- English

- عربي

The Week Ahead: Powell’s Jackson Hole Pivot Reinforces the Fed Put

The key fear was that Powell’s speech could see implied rate cuts priced out, leading to a bear flattening of the Treasury curve, USD strength, drawdown in risk assets (equity, crypto, risk FX), and higher cross-asset volatility.

Powell dismisses the ongoing risk to inflation – a potentially dangerous path to tread

What unfolded caught many off guard. Powell downplayed the ongoing risk of a tariff-affected inflation rise, stressing he still believed tariffs would lead to a one-off or two-off lift in the price level, rather than a steady, prolonged rise in price pressures into CY2026 – and even stoked conjecture the Fed was moving away from targeting a 2% average inflation rate.

His speech was seen as market-friendly as the bulls could have hoped for, at least at this time, as the pivot may well prove to be a poor call, and we watch the extent of any further rise in the market’s pricing of inflation expectations, and in the long end of the Treasury curve (i.e. 10- and 30-year Treasuries), as the bond market will soon let us all know if they see this as a ‘policy mistake’. We then also consider that September is seasonally the worst month for bond returns, notably given the US Treasury Department’s sizeable net cash borrowing requirement ahead.

A low bar to ease in September

However, Powell’s pivot not only opened the door to a September rate cut but it aligned with the thesis already expressed in interest rate pricing – that the fed funds rate should be lowered towards neutral far sooner to support growth and jobs. In essence, the perceived divergence between Powell's policy stance and that of the interest rate (IR) market has converged, with both now singing from the same song sheet.

The ‘Fed Put’ reinforced into market psychology

The base case is now for the Fed to cut in September, with another 25bp cut priced before year-end and the perceived terminal fed funds rate eyed at 2.94%.

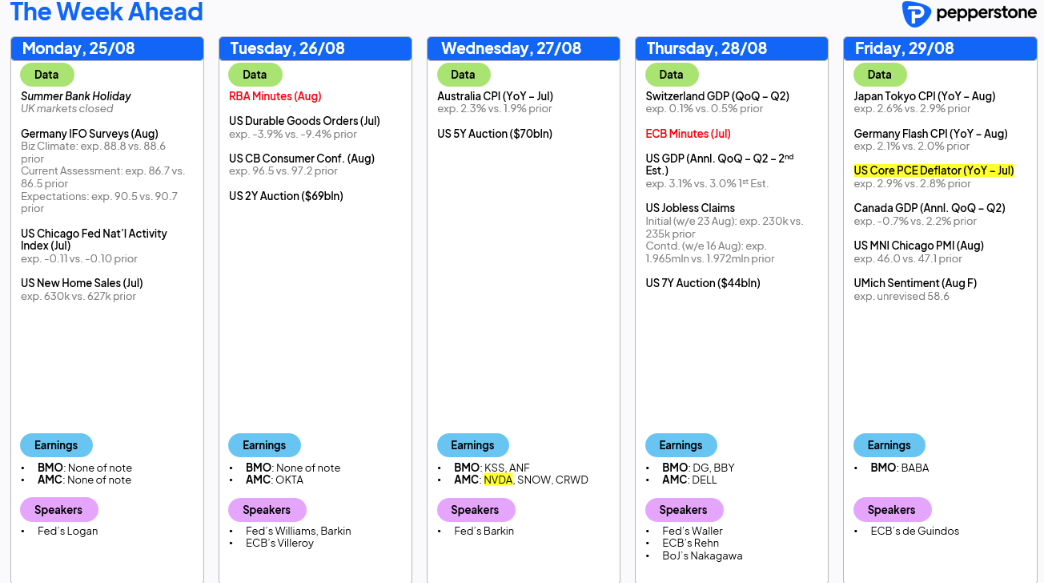

With a new appetite to ease, the strike price on the ‘Fed Put’ has essentially been pulled closer to market levels. Intuitively, the bar for a September cut seems to be set low – which makes Friday’s US core PCE inflation read even more important, as a print at or above 3% would increase the selling in long-end Treasuries and further steepen the yield curve. Conversely, one could also argue that if US core PCE proves more benign than expected (at 2.8% y/y or lower), and the August nonfarm payrolls (due 5 Sept) come in under 80k with unemployment above 4.3%, and we again we see outsized revisions, then a 50bp cut in September could be partially priced into IR swaps.

Broad US financial conditions breaking to new cycle highs

US financial conditions look set to break to new cycle highs, with real Treasury yields closing a punchy -14bp lower on Friday. Traders felt reinvigorated to sell equity vol and move cash off the sidelines to chase equities higher. Flows into higher-risk equity were obvious: small caps surged, non-profitable tech and high short-interest stocks rallied hard, and US homebuilders gained +5%. Crypto also lit up, with Ethereum closing +14%, briefly hitting a new ATH, and record volumes seen in ETHA (iShares ETH ETF). The USD was sold against all majors, as recently initiated longs were cut back, and some even reversed and moved to a net short USD position, largely inspired by the moves in US real rates.

The question for traders early this week is whether to chase Friday’s rally in risk and the USD downside. Given the extent of Friday’s move was premised on positioning being offside, and with much of that being cut, we enter the week with a cleaner slate. Still, while the risk of Powell getting this one wholly wrong perhaps reinvigorates the case to own gold, the fact that he has cemented the Fed Put and helped lower the implied volatility in markets should see support for risk continuing.

Hard to be tactically short risk – Nvidia’s Q226 earnings in the mix

It certainly feels difficult to be short risk at this point, although an open mind is key, as sentiment could easily turn when we’re at such lofty levels in risky markets. Nvidia’s 2Q26 earnings (on Wednesday) will be a clear risk to equity and index positioning – granted, options market makers have reduced the implied volatility for a move in response to earnings to -/+5.8%, but the extent of any beat and raise to sales and margins will likely be a key risk that many should be set to manage.

For the USD specifically, Trump’s increasing focus on pulling Fed governor Cook from her position will not do the buck any favours, but given current IR pricing, we may need a fresh catalyst to push the DXY below the 27 July swing low of 97.10 and towards the YTD lows of 96.37. That kicker is likely to come from incoming US data, but markets now take comfort that Powell’s concerns mirror what IR pricing has already implied – that growth and labour markets are increasingly vulnerable under restrictive policy.

The rise and rise of Asian equity

Asian equities should fire up on Monday, with the ASX200 set to post a new ATH and China continuing to climb and outperform. Chinese equities certainly need close inspection, as the rally we’re witnessing in mainland equity bourses (and the CN50) seems almost entirely driven by liquidity dynamics and in no way justified by the economics or fundamentals – that said, that is so often the case with most risky assets these days, so we shouldn’t be wholly surprised.

We live in interesting times, and equity should be supported into weakness, yield curves pulled steeper and the USD selling likely back in vogue. However, the further this all goes, the greater the urgency to consider hedging the risk as words like “policy mistake,” “bubble,” and “term premium” start to be used more liberally in traders’ conversations.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.