- English

- عربي

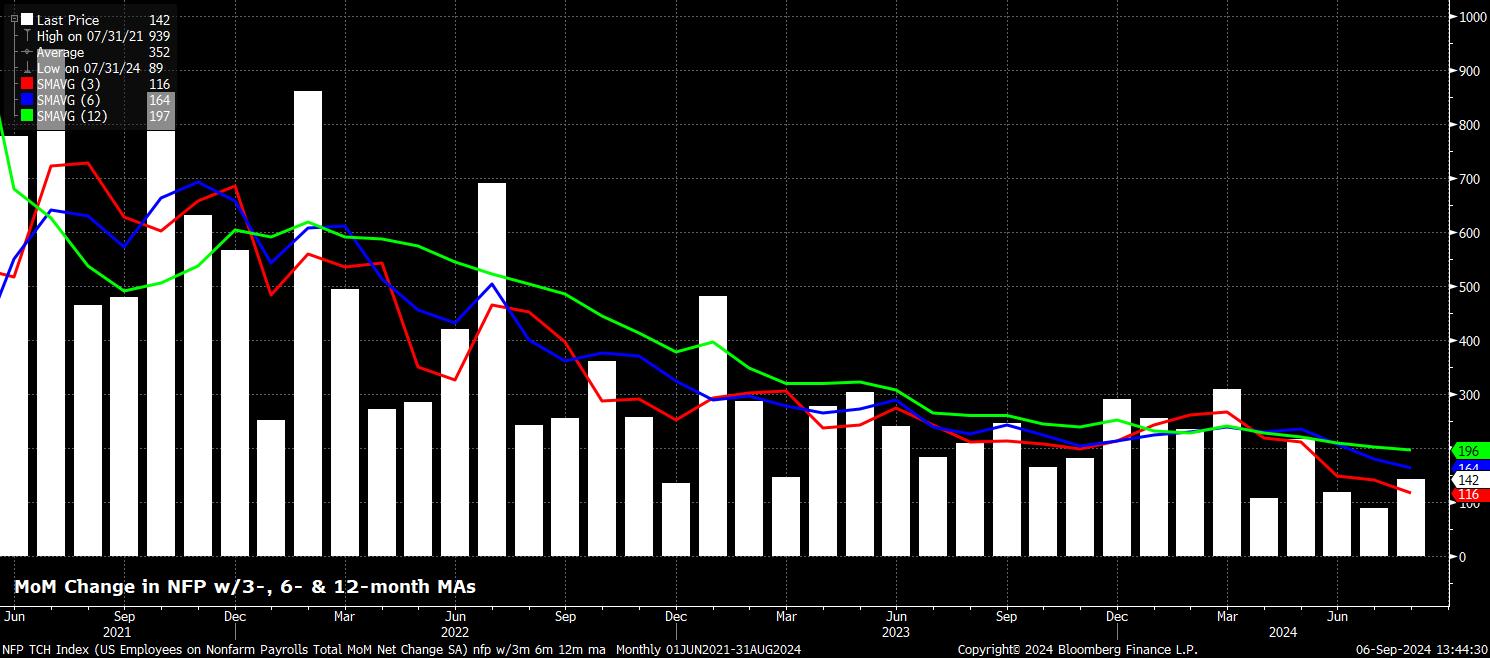

Headline nonfarm payrolls rose by +142k in August, below consensus expectations for a +165k increase, albeit within the always-wide forecast range of +100k to +208k. At the same time, data for the prior two months was downwardly revised by a net -86k, hardly optimistic, which in turn dragged the 3-month average of job gains to a rather dismal +116k, and the 12-month average of job gains below 200k for the first time in over 3 years.

Taking a deeper look into the data, the sectoral split of employment gains shows that, while headline payrolls growth did marginally miss expectations, job gains were relatively broad based. Substantial weakness in the manufacturing sector, which shed 24k jobs, was notable, though all other sectors – besides information – saw a monthly job gains, with the info sector extending its run of no net job gains since back in March.

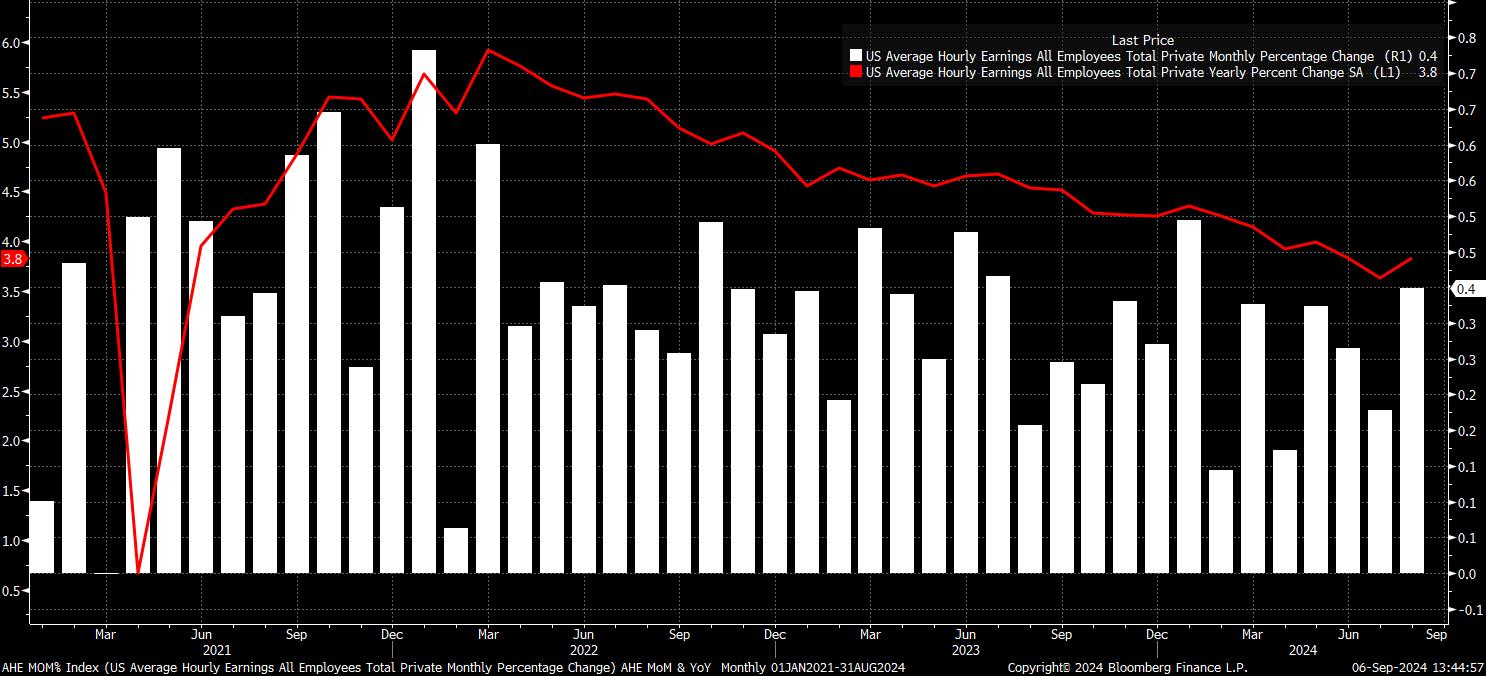

Sticking with the establishment survey, the employment report also showed that average hourly earnings rose by a hotter-than-expected 0.4% MoM in August, an 0.2pp quickening from the pace seen a month prior.

Meanwhile, on an annual basis, earnings rose 3.8% YoY, a fairly chunky rise from the 3.6% YoY pace seen in the prior report, and also marginally above consensus. Said quickening, however, is unlikely to be of particular concern to officials on the FOMC, with the pace of real earnings growth remaining contained, and policymakers having seemingly already obtained sufficient confidence in inflation returning towards 2% to begin policy normalisation at the September meeting.

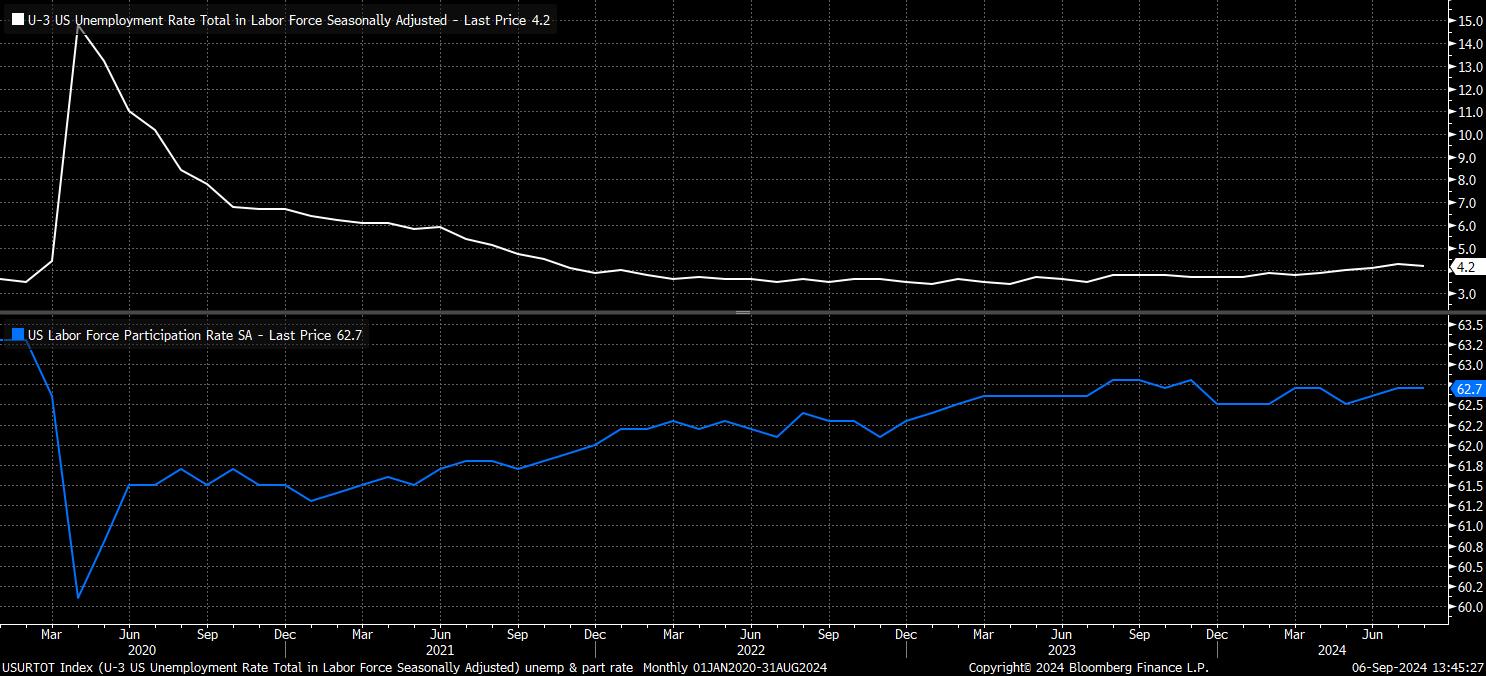

Turning to the household survey, and the unemployment rate, which fell from 4.3% in July, to 4.2% last month, in line with consensus expectations, and a retreat from the near 3-year high seen in the prior report, as temporary weather-related weakness from the prior report was unwound.

Meanwhile, other measures of labour market slack painted a mixed picture, with participation remaining close to cycle highs at 62.7%, as underemployment ticked 0.1pp higher to 7.9%.

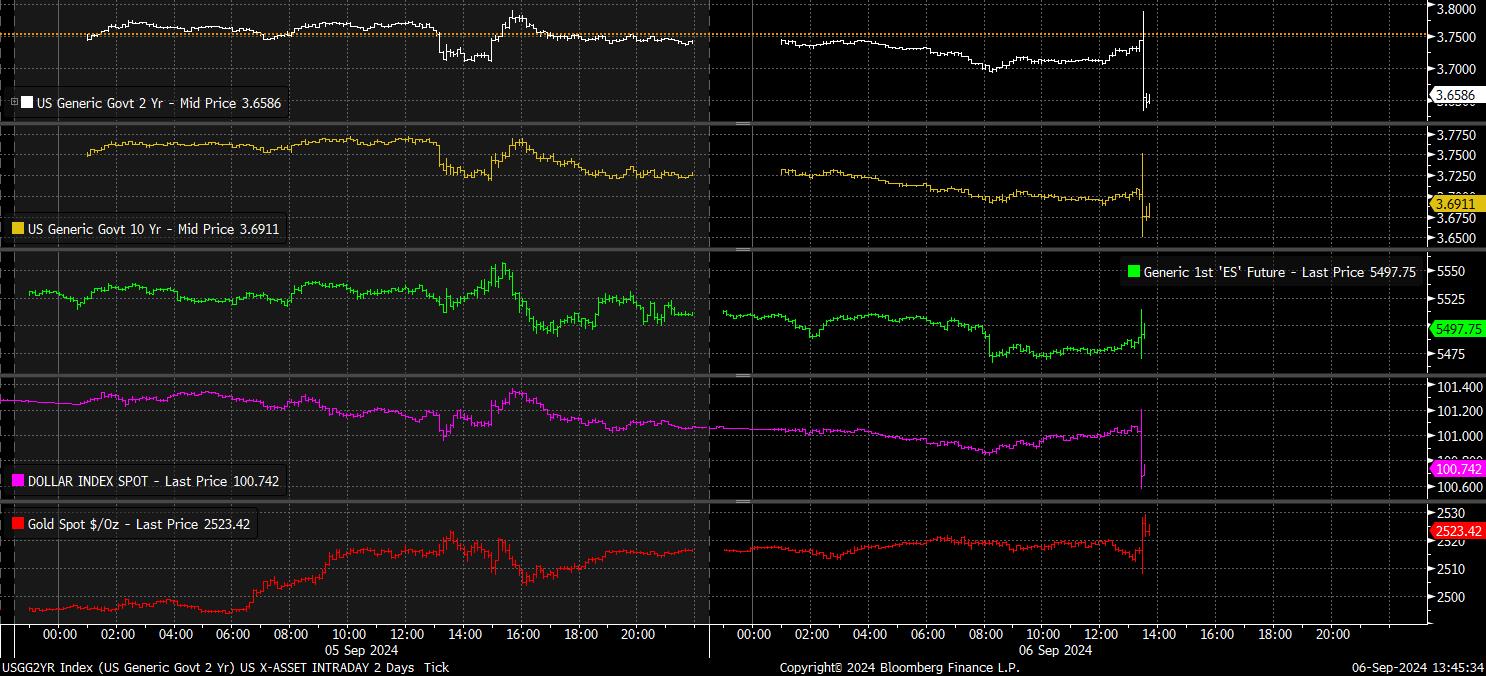

In reaction to the jobs data, the USD OIS curve underwent a rather modest dovish repricing, primarily in reaction to the marginal negative payrolls surprise, and the sizeable 2-month net revision. The curve now sees a 50bp cut at the September FOMC as an even chance, compared to a one-in-three probability before the release, while discounting a total of 115bp of cuts this year, compared to 106bp pre-NFP.

As for markets more broadly, this dovish repricing saw Treasuries rally to fresh day highs/yield tights, led by the front end of the curve, with 2-year yields falling around 10bp on the day, and the 2s10s curve steepened to its most since the middle of 2022.

Elsewhere, stocks traded choppy, though buyers ultimately managed to wrestle control of proceedings with the front S&P and Nasdaq futures both notching fresh day highs. The greenback, meanwhile, was broadly softer, as the DXY surrendered the 101 figure, while gold made fresh highs, as the yellow metal benefitted from lower yields, and the softer USD.

Overall, does little to clear-up the debate over the September Fed meeting. Doves will point to a cooling pace of headline payrolls growth as potential reasoning for a larger 50bp cut. Hawks, meanwhile, will reasonably point towards the lack of further cooling compared to the July report, and hot-ish earnings growth, as reasons to kick-off the normalisation cycle with a more modest 25bp move. My base case remains for the latter, particularly given the risk the Fed run of sparking a market panic were a larger cut to be delivered.

In any case, the path of least resistance should continue to lead higher for equities, as focus remains on the forceful ‘Fed put’, with the key factor remaining the Fed’s ability to deliver sizeable stimulus if required, not the precise magnitude of the upcoming rate cut.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.