- English

- عربي

A Loss of Fed Credibility? Markets Weigh Trump’s Push to Remove Governor Cook

While the timing of Trump’s push to dismiss Governor Cook is important in assessing just how much influence he may ultimately wield within the Fed, I would argue that very little in the way of a risk premium is currently priced into markets. If investors genuinely believed the Fed’s ability to set policy freely in line with economic reality was impaired, the risk premium embedded in markets would be significantly higher, and that is not currently evident....

As the daily news flow details, Trump continues to explore new avenues to formally remove Governor Cook from her position, but the implied probability of him being successful any time soon remains low (betting markets put it at 31%). Still, we should not doubt Trump’s resolve or creativity in the matter. In effect, the ramifications of Governor Cook’s dismissal would be incredibly powerful and would demand an immediate, forceful response from both the Trump administration and from the Fed.

The removal of Gov Cook would open up a can of worms

The fact that no Fed governor has ever been fired by a sitting president would open a can of worms, leaving market participants scrambling to understand what this means for the future path of interest rates and the Fed’s wider policy toolkit. That lack of visibility would create a broad dispersion of views, and when the distribution of potential outcomes becomes more extreme, liquidity typically deteriorates, implied volatility rises sharply, and derisking and deleveraging become evident.

Interest rate markets are the best gauge on Fed credibility

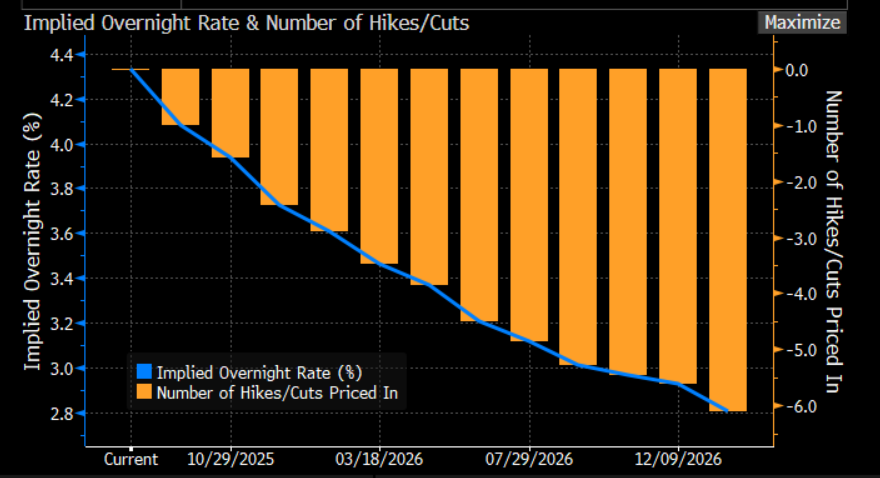

I would argue that the interest rate markets offer the cleanest guide to the perceived risk of Trump significantly influencing monetary policy — and therefore the Fed’s credibility. Specifically, this can be observed in pricing for the implied terminal (or trough) fed funds rate, which is currently set at 3% by September 2026 — firmly in line with the Fed’s estimate of the neutral rate.

If markets were genuinely pricing a credibility issue, they would not only assume the Fed gets to 3% far sooner, but would likely be pricing a terminal rate lower at 2.5%. As it stands, swaps pricing suggests an orderly cutting cycle consistent with a cooling, but not collapsing, labour market, and with inflation moving back towards the Fed’s 2% target in early 2026.

Meanwhile, the S&P500 sits near all-time highs, the VIX remains well below 20%, the USD is unchanged since Trump's announcement that he had fired Gov Cook, and the US 10yr Treasury yield sits at 4.15% — its lowest level of yield since 1 May.

If markets truly feared an overly politicised Fed that might take policy to levels inconsistent with the reality of economic fundamentals (i.e. too dovish), long-end yields would be much higher as inflation expectations lifted term premium. The long end of the curve, therefore, is hardly expressing concern about a real loss of credibility.

Gold flying but not on Fed credibility concerns

Some have suggested gold has acted as a hedge against Fed credibility risk. Clearly, the news flow wouldnt harm the investment case for gold, but much of the move has really been driven by systematic players, portfolio managers attracted to gold’s lack of correlation with the S&P500 and USTs, and EM central banks increasing gold reserves. It is difficult to quantify how much the Fed credibility narrative has contributed. Still, if a major announcement were made that Cook was to be stood down — and she accepted it, a big if — then I would expect gold to run red hot, with the USD taking a big leg lower.

For now, I would argue that interest rate pricing shows very little is built around a true loss of Fed credibility. But this remains a major risk to observe. Should it become a more defined market theme, the ramifications for USD assets and confidence in US capital markets would be significant. It would almost certainly require a response from both the Fed and Trump, and markets would demand it — similar to April, when developments forced the Trump pivot. The market currently views Governor Cook’s departure from the Fed as a low-probability outcome. Still, while it is only one step towards Trump exerting greater influence over the most important entity in financial markets, should the odds of it increase — and the rates market react — traders must be prepared for a major shift in the environment.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.