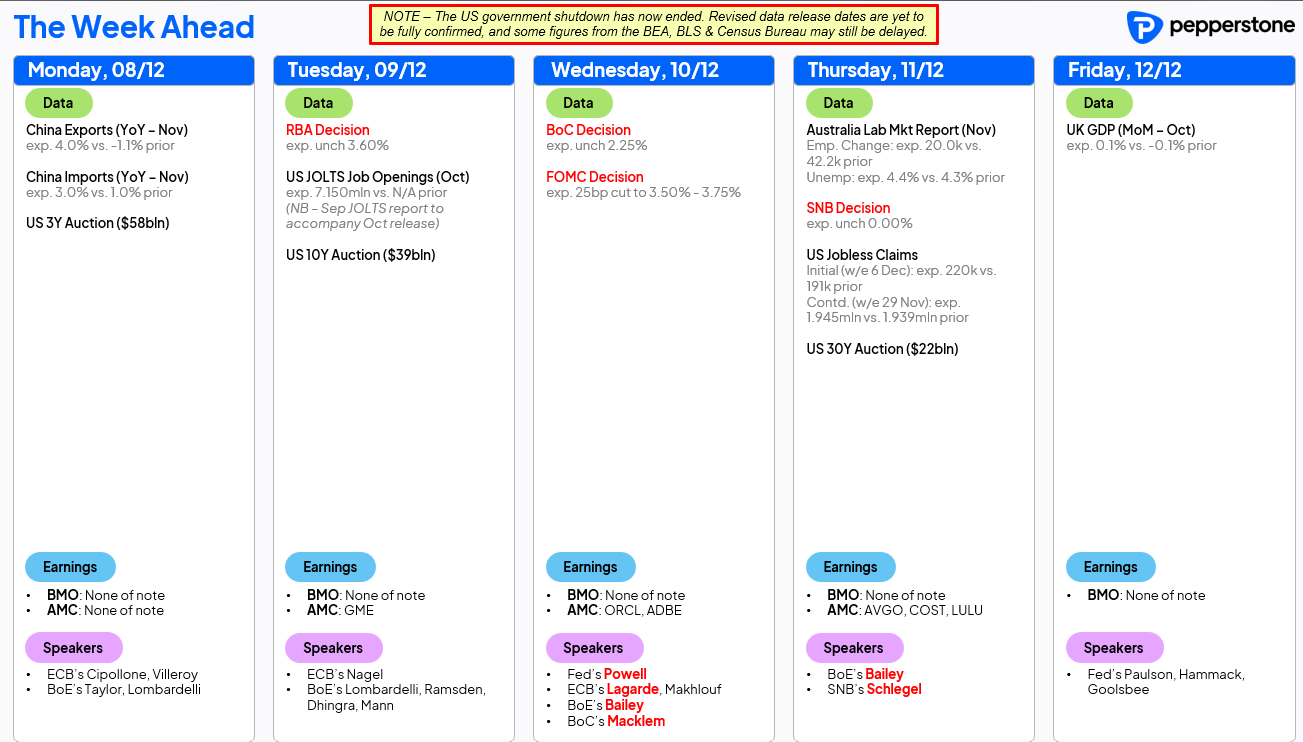

FOMC: The Marquee Event of the Week

The FOMC meeting will be the headline risk event. A 25bp cut is fully priced and viewed as a done deal, but the real debate centres on what a “hawkish cut” looks like and whether the statement and Powell’s press conference aligns to that well-subscribed outcome. Understanding exactly what constitutes a 'hawkish cut' is difficult to quantify given the Fed are still yet to receive the upcoming November NFP (16 Dec) and CPI (18 Dec) prints, and we also consider the composition of the Fed in 2026, a factor which remains a major grey area - and specifically around how closely aligned the future governors and regional presidents will be to Trump/Bessent.

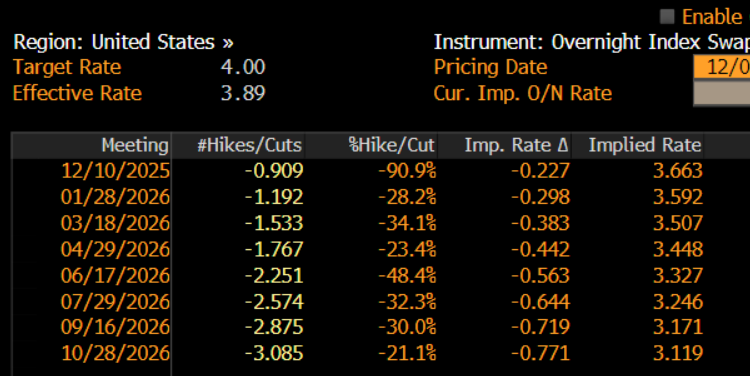

With USD swaps pricing a following 25bp cut in June 2026 and another by October, Powell and co. will need to signal that the Fed remains open to taking the fed funds rate toward 3%, and that should be the case conditional on whether the data gives them reasons to do so. The Fed's “recalibration” stage will likely formally come to an end at this meeting, but the market still needs reassurance that the 'Fed Put' remains intact; if not, the risk of a Treasury market sell-off is elevated, and the USD will be highly sensitive to that dynamic.

RBA & BoC: Lower-Drama Central Banks

The RBA and BoC meetings should be relatively more straightforward. Neither is expected to move policy, and the forward rates markets are pricing the next step as a hike, though not until late 2026. The RBA meeting in particular appears relatively benign for traders looking to manage exposures over. We've only just heard views from Governor Bullock, which should reduce the probability of a strong surprise. The market heads into the meeting long AUD, with AUDUSD eyeing 0.6690 (the June range highs), and with major range breakouts in EURAUD and AUDCHF drawing attention.

Canada also delivered another strong beat in its November jobs data on Friday, with the unemployment rate coming in a sizeable 50bp below expectations. The reaction was emphatic: 2-year Canada government yields rose 17bp on the day (+22bp w/w), fueling strong upside moves in CADCHF and CADJPY, while driving USDCAD toward 1.3800.

Global Fixed Income: Front-End Repricing and Supply Risks

Repricing in front-end bond yields across CAD, AUD, NZD and Japan has spilled over into a broad sell-off in developed-market fixed income. Japan is also confronting expectations of additional government bond supply to fund the new Prime Minister’s fiscal stimulus program. For now, risk assets are content to absorb higher yields, interpreting them as signs of resilient economic conditions. But that could shift quickly if the rate of change accelerates and term premia pushes higher. Earnings Spotlight: Oracle & Broadcom Earnings from Oracle and Broadcom will draw intense focus from equity and index traders, with guidance and outlook commentary set to influence the entire AI complex.

Oracle (ORCL)

Oracle has a reputation for outsized post-earnings volatility. The average move over the past eight quarterly reports is 8%, skewed by a massive +36% jump in Q1 2026. The options market currently implies a ±9.9% move. Beyond whether Oracle can beat consensus revenue expectations for Q2 2026 ($16.2B) and Q3 2026 ($16.87B), traders remain laser-focused on the company’s relationship with OpenAI and any updates on it's capex intentions and the financing mix tied to its cloud and AI-infrastructure commitments.

Broadcom (AVGO)

Broadcom is in a different position. Having firmly established itself in the Google AI hardware ecosystem, the market has treated AVGO as a premier AI play, with shares up 68% YTD and trading just $13 shy of all-time highs heading into earnings.

The options market implies a ±6.6% move. Given the YTD move in the share price and the heavy crowding, expectations are set high, meaning AVGO will likely need a solid beat-and-raise quarter on sales to push the stock decisively above $403. The market expects not only steady sales growth but for the growth rate to even accelerate in coming quarters, with gross margins holding in the high 70s.

Unless there is a genuine shock from the earnings, any disappointment from such a high bar is likely to result in a pullback being shallow and well-supported. The aftermarket reaction will be critical - it could spill over into the broader AI/Semiconductor space and influence NASDAQ 100 sentiment.

Overall, we look to see if the equity trade can soldier on past this event-heavy week, and for new ATHs to be seen in the S&P500 and NAS100, with commodities continuing to find strong buying into dips and the AUD and CAD to maintain its outperformance.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.