- English

- عربي

Daily Fix: Market volatility to rise with the event risk rising

The early indication we see from the FX open is the NOK finding a bid, indicative of a pop in the Brent and WTI price when futures open in just over an hour. We’ve seen a slight bid in the AUD or CNH too, although it's unconvincing and we may need to see a better feel and turnaround in Chinese and HK equity markets to inspire AUDUSD higher, where, as it stands our opening calls for Asian equities open are flat.

China has set the ball rolling, with the developed world hitting us with their November manufacturing numbers this week. The early signs are promising, with Chinese manufacturing PMI data (released on Saturday), detailing headline manufacturing easily beating expectations at 50.2 and showing the first expansion since April. The trade-related subcomponents of the manufacturing print, those being new exports (48.8), production (52.6) and imports (49.8), hardly suggest the Chinese economy is on fire, but they improved and this has set the tone ahead of today's US ISM manufacturing PMI (02:00 AEDT), with manufacturing reports also seen across the Eurozone, Canada and the UK.

GBPUSD and the GBP crosses have found a touch of selling with the weekend polls showing Labour modestly closing the sizeable gap with the Tories, although, this depends on which of the many polls you focus on. The average of the nine polls I have seen give the Tories a ten-point advantage, which is still more than enough to get a majority. As mentioned on Friday though, a decent Tory majority is in the price and I questioned what would take us higher if polls are the key influence. GBP remains a buy on dips here.

After what was a quiet week in terms of event risk the landmines increase this week, so it would not be a surprise to see implied volatility rise a touch, from incredibly suppressed levels. We still look at the big picture, and the market will key off the risks here, with the focus Thursday’s OPEC meeting, UK election (12 December), the 15 December deadline (in US-China talks) before the additional 15% tariffs are implemented on some $160b of Chinese exports, as well as a focus on the repo markets, with the turn of the year and liquidity.

At a data level, it's US manufacturing and US payrolls that are our major landmines this week and we need to see that the data is holding up to justify the more neutral turn recently from central banks.

(Implied volatility setting)

(Source: Bloomberg)

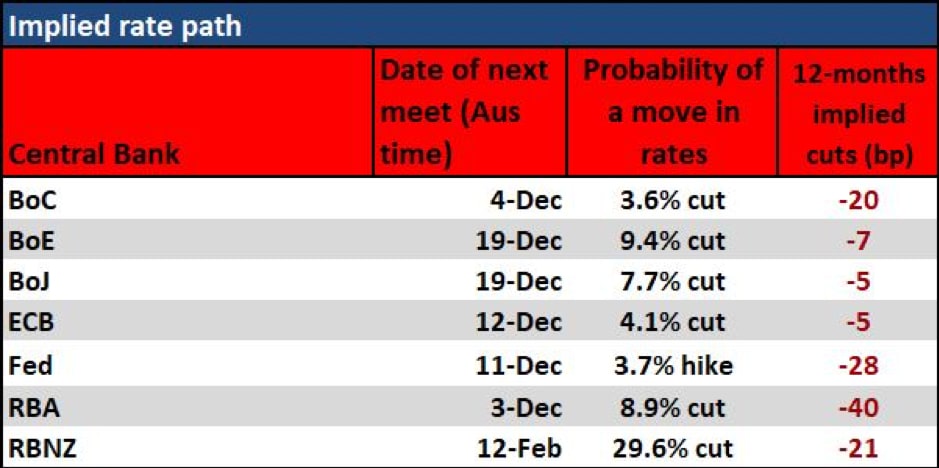

With so many leading indicators giving us a view that tonight’s US ISM manufacturing report will head back into expansion, even with the consensus set at 49.2, should we get a reading closer towards last month’s print of 48.3 and we’ll see a better bid emerge in short-term US Treasury’s, and the 10% chance of a January cut from the Fed will likely head towards 20%. We can see US rates markets actually pricing a small chance of a hike for the December meeting, which is perhaps a touch mispriced, as, of course, that won’t play out.

(Central bank policy expectations model)

USDJPY closed above the 61.8% fibo of the April to August sell-off at 109.35 on Friday, and the recent flow of capital suggests the pair can head to 110.50/111.00, but to justify this move we will absolutely need to see expansion in manufacturing, as well as a renewed bull move in global equity markets. One for the radar.

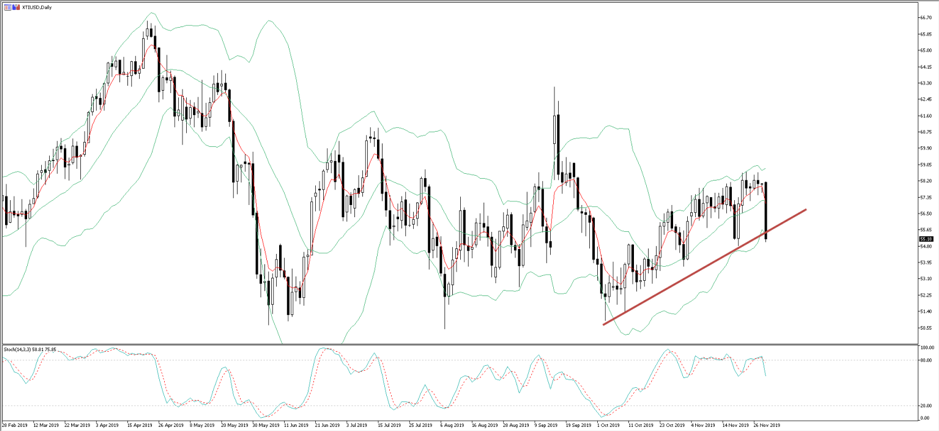

As mentioned, we expect a slight pop in crude, reversing an element of the 4.4% sell-off in Brent and 5.1% in US crude on Friday. There was no one smoking gun behind the move, rather a series of factors that saw the bid dry up and crude volatility spike 5.9 vols to 36.7%. If I had to focus on one fundamental driver it would be the idea that the Saudi’s were losing patience with producing below their compliance rate, when other OPEC nations were producing above their own set targets.

The talk in the press today, quoting the Iraqi oil minister, is that OPEC is now considering deeper production cuts to the tune of 400kbpd and this should help repair the technical damage seen on Friday. Clearly, the Saudi’s will be keen to see stability into the crude price ahead of the Aramco IPO (11 December) and while we can expect a pop in Brent futures, any reversal and a test of $60 this week will no doubt be met with a barrage of supportive rhetoric from the Saudi’s.

(Daily chart of WTI crude - XTIUSD)

Crude may have seen the big moves on Friday, but there are certainly some ugly moves in Chinese and HK equity markets too. The weekend manufacturing data should help lift sentiment, but the headlines I have seen over the weekend suggest a rollback of US tariffs on 15th December are unlikely and as the Chinese vice-minister of commerce stipulated, perhaps we need to be looking more closely at a trade deal towards Chinese New Year in late January. Without a rollback of tariffs, it seems there will be no Phase One deal, which is looking highly unlikely to play out this year anyhow. There will, however, need to be a loose agreement to halt the tariff implementation on the 15th though, or risk will be sold.

The news on trade will hardly inspire Chinese equity appreciation at a time when we are hearing a number of worrying views on the credit markets in China, with last week’s PBOC Financial Stability Report highlighting 13% of some 4379 lenders were deemed ‘high risk’ and state-owned commodity trader Tewoo tender their corporate bonds. On the face of it, this seems bad news, as most know state-owned corporates with high debt levels have not been 'allowed' to publicly restructure its debts, let alone fail, but this sets a precedent and could allow greater transparency on how analysts rate credit. It will make interesting viewing as to how equity trades should the corporate credit markets show more public cracks.

It makes for an interesting week and one where I wouldn’t be surprised to see volatility rise a touch from current levels, as it is cheap to hedge risk.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.