- English

- عربي

Trading Overview

EURUSD has closed lower by the same duration, and that makes a fitting backdrop for the two headline catalysts this week: the September ECB meeting, and the US CPI print.

Further afield, the CLP (Chilean Peso), PLN (Polish Zloty) and MXN were the weakest currencies in FX markets last week (all offered by Pepperstone). USDMXN has seen increased attention from traders, and we’ve seen exhaustion in the buying in USDMXN after 6 straight days higher. I am a buyer of weakness.

AUDUSD fell 1.2% last week and remains a liquid proxy of China, but again, after a strong move to below 0.6400 we see that the sellers are feeling fatigued – consolidation can be a good thing, even for those whose strategies work their edge in more linear moves. China’s CPI/PPI, released on Saturday (coming in at 0.1% and -3% respectively), shouldn’t worry markets to any great degree.

.png)

US and Brent Crude gets close attention, with OPEC+ determined to tighten supply. After the strong run price is factoring in a lot of positive factors, however, a daily close above $88 (in SpotCrude) would greatly accelerate the prospect of $100 coming into play, with BrentCrude likely to get there first. I’m not sure risk assets will appreciate further upside in energy prices, and I consider a scenario where we see further gains in crude, married with an above consensus US core CPI print. One suspects if that scenario we’re to play out we could see increased angst, and higher vol.

While the VIX index has moved below 14% and S&P500 20-day realised vol is turning lower again, it is still a big week for equity – after a small pullback, we question if the US500 is ready to make a tilt at strong support at 4330 or find a more positive tone?

This week we manage risk, consider our exposures and positions over key event risk/news and model potential movement against the account balance. Stop placement is key, where understanding the degree of risk taken on will only serve you well. Good luck.

The marquee event risks for the week ahead:

ECB meeting (Thursday 22:15 AEST) – A hawkish pause? The ECB meeting is a significant risk event for EUR FX / EU equity traders and one that could result in a sizeable bout in cross-asset volatility. EU swaps price 9bp of hikes (a 38% chance of a hike), and 18bp of hikes cumulative to the peak rate (in December) and this could play a key factor in the reaction of the EUR. We see 26/49 economists see the ECB leaving rates unchanged, highlighting just how split the view is out there. Positioning in the EUR is held very short by leveraged insto funds, while retail has positioned exposures for a counter move and a bounce in EURUSD.

Given pricing and positioning, we should see a more pronounced rally in the EUR on a 25bp hike, than a fall if we see rates kept unchanged, at least to the initial reaction to the rates call. Rate hike (or not) aside, ECB guidance, new economic projections and debate around PEPP reinvestments could result in vicious intraday reversals playing out, so trading over news – if that is your tipple - will be a challenge and it pays to be nimble.

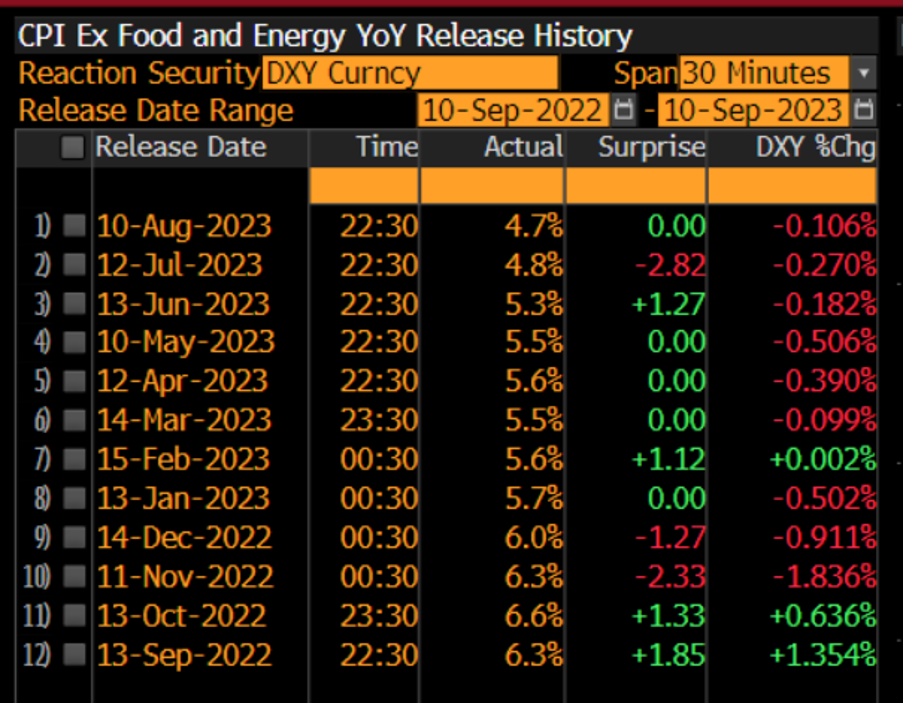

US CPI (Wed 22:30 AEST) – The outcome of the CPI report could significantly shape expectations for the November FOMC meeting, where the market is currently pricing a balanced 12bp of hikes. The market eyes US headline CPI at 0.6% MoM/3.6% YoY and core CPI at 0.2% MoM/4.3% YoY. By way of market pricing, the CPI ‘fixings’ market (market pricing for the CPI print) is pricing headline CPI at 3.64%, while alternatively, the Cleveland Fed inflation Nowcast model sees US headline CPI headline inflation higher at 3.8% and core CPI at 4.46%, offering modest upside risk to the economist’s consensus call.

The form guide has favoured short USD positions, where the USD index (DXY) has dropped in the 30 minutes after each of the past 6 CPI reports. This time could be different given USD positioning.

US PPI inflation (Thursday 22:30 AEST) – Overshadowed by the US CPI report and the ECB meeting (15 minutes earlier), US PPI is expected to print 0.4% MoM / 1.3% YoY. If the PPI print proves to be a big beat/miss to consensus it could make trading through this period even more problematic.

US retail sales (Thursday 22:30 AEST) – The market eyes sales of +0.1% for August, while the ‘control’ group – the sales element that feeds more directly into the GDP calculation – is expected to fall 0.1%. The market picks and chooses when to run with this data point, so I suspect it could be a vol event only should we see a sizeable beat/miss to expectations.

UK jobs and wages report (Tuesday 16:00 AEST) – The swaps market prices 19bp of hikes for the 21 Sept BoE meeting, with peak bank rate expectations at 5.56% by Feb 2024. The UK jobs/wages report could influence that pricing, with the consensus expecting the unemployment rate eyed at 4.3% (from 4.2%) and wages unchanged at 7.8%. GBPUSD eyes the 200-day MA (1.2427), and a level for the scalpers. Leveraged funds are now short GBP, while the slower-moving real money is still holding a punchy net long GBP position.

BoE speakers – Chief economist Huw Pill speaks (Monday 18:00 AEST) and External member Catherine Mann speaks the day after (Tuesday 09:00 AEST). The market is certainly warming to a one-more-and-done approach from the BoE and GBP has taken notice.

China high-frequency data (Friday 12:00 AEST) – We watch for Industrial production (consensus 3.9% vs. 3.7% July), fixed asset investment (3.3% from 3.4%), and retail sales (3% vs. 2.5% July) – so some improvement is expected in this data flow. China equity could be sensitive to this growth data, although on current trends CHINAH is favoured into 6000. USDCNH also pushing to new cycle highs, and I stay bullish this cross.

PBOC decision on the Medium-term Lending Facility (MLF - Friday 11:20 AEST) – Only one economist (of 11 surveyed by Bloomberg) is calling for a cut to the MLF facility, with the strong consensus that it is too soon after the recent policy easing to see more. USDCNH is still a favoured long exposure.

Australia employment report (Thursday 11:30 AEST) – The consensus calls for 25.5k jobs created in August. The unemployment rate is expected to be unchanged at 3.7%, although that could be influenced by the participation rate, which is expected to remain at 66.7%. I can’t see this data point affecting expectations of RBA policy too intently, with the market staunchly of the view that the RBA are on an extended pause. AUDUSD - Tactically, favour placing limit orders and to fade intraday extremes, as the initial move shouldn’t stick.

Apple ‘Wonderlust’ event (Tuesday) – The market is looking more closely at the news flow around China’s proposed iPhone curbs, and how that plays into expected revenue. ‘Wonderlust’ is likely more of an event for the tech heads, with the new iPhone 15 due to be unveiled – I see no statistical pattern, or price trends, through prior product launches to offer any bias on how the tech giant could trade.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)