- English

- 中文版

No relief from US fiscal measures as Dow Jones falls into bear market

Panic has ramped up as the World Health Organisation declared the coronavirus an official pandemic overnight. Seattle became the first major American city to close schools while many others ban gatherings of over 1000 people. The NBA has cancelled the rest of its season. Across the Atlantic, Italy saw a 31% increase in virus fatalities overnight and closed all businesses except grocery stores and pharmacies.

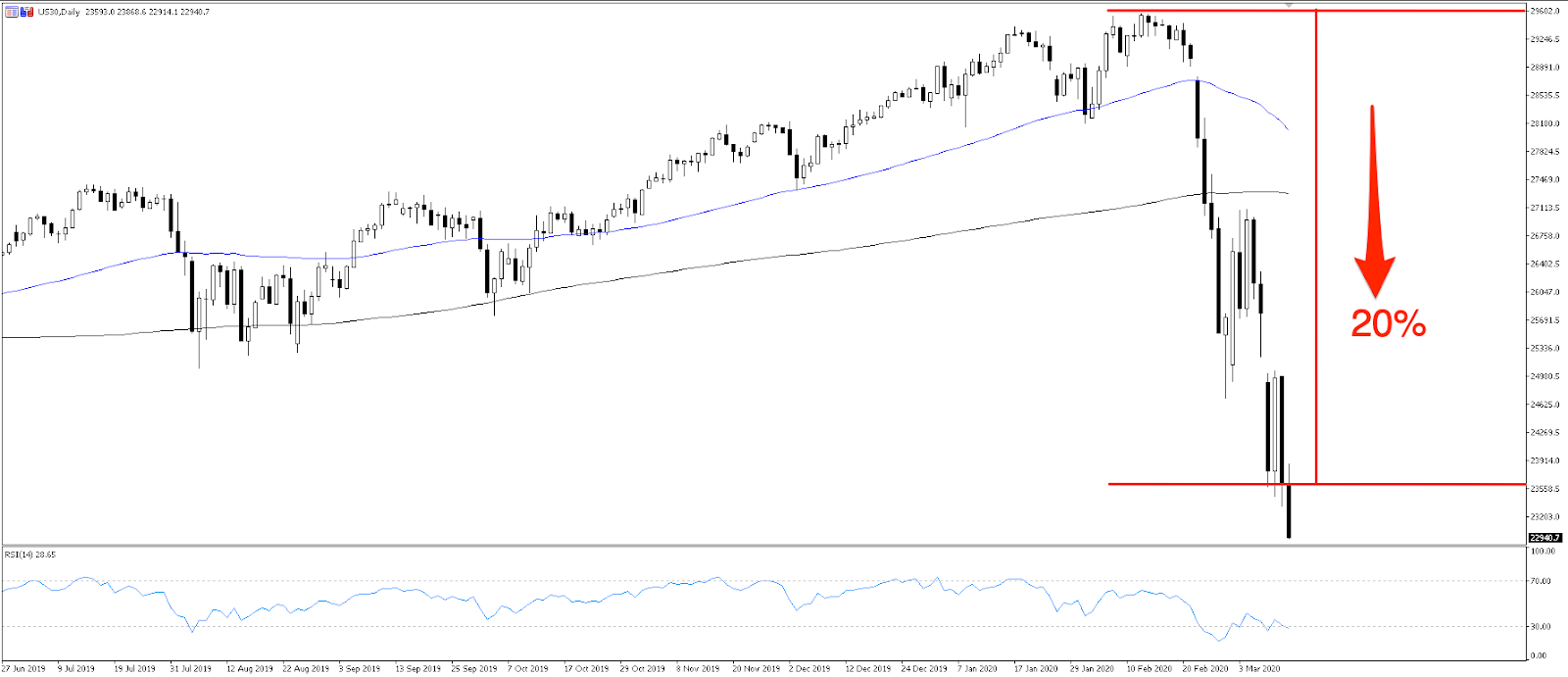

The Dow Jones (US30) slid into a bear market on the newsflow overnight, ending the longest bull market for US equities in history. The industrial index dropped almost 5% on the day Wednesday, marking a 20% drop since the all-time high on 12 February.

Dow Jones index (US30) enters bear market after falling 20% since February highs.

Source: Pepperstone

Markets had been expecting more in the way of fiscal stimulus from President Trump when he spoke on Wednesday night (12:00pm Thursday AEDT). He assured viewers “this is not a financial crisis” and offered lightweight stimulus measures, including urging US Congress to approve a payroll tax relief measure. US stock futures extended their losses, as did Australian and Japanese stocks. USDJPY is down 1% in response to the limited measures.

The fate of the global economy rests on how global central banks and government stimulus will cushion the blow. Not only is the coronavirus pandemic disrupting supply chains and consumption amid large-scale quarantines and refrained travel, but a sharp drop in oil prices threatens to put energy companies out of business and employees out of work. WTI crude fell more than 6% on Trump’s announcement of a 30-day EU travel ban.

Markets are finding little relief in policy relief measures

The Bank of England slashed rates by 50bp to 0.25% in an emergency announcement yesterday. The decision was followed by a fiscal package from Downing Street, offering 30bn pounds of stimulus and 600bn into mass infrastructure projects by 2025.

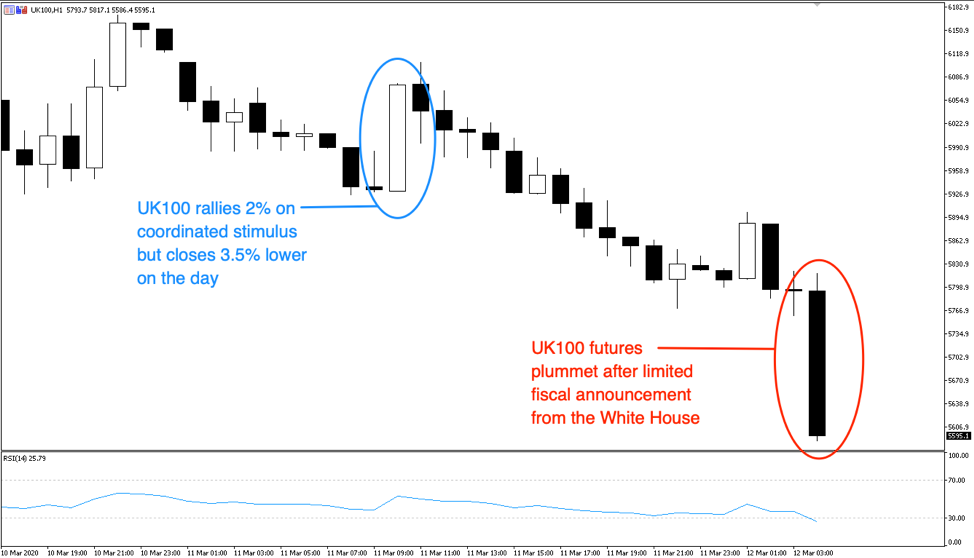

The coordination was a bazuka of policy in an attempt to cushion Britain’s economy from a drastic economic fallout. Cable price action was fairly choppy in the hours following the surprise rate cut but eventually closed 0.7% lower on the day at 1.2820. The FTSE 100 index (UK100) advanced more than 2% on the announcement of coordinated stimulus but went on to close 3.5% lower on the day. An emergency 50bp rate cut by the US Federal Reserve last week similarly failed to calm markets.

UK stocks rallies 2% on coordinated stimulus but closes 3.5% lower on the day. Futures plummet after limited fiscal announcement from the White House.

Source: Pepperstone

The European Central Bank (ECB) goes tonight and is expected to cut by 10 or even 15bp, taking the deposit rate further into negative territory. The central bank will likely boost quantitative easing (QE) and bond purchases, and discuss targeted lending programs.

Fiscal and monetary coordination is challenging on the EU level due to a single central bank but numerous individual governments. At the helm of the EU’s biggest economy, Chancellor Angela Merkel has said the German government will do whatever it takes to aid the downturn. A coordinated response tonight from the ECB and German government could maximise the impact of recovery measures before it’s too late.

EURUSD has rallied since volatility picked up late February, driven by Fed expectations and the unwinding of short positions. If tonight’s measures fail to relieve markets, which seems to be a trend at the moment, we could see continued upside towards the 2019 highs of 1.15.

EURUSD: Further upside towards 1.1500 level if stimulatory measures fail to relieve markets.

The EU response is critical. We’ve recently had a concerning eye on EU banks, where the EU Stoxx 600 banks index is trading at all-time lows - a loss of 44% since early 2018. Companies have binged on cheap debt in recent years and concerns of a credit crunch are building as major companies, particularly energy companies, come under increasing strain.

The EU Stoxx 600 banking index has faced concerning losses. The auto index has also suffered considerably in the crisis.

Source: Bloomberg

The auto industry is trailing with losses of a similar magnitude. China is not only a crucial market for German auto exports (and the largest for VW, BMW, and Mercedes) but also supplies a considerable amount of parts, and the auto index is down almost 42%. As consumer confidence falls, households will likely delay expensive discretionary purchases such as new cars.

The overall EU Stoxx 600 index is down only 14.3% in the same period.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.