السيولة

تُعد السيولة عاملًا مهمًا في التداول، لأنها تحدد مدى سهولة شراء وبيع الأصول بسرعة وبأسعار قريبة من السعر السوقي. وكلما كانت السيولة أعلى، كان تنفيذ الصفقات أسهل، مع تقليل فروقات الأسعار ومخاطر الانزلاق في سعر التنفيذ.

ربما يكون الاعتبار الأكثر أهمية، بغض النظر عن نوع الحساب، هو ظروف السيولة عند سعر البيع والشراء المعروض. السيولة هي السهولة التي يمكن للمتداول من خلالها الدخول والخروج من مركز تداول بالسعر المعروض، ودون الحاجة إلى الانتقال إلى أسفل دفتر الطلبات للتنفيذ على السعر التالي الأفضل.

الحصول على سعر أسوأ لأن الحجم الذي يقدمه صانع السوق أو مزود السيولة للتداول بالسعر المعروض غير موجود يسمى "الانزلاق" وسيؤدي إلى دفع المتداول لسبريد أوسع.

يحدث هذا بشكل متكرر أكثر بكثير مما يعتقده الكثيرون ، خاصة من قبل الوسطاء الأصغر الذين يستخدمون نموذج السبريد الصفري. حيث قد يرى المتداولون الذين يبحثون عن ملء 0.1 أو أكثر أن التعبئة الفعلية تختلف تمامًا عن السعر المعروض على المنصة.

في معظم الحالات، لن يقوم المتداول بتسوية الفرق، ولكن هذا الانزلاق سيضيف تكلفة على المحفظة، خاصة بالنسبة للمتداولين الذين يتعاملون في الأحجام الكبيرة، مما يشير إلى نقص الشفافية في التسعير ويمكن أن يضر بالثقة بين العميل والوسيط.

مثال على تميز Pepperstone

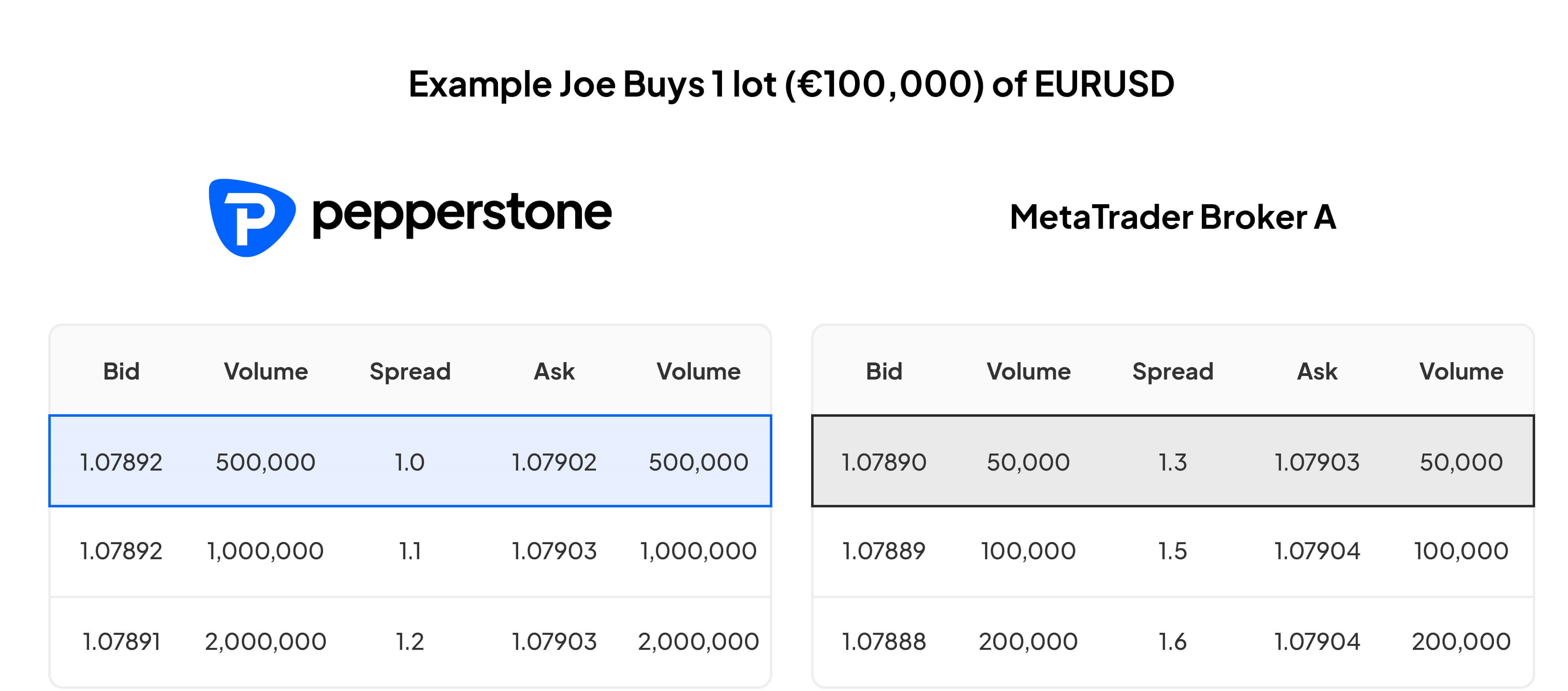

لنفترض أن جو يريد شراء لوت ١(١٠٠،٠٠٠ يورو) من اليورو مقابل الدولار الأميركي. باستخدام بيبرستون، يتم تنفيذ أمر جو بالسعر المعروض 1.07902. ولكن مع الوسيط أ، يتم تنفيذ الأمر بمتوسط سعر الحجم المرجح (VWAP) وهو 1.07904، والذي ينحرف عن السعر المعروض. هذا لأن الوسيط أ لديه سيولة ضئيلة، حيث يقدم ٥٠،٠٠٠ فقط في الجزء العلوي من سبريد الكتاب. نظرًا لأن جو اشترى عقدًا واحدًا (١٠٠،٠٠٠ يورو)، فإن الجزء المتبقي من الصفقة (٥٠،٠٠٠) ينتقل إلى الطبقة الثانية من دفتر الطلبات التي تقدم ١٠٠،٠٠٠ حجم، وهذا هو السبريد المطبق على ٥٠،٠٠٠ حجم تداول.

The above table is for illustration purposes only.

مع بيبرستون، يتم تنفيذ أمر ١ لوت بالسعر المدرج 1.07902. ومع ذلك، مع الوسيط أ، لا يوجد الحجم لتسهيل طلب 1 لوت، لذلك يتم تنفيذ الأمر بمتوسط سعر الحجم المرجح (VWAP) وهو 1.07904 بدلاً من السعر المعروض.

قد يبدو هذا فرقًا بسيطًا، لكنه يسلط الضوء على أن السعر الذي اعتقد جو أنه تعامل به وأن التنفيذ الفعلي للعملية قد يكون مختلفة نظرًا لديناميكيات السيولة.

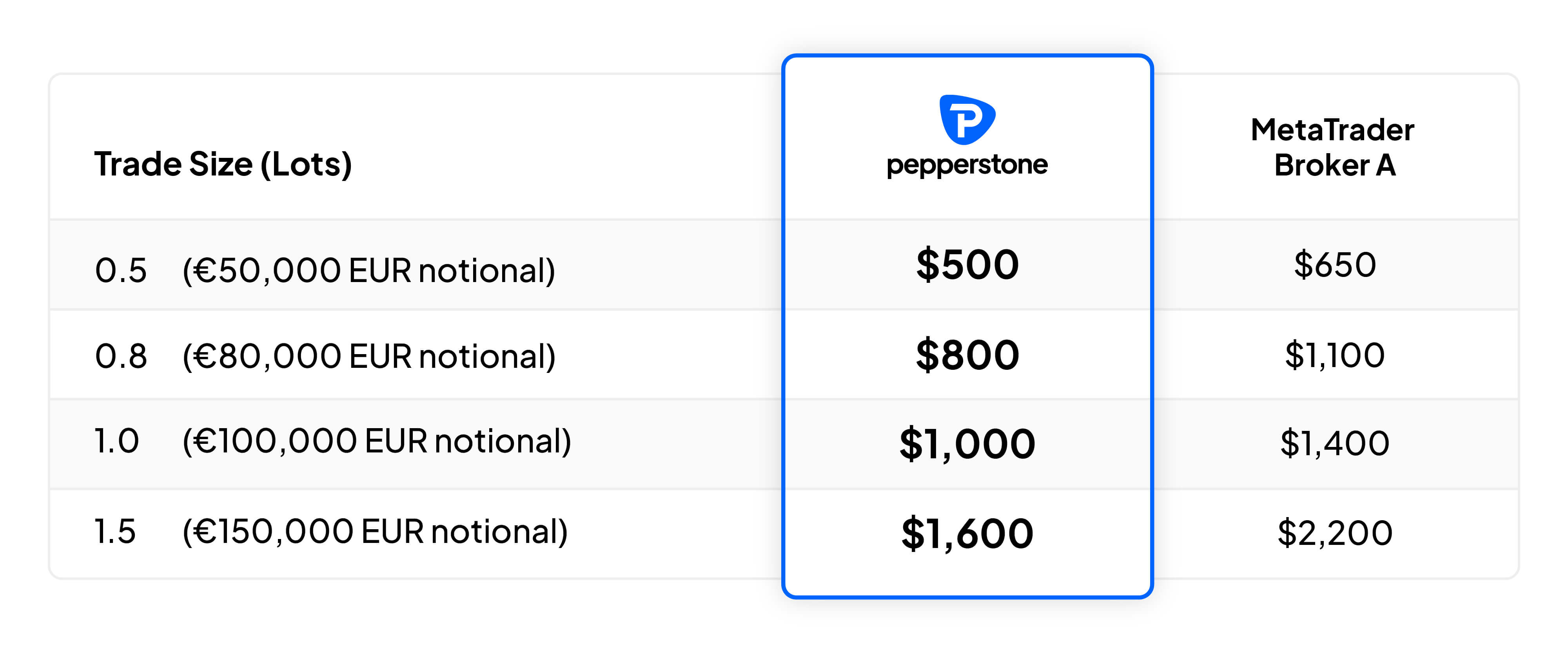

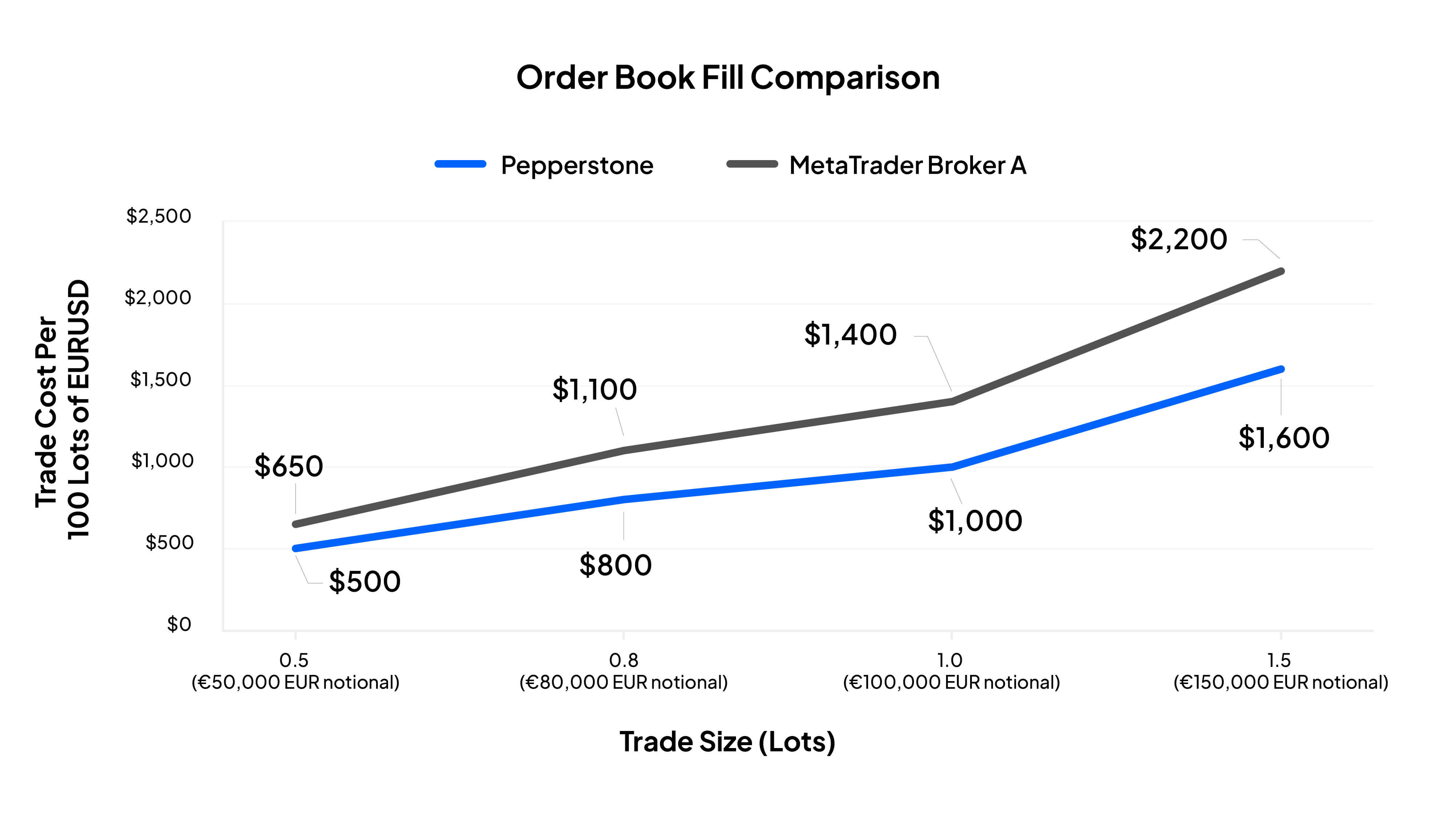

ضع في اعتبارك كيف يتم تنفيذ هذا السيناريو في أكثر من ١٠٠ صفقة. في حين أن السعر وسبريد العرض والطلب سوف يتقلبان (من هذا المثال)، وسوف تختلف السيولة بين عملية وأخرى، يمكننا أن نرى كيف يحدث ذلك بمرور الوقت إذا استقرينا المعلمات في هذا المثال.

The above table is for illustration purposes only.

The above table is for illustration purposes only.

السيولة العميقة لشركة بيبرستون بالسعر المعروض (المعروف أيضًا باسم سيولة أعلى الكتاب) هي الرائدة في مجالها وتعتبر واحدة من الأفضل. عادةً، إذا أراد المتداول أن يتعامل بحجم أكبر، فستكون لديه فرصة أكبر بكثير لفتح وإغلاق صفقة بالسعر المذكور، مقارنة بالعديد من الوسطاء الآخرين.