- English

- عربي

A Traders’ Weekly Playbook: Trading Through an Impending US Government Shutdown

This, in turn, has pushed the USD Index (DXY) to 98.60, where better sellers have emerged at the August range highs and the 100-day MA. Those long of USDs will want to see a daily close above 98.80 and below 1.1660 (EURUSD) to see technical momentum build, but that will likely require rates traders to reprice/reduce expectations for a Fed cut in the October FOMC meeting, which is currently implied at 88% probability.

The State of Play in Markets:

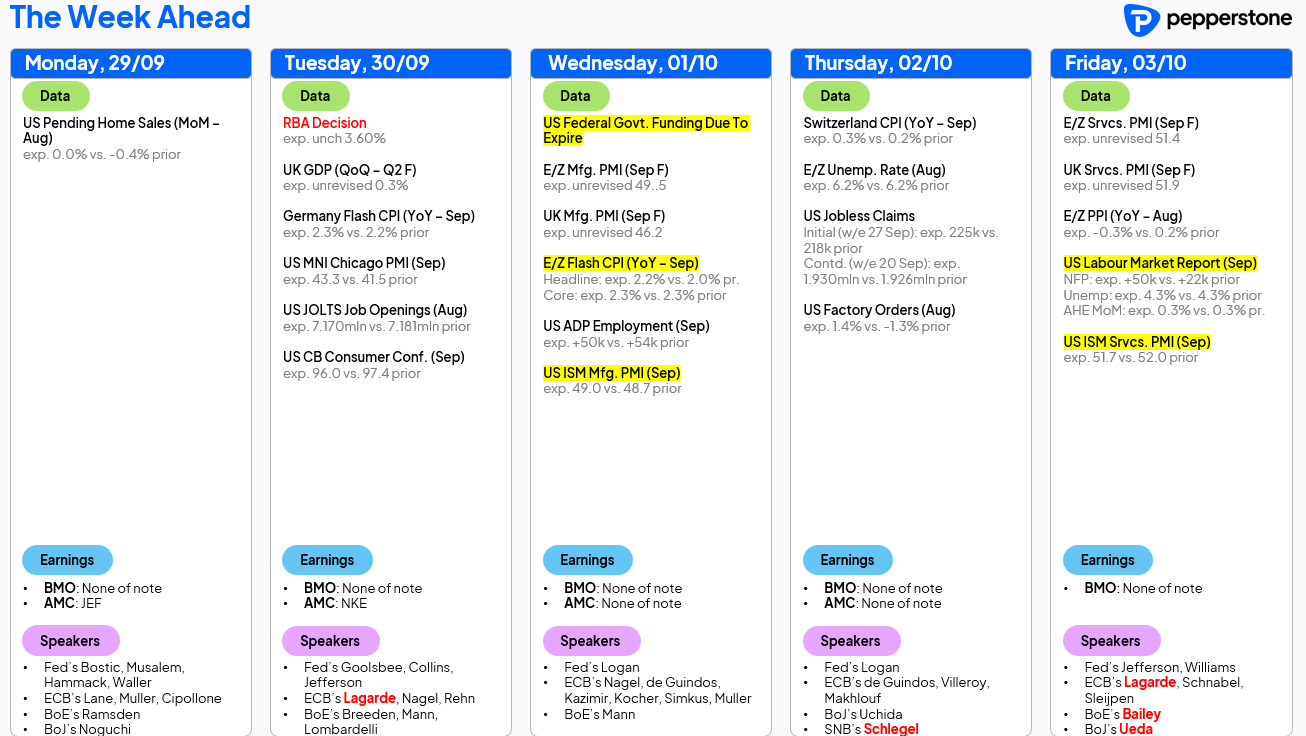

With the US government expected to temporarily shut down this week, there is a clear risk that the BLS may not have the capacity to release the September payrolls report—a key input for assessing whether high expectations for a follow-up Fed rate cut are indeed justified. If we hear early this week that the NFP report will be delayed (potentially until the govt re-opens), traders may recalibrate their approach to risk and increase their sensitivity to the JOLTS report, ADP payrolls data, and the employment sub-components of the ISM services release.

Major equity markets are set to close out another solid quarter for returns, with only the German DAX currently in the red for Q3. Chinese equities have outperformed, with the CSI300 +15.6%, alongside solid gains in the NKY225 (+12%), NAS100 (+10.4%), and Spanish IBEX (+9.7%). While there have been pockets of concern about lofty valuation and the trajectory for equity risk, markets have navigated political and economic headwinds incredibly well. Few participants have seen the news flow as reason enough to dump equity, with players instead actively rotating between sectors, styles, and factors, and quick to sell volatility on any momentary spikes.

In fact, perhaps the most impressive theme of Q3 has been the low-volatility regime—both realised and implied, and not just in equity vol, but volatility across rates, FX and Treasuries. Whether we are treated to a less suppressed vol regime in Q4 is uncertain, but until we see an increased consistency for more outsized daily percentage closing changes, buying volatility remains a tough trade given the cost (negative carry) involved and the idea that hedges that don't work subtract from one's performance. With US Q3 growth tracking around a healthy 3%, the Fed put firmly embedded in markets, and large financial institutions maintaining an ingrained bias to enhance returns via short-vol strategies, we’ll need fresh catalysts to drive a sustained shift to a higher-volatility regime.

For those seeking volatility, movement, and trend, the action has been in platinum, silver, and gold—although the gold price is now consolidated around $3770, while a number of the FX cross rates have also been well subscribed by trend FX traders (notably NZDCHF). Crypto has also screened well by way of movement, with the recent heavy liquidations driving broad prices sharply lower, triggered by a classic flush-out of long positioning. This week, price action suggests buyers may be stepping back in after two days of indecision, making the case for renewed short-term upside. A closing break below 108,650 in Bitcoin or 3823 in Ethereum would negate that view and point to further drawdown ahead.

The Key Data and Influences for Traders to Navigate in the Week Ahead

- US Government Shutdown – Barring a last-minute agreement, the US government is expected to temporarily shut down on 1 Oct. A shutdown in isolation shouldn’t impact financial markets to any great extent, but as we saw in 2013, various government agencies may delay releasing important economic data until the government reopens. That puts a high probability that Friday’s US payrolls report, and possibly the US CPI release on 15 Oct, may be delayed.

- US Nonfarm Payrolls (NFP, Friday) – If the BLS can release the NFP data, the consensus is for 50k payrolls (with economists’ forecasts ranging from +105k to -20k). The unemployment rate is expected to remain unchanged at 4.3%, with average hours worked also steady at 34.2.

- Scheduled Fed Speakers – We have a lighter line-up of Fed speeches this week, and it’s unlikely we’ll hear much new information that meaningfully shifts market pricing. If the NFP report is released, Fed Vice-Chair Philip Jefferson is scheduled to speak shortly afterwards and may offer context on how the payrolls print and other recent data (such as Friday’s stronger personal spending) influence his call for a follow-up 25bp cut at the October FOMC meeting.

- US JOLTS Job Openings Report (Tuesday) – The market expects a modest cooling in job openings in August to 7.17m (from 7.18m). The layoff rate (with the JOLTS report) will also attract attention, particularly if it ticks higher from the current rate of 1.1%.

- US ISM Services (Friday) – Released shortly after the NFP report at 52.0, this data point won’t be affected by a potential government shutdown. If the NFP report is delayed, the market may react more sensitively to the ISM services release. The consensus is for the diffusion index to come in at 51.7, suggesting a slightly slower pace of expansion in the service sector in September.

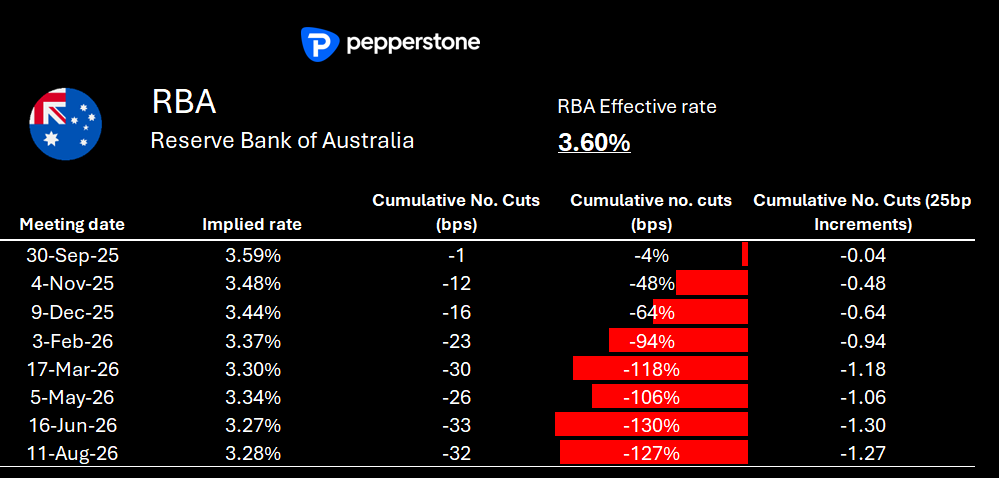

- September RBA Meeting – The RBA will almost certainly leave the cash rate unchanged at 3.60%, and the market ascribes no chance of a follow-up rate cut. Looking further out, the AUD interest rate swaps curve shows a 49% probability of a 25bp cut at next RBA meeting in November. Essentially, that pricing suggests a cut is currently seen as a line-ball call, with the outcome set to be influenced by the September employment report (16 Oct) and the Q3 CPI report (29 Oct). Expect the RBA’s statement and Governor Bullock’s press conference to acknowledge the improved growth dynamic and the recent build in price pressures. While the statement may initially be read as hawkish (bullish for the AUD), Governor Bullock will likely leave scope and the optionality for further rate cuts if the Q3 CPI print comes in below current tracking rates.

- China (September) Manufacturing and Services PMIs (Tuesday) – China’s PMIs are unlikely to be a market mover, despite some upside risk to consensus expectations (manufacturing PMI eyed at 49.6 and services PMI at 50.2). China’s Golden Week holidays (1–8 Oct) will see its markets close, with economists keen to review the impact on the economy from the level of travel, spending, and consumption seen through the period.

- EU CPI Inflation (Wednesday) – The market expects headline inflation to tick up 20bp to 2.2%, with core inflation unchanged at 2.3%. EUR interest rate swaps currently price the next full 25bp ECB cut by March 2026, so it would likely take a sizeable downside surprise to bring forward expectations for the next 25bp cut. Conversely, a hotter CPI print could fuel debate that the ECB’s easing cycle is already complete.

- Japan Tankan Report (Wednesday) – While much focus will be on the polls ahead of the LDP leadership election (Saturday), further improvement across Tankan metrics could influence JPY swaps pricing. The October BoJ meeting is seen as a live event, with markets pricing a 59% probability of a 25bp hike and roughly two hikes over the next 12 months. Month & Quarter-End Rebalancing Flows – Amid the data and Fed speakers, investment managers will also be rebalancing portfolios to bring equity, bond, and FX positions back in line with mandates. These flows can affect market pricing, but while it’s useful to know they’re present, they shouldn’t dictate a trader’s decision to be in or out of the market this week.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.