- English

- عربي

Of course, it is important to recall that this Statement was never supposed to see the delivery of fresh fiscal measures. One of Reeves’s first acts as Chancellor was to commit to just the one major fiscal event each year, to be held in the autumn; a statement in the spring was supposed to only be an interim update, as to whether or not the UK remains on track to stay within the fiscal rules, per the OBR’s updated forecast.

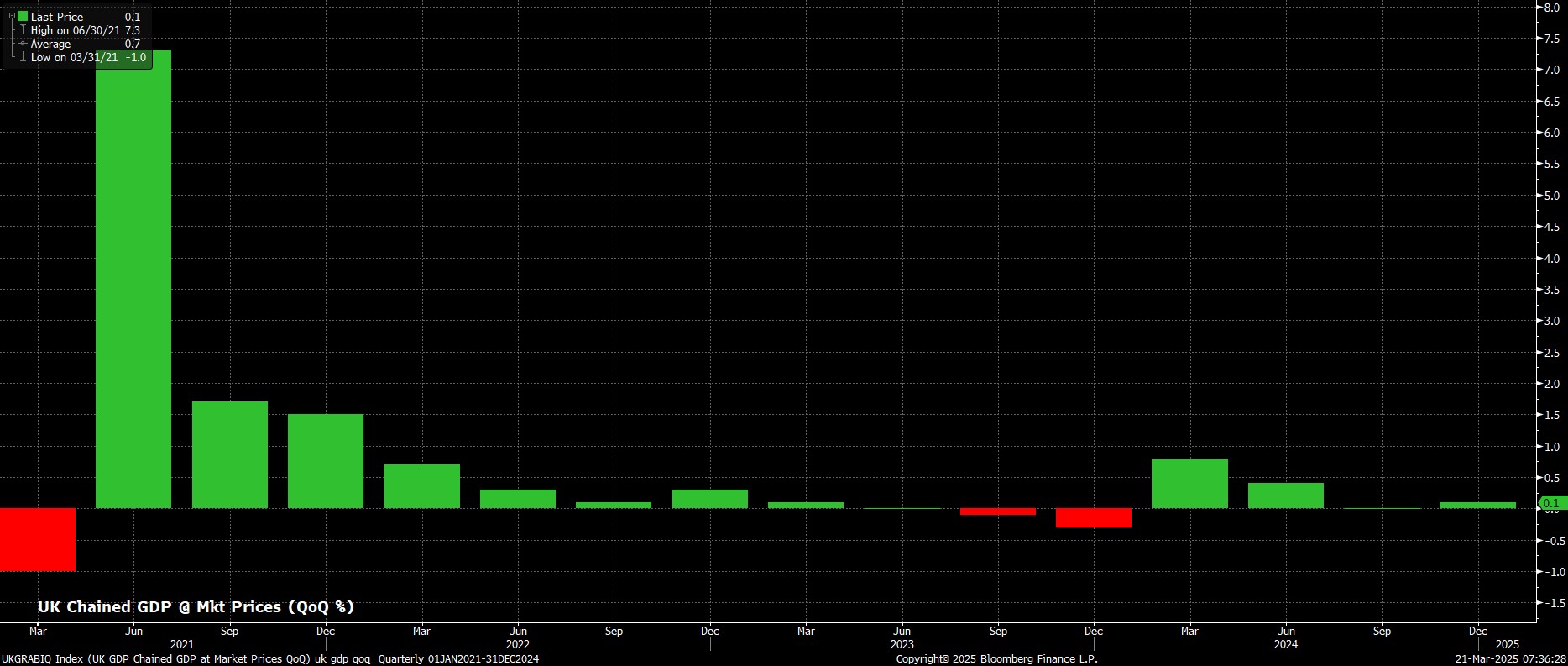

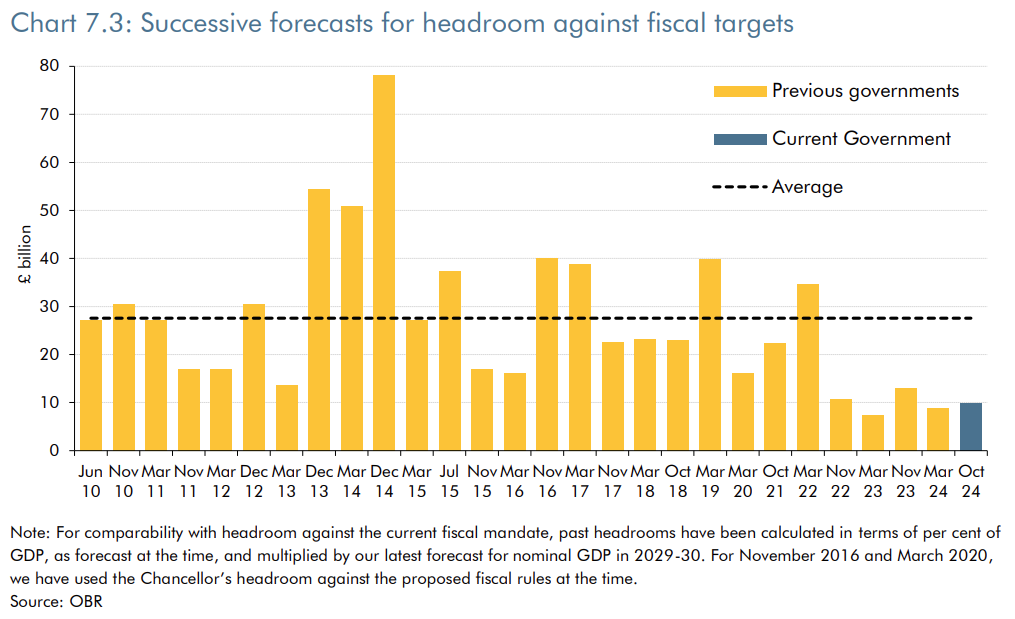

However, since the Budget last October, economic conditions have clearly worsened. The approx. £9.9bln of headroom against those rules that Reeves left herself last year has been eroded, and more, by virtue of the sharp rise in Gilt yields, and the anaemic economic growth, experienced by the UK in the intervening period.

Consequently, by accident rather than design, the Spring Statement has morphed into a significant fiscal event, as Reeves seeks to restore the headroom that has now been eroded.

Doing so will likely require fiscal tightening to the tune of around £15bln, though this would only restore headroom to the meagre £10bln that it was six months ago. As we have seen recently, such a margin is wafer thin in macro terms, and considerably below the approx. £30bln headroom with which the Treasury tended to operate pre-covid. Still, conditions as they are at present simply don’t allow Reeves to build a bigger buffer.

Of course, there are two ways in which this headroom can be restored – spending cuts, and tax increases.

Pre-statement sources reporting indicates that tax rises are, for the time being, off the cards, with changes to revenue-related measures likely being punted until the autumn Budget. This is somewhat unsurprising, especially considering the dismal reception that changes to employer NI contributions, and IHT relief, received last year. Furthermore, the former changes have yet to actually come into effect, making further changes even less likely.

Consequently, focus will naturally fall on spending cuts. Here, Reeves is likely to make significant changes welfare spending, aiming to reduce the overall benefits bill by as much as £5bln by 2030. In addition, departmental budgets are likely to incur significant real terms spending cuts, outside of those protected areas such as defence and healthcare. In fact, many of these changes are necessary in order to fund the promised 0.2pp uplift in defence spending in the next financial year.

Besides those changes, market focus will also fall on the updated Gilt issuance remit. Here, issuance is expected to be between £310bln to £315bln for the upcoming fiscal year, around £20bln more than in 2024-25. That said, risks to this view clearly tilt to the upside, especially given the tiny sliver of fiscal headroom with which the Treasury are set to operate.

_10_2025-03-21_07-39-29.jpg)

Also of interest for FI participants here will be the average maturity of said issuance. The weighted average maturity (WAM) of issuance has now been falling for some time, with the DMO having frequently noted a preference among market participants for this trend to continue. With a current WAM of around 12 years, there is perhaps limited scope to significantly change the composition of issuance, though once more fresh Gilt sales are likely to be tilted towards the front-end and belly of the curve.

On the whole, it is tough to see the Spring Statement as a game-changer for the UK economy, which sadly remains mired in a stagflationary mess, amid next-to-no economic growth, and with stubborn price pressures becoming increasingly embedded.

In fact, the majority of what Reeves presents at the despatch box will already be out of date by the time she delivers it. 10-year Gilt yields, for instance, have risen 20bp since the OBR’s forecast window closed in early-February, meaning that any fiscal headroom that has ‘technically’ been restored in the forecast, will in reality have already started to be eroded.

Furthermore, market participants remain decidedly unconvinced by the Government’s fiscal stewardship and plans for the economy – huge public sector pay rises, punitive taxes on jobs, slashing benefits for the elderly and infirm, and a surge in defence spending simply does not add up to a sustainable plan to either engineer growth, or balance the books.

Frankly, Chancellor Reeves has already lost the confidence of investors, no matter what remarks are delivered in the Spring Statement. Where Gilts go next – or, more accurately, how far prices fall – is well out of Reeves’s control. The bigger question now is whether we should measure in days, weeks, or months, how long Reeves may have left in Number 11.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.