- English

- عربي

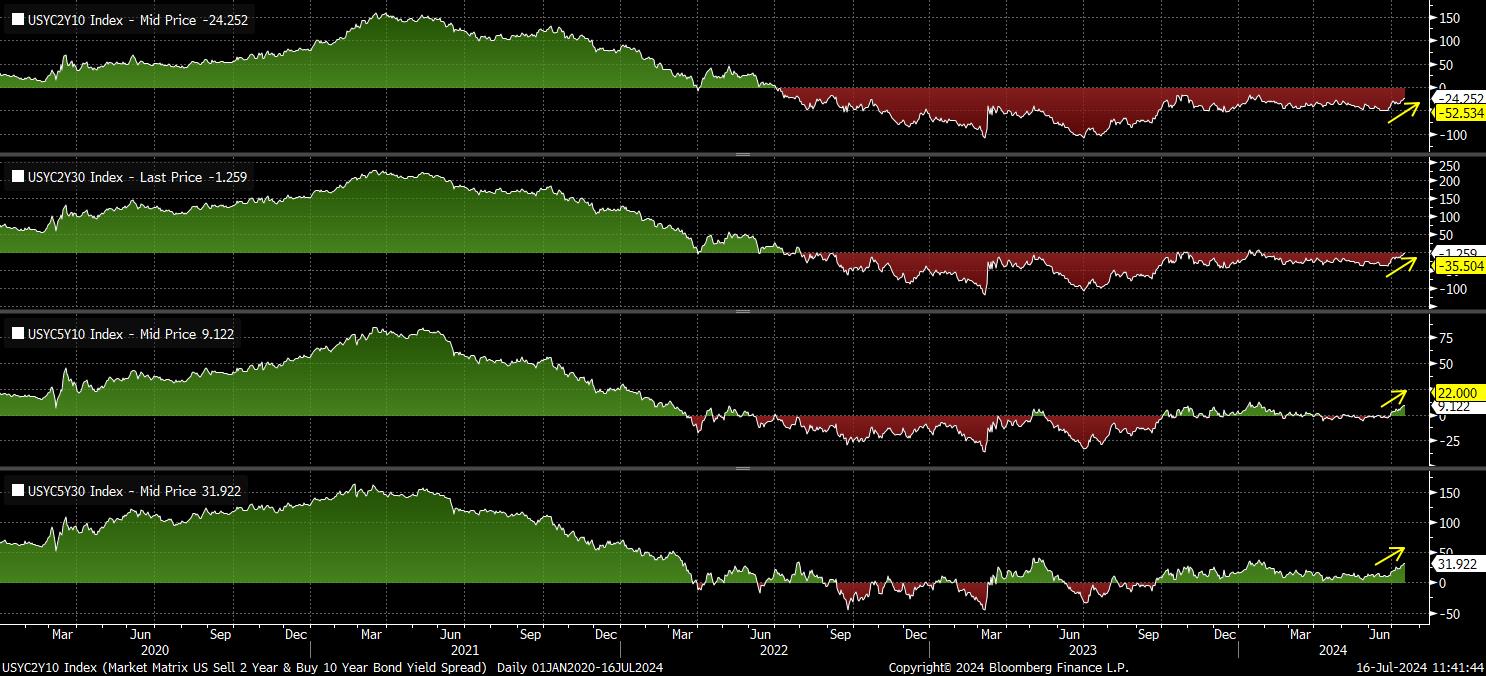

One of the many views that I’ve outlined in these pages over the course of the year so far is that the Treasury curve should, as time goes on, steepen, as a result of the Fed beginning to cut overnight rates, at the same time as inflation remains some way above target, and concern lingers over fiscal largesse as government deficits continue to balloon.

In short, the mid-2020s monetary policy regime is one where the 2% inflation target – which, of course, was essentially made up a New Zealand politician trying to bluff his way through a television interview – is no longer an explicit aim, but instead the bottom of a range. This range, likely, extends towards 3%, with any headline inflation reading within this range being judged by policymakers, desperate to cut rates, as price pressures having ‘hit target’.

Though this view has taken some time to pan out, the Treasury curve, over the last month or so, has finally begun to bull steepen in a more significant way, with the latest landmark being the 2s30s spread dis-inverting for the first time since 2022.

It is not only monetary policy that has driven this move, even if last week’s cooler-than-expected US CPI print, coupled with ongoing signs of softness in the labour market, have cemented the case for a September Fed cut.

Incidentally, the USD OIS curve now implies a greater than 100% chance of such a move for the first time since April. As we are all well aware, it is incredibly rare for the FOMC not to deliver when the market has such lofty expectations, particularly when recent speakers, including Chair Powell, have done little to guide away from this pricing.

While CPI may have been the spark to ignite the recent steepening, the move has been helped along by increased expectations that former President Trump will re-take the White House come November and, with him, bring another wave of (likely unfunded) tax cuts, as well as a further increase in government spending, chiefly on defence.

Such a significant degree of deficit spending, while running contrary to the traditional principles of the GOP, is likely causing an increasing degree of consternation, particularly at the long-end of the curve, where last week’s 30-year bond auction was the first in ten not to stop through, or on the screws of, the when issued yield.

Nevertheless, it must be said that it seems far too early to be running away with the idea of a ‘Trump trade’ just yet. There remains just under 4 months of the election campaign to run and, as Harold Macmillan famously said, “events, dear boy, events” could dramatically alter the course of the campaign between now and polling day. This covers not only ‘known unknowns’, such as whether President Biden will actually prove to be the Democratic nominee, as well as ‘unknown unknowns’, or potential ‘black swan’ events.

In any case, from a market perspective, the outlook appears relatively clear – a Fed cut is on the way in September, and likely in December too; while, whoever controls the White House, and Congress, after November, government spending seems set to increase, further widening the deficit.

As I noted all the way back in early-March, this will see us move into a new monetary policy regime, whereby rates will move back to a more neutral level, as the process of balance sheet run-off slows, leaving central bank asset holdings substantially higher then both pre-covid, and pre-GFC. In fact, if the BoE’s experience is anything to go by, with rapidly increasing repo facility usage, run-off may well end sooner than expected.

There are a few consequences of the above:

- The curve should continue to steepen, so long as inflation expectations remain well-anchored, as they appear to be at present

- The central bank ‘put’ will remain in place, with policymakers both willing and able to provide greater policy support should they deem it to be required

- The path of least resistance for equities should continue to lead to the upside, with dips remaining shallow, as investors retain confidence to remain further out the risk curve

- A proportion of government debt, across DM, will in effect be permanently monetised as a result of increased central bank bond holdings

- Cross-asset vol should, by and large, settle at lower levels, with the aforementioned ‘put’ insulating markets from exogenous shocks

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.